Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Kommentare von André Will-Laudien

Kommentar von André Will-Laudien vom 21.02.2023 | 04:44

Stock news: Deutsche Bank - Back on stage again

The major interest rate turnaround in 2022 is bringing the big banks back into business. While banks had to contend with negative interest rates during the period of low-interest rates, the situation is now increasingly easing. The deposit side is generating positive inflows, and the lending business is again generating adequate margins. Deutsche Bank is back at the level of 2007, i.e. shortly before the outbreak of the financial crisis. Its transformation into the modern age would be largely complete if it were not for the threat of insolvencies generated by the aftermath of the Corona pandemic hanging over the lending business as a sword of Damocles. We provide an update from Frankfurt.

Zum KommentarKommentar von André Will-Laudien vom 03.02.2023 | 06:24

Stock news: Nel ASA - With full order books into the new year

The war in Ukraine exacerbates the need for the measures adopted in recent years to change our energy supply. The sudden scarcity and accompanying price explosion of fossil fuels is driven by our dependence on Russia and China alone in the European renewal process. Experts now realise that electromobility will probably only have a positive impact on the ambient air. Other concepts must be put on the table! When it comes to hydrogen, the EU can be said to be a global pioneer in hydrogen technology, despite much lip service. Nel ASA is a Scandinavian protagonist with high innovative power. An update from Norway.

Zum KommentarKommentar von André Will-Laudien vom 02.02.2023 | 04:00

Stock news: Globex Mining - Dream returns in the commodities sector

Greentech is on everyone's lips. Politicians, climate activists and even ordinary citizens want a cleaner world and are establishing a more sustainable lifestyle. This can only be achieved through widely available and affordable energy because then industrial and mobility concepts can be transferred to an age of decarbonization. The clean forms of energy generation still require a high input of resources because the necessary infrastructure must first be created. In a second step, savings and a reduced CO2 footprint will follow. Globex Mining is a broadly diversified resource company; its founder and CEO, Jack Stoch, is a mining legend. He knows a thing or two about finding and industrially producing metals. Here is an update from Ontario.

Zum KommentarKommentar von André Will-Laudien vom 01.02.2023 | 04:44

Stock News: Almonty Industries - Armaments need tungsten

Access to critical metals has always been a political issue. Strategic alliances are becoming increasingly crucial in geopolitical environments such as we have been experiencing since Donald Trump and Vladimir Putin. In a world where climate protection and armaments are being pushed in the same breath by all political forces, it is essential to secure access to raw materials. Tungsten has been placed on the EU's list of critical metals. Almonty Industries has been mining tungsten for a long time and is currently working on opening a mine in South Korea that can supply 5% of the world's supply. In addition, there is molybdenum there as well. We provide an update.

Zum KommentarKommentar von André Will-Laudien vom 27.01.2023 | 04:44

Morphosys - The pipeline is full to bursting

In 2021, 18.7 million people received the shocking diagnosis of "cancer". Current trends, unfortunately, suggest that this number will continue to rise in the coming years. Thanks to growing research successes, however, there is hope that biotechnology will make survival more likely for those affected. It is a matter of developing suitable active substances and launching modern therapies. Why some people get cancer, and others do not is unclear. The Munich-based biotechnology company is looking for suitable answers and is very far advanced with its current pipeline. Is the next blockbuster lurking here?

Zum KommentarKommentar von André Will-Laudien vom 24.01.2023 | 04:44

Stock News: TOCVAN VENTURES - Great news from Mexico

Is the economy still alive, or is it heading downhill again in 2023? This was the question posed by participants at the World Economic Forum in Davos. In 2022, the central banks had to deal with their primary topic of "currency devaluation" and raised interest rates, in some cases sharply. But the period of significant interest rate hikes is now drawing to a close, although inflation could remain high for a few more months. This is bad news for the economy and society. For precious metals, however, which serve as inflation protection, this is water on the mills. Of the 10 largest gold and silver states in the world is Mexico. In the state of Sonora, the Canadian explorer Tocvan Ventures has impressive findings to report.

Zum KommentarKommentar von André Will-Laudien vom 23.01.2023 | 07:30

Stock News: Saturn Oil + Gas with the next big bang

They did it again - the next takeover goes over the ticker! Saturn Oil & Gas delivered another bang for the buck in the Canadian oil and gas business on Friday. With the CAD 525 million acquisition of Ridgeback Resources, the Calgary-based company thus makes another giant leap. At a time when fossil raw materials are needed again more than ever, the Canadians have once again succeeded in making a deal of perceivable size. As a result, the daily production rate will increase by 140% to approximately 30,000 BOE/day after the transaction's closing. The total enterprise value is thus getting closer and closer to the billion mark. Good news for all shareholders because the management is sticking to its successful motto: Growth!

Zum KommentarKommentar von André Will-Laudien vom 19.01.2023 | 04:44

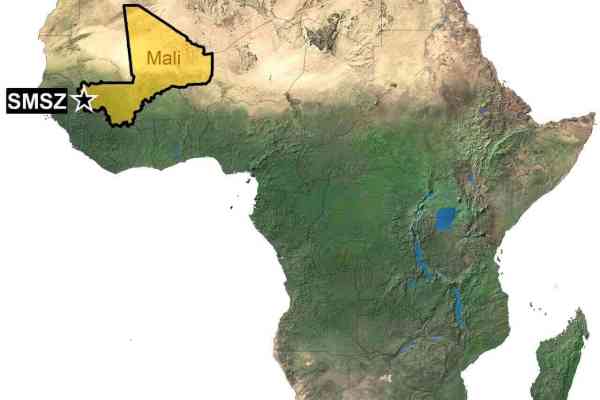

Stock News: Desert Gold - The Next Gold Rocket?

Gold has been in strong focus since the turn of the year. Driven by geopolitical uncertainties and a historic inflation rate of just under 10% in Europe, the precious metal approached the USD 2,000 mark again in January. While the gold price in euro terms is only EUR 100 per ounce below the high of August 2020, the gap in the world currency US dollar, is still around USD 170 per ounce or 8% from the nominal all-time high at USD 2,075 per ounce of gold. At the moment, the smaller public companies in the gold segment are trading at a deep discount. In turn, this invites the big players in the market for takeovers because it is currently impossible to buy into the increasingly scarce new gold projects at a lower price. Desert Gold Ventures is sitting on a premium project in Mali, West Africa, and its more prominent neighbors are likely just waiting for the next results.

Zum KommentarKommentar von André Will-Laudien vom 18.01.2023 | 05:44

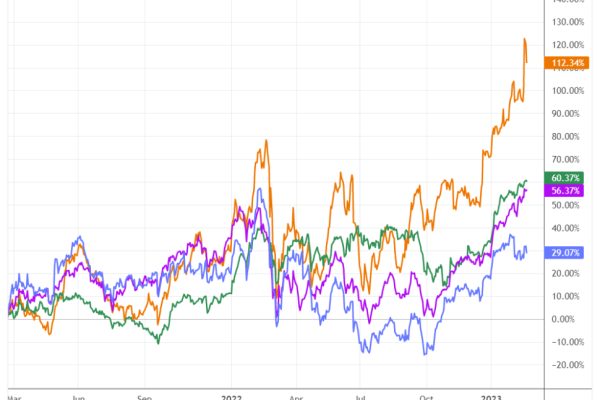

Stock news: Barrick Gold - The mining giant misses its targets for the year

Gold got off to a good start in 2023, with prices beyond the USD 1,900 mark. Due to the general price increases in the commodity and goods markets, the central banks reacted in 2022 with some upward interest rate adjustments. The onset of inflation also gave precious metals a good raison d'être. That is because they offer wealth preservation in the longer term and protect against excessive loss of purchasing power. Large mining companies thrive on their product diversity and the resulting diversification in their proprietary balance sheets. For investors, the framework conditions for commodity investments have improved dramatically in the last 2 years. However, despite all the euphoria surrounding important metals such as copper, the major producers still lag behind their expectations. Barrick Gold is well positioned with its deposits in gold and copper. Yesterday, the Company delivered its first figures for the full year 2022.

Zum KommentarKommentar von André Will-Laudien vom 18.01.2023 | 04:44

Stock News: VARTA AG - Off to new shores!

The past stock market year was a disaster for the loyal Varta shareholders. With a minus of 85%, the popular technology stock has been hit hard. But the new year starts with a bang. Because in the first two trading weeks, the share recorded a plus of around 20%! Many issues put pressure on the mood in 2022: sales and profit forecasts were lowered several times, the resignation of the CEO, and some major shareholders threw bundles of Varta shares onto the market. Many analysts had dramatically lowered their price target because of the operational weaknesses. The new Varta CEO Markus Hackstein has now brought in restructuring experts from Boston Consulting to get the battery manufacturer, which had come under pressure, back on track. We look at the chances of a comeback for the Ellwangen-based technology company.

Zum Kommentar