Diversity - Over 200 projects in the portfolio

Iron, copper and tin, but also almost all other metals of the periodic table, make our modern civilization possible. Many elements are indispensable for modern technology, whether gallium, chromium or rare earths, because, without them, most technical applications would not exist - from cars and computers to televisions and cell phones. Climate activists complain about the slow pace of renewal of our supply cycles. It is quickly forgotten that the necessary resources must first be searched for at great expense, their extraction approved, and finally, they must be efficiently extracted. According to today's environmental standards, the entire installation process of a mine takes at least 5 years. Market experts know today's shortfall in copper and lithium, for example, cannot be made up in the next decade, despite all political and corporate efforts.

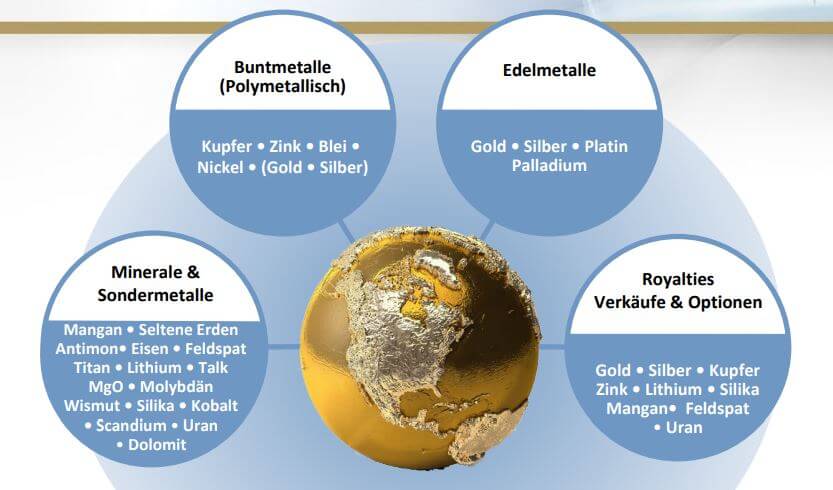

Globex Mining Enterprises Inc. was founded more than 70 years ago under the name Lyndhurst Mining Co. Ltd in 1949 to bring a copper mine into production. In 1974 a new group of investors took control of the Company, which was renamed Globex Mining Enterprises Inc. In 1983 the current management took over the Company, which was first listed on the stock exchange as Globex in 1987. Today, nearly all commodities are represented within the portfolio, ranging from the precious metals gold, silver, platinum and palladium, to the industrial metals copper, zinc, iron and nickel, to rare earths and energy metals such as lithium, uranium and cobalt.

Unlike most other junior exploration companies, Globex wholly owns its properties, many of which are available as options for third parties to conduct exploration and new resource estimates. Globex currently owns a broad portfolio of more than 200 property parcels and various commodities, all of which have resources or reserves, mineralized drill intercepts, untested geophysical showings or a combination thereof.

Diversification is the king of asset management

Globex has been in this business for a long time, and industry veteran and CEO Jack Stoch continues to develop his network consistently. The Company's primary goal is not the capital-intensive development of a mining operation, but rather the optimization and portfolio maintenance of the broadly diversified properties.

broad diversification in precious metals, non-ferrous and polymetals, special metals, and rare minerals. 89 royalties and 8 active options.

In addition to its many holdings in gold, silver, copper, platinum and palladium, as well as base and specialty metals, the debt-free company also has a well-stocked treasury to allow it to make additions or new acquisitions whenever needed. Globex has acquired over 100 projects in the last 10 years, usually not taking a lot of cash. The value upside happens later at the negotiating table when an interested party wants to develop the property. Global networking, access to deals, and the consistent will to sail on the pulse of the times make the Canadians very successful in their investment strategy and robust even in difficult times. Good diversification always allows for top-ups or new acquisitions when needed.

A series of good deals and announcements

Globex Mining has already reported several successes in the new year. For example, partner Brunswick Exploration Inc. has acquired further mining claims in Quebec, including Globex Mining's new Mirage project. It consists of 198 claims with lithium anomalies in excess of 100 parts per million. The project acquisition also includes an option on Globex's Lac Escale claim block. Once the option agreement is finalized, Brunswick Exploration will sign a license agreement granting Globex a 3% royalty applicable to all newly staked mineral rights acquired by either party within 1 km of the current claim boundaries.

Also fitting into the picture are drill results at the Harricana project in the Main Fontana gold zone in Duverny Township, Quebec, where the Company holds a 2% royalty. Kiboko Gold Inc. has reported assay results from 26 holes totaling 3,449 metres, which are part of an ongoing systematic verification program of 67 holes for 11,000 metres in the Main Fontana gold zone. Mineralization ranges from 2.3 to 47.2 grams/tonne gold in intercepts from 1 to 9 metres in length. Numerous other lower-grade intercepts have also been reported, which Kiboko intends to evaluate further.

The large number of holdings ensures a steady news flow. For example, five follow-up drill holes have been completed at Maple Gold Mines. Interim results indicate that the North Mine Horizon intercept may be wider than previously thought. Globex Mining is also involved in an interesting project in Germany. Namely, Excellon, which holds prospecting licenses for a total area of 340 sq km of high-grade silver intercepts in the German state of Saxony. This project could be taken public as a spin-off under the name Silver City in 2023. This would be a nice dividend for Globex shareholders via a spin-off.

A full 50 percent in the first swing

Since our initial analysis in November 2022, Globex has already seen a 50% increase in value. The market capitalization has risen from CAD 36 million to CAD 50 million within 2 months. However, the fundamental view has hardly changed. In addition to the CAD 11 million in cash and cash equivalents, total assets less liabilities as of September 30, 2022, amount to CAD 23.9 million. The strike rate is very high; already in the new year Jack Stoch can show another five deals.

Revaluation is in full swing

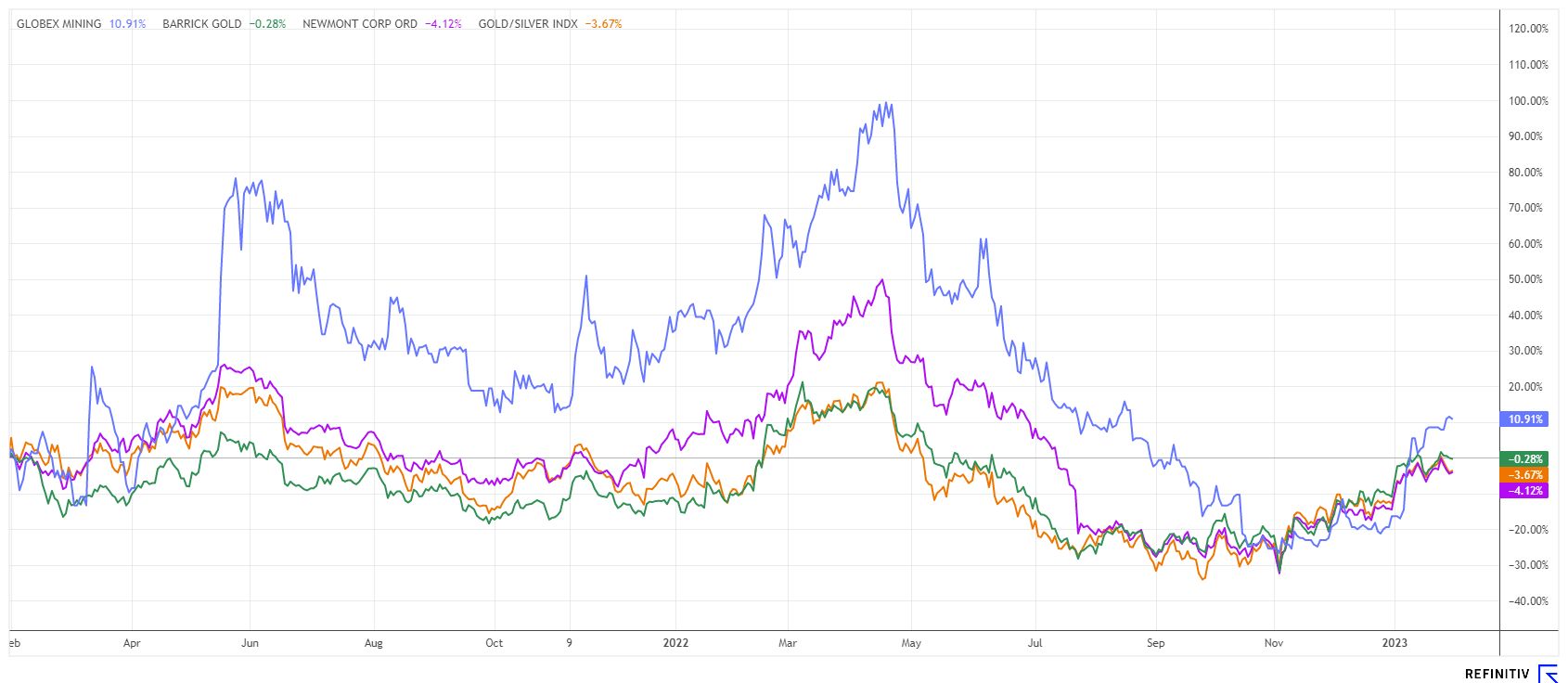

The two-year performance of Globex Mining shares reflects the ups and downs of mining stocks in North America very transparently. In the chart below we compare Globex Mining to the two majors Barrick Gold and Newmont Mining. For comparison, we also include the Philadelphia Gold and Silver Index. Only Globex Mining managed to gain 11% over the period under review. All comparison values are about the same and slightly in the loss zone. The price trend illustrates how hard the sector has struggled over the past 2 years. In addition to the significant increase in energy and exploration costs, Corona has also led to heavy losses. That could turn into the opposite this year with rising gold and silver prices.

Interim conclusion

Based on the high project quality and reported progress in the investment portfolio, Globex can be expected to continue to outperform significantly over the next 24 months. Commodity demand from a decarbonization perspective is leading to an international commodity shortage that cannot be addressed in the shorter term. This can only result in further price adjustments on the supply side. Globex Mining should be able to benefit disproportionately from this in the medium term.

The update is based on the initial report 11/2022.