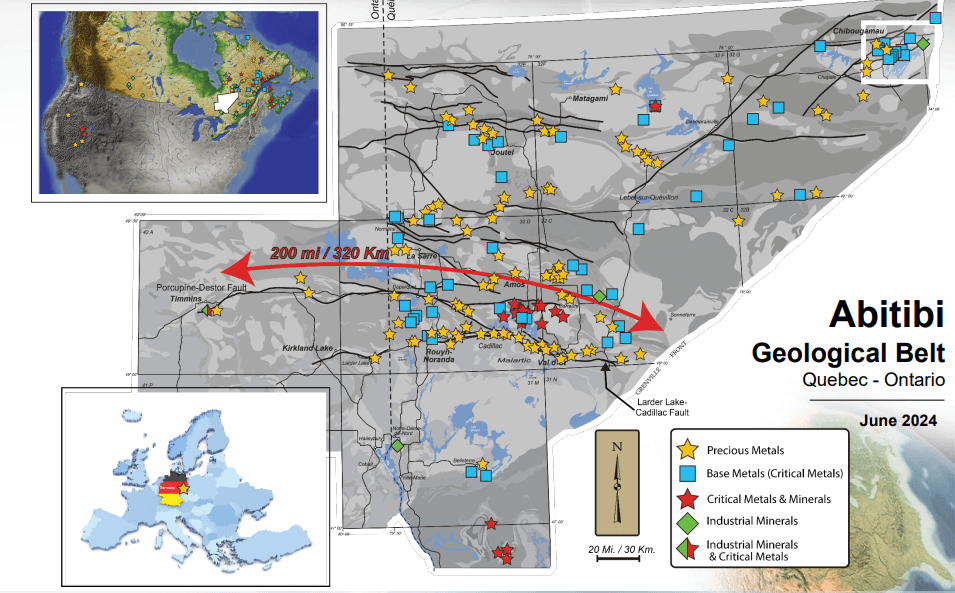

A promising collection - Over 240 projects in the portfolio

Iron, copper, and tin, as well as almost all other metals on the periodic table, are what make our modern civilization possible. Whether gallium, chromium or rare earths - many elements are indispensable for modern technology because without them, most technical applications would not exist - from vehicles and computers to televisions and mobile phones. Climate activists criticize the slow pace of renewal of our supply cycles. However, it is easy to forget that the necessary resources must first be laboriously sought, their extraction approved, and ultimately extracted efficiently. The entire process of installing a mine to today's environmental standards takes at least 5 years. Market experts know that the current shortfall in copper and lithium, for example, cannot be made up in the next decade despite all political and entrepreneurial efforts.

Broad diversification in precious metals, non-ferrous metals, polymetals, specialty metals, and rare minerals. Over 100 royalties and some options.

Globex Mining Enterprises Inc. was founded over 70 years ago under the name Lyndhurst Mining Co. Ltd. in 1949 to bring a copper mine into production. In 1974, a new group of investors took control of the Company, which was renamed Globex Mining Enterprises Inc. In 1983, the current management took over the Company, which was first listed on the stock exchange as Globex in 1987. Today, the portfolio covers almost all commodities, from the precious metals gold, silver, platinum, and palladium to the industrial metals copper, zinc, iron, and nickel, as well as rare earths and energy metals such as lithium, uranium, and cobalt.

Unlike most other junior exploration companies, Globex wholly owns its properties, many of which are available as options for third parties to conduct exploration and new resource estimation. Globex currently holds a broad portfolio of more than 249 property packages and various commodities, all of which have resources or reserves, mineralized drill intercepts, untested geophysical showings, or a combination thereof.

Globex Mining acquires two prospective gold projects

In July 2024, the Company announced a transaction with Iamgold Corp. whereby it acquired two gold projects in the Abitibi West region of Quebec. These projects include the former Eldrich Gold Mine (also known as the Pierre Beauchemin Gold Mine) northwest of Rouyn-Noranda and the Porcupine West gold property west of the town of Duparquet. As part of the transaction, Globex acquired these two properties in exchange for the Rich Lake (base metals) and Lac a l'Eau Jaune (gold) properties in Globex's portfolio. Both Globex and Iamgold will retain a 1% net smelter return (NSR) on their respective traded properties. The two additional royalties on Rich Lake and Lac a l'Eau Jaune bring Globex's total royalty portfolio to 105. No cash or shares were issued as part of the transaction.

The Eldrich Gold Mine shows historically high grades

The Eldrich Gold Mine is located 14 km northwest of Rouyn-Noranda and consists of eight claims totaling 235.55 ha. Between 1955 and 1962, 652,400 tons of rock grading 4.8 grams per tonne (g/t) gold AU were mined, yielding 100,679 ounces of gold. In 1987, Cambior reported a resource of 1,433,100 tons with a grade of 5.3 g/t AU; mining began in 1989 and was discontinued in 1993. The remaining resources are reported at 213,317 tons, grading 5.8 g/t. Note that the gold price fell from a high of USD 483 to a low of USD 395 in 1988 and ended the year at USD 410, while a profitability study by Cambior assumed a price of USD 560. The project proved to be less profitable at the time. **Given the six-fold increase in the price of gold since the 1988 study, Globex believes that a fresh look at the exploration and economic potential of the mine property is warranted, especially since depths in excess of 500 m have not yet been tested.

The Porcupine West property is vast and underexplored

The Porcupine West property is located in the municipality of Hebecourt, Quebec, west of the town of Duparquet. It comprises 89 claims totaling 4,711.27 ha, spanning 14 km of the gold-bearing Porcupine-Destor fault. Data collected indicates that 355 drill holes totaling 52,339 m have been drilled on the property. Numerous additional geophysical surveys have been completed on the property, including airborne electromagnetic and magnetic surveys, IP (induced polarization), ground electromagnetic and magnetic surveys, and BeepMat surveys. Gold mineralization ranging from 2 to 6.7 g/t AU has been identified over varying widths, lengths, and depths.

Globex believes that much potential remains untested on the property, particularly at depth and in parallel and transverse structures to the gold-bearing Porcupine-Destor fault. A historical resource of 195,300 tons grading 5.2 g/t AU is reported, of which 156,630 tons grading 5.1 g/t Au are within the main lens. Several other areas on the property, such as the Hebecourt Lake and St-Francois deposits, also have gold values. The acquisition of over 14 km of the gold-bearing Porcupine-Destor fault adds prospective land positions to Globex's gold base.

Positive sentiment ensures high deal flow

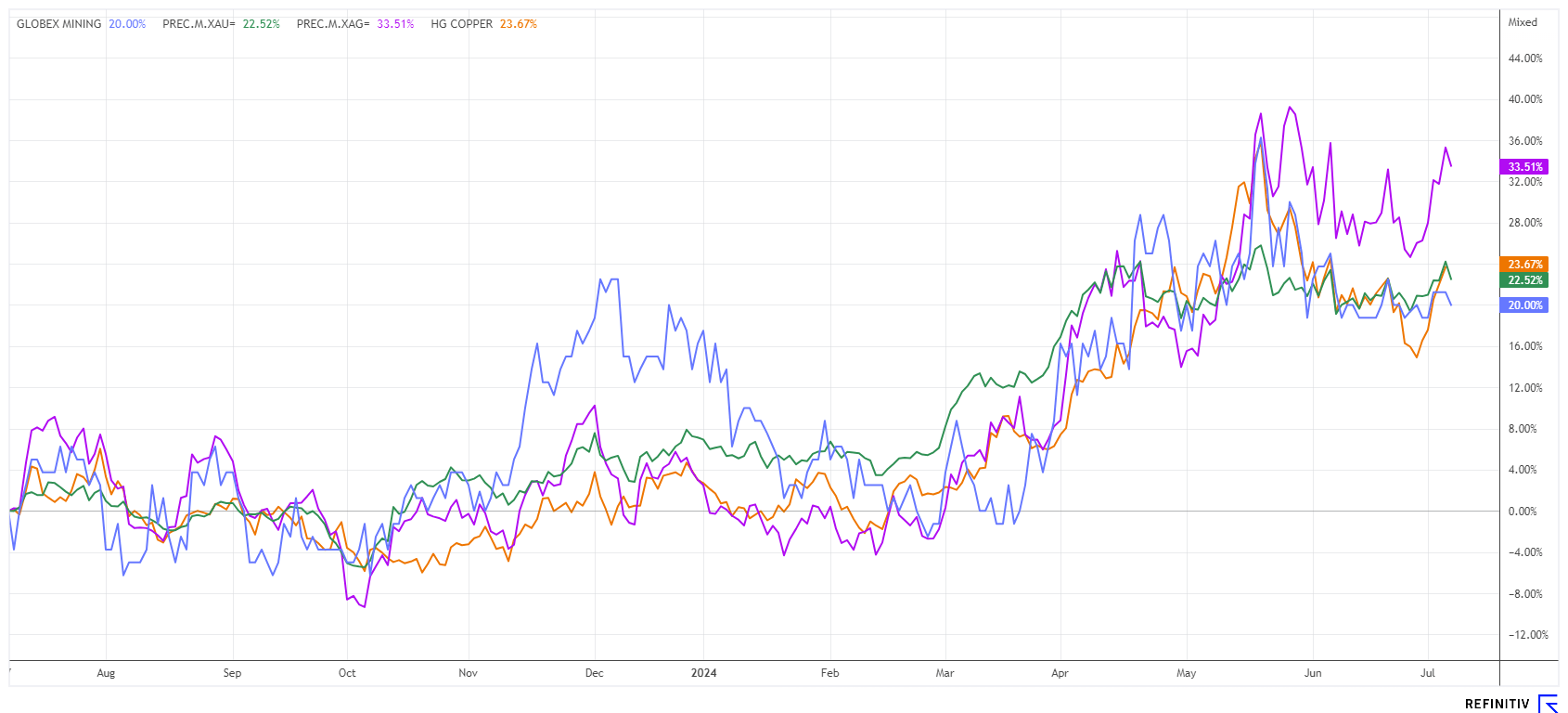

CEO Jack Stoch has been in this business since the 1980s, and the industry veteran is still constantly developing his network. The Company's primary goal is not the investment-heavy development of a mining operation but rather the optimization and maintenance of its broadly diversified properties. The year 2024 has started with 30% higher gold and silver prices, which gives precious metal investors hope for the future. For Globex, positive sentiment is crucial. The partner drilling programs have been able to continue on many properties thanks to the recently improved refinancing conditions.

There are signs, especially in North America, that the environment for strategic metals could also improve for several years to come. Added to this are the major geopolitical uncertainties worldwide. They are drawing investors' attention to safe jurisdictions. Commodity experts see precious metal prices on a strong upward trend towards USD 2,500 for gold and USD 50 for silver after a 3-year consolidation. With this price outlook, Globex's current portfolio would have to experience an appreciation of 200 to 300%.

Interim conclusion: The new commodity cycle creates high values

While spot prices of precious metals have already reached positive territory in the last 6 months, large and small mining companies are only at the beginning of a longer upswing. One reason for the reluctance of market participants is the cost explosion in the entire sector, which has caused exploration and production prices for precious metals to rise by around 20 to 30%. However, market sentiment is currently back in upward mode. Globex Mining has traditionally kept its costs under control because it acts as an asset manager and does not drill itself. This produces no costs, and if a project is successful, Globex either receives option income or generates royalties.

The GMX share is stable in the CAD 0.90 to 1.10 range after a good 30% increase in the last 12 months. There are always days with rising volumes, which shows the increasing interest of institutional investors. With 56.2 million shares, the market capitalization is currently around CAD 54 million. The share price is boosted by a constant deal flow, continued option income, and new royalty deals. In addition, the Company had CAD 23.7 million in available funds and valued company shares as of March 30, 2024. GMX shares should continue to outperform the resources sector due to the large number of high-quality projects, the high diversification across the entire commodities sector, and the prospect of promising deals. In the last bull cycle, the share price reached CAD 1.70, offering sufficient scope for performance from the current CAD 0.96. Time to stock up like Jack Stoch!

The update follows the initial report 11/2022.