The battery foundry principle as an industrial policy game changer

A sobering fact for Western managers: dependence on China will continue to dominate the picture for several years to come. This is because China's dominance in the battery market is difficult to break. Around 95% of global graphite capacity and around 80% of cell production is located in China, led by CATL with a 37% market share and BYD with 17%. At the same time, export controls on lithium compounds, LFP cathodes, and graphite ensure that Western companies remain heavily dependent.

NEO Battery Materials (ISIN:CA62908A1003|TSX-V:NBM|FRA:1BC|WKN:A2QQBV) does not follow the classic cell manufacturer model, but instead applies a principle proven in the semiconductor industry to the battery market: the foundry model, comparable to TSMC. While companies such as Apple and Nvidia design their chips but do not manufacture them themselves, TSMC takes on the capital- and technology-intensive production.

Applied to the battery market, this means that OEMs in the automotive, drone, robotics, and defense sectors require highly specialized batteries but are reluctant to invest billions of USD in their own cell production facilities. Standard cells from China, which today account for around 77 to 80% of global production, are often unsuitable in terms of form factor, energy density, charging characteristics, and supply chain risk.

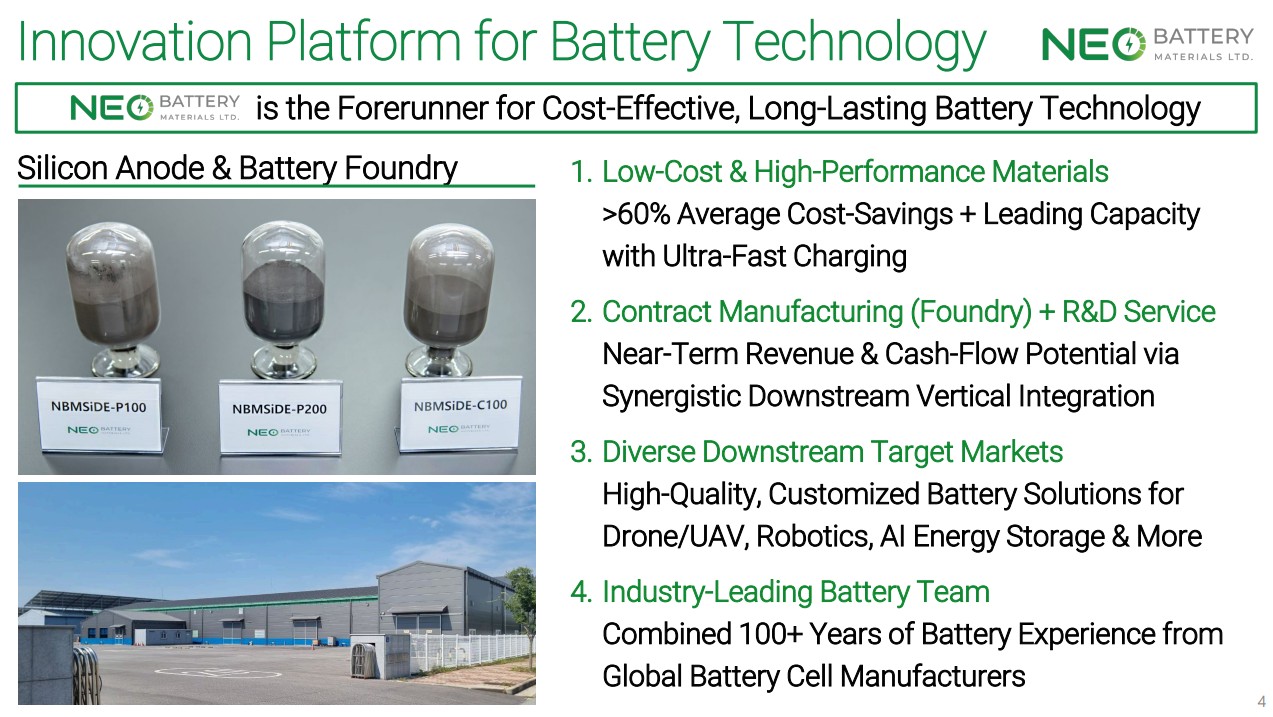

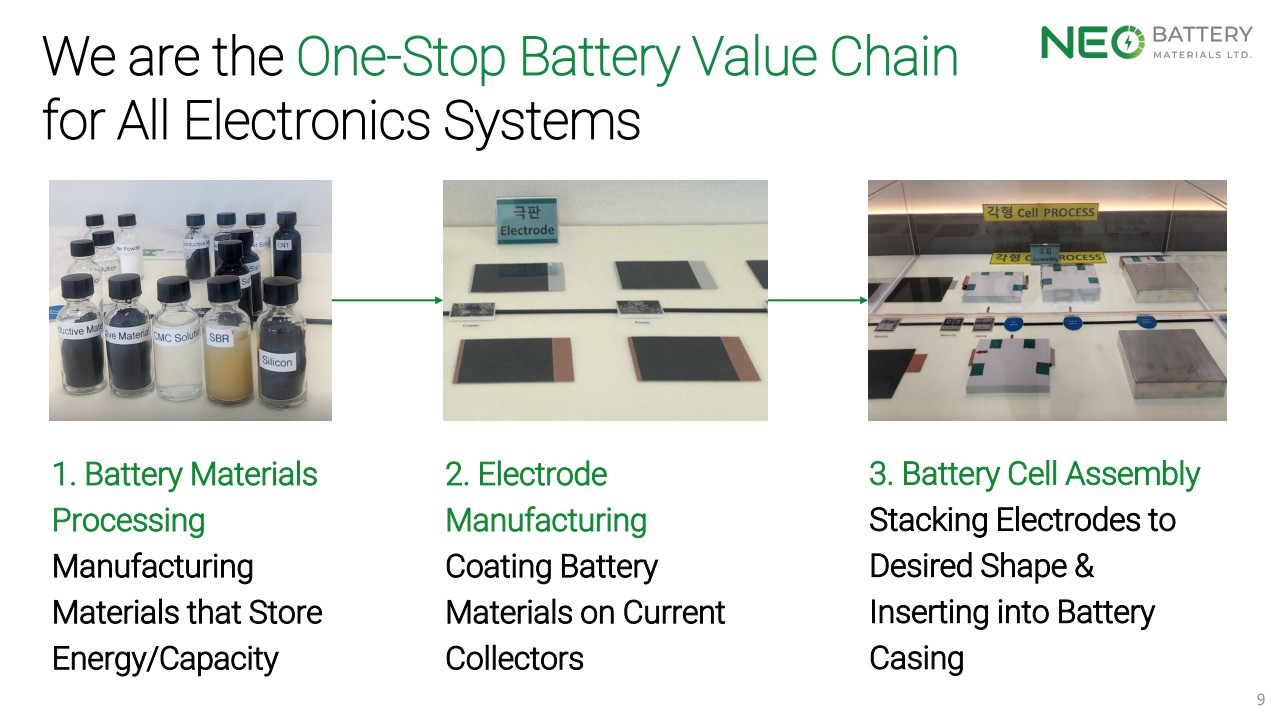

NEO is positioning itself as a one-stop shop to fill this gap:

- Material development (silicon anodes),

- Electrode and cell manufacturing,

- Customized battery design through to packaging.

The company manufactures to customer specifications, reducing capex risks on the customer side while addressing political pressure to onshore and friendshore critical supply chains in North America, Europe, and Asia.

Technological core: Silicon as the key to the next generation of batteries

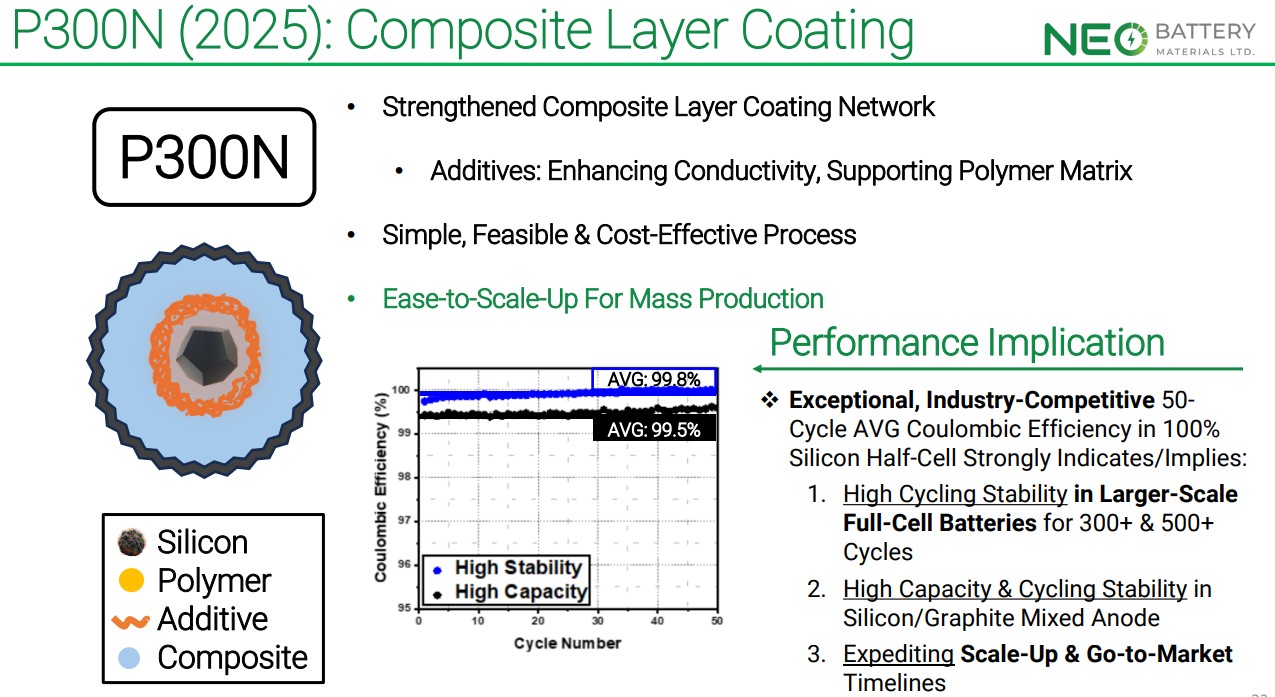

NEO Battery Materials' technological approach is based on the targeted substitution of graphite with silicon-reinforced anode materials in order to overcome the physical limitations of conventional lithium-ion batteries. While graphite anodes have a theoretical capacity limit of around 372 mAh/g, silicon has a potential of around 3,600 mAh/g. NEO has succeeded in making this advantage industrially viable without having to accept the known weaknesses of silicon, such as volume expansion and rapid capacity loss. Using a patented single-step coating and wet grinding process based on low-cost metal silicon, the company achieves specific capacities of over 2,000 mAh/g, initial Coulomb efficiencies of more than 88%, and a capacity retention of at least 90% after 300 charging cycles. At the same time, manufacturing costs are reduced by over 60% compared to alternative silicon anode approaches. This combination of performance enhancement and cost leadership represents a rare value proposition in the battery materials market and forms the technological basis for scalable industrial application.

From proof of concept to industrial validation

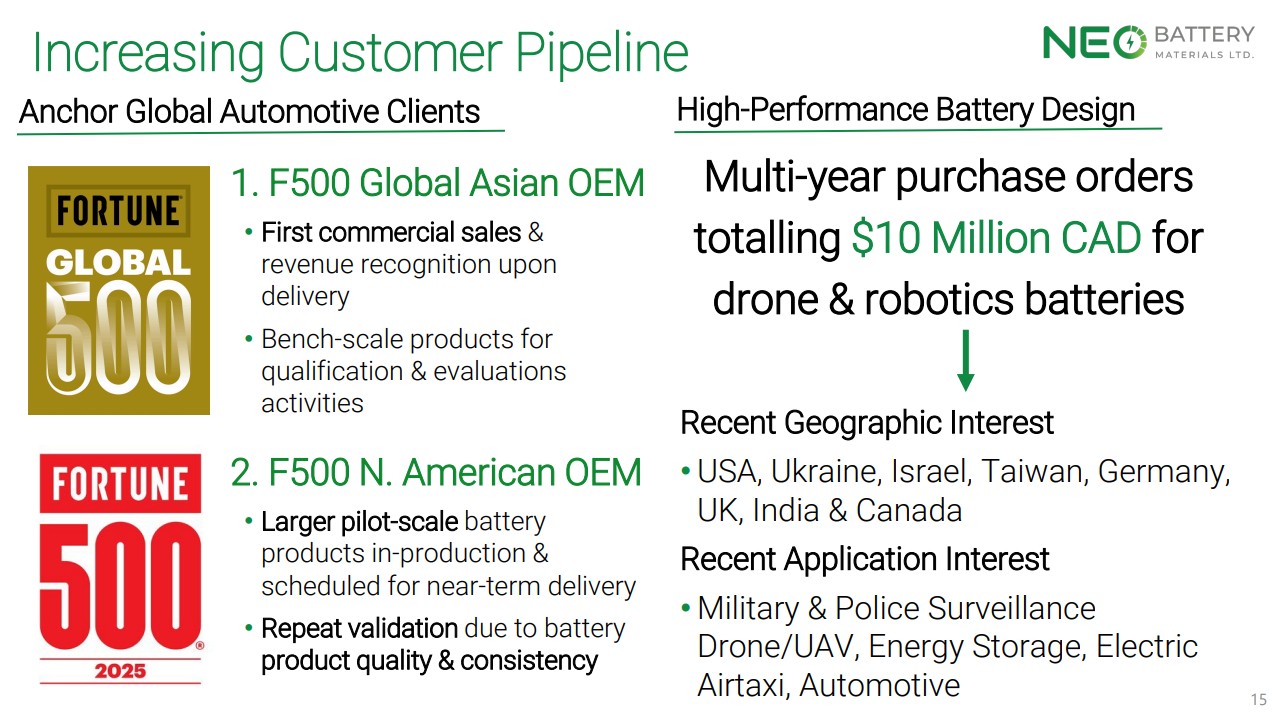

NEO Battery Materials has already made the transition from the development to the implementation phase and has demonstrated this through a series of operational milestones. Within a period of around two months, new high-performance drone cells were developed, manufactured, and validated internally, achieving over 50% higher capacity and around 40% higher energy density compared to standard Chinese reference cells of identical cell size. At the same time, a total of 48 prototype cells were manufactured to demonstrate reproducibility and quality across multiple batches. On this basis, the transition to pack assembly was made in cooperation with a South Korean manufacturing partner, combined with the preparation of live field tests under real operating conditions. This technical validation is flanked by concrete customer relationships, including multi-year purchase agreements worth around CAD 10 million, a four-year contract for 50 tons of silicon anode material, and official supplier status with an Asian Fortune 500 automotive OEM. This shows that NEO not only demonstrates technological capability, but also translates this into industrial acceptance and resilient supply relationships.

Niche focus as a scalable entry into the mass market

Management is pursuing a clearly structured market entry strategy that deliberately focuses on high-performance niche markets such as drones, UAS, robotics, defense, and AI-related energy storage. These segments demand significantly higher energy densities, shorter charging times, and reliable, non-Chinese supply chains, while price plays a secondary role. This focus allows NEO to validate its silicon anode technology under real-world conditions, industrialize production processes, and generate margins at a very early stage. Strategic collaborations with Fortune 500 OEMs and defense-related institutions such as the Korea Institute for Defense Industry (KOIDI) serve as door openers to larger industrial ecosystems. In the long term, these validated applications are intended to serve as a springboard into higher-volume markets such as electromobility and stationary energy storage, without incurring the typical start-up risks of the mass market.

The following interview with NEO conducted by Lyndsay Malchuk provides deeper insights into the strategic cooperation with a Fortune 500 company.

Market potential from the drone market to AI energy storage

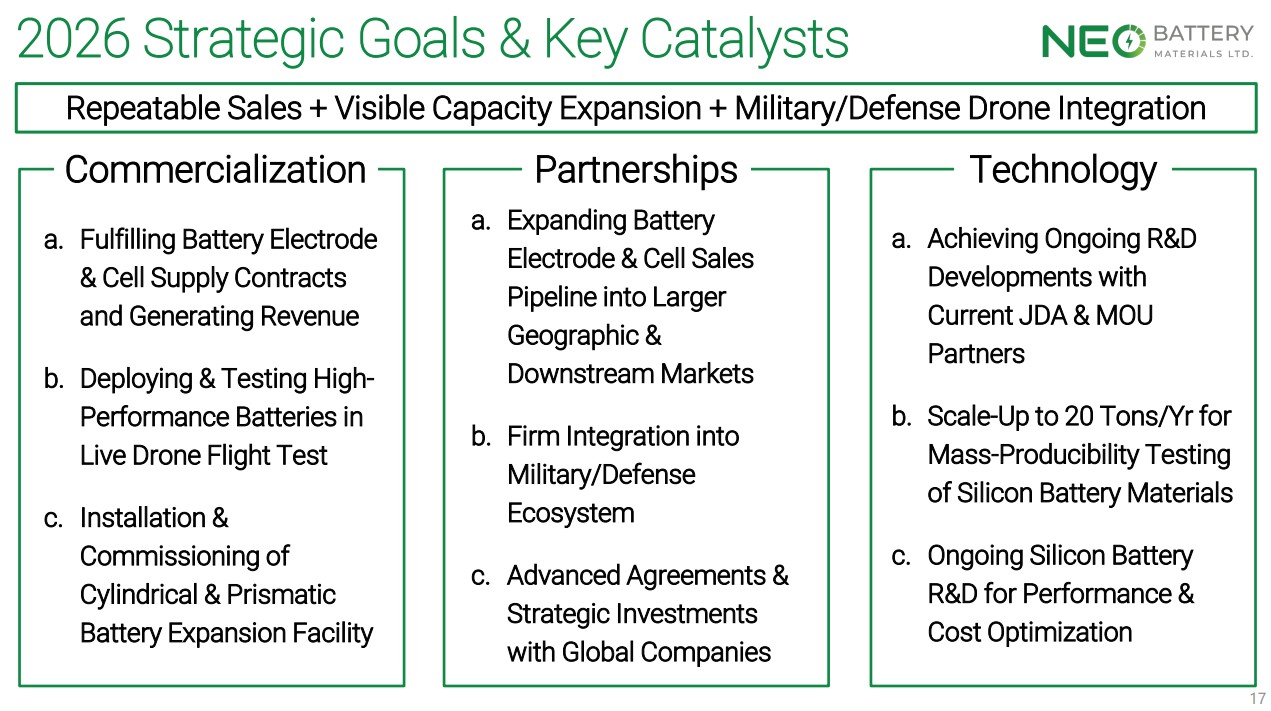

The market for silicon-enhanced lithium-ion batteries is poised for a structural growth spurt and, according to market researchers, is expected to grow from less than USD 5 billion to around USD 30 billion by 2032. At the same time, geopolitical tensions and possible export restrictions by China are increasing pressure on Western manufacturers to establish alternative supply chains. NEO is right at this intersection and is actively driving industrialization forward. Production capacities in South Korea are already operational and can be expanded from currently around 250 MWh to up to 500 MWh in the future. In addition, the company's own silicon anode production is being gradually expanded to up to 20 tons per year. With announced live field tests, OEM pilot programs, and ongoing supply contracts, the first significant revenues are approaching, while technological differentiation is maintained.

Solid capital base with manageable valuation

With the CAD 7 million capital increase completed in January 2026, NEO has strengthened its financial base for the transition from the development to the implementation phase. The funds will be used specifically to expand cell production, add additional production lines for cylindrical and prismatic formats, and invest in the defense and drone segment. With approximately 153.4 million shares outstanding and a share price of around CAD 0.66, the market capitalization amounts to approximately CAD 101 million. Measured in terms of technological maturity, existing multi-year contracts worth around CAD 10 million, and the billion-dollar markets addressed, this valuation continues to reflect an early commercialization status and offers scope for revaluation if scaling is successful. Investors should keep a close eye on the next steps.

Conclusion: Good entry opportunity before the next growth spurt

NEO Battery Materials stands out in the battery technology sector with a rare combination of measurable performance progress, industrial implementation speed, and strategic relevance. The proven technological leap of over 50% capacity in drone cells, concrete OEM orders, official supplier status, and operational production facilities outside China significantly reduce the risk of classic development stories. At the same time, with a market capitalization of more than CAD 100 million, the company is now leaving the small-cap sector. For risk-conscious investors, the recent 15% price correction presents a good entry opportunity and substantial upside potential in the long term, provided that the ongoing industrialization is translated into scaling revenues as planned. Due to the highly innovative nature of the company, investors should be on their guard, as the right news could send the stock soaring.

Note: This update follows our initial report from November 2025.

https://researchanalyst.com/en/updates/neo-battery-materials-gamechanger-for-the-ai-era