Early to the source: Silver Viper leverages new silver and gold discoveries

Silver Viper Minerals Corp. is a Canadian exploration company focused on the acquisition and development of gold and silver projects in Mexico. The Company pursues a value-oriented business model that focuses on the early stages of the mineral value chain, where the leverage on exploration success and rising commodity prices is particularly high. Silver Viper combines traditional greenfield and brownfield exploration with strategic project acquisitions in established mining regions. The goal is to bring projects to an economically attractive stage of development through systematic exploration, resource expansion, and geological reevaluations to either attract acquisition interest or enter into partnerships with larger producers.

Focus on Mexico: Exploration projects in one of the world's richest silver belts

Mexico dominates the global silver market as the world's largest producer with annual production of around 6,300 tons, corresponding to approximately 25% of global output. Analysts forecast continued growth potential for 2026, as reserves in projects such as Panuco contain over 200 million ounces of silver and geopolitical and strategic demand continue to drive the sector.

annual production of silver in Mexico

Silver Viper's project portfolio includes three core projects, La Virginia, Coneto, and Cimarron, all of which are located in productive and historically proven precious metal regions of Mexico. This clear regional focus enables operational efficiency, regulatory experience, and access to existing infrastructure. La Virginia in Sonora and Coneto in Durango form the strategic backbone of the Company, while Cimarron acts as an optional growth driver. Geologically, Silver Viper primarily targets epithermal gold-silver systems and polymetallic structures, which are responsible for numerous Tier 1 deposits in Mexico. The low level of exploration to date on large parts of the properties underscores the significant discovery potential.

Resources with growth potential: The next steps

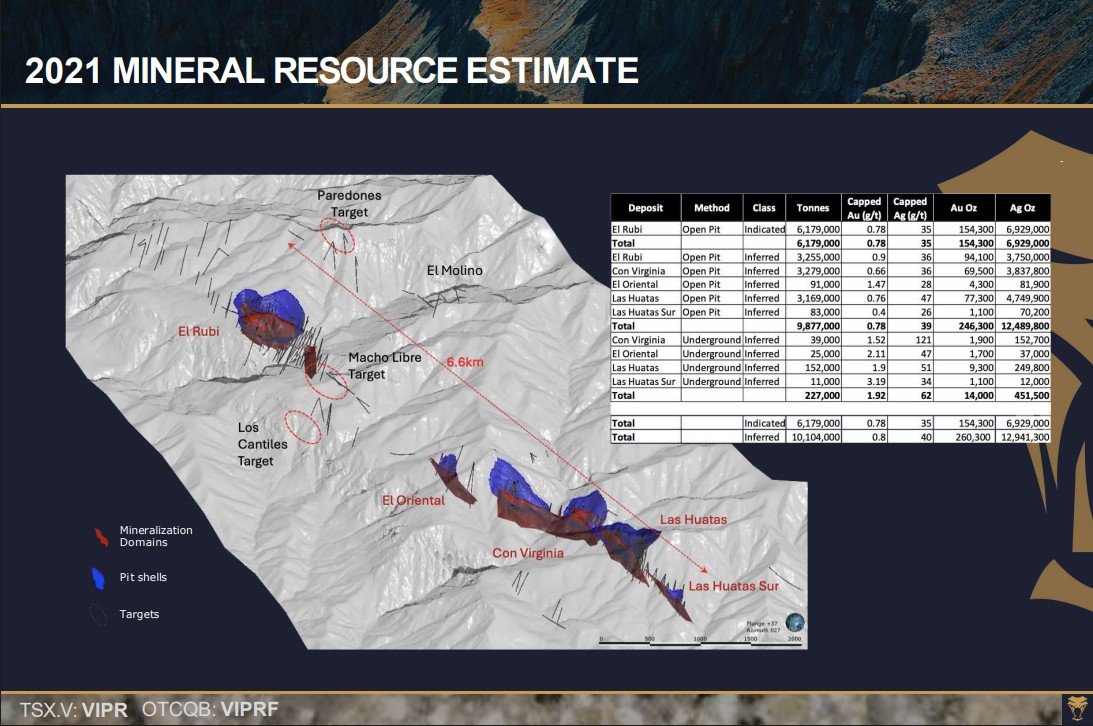

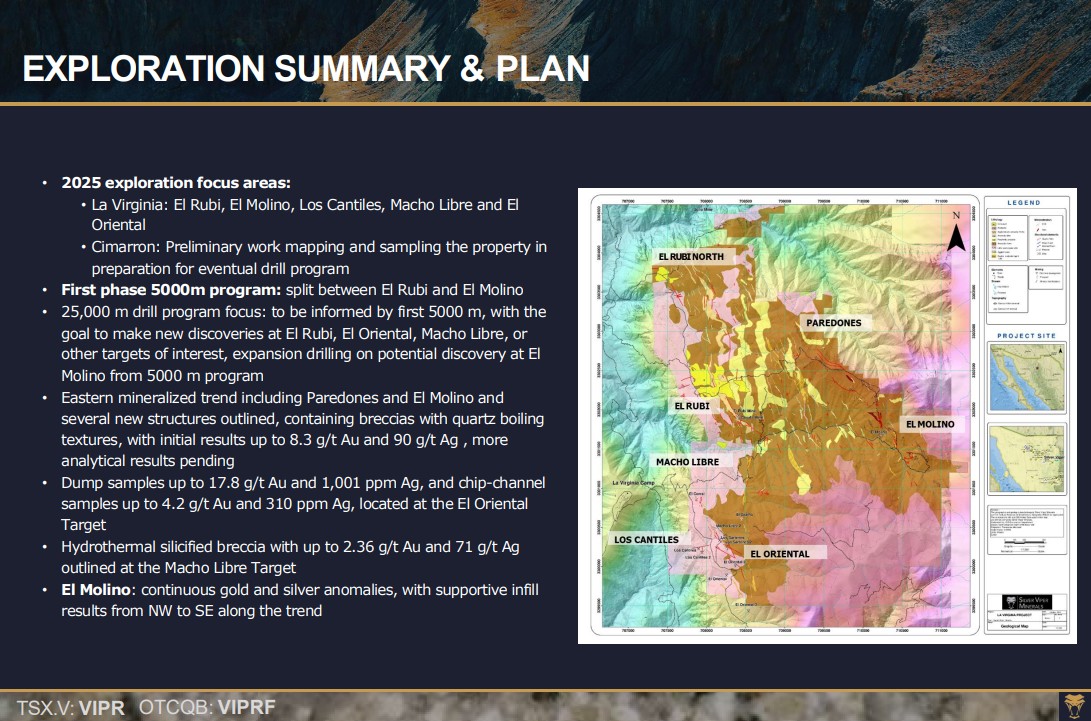

Approximately 52,000 meters of drilling have already been completed at the flagship La Virginia project, providing a solid foundation for targeted follow-up programs. The existing NI 43-101-compliant resource has substantial gold and silver grades in both the “indicated” and “inferred” categories. The operational focus is currently on expanding known mineralized zones, particularly El Rubi, and generating new drill targets through detailed surface exploration. The planned drilling campaigns in the coming years are considered key operational catalysts. Any resource expansion or new discovery will immediately add value, as Silver Viper is still in an early stage of valuation.

La Virginia and Coneto: Two projects, one goal

A closer look at the projects reveals why Silver Viper has above-average strategic potential. La Virginia is characterized by a large, contiguous concession area with several mineralized trends that have only been partially tested to date. The existing resources are concentrated in a few zones, while geochemical anomalies, structures, and historical mining traces indicate additional target areas. This opens up the possibility of not only expanding existing zones, but also developing the project as a whole to a new scale.

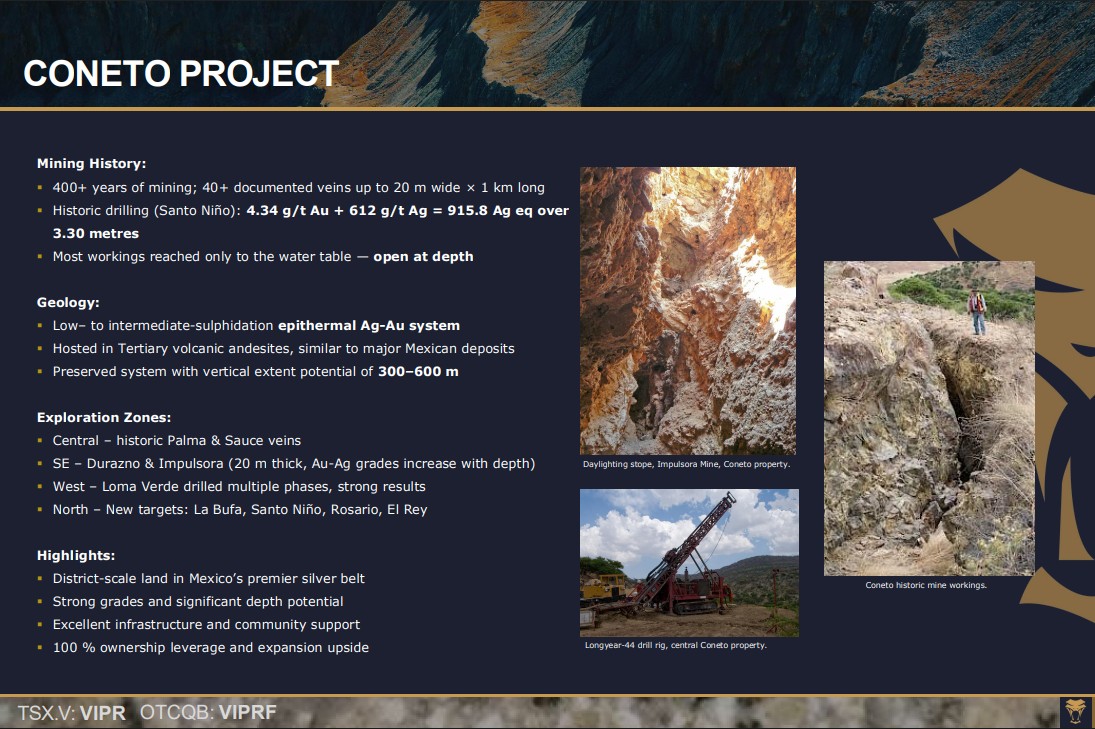

Coneto, on the other hand, is a classic district-scale exploration project. The region is known for high-grade silver mineralization, but has historically been fragmented and explored in an unsystematic manner. Through the share swap with Fresnillo and Orex Minerals, Silver Viper has established a strategically significant footprint in this region. Of particular relevance is that Coneto adds a project to the portfolio that is potentially of immediate interest to larger producers as well. Overall, La Virginia and Coneto complement each other perfectly: while La Virginia already has defined resources, Coneto offers significant upside potential through new discoveries.

Strong capital base and institutional validation: Why the big names have already invested

Silver Viper's shareholder structure is exceptionally high quality for an exploration company of this size. With Fresnillo, the world's largest silver producer, a strategic player is involved that contributes not only capital but also industry expertise. The management share of around 15% ensures a strong alignment of interests. The recent capital increase of around CAD 17 million was quickly sold out and provided the Company with financial planning security for several exploration cycles. The attached warrants further increase financial optionality and create a potential capital inflow as the share price continues to rise. With a market capitalization of around CAD 180 million, Silver Viper has also reached a size that is investable for institutional investors.

The management and extended advisory team are further key strengths of Silver Viper. The appointment of Jeff Couch to the Board of Directors brings in-depth capital markets and private equity experience. At the same time, Andreas L'Abbe and Gernot Wober take the Company to a new level, both financially and technically. In particular, the experience gained from the successful development of the Cordero project at Discovery Silver is highly relevant. This personnel lineup increases the likelihood that Silver Viper will not only discover its projects, but also strategically develop and monetize them in an optimal manner.

Conclusion: Mexican call option on the silver bottleneck with high momentum

Silver Viper Minerals is more than a classic exploration bet. In an environment of rising silver demand, structural supply deficits, and increasing geopolitical uncertainties, securing future raw material sources is becoming increasingly important. The well-financed company is positioning itself precisely at this strategic bottleneck. The combination of high-quality projects, industrial validation by Fresnillo, and experienced management makes the Company a strategic option for future silver and gold supply. For investors, successful exploration and continued strength in the precious metals market offer considerable upside potential. At a share price of CAD 1.98, the market capitalization remains a modest CAD 180 million - the growth train is just leaving the station.

CEO Steve Cope was a guest at the 17th International Investment Forum in December. He provided deep insights into the plans for 2026.