Strategic metals in the focus of geopolitical upheavals

In an environment of increasing geopolitical fragmentation and growing trade barriers, reliable sources of raw materials in stable jurisdictions are becoming massively important. This is because industrialized countries are increasingly pursuing the goal of regionalizing critical supply chains and reducing dependencies on politically unstable regions. Power Metallic Mines is positioning itself at precisely this intersection by advancing a broadly diversified polymetallic project in Québec, one of the world's most attractive regions for sustainable and regulation-secure mining. The combination of political stability, clear legislation, excellent infrastructure, and access to CO2-neutral electricity gives the Company a structural locational advantage. For North American industrial, automotive, and technology companies, such assets are increasingly becoming the focus of strategic planning.

From explorer to industrial option

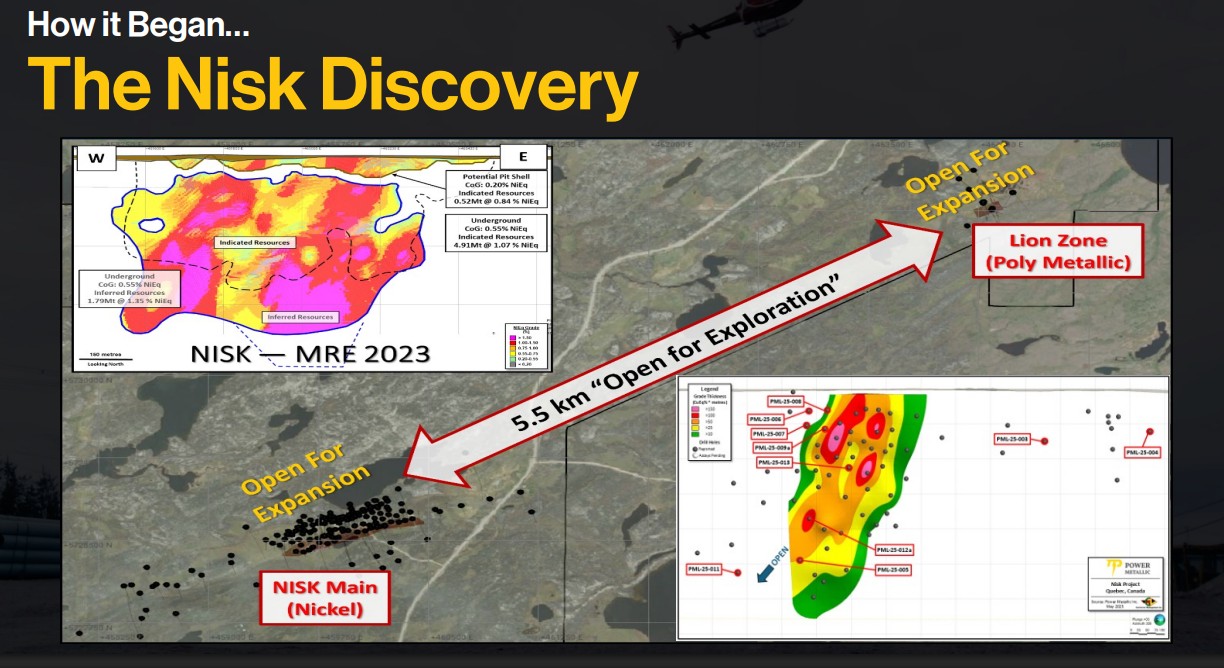

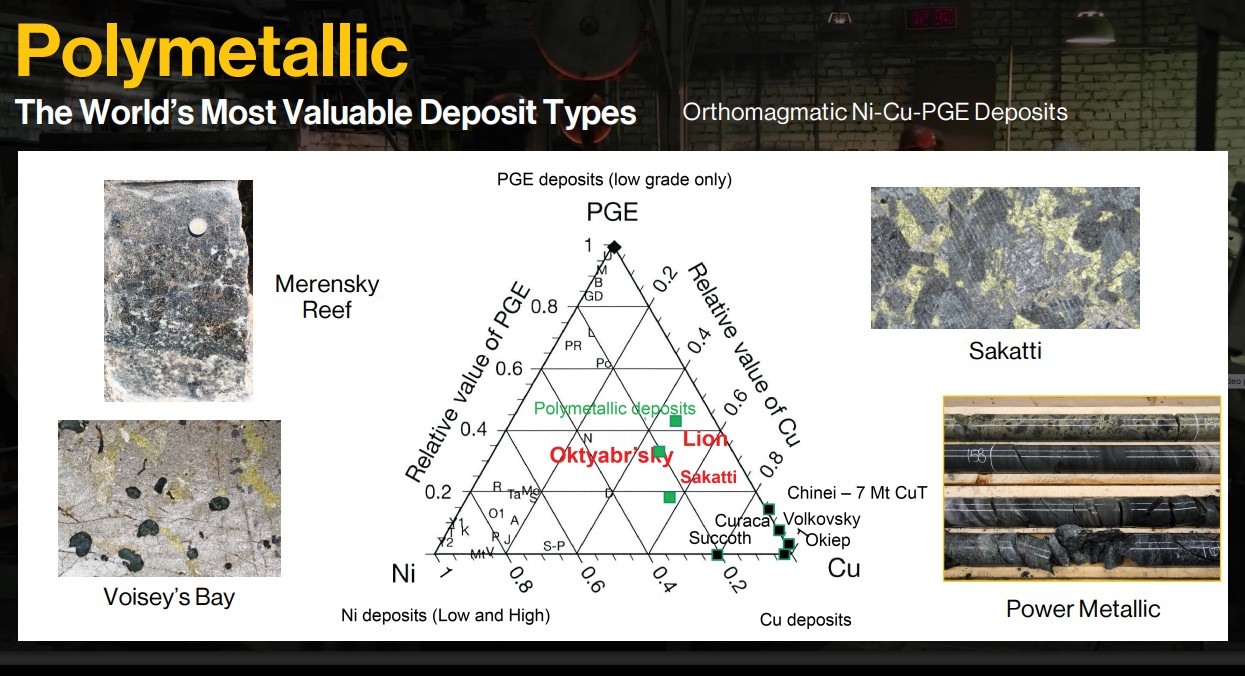

Power Metallic Mines has rapidly emerged as a key player in the North American commodities market. The focus is on developing polymetallic resources with an emphasis on energy transition and high-tech metals such as copper, nickel, cobalt, and platinum group metals. The centerpiece is the NISK project in Québec, which is now positioned as one of the most attractive polymetallic deposits in North America. Within a short period of time, the NISK project has evolved from a classic exploration story to a potentially industry-relevant deposit.

Strategic acquisitions by Li-FT Power and other parties have increased the project area to 313 km².

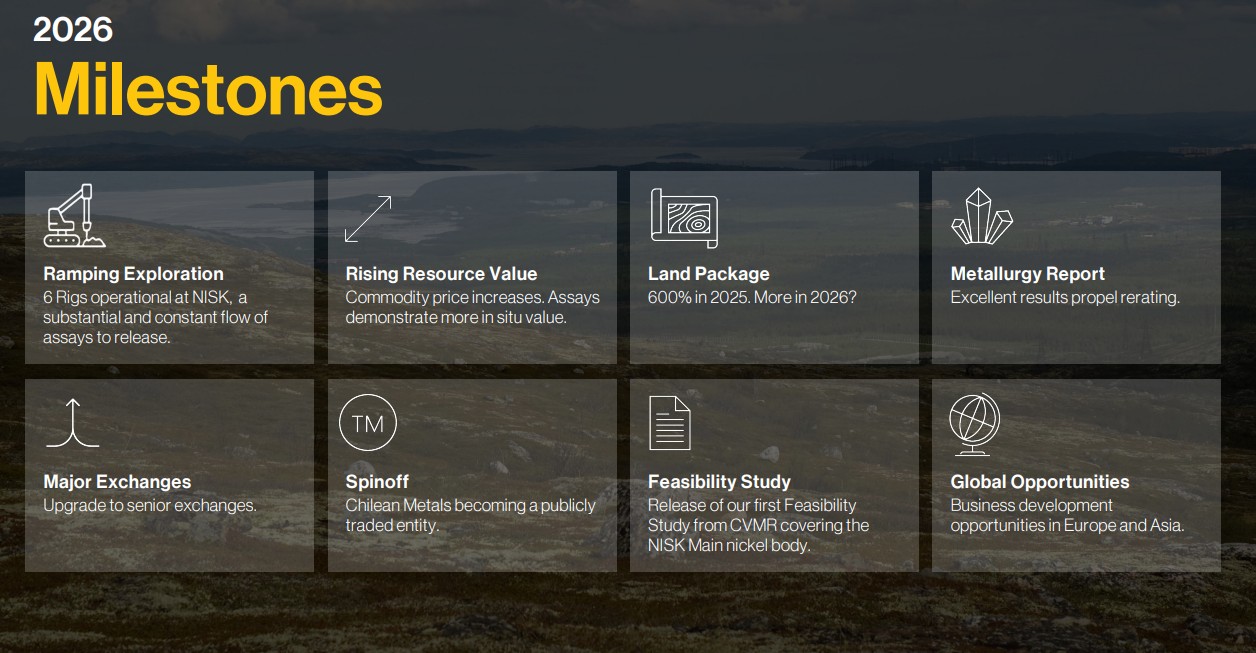

Extensive drilling programs, high-grade hits, and a massive expansion of the area indicate that the known deposit reflects only a portion of the total potential. It is particularly noteworthy that the project area has been specifically expanded along geologically promising structures. Through strategic acquisitions of Li-FT Power and other parties, the project area has grown by more than 600% to 313 km². In addition, Power Metallic controls over 50% interests in Chilean and BC assets, as well as Jabul Baudan in Saudi Arabia (200 km² of VMS potential), creating diversification and diversifying geopolitical upside sources.

With a planned drilling volume of around 100,000 meters, a constant, substantial flow of news is expected in the coming quarters. This operational momentum should further sharpen the geological dimension of the project and bring additional zones into focus. The upcoming results promise significant attention potential.

Metallurgical turning point: Risk becomes confirmed value

The decisive qualitative leap is marked by the recently published metallurgy, which gives the project a new basis for valuation. Locked-cycle tests conducted by SGS on material from the Lion Zone deliver recovery rates close to the physical optimum: just under 99% for copper, around 97% for platinum, and over 93% for palladium. Such values are exceptional for polymetallic deposits and are considered the benchmark in the industry. It is particularly relevant that these results were achieved using conventional flotation methods, without complex or cost-intensive special processes. This largely eliminates one of the biggest risks in early exploration phases, namely, technical and economic viability, and translates it into a clearly quantifiable value factor. Power Metallic enjoys the confidence of world-renowned investors, including industry giants such as Robert Friedland, Rob McEwen, and Gina Rinehart. They have already invested in this project in its early stages.

A concentrate with strategic depth

The metallurgical data also show that Power Metallic is not only developing a copper project, but can also produce a high-grade multi-metal concentrate. With over 25% copper content and significant proportions of platinum, palladium, gold, and silver, the result is a product that is exceptionally attractive from both a metallurgical and economic perspective. This diversity of metals acts as a natural hedge against cyclical price fluctuations of individual commodities and increases the robustness of the business model. At the same time, it increases the strategic relevance for customers in the automotive industry, hydrogen economy, and energy technology, who are increasingly looking for integrated, ESG-compliant sources of supply. Such a concentrate combines several critical metals in a single supply stream.

Strategic relevance of raw materials in geopolitically volatile times

Power Metallic is gaining additional significance in the global context. China's recent export restrictions on critical metals highlight how urgently Western industries need stable supply chains. Even a Trump deal in exchange for soybeans does not help much. The geopolitical environment remains extremely fragile. A diversified metal project in a politically secure jurisdiction such as Québec is therefore of particular strategic importance. Copper, nickel, and PGEs are considered key building blocks for electromobility, renewable energy, and digitalization, markets whose growth potential can hardly be overestimated. Power Metallic is set to become a key component of North American raw material autonomy.

An exploration stock with large-scale project potential

Power Metallic Mines combines everything investors are currently looking for in the raw materials sector: clearly focused management, a growing project with exceptional metal grades, and a portfolio that capitalizes on global demand for critical metals. With ongoing land expansion, solid finances, and recent drilling results, the Company is entering a decisive phase. If the trend continues, PNPN could become one of North America's most exciting polymetallic growth stocks. The overview of milestones achieved clearly shows that CEO Terry Lynch is pushing for rapid implementation and has no intention of wasting time.

The updated metallurgical assumptions lead to a significant increase in the recoverable metal equivalent, which is likely to have a direct impact on future resource estimates and economic studies. In particular, the strong weighting of platinum and palladium by-products has been underestimated to date. Against this backdrop, analysts see considerable upside potential, especially if further drilling programs confirm the size and continuity of the deposit.

Conclusion: Fundamental revaluation and institutional attention

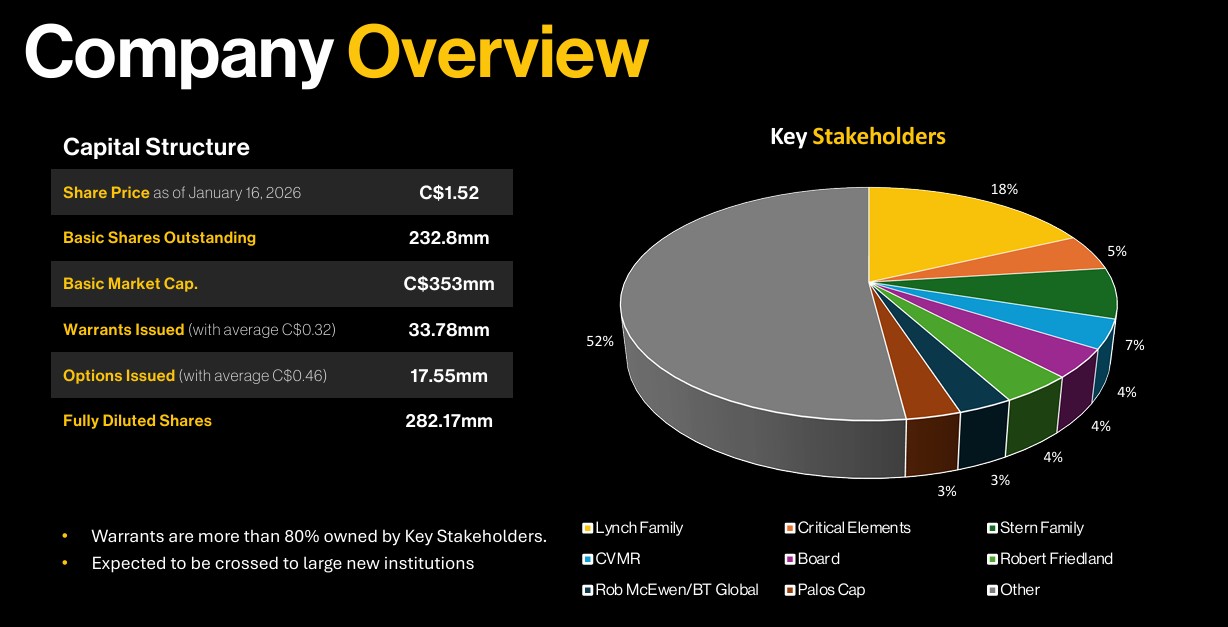

Despite a market capitalization of around CAD 370 million, Power Metallic Mines is often still valued like a classic explorer. The CAD 50 million capital increase completed in 2025 gives Power Metallic the financial leeway to complete the next exploration phases in the current year without pressure. Analysts also remain optimistic: Roth Capital Partners recommends the stock as a "Buy" and sees a 12-month target of CAD 3.00, while Red Cloud has set a price target of CAD 2.50. The experts agree that this is an extremely interesting opportunity.

With a fully diluted share count of 282.17 million and a market valuation of approximately CAD 370 million, explorer Power Metallic Mines is set to enter a new league in 2026. The stock now has a firm place in the TSX-V's commodity spectrum. According to current research reports, the PNPN share has solid upside potential of 80 to 100% at current prices of CAD 1.50 to 1.60. This implies a medium-term revaluation. If progress continues at the same pace, Power Metallic will achieve developer status sooner than expected. However, it is more likely that a large mining company will strike first and add this extraordinary project to its own books.

CEO Terry Lynch discusses the current status of exploration work in Québec in an interview with Lyndsay Malchuk.

This update follows our initial report on the former Power Nickel, which changed its name at the end of 2024. Click here for the initial study.