Rising demand and market concentration

There are many data and estimates on the current situation of the nickel market and its future. In detail, there are sometimes not inconsiderable differences. The common denominator is that there is increasing demand for the metal, with electromobility being a major driver. In addition, market concentration is intensifying due to the expansion of Indonesia, the largest global producer. Key challenges are thus the establishment of nickel production in secure jurisdictions and the associated sustainable extraction of raw materials.

The silvery-white metal has many advantageous properties. Around 70% of nickel is used in the production of stainless steel products and nickel alloys. Another 15% is used in other steel and non-ferrous alloys - often for highly specialized industrial, aerospace and military applications. Use in batteries currently accounts for around 5% to 8%. With the expansion of electric mobility batteries will consume about 20% of nickel production as early as 2025. 1

with the expansion of electric mobility, batteries will consume around 20% of nickel production as early as 2025.

Currently, global production is 2.7 million tons of nickel per year. However, due to the required degree of purity, only 1 million tons or 42% of global production is currently available for the production of batteries. According to estimates by the Nickel Institute, the nickel content in modern batteries will also increase significantly in the coming years. One reason is that less cobalt will be used. Expert estimates predict an increase in nickel demand to 3.4 million tons in 2025.

According to Dr. Michael Szurlies, nickel expert at the German Federal Institute for Geosciences and Natural Resources (BGR), major upheavals are imminent: "Overall, the nickel market is facing a caesura in terms of demand in the coming years, which will lead to a significant shift in market shares within the areas of use." However, due to the metal's high recycled content, an even sharper shortage can be mitigated.

Global nickel resources are currently estimated at nearly 300 million tons. Indonesia will become even more important to the world market in the future due to its significant nickel resources. The island nation already has the world's largest mine production and refining output and, after China, has the world's highest nickel consumption.

Currently, demand already exceeds the existing supply. The nickel price exploded by 27% to USD 23,500 per tonne in the last 12 months.

Company Profile

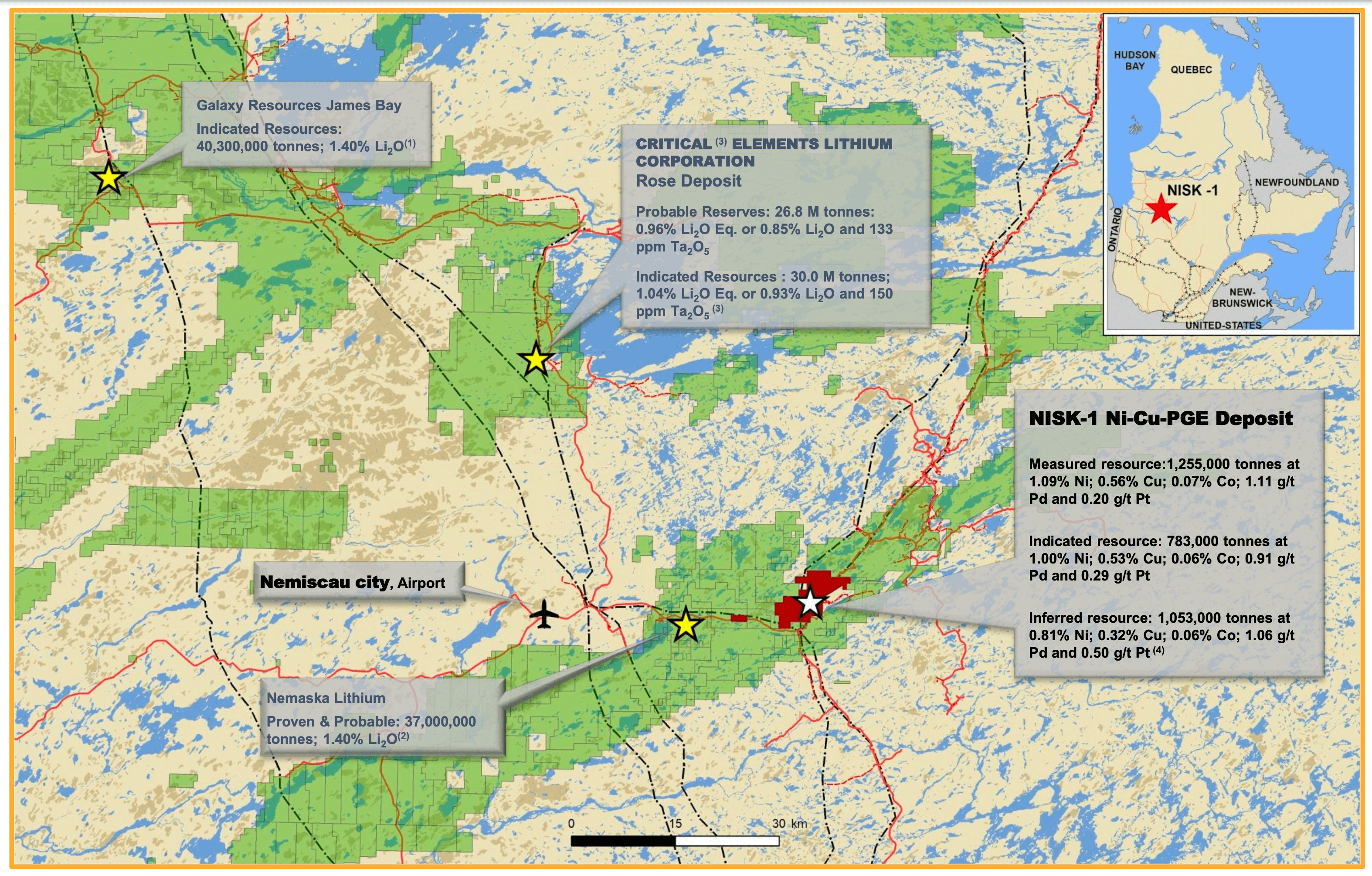

The Canadian exploration company underpinned its change in strategy last year by changing its name from Chilean Metals to Power Nickel. Efforts are now focused on continuing development of the James Bay high-grade nickel-copper-cobalt-palladium-platinum NISK project in Ontario, Canada. The medium-term goal is to serve the growing North American lithium-ion battery market as a producer with high-grade nickel.

The Canadians announced to contribute non-core assets to a separate company and spin them off. The spin-off, Consolidation Gold and Copper, is to be listed in the future. 20% of the shares are to be distributed to existing shareholders of Power Nickel, while 80% will remain with Power Nickel. Consolidation Gold and Copper's portfolio will include the 100% interest in the Golden Ivan project in British Columbia's Golden Triangle, several concession rights in Chile, and the Copaquire Royalty.

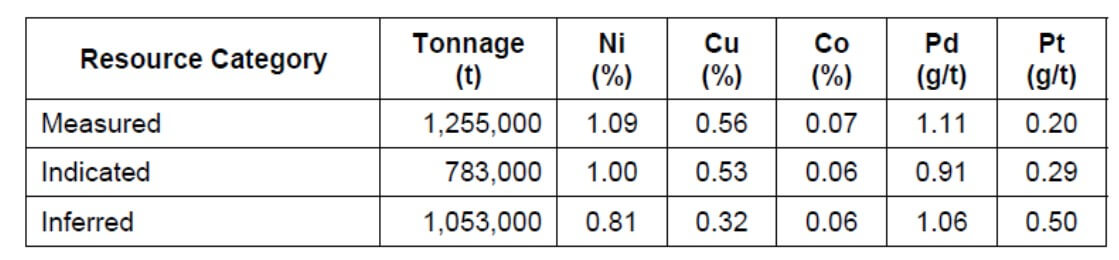

Flagship NISK project: Battery metals

The NISK property in Quebec, Canada, comprises a large land position with 20km of strike length. Historically, high-grade mineralization of nickel, as well as mineralization of copper, cobalt, palladium and platinum has been proven. A historical resource dates back to 2009. Last year Plug Power completed the acquisition of the option to acquire 80% of the property from Critical Elements Lithium Corp.

The Canadians launched a drilling program last November designed to cover 4,000m to confirm the mineralization and identify additional high-grade mineralization. The planned 15 drill holes are expected to reach depths of 80 to 500m. Recently, the Company released initial drill results.

The data confirms the presence of high-grade nickel mineralization in the northeastern portion of the Nisk Main mineralized lens. Compared to historical results, the results obtained also indicate that the high-grade mineralization in this portion of the Nisk Main lens extends by an additional 150m at depth and to the northeast.

"We are very pleased to present our first drill results at Nisk. The results demonstrate that Nisk has the potential for a commercial, high-grade nickel sulfate deposit. Our objectives in this first drill program conducted by Power Nickel were to drill enough holes to establish a new NI 43-101 compliant resource to confirm and replace the historical resource and expand the known nickel mineralization. We believe we have accomplished the latter and expect to deliver a NI 43-101 compliant mineral resource estimate in the second quarter," Terry Lynch, CEO of Power Nickel, told researchanalyst.com.

In total, Power Nickel has defined four different target areas for future drilling, covering a strike length of over 7km. So exciting newsflow can be expected in the coming weeks. First up is the release of additional drill results. Central will be the updated resource estimate, expected by the end of June.

The first results of the current drill program confirm high nickel mineralization. The release of an updated resource in Q2 will be crucial.

Consolidation Gold and Copper (planned spin-off)

Golden Ivan Project (Canada)

The Golden Ivan property consists of 13 mineral claims totaling approximately 797 hectares. Power Nickel owns the project outright. Golden Ivan is located south of British Columbia's prolific "Golden Triangle" in Canada. The Golden Triangle hosts numerous high-grade gold and gold and silver veins. Estimates suggest that the area, which hosts many past and present mining operations, has mineral resources totaling up to 67 million ounces of gold, 569 million ounces of silver and 27 billion pounds of copper.

Recent encouraging results have been announced with respect to Golden Ivan. Assaying of 210 rock samples from the 2021 summer program showed 17 samples grading greater than 0.1 g/t gold, as well as significant silver, copper and palladium occurrences. Of particular note is the discovery of two new high-grade gold zones. These are Molly B. East, where mineralization of 15.1 g/t gold was detected in a 0.75m channel sample. The new Lone Goat discovery even showed 16.2 g/t gold mineralization. Based on this data, the Company will initiate a drill program during the current year. This first drill program conducted on the property is eagerly anticipated.

Concession rights Chile

In total, the Company holds three concession areas in Chile. The 5,600 hectare Tierra de Oro property is located 70km south of the town of Copiapo in Chile's "Little North" in the Región de Atacama in Chile's prolific iron oxide-copper-gold belt. Previous owners invested approximately CAD 6 million in the exploration of the property. The most recent drill program, completed in January 2021, showed mineralization of 716 g/t silver and 0.45% copper in a 2m interval.

The 4,300 hectare Zulema property is located approximately 50km southwest of Copiapo and is adjacent to Lundin Mining's Candelaria Mine property. The Candelaria mine is one of the largest copper mines in the country.

The Zulema property is poorly explored. In 2018, a rock sample showed copper-magnetite mineralization. Copper grades ranged from 0.12% to 1.19%, and gold mineralization ranged from 0.05 g/t to 0.99 g/t.

The 9,000 hectare Palo Negro and Hornitos properties are located in Region 3, approximately 30km west of the Candelaria Mine. The properties are currently the focus of several geophysical programs.

Copaquire Royalty (Chile)

The Copaquire property is located in Chile's Region 1, 125km south of the capital city of Iquique, on a high plateau in a resource-rich area with good infrastructure. The project is adjacent to Teck Resources' Quebrada Blanca mine. Anglo-Xstrata-Mitsui's Collahuasi copper mine is also nearby. Power Nickel sold the property to a subsidiary of resource giant Teck Resources for CAD 3,033,500 in return for a 3% NSR royalty.

Net Smelter Return (NSR), or net smelter return, is the net revenue received by the owner of a mining property from the sale of the mine's metal / non-metal products less transportation and refining costs. Teck can reduce the NSR fee to 2% by paying CAD 3 million. That results in short-term cash flow potential.

In the medium term, Power Nickel shareholders will benefit significantly from the commencement of production at the Copaquire copper-molybdenum deposit. Copaquire has two 43-101 compliant resources: Sulfato South (primarily copper) and Cerro Moly (primarily molybdenum).

Highlights

- Development of a high-opportunity battery metal project to serve growing demand

- Boom in demand for nickel

- Need for sustainable production outside Asia in the face of increasing market concentration

- Pending new resource estimate in Q2 under Canadian NI 43-101 standard

- Spin-off of gold and copper assets sharpens equity story and should lead to higher share valuation

- Copaquire Royalty: short term cash flow potential of CAD 3 million from NSR royalty reduction by asset buyer, the medium-term: cash flows from mine production with an NSR royalty

Conclusion: Many arrows in the quiver

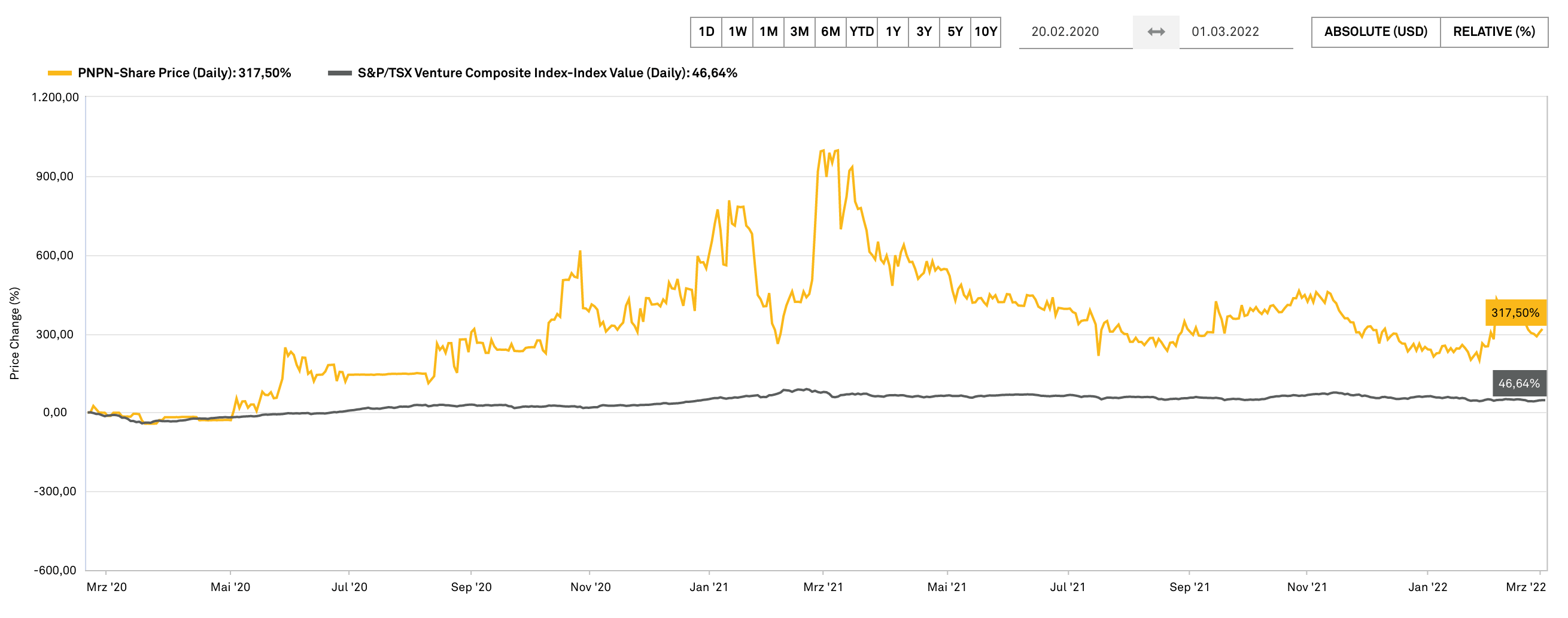

Over the past two years, Power Nickel's stock has substantially outperformed its TSX:V benchmark. Also, the chances for outperformance are very good for the future. After all, the Canadians have many arrows in their quiver. With a high-grade battery metal project, the Company is hitting the nerve of the times.

This is how high experts currently estimate global nickel resources

The pending resource estimate should give the stock a big boost. In addition, the spin-off of the gold and copper assets makes the value of this portfolio more tangible. The Company could also soon surprise in terms of cash flow. That is because the buyer of Copacquire could significantly reduce the production royalty (NSR) by paying CAD 3 million. When the mine goes into production, a net smelter return beckons to spin-off Consolidation Gold and Copper. Power Nickel will hold 80%, and the remaining 20% will be "distributed" to existing Power Nickel shareholders. Thus, currently valued at only about CAD 14 million, the stock has several value enhancement levers.