Power Nickel Inc. - A polymetallic sensation

Power Nickel (ISIN: CA7393011092 | TSXV: PNPN) is a Canadian junior exploration company that originally focused on developing the high-grade Nisk project into Canada's first carbon-neutral nickel mine and has now discovered additional value drivers. The Nisk property encompasses a significant 20 km with numerous high-grade intercepts in a variety of metals. Power Nickel is now focused on expanding the historic high-grade nickel-copper-PGE mineralization with a series of drill programs. Of particular interest is what may be found on the neighboring properties. The medium-term goal is to serve the growing North American lithium-ion battery market with high-grade nickel and to further develop the polymetallic deposits. The partnership with CVMR adds a strategic layer to the profitability of the nickel sales via the refining of high-grade nickel powder, discussed later in the article. With its land packages, Power Nickel is currently one of the promising owners of several strategic metals for securing resources for Western industries.

Flagship Nisk project: High-grade and long-term climate-neutral

The Nisk project is located close to a major highway with direct access to a distribution plant of the green power producer Hydro Quebec. The city of Nemaska, with its adjacent airport, is also within easy reach. The initial drilling at Nisk was fantastic and nothing short of sensational.

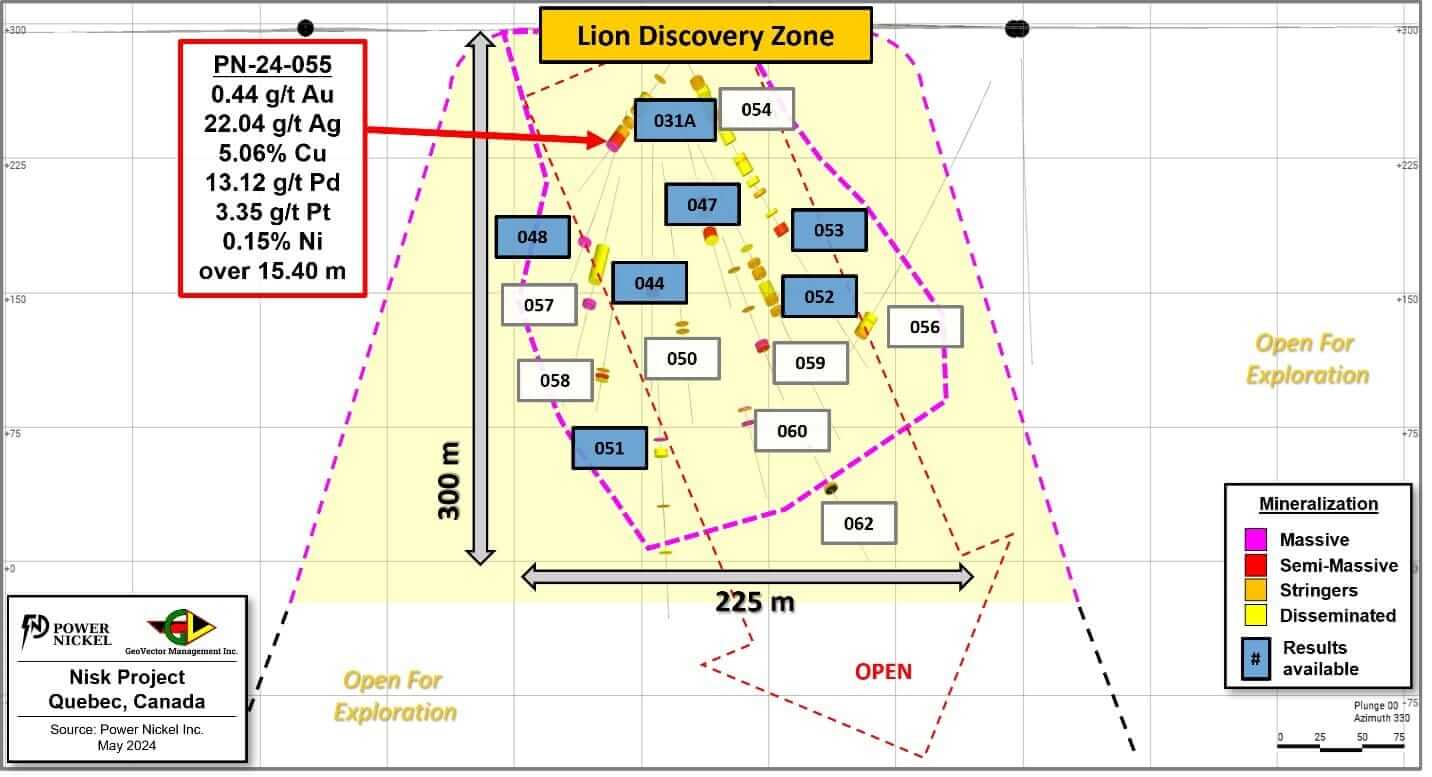

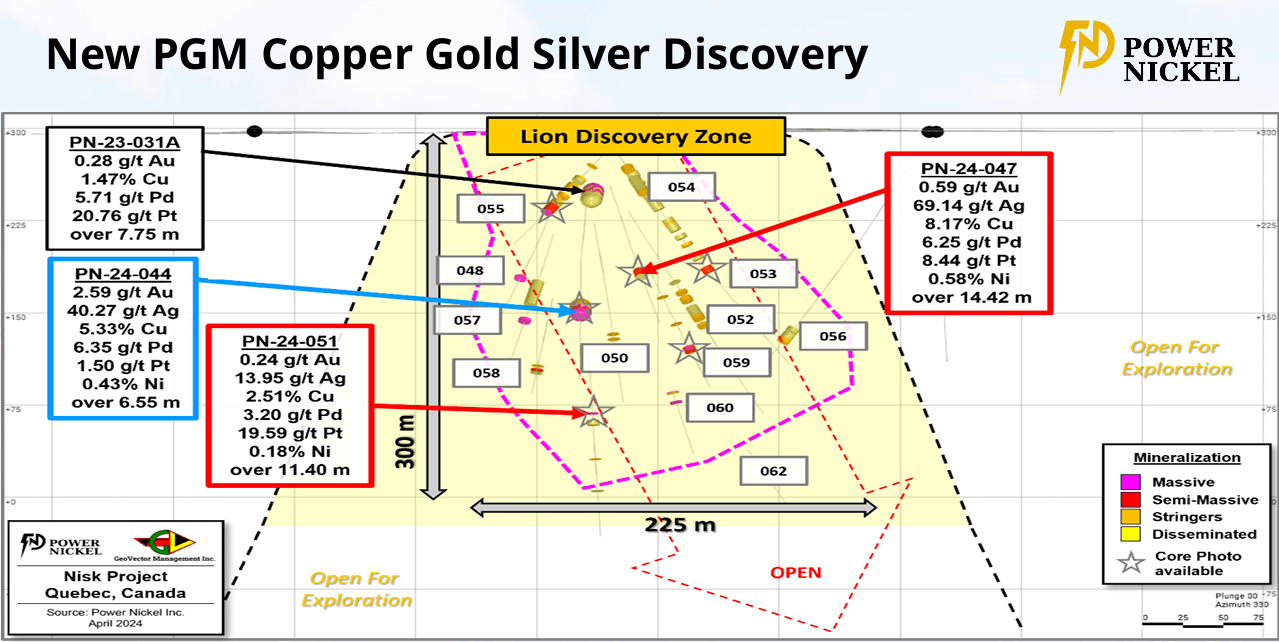

The "Lion" drill hole intercept PN-24-055 returned 9.5% copper equivalent over 15.4 meters, delivered the best polymetallic results since drilling began. High-grade Copper at 5.06%! Including 3.35 g/t Platinum, 13.12 g/t Palladium, 0.44 g/t Gold, and 22.04 g/t Silver.

Another outstanding Lion drill hole intercept, PN-24-051 returned 9. 1% copper equivalent over 11.4 meters, extending the high-grade polymetallic results. High-grade platinum was also found at 19.59 g/t! As a rule, it is rarely found in North America. The sample also contained 2.51% Copper 3.20 g/t palladium, 0.24 g/t Gold, and 13.95 g/t Silver. Nickel equivalents of 2.00% and 1.98% were identified over lengths of 18.5 to 26.6 meters. Using a special "carbon capture technology", ultramafic tailings can absorb more CO2 than the entire project emits. This means that the project can be described as climate-neutral; few mining projects achieve this status.

"We are pleased to have finalized our earn-in with Critical Elements for the Nisk project. We feel we have found a large productive area that hosts different types of polymetallic mineralization, each representing a smaller part of a much larger system. We look forward to intensifying our efforts in 2024 and 2025 to bring these targets to a production decision", said CEO Terry Lynch.

"A good example of the assay results being better than what we expected visually is drill hole 51. It doesn't look that impressive, but as the assay results show, it was a spectacular drill hole," Terry Lynch further commented.

The Company's 2024 winter drill program ended with 15 successful holes drilled on the Lion subsection. Expected assay results to be released shortly may demonstrate further progress on the significant discovery. Power Nickel will continue drilling at the Lion discovery in the upcoming summer season.

In May, Power Nickel secured internationally recognized geoscientist and polymetallic specialist Dr. Steve Beresford as a special advisor. Dr. Beresford (FAIG, FSEG) has been Chief Geologist for three major mining companies, lecturer and professor, and founder of several exploration companies. He began his exploration career with WMC Resources and has conducted exploration work in 66 countries, primarily in magmatic nickel-copper-PGE deposits. He is currently a professor at the University of Western Australia and a board member of Agemera in Europe.

For Dr. Beresford, the Nisk project is a good example of how large polymetallic systems can be found. High-grade nickel is a geological indicator of much more mineralization, so Nisk is more like large PGM deposits such as Norilsk (Russia), Jinchuan (South Africa) or Sakatti (Finland).

Dr. Beresford explained: "Nisk has the geodynamics and prospectivity characteristics of a zoned metal system, which is why I look forward to joining the Power Nickel team in advancing and converting Nisk into a polymetallic deposit. ”

For more information on Dr. Beresford's research on polymetallic deposits, please visit this link: youtube.com/watch

Quebec, Canada - A top, globally recognized, jurisdiction for sustainable mining

Western industrial producers are keeping a wary eye on market concentration due to the expansion of Indonesia, the largest global producer, as the strong trend towards electrification alone will make around 25% of the nickel produced necessary for e-mobility from 2028. The key challenge is, therefore, the development of new nickel projects in secure jurisdictions and the associated sustainable securing of raw materials, making Power Nickel (ISIN: CA7393011092 | TSXV: PNPN) a flagship project.

With the expansion of electromobility, batteries will consume around 25% of nickel production as early as 2028.

Canadian mining laws offer numerous advantages that make the country an attractive location for commodity investments. The Canadian government, together with the Quebec administration, grants 50% exploration subsidies. This means that for every dollar spent on drilling, Power Nickel can receive an additional dollar in funding. These are excellent conditions for Power Nickel's investors.

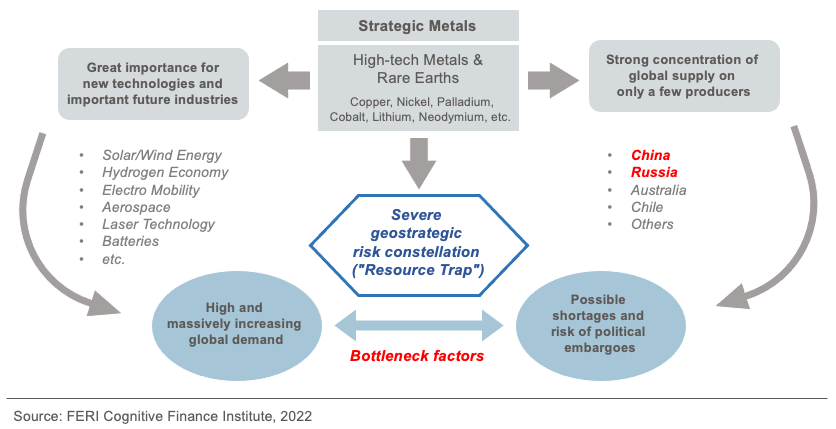

Geopolitical uncertainties and increasing demand for strategic metals

The geopolitical uncertainties of recent months show an unbroken demand for critical metals around the globe. In the search for secure suppliers, Western industry cannot avoid securing suitable sources of supply. The imposition of punitive tariffs on Chinese e-vehicles in the US has also triggered the next round of the trade war between the US and China. It is not unlikely that China will ration the supply of essential metals to the West at some point. The increasing military build-up in the NATO area is also leading to increased demand for rare raw materials and industrial metals. Precious metals are once again in focus, as for decades, they have provided a hedge against political upheaval and unrest in the financial systems in addition to securing value.

The recent rise in the price of copper documents the need for a dramatic expansion of current production figures. Asia, and China in particular, will demand more copper than ever in 2023 in order to keep production of sought-after consumer goods high. According to copper legend and founder of the Ivanhoe Mine, Robert Friedland, the current undersupply could lead to a "Train Wreck". (Source: Bloomberg). In addition to copper, platinum and palladium will also be used in the hydrogen economy. Although hydrogen technology is still in its infancy, analysts at PwC estimate that demand for hydrogen will grow steadily. From 2035, demand is even expected to rise sharply, particularly to achieve the climate targets of the 2015 Paris Agreement. Power Nickel can also trump here with its polymetallic deposits.

Good metal deposits, technological quantum leaps and established ESG principles complete the picture

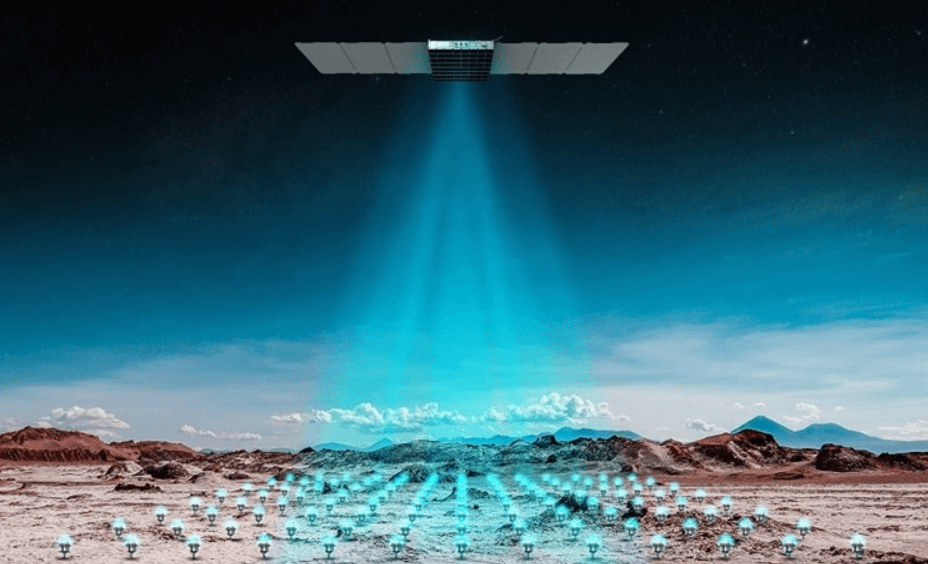

Power Nickel's cooperation with Fleet Space Technologies enables a quantum leap in 3D modeling. Microsatellites will enable Power Nickel to find more high-grade nickel sulphide deposits. The satellite-based earth exploration technique is called Ambient Noise Tomography (ANT). The data obtained can be used to create a complete 3D visualization of the subsurface at depths of up to 2 km.

Power Nickel (ISIN: CA7393011092 | TSXV: PNPN) submitted its first ESG sustainability report in 2022, in which the good infrastructure of roads and energy supply (hydropower), cooperation with the country's indigenous inhabitants, and CO2-compensating measures during exploration are demonstrated and documented. Power Nickel wants to keep its climate footprint as small as possible and develop into a reliable supplier of critical metals in the long term.

10 Reasons for an outstanding risk/reward ratio in Power Nickel

- Phased development of a promising polymetallic project with huge potential

- Current NI 43-101 resource estimate and “dream drill hole” PN-24-051

- Excellent study partner CVMR and high-quality processor in the nickel sector

- Located close to a major highway with direct access to a distribution plant of the green power producer Hydro Quebec

- Quebec, Canada is one of the top jurisdictions for sustainable mining in the world

- Need for sustainable production outside Asia given increasing market concentration and geopolitical uncertainties

- Demand boom for strategic metals continues unabated

- Best environmental and social implementation of ESG principles (ESG/SR 2022 report)

- Spin-off of gold and copper assets sharpens the equity story and creates shareholder value

- General higher valuation of metals and resources due to new commodity cycle in 2024 and beyond

Conclusion: Ideally positioned in the current commodity cycle

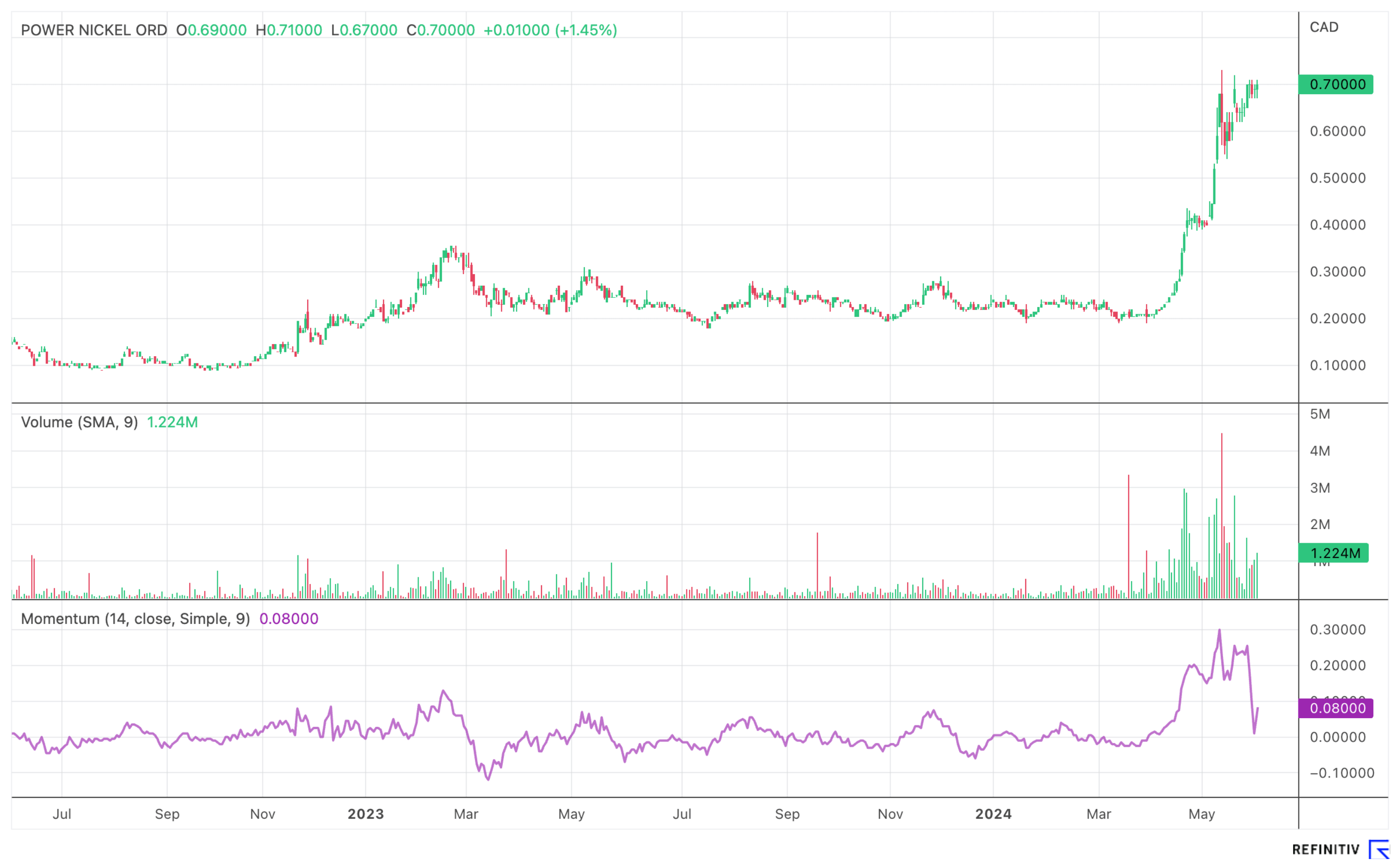

With access to abundant low-carbon hydropower, shallow mineral depth and established infrastructure nearby, the Nisk deposit is ideally positioned to be one of the lowest costs and most environmentally friendly sources of high-grade nickel in the world. In addition, Power Nickel can also develop copper, cobalt, gold, silver, platinum and palladium. In 2024 Power Nickel shares have already began to demonstrate that outstanding project quality leads to a significant upside valuation in the current market environment. Management has already identified the metal deposits very well and is continuing its geological investigations consistently. With the preparation of a feasibility study by the respected partner CVMR, the Power Nickel share could become a shooting star among strategic metal resources in 2024. So far, capital increases have been raised at a significantly higher market price. Power Nickel shares are currently consolidating at a high level of around CAD 0.70.

With a fully diluted share count of 220.4 million shares and a market valuation of over CAD 100 million, the junior explorer Power Nickel entered a new league in Q2 2024. Since then, institutional investors have also shown great interest, and the share price and stock market turnover have risen dramatically. We assume that Power Nickel will also encounter excellent mineralization in the next exploration zones. With Dr. Steve Beresford’s closest comparable being Norilsk and Platfeef, Power Nickel is grabbing the attention of mining investors globally. With further operational successes and a positive economic environment, the importance of Power Nickel for the supply of raw materials to democratic countries is expected to continue to grow. In the long-term development, overcoming the symbolic CAD 1.00 mark should only be an intermediate step in the foreseeable revaluation.