The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Kommentare von Carsten Mainitz

Kommentar von Carsten Mainitz vom 25.08.2022 | 05:09

Stock News: Altech Advanced Materials - Game Changer of Electromobility

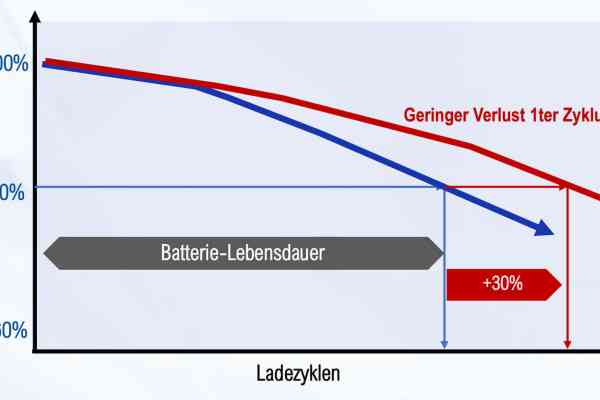

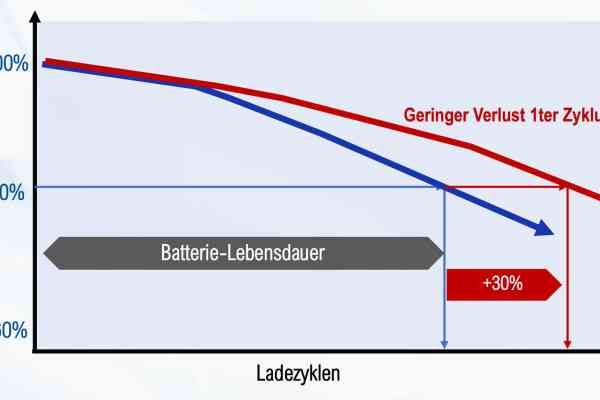

Charging infrastructure and the performance of batteries are decisive factors influencing the spread of e-mobility. Altech Advanced Materials is using an innovative coating technology to leave behind the disadvantages of conventional lithium-ion batteries, which already lose significant capacity after the first charging cycle. Using a patented process, batteries with significantly higher performance and service life are now being developed. Test production in a pilot plant is planned. There is much to suggest that the Company will create an e-car battery that is much more powerful than competing products in terms of weight or volume. An update.

Zum KommentarKommentar von Carsten Mainitz vom 03.06.2022 | 05:09

Desert Gold - In Pole Position

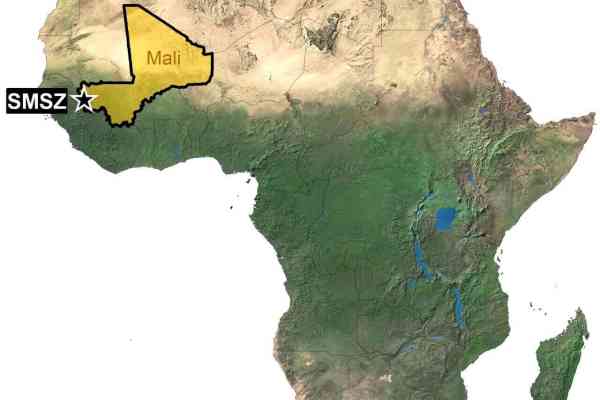

Desert Gold Ventures is a Canadian gold exploration and development company focused on gold deposits in Africa, primarily West Africa. The Company's SMSZ project is one of the largest gold exploration projects in West Africa and has more than 20 open gold zones discovered to date. The project has the potential for further resource increases and the discovery of one or more large gold deposits comparable to Tier 1 gold mines in the region. Current news, project progress, and increasing M&A activity in the industry should boost the stock.

Zum KommentarKommentar von Carsten Mainitz vom 02.03.2022 | 05:09

Power Nickel - In the fast lane with battery metals

In the debate about the spread of electromobility and the battery metals required, the focus is often on the raw materials lithium, cobalt and copper. Another key raw material is criminally neglected: nickel. Due to its specific properties, the metal is of central importance in implementing the energy and transport revolution. Demand for the raw material will continue to increase in the foreseeable future, and sufficient supplies of the metal will become increasingly critical. This is the hour of (prospective) nickel producers. One of these companies, which is currently under the radar of most investors with a stock market value of around CAD 15 million, is Power Nickel. The Company is focused on a high-potential battery metal project in Canada. The gold-copper assets will be taken public in the next few months as a spin-off in a separate company. This sharpens the equity story and should give the share positive impetus. In the short term, important newsflow is expected from the current drilling program at the battery metal project. A new resource estimate announced for the second quarter could provide the impetus for a significantly higher valuation of the shares.

Zum KommentarKommentar von Carsten Mainitz vom 16.02.2022 | 05:08

Altech Advanced Materials - Better batteries for e-cars!

The mobility revolution is in full swing. The future belongs to battery-powered vehicles. The sales figures for e-cars are rising sharply worldwide. So is the price for the all-important raw material lithium. With innovative approaches, Altech Advanced Materials AG could revolutionize the market for lithium-ion batteries. Conventional lithium-ion batteries already lose significant power during the first charging cycle. Altech uses an anode coating with high-purity aluminum oxide (HPA) and an enrichment of silicon. In this way, battery performance can be increased by more than 15%, and service life can be extended by as much as 30%. The Company is still a long way from bringing its products to market. The next stage is to set up a pilot production facility and demonstrate commercial and industrial production. If this succeeds, customers are likely to be knocking at the Company's doors. An analysis.

Zum KommentarKommentar von Carsten Mainitz vom 24.01.2022 | 05:08

Stock news: Desert Gold with first resource estimate

The Canadian gold explorer had an impressive start to the new year by reaching a milestone. The Company has one of the largest non-producing land areas in West Africa. Located in Mali, Africa's third-largest gold producer, the project has enormous development potential. The right course has been set. It is just a matter of when, not if, the Company will reevaluate. Furthermore, the Canadians are increasingly a potential takeover candidate.

Zum KommentarKommentar von Carsten Mainitz vom 19.01.2022 | 08:22

Cardiol Therapeutics - shares with blockbuster potential

Humanity is still caught up in the covid pandemic. The shares of vaccine manufacturers have skyrocketed. Despite great successes in combating the pandemic, there are also downsides. These are secondary damages, such as damage to the heart. This is where the Canadian company Cardiol Therapeutics comes in. The company is currently undergoing promising clinical trials with preparations based on cannabidiol that are intended to treat inflammatory heart disease. Recent research shows that cannabis ingredients can prevent infection with the Corona virus by blocking its entry into cells. This suggests that Cardiol’s preparations could have blockbuster potential. Analysts unanimously believe that the shares, which are also listed on the NASDAQ, have the potential to multiply.

Zum KommentarKommentar von Carsten Mainitz vom 08.12.2021 | 05:09

Valneva - Will the newcomer become a top dog?

We are in the middle of the fourth Corona wave. Uncertainty about the effects of the new mutation Omicron recently weighed on the mood on the stock markets. Skeptical statements by Moderna's CEO on the controllability of the new variant are irritating, especially since BioNTech has an entirely different view of the situation. This uncertainty hit Valneva, a new Corona vaccine supplier looking to throw its hat into the ring, particularly hard. Shares in the French-Austrian biotech company lost significant ground after - at first glance - disappointing results on the suitability of their vaccine as a booster vaccine. Valneva's approach with so-called dead vaccines contrasts with vector or mRNA vaccines, which are currently exclusively used. Dead vaccines have been used in medicine for a long time (tetanus, pertussis, diphtheria, influenza vaccination) and are considered well-established. The new vaccine category could thus persuade vaccine skeptics to get vaccinated. Approval of the Valneva vaccine in the EU has been applied for, and initial orders have been received. The green light from the health authorities should come soon. US-based Novavax should be even quicker to market with a protein vaccine. What chances do the newcomers have? Are they the new top dogs?

Zum KommentarKommentar von Carsten Mainitz vom 24.11.2021 | 05:09

Barsele – Game Changer, with announcement

In view of high inflation, which is certain to continue, there are good opportunities for precious metal prices to rise in the medium term. As a rule, gold stocks exhibit a high sensitivity to gold price developments over longer periods. High-opportunity stocks are particularly rare. The Canadians presented here hold 45% in the Barsele Gold Project in Sweden. Even though a takeover failed for the time being, a closing can apparently be expected next year. That would lead to a rapid re-rating of the stock. The project currently has a 2019 resource estimate of 2.4 million ounces of gold combined with the potential to expand this to 3.5 million ounces in the near future. Analysts already attest to the stock's significant upside potential. The project size also makes the Canadians a takeover candidate. We look at the details.

Zum KommentarKommentar von Carsten Mainitz vom 18.11.2021 | 05:08

Desert Gold Ventures - extraordinary potential

Inflation is on everyone's lips. In addition, interest rates are low, so investors from the major economies of Europe and North America are currently suffering a loss of purchasing power of around 4% to 6% per year. A proven strategy for asset protection over a more extended period of time is to invest in tangible assets such as shares, real estate or precious metals. In addition to physical investments in gold, gold shares are also an option. With these, the precious metal price increase can usually be leveraged. This connection is especially true for exploration companies. Therefore, rising gold prices and an upcoming resource estimate are good reasons to take a closer look at Desert Gold Ventures. The Company could become a desirable takeover candidate in the future.

Zum KommentarKommentar von Carsten Mainitz vom 09.11.2021 | 18:00

Barrick Gold - Need to catch up with the top dog?

After a brilliant rally last year, gold stocks are in correction mode this year. From a historical perspective, however, the current level of around USD 1,800 can be considered high. In the medium term, the prospects for rising precious metal prices look good. Decisive framework conditions are the low interest rate level, inflation, economic growth, the condition of the stock markets and the level of gold reserves or the long-term production outlook. We provide a deeper insight into the situation of Barrick Gold and the industry.

Zum Kommentar