Lithium and the challenges of battery technology

Raw materials such as lithium, cobalt, nickel, graphite, aluminum, tin, manganese, and copper, among others, are used in the production of lithium-ion batteries. **Lithium and graphite are critical to today's generations of lithium-ion batteries.

Prices have skyrocketed in recent years.

Due to the high demand for lithium, prices have exploded in recent years. There is no end in sight. Recycling or the use of other materials are, in principle, medium-term options for easing the worsening supply shortage of lithium. Much more promising at present are innovative processes that make batteries cheaper, longer-lasting and safer. This is where Altech Advanced Materials AG comes into play.

Company profile Altech Advanced Materials AG

Altech Advanced Materials AG focuses on innovations in the field of lithium-ion battery technology. Organizationally, the Heidelberg-based company is set up as a participation company focusing on raw material extraction and processing, chemicals, the manufacture of all types of packaging and paper products, and their distribution.

In December 2020, the Heidelberg-based company acquired 25% of the shares in Altech Industries Germany GmbH ("AIG"). The major shareholder is Altech Chemicals Australia Pty Ltd (ATC), in which Altech Advanced Materials AG in turn holds an interest. The Australians and the German subsidiary are planning to set up a pilot production plant for the manufacture of the coating material for battery anodes in eastern Germany.

AIG holds the exclusive rights for the European Union to use ATC's and Altech's patents related to the production of high purity alumina (HPA) and anode grade alumina, the anode battery coating material. In addition, the Australians plan to start building a factory in Malaysia and thus supply the German plant with HPA.

HPA is a high-value, economically lucrative and highly demanded product, as it is essential for the production of synthetic sapphire. Synthetic sapphire is used in the manufacture of substrates for LED lamps, semiconductor wafers in the electronics industry, and scratch-resistant synthetic sapphire glass for wristwatches, optical windows, and smartphone components. No substitutes exist and demand continues to grow unabated.

Game-changer technology

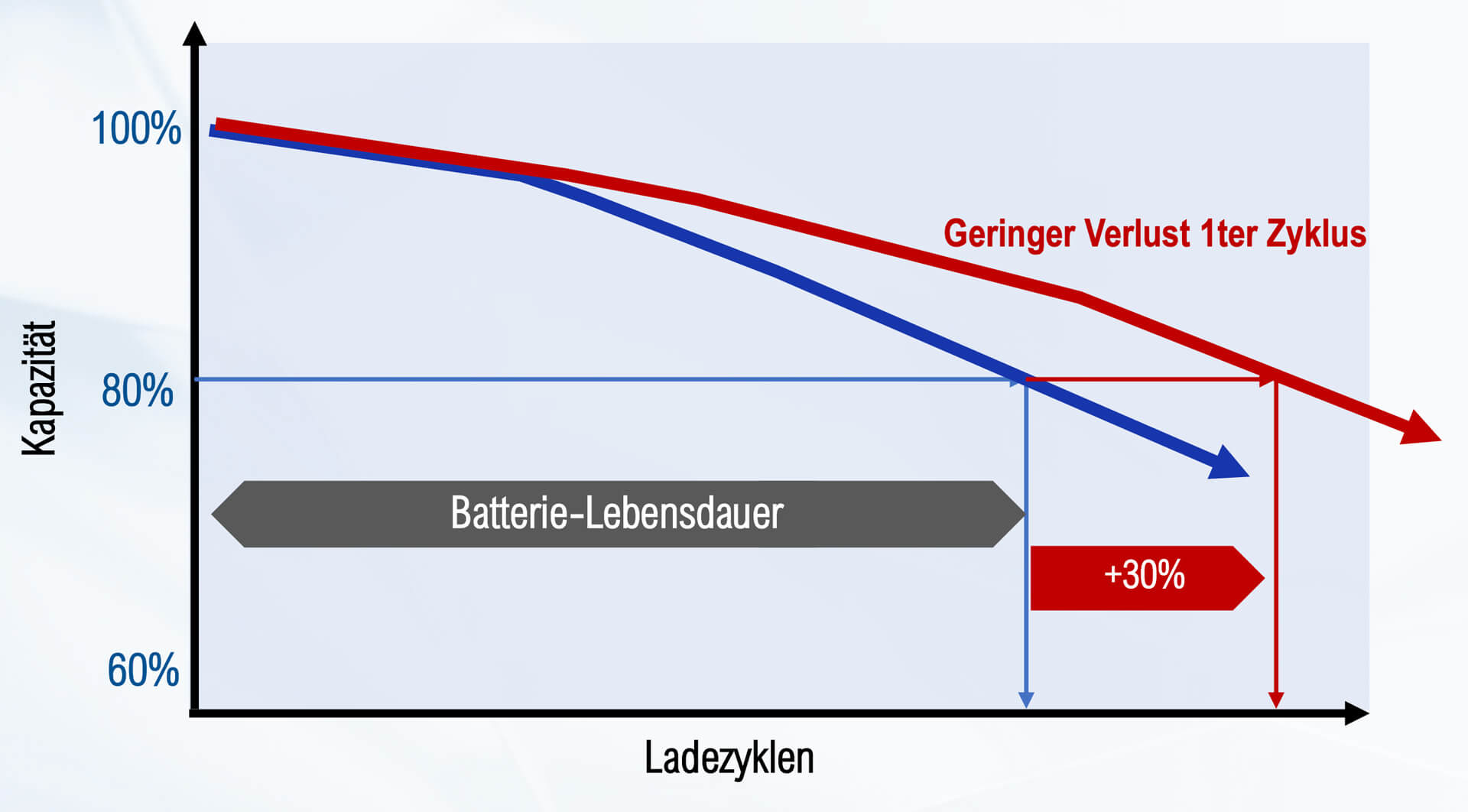

Existing lithium-ion batteries have a decisive disadvantage. They lose up to 15% of their power after the very first charge cycle. This loss of power continues over the life of the battery. The cause lies in the formation of a boundary layer in which the lithium is bound. That is where Altech comes in.

The solution: with a ceramic, i.e. ultra-thin coating, a nano-coating of the anode material with aluminum oxide, this boundary layer can be reproduced so that, according to specifications, the negative effect does not occur.

Altech has a great deal of experience in the production of high purity alumina, the ceramic base material. The Heidelberg-based company is now using this technology and process experience in the development of innovative lithium-ion batteries.

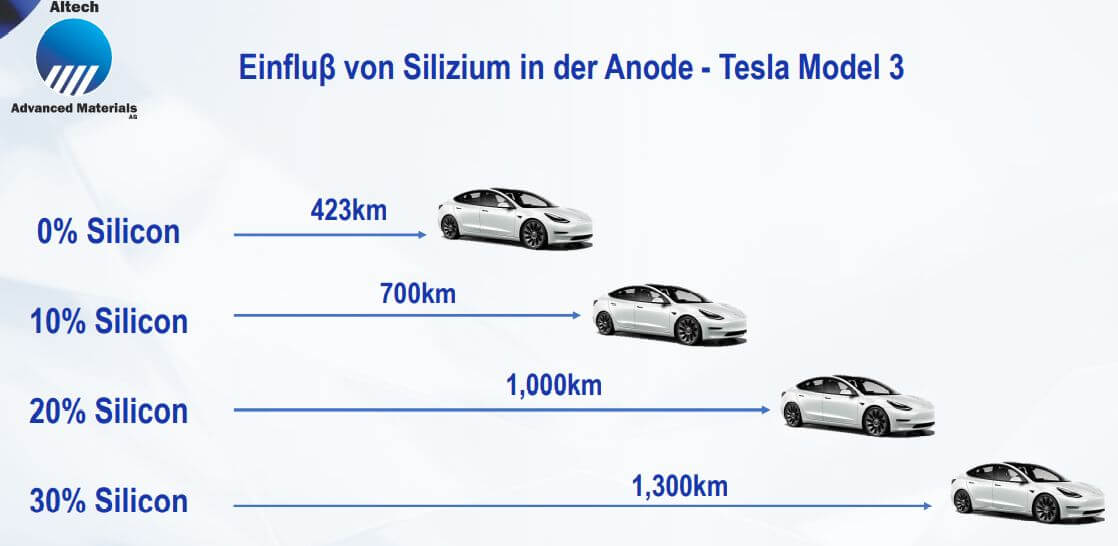

Graphite is normally used as the anode. However, graphite only has around one-tenth of the charging capacity of silicon. That is why the Germans are developing ceramic anode coatings enriched with silicon. This approach allows the energy density of lithium-ion batteries to be increased, leading to a significant reduction in storage costs, i.e. battery costs per charging capacity. The range of e-cars can also be significantly increased.

A pinch of the future

Metallurgical silicon is a promising anode material for the next generation of lithium-ion batteries. As described, silicon offers ten times the energy density of graphite. Silicon is also a comparatively inexpensive material, and its extraction involves little environmental impact. Silicon is a classic semimetal and therefore has properties of both metals and nonmetals and plays a major role in solar and semiconductor technology, among others.

However, the material also has two decisive disadvantages, which is why the use of a larger proportion of silicon in battery anodes has failed so far. First, silicon expands significantly during battery operation - as a consequence, this leads to swelling, fracturing and ultimately battery failure. Second, silicon deactivates up to 50% of the lithium ions in a battery, equivalent to halving its performance.

Already, it is possible to achieve increased battery performance of more than 15% and up to 30% longer battery life. Should the Heidelberg-based company succeed in further increasing the proportion of silicon on the anode, performance increases of 50 or 100% are also possible, according to the Company.

Already now the performance of batteries can be increased by the technology.

Initial results from technology partner Altech Chemicals Limited are promising: Laboratory tests of Altech's graphite-silicon composite batteries have demonstrated stable results with significantly improved properties.Laboratory tests with micro half cells have shown that Altech's lithium-ion batteries have an average value of about 430 mAh/g. Standard lithium-ion batteries, on the other hand, only have a value of 330 mAh/g. In addition, Altech's batteries have very good cycle stability, which has been proven in battery tests over long periods of time with more than 150 cycles.

The bottom line is that this approach can thus achieve an increase in battery performance and lifetime, as well as improved safety.

Research and collaborations

Modern batteries take years to develop. However, Altech could be on the market quickly by using a so-called drop-in technology. Intensive research and collaborations and a sense of what the market wants are crucial. So, of course, there is always a trade-off between maximum performance and weight. The Company is confident of creating an e-car battery that is much more powerful than competing products in terms of weight and volume.

But raw material security must also be a given. For example, the Heidelberg-based company has signed a cooperation and supply agreement with SGL Carbon as well as with the Spanish silicon manufacturer Ferroglobe.

Road Map

An important step towards market maturity is the construction of a pilot plant to produce the innovative anode coating. A 14-hectare industrial site has been acquired for this purpose in the Schwarze Pumpe industrial park in the municipality of Spreewald in Saxony. Several companies have set up battery projects in this region, and sites of car manufacturers are located not far away.

The plant is expected to produce a capacity of about 10,000t annually. The design of the pilot plant has been completed, and initially, 120kg per day of the lithium-ion battery material will be produced for customer testing and qualification. This knowledge will be used to optimize the plant design and process parameters for a full-scale production plant.

Also part of the Group is a company that is driving forward the construction of a plant in Malaysia. The raw material, high-purity alumina (99.99%), for the German plant is to be sourced from this site. However, as high-purity alumina is experiencing strong demand in many areas, e.g. from the semiconductor, medical technology and sapphire glass sectors, the plant, with a planned annual capacity of 4,500t of HPA, looks forward to a rosy future even without the demand from Germany.

"We know exactly what we are doing and are implementing a technology that is proven for us to be industrially applicable and scalable."

Financials

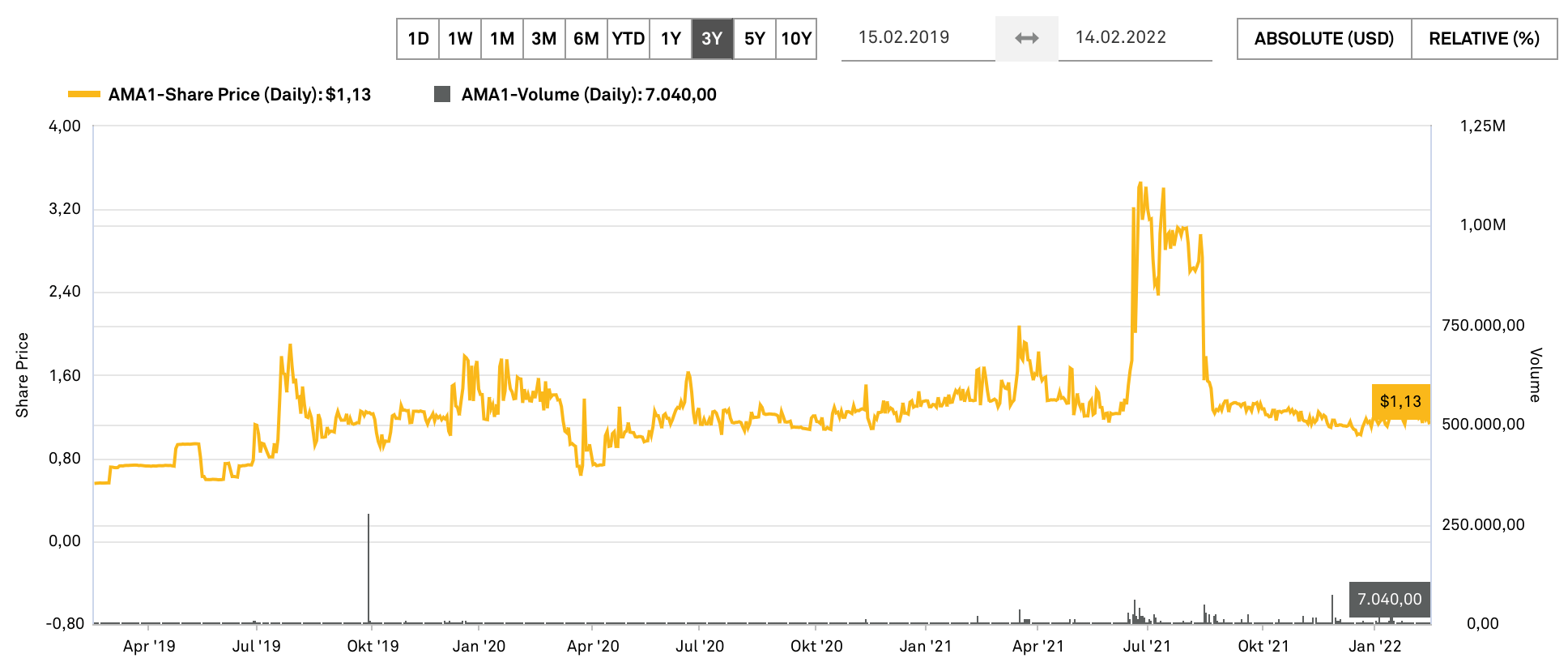

The company is in a relatively early stage of business. After the development and testing of the innovative processes, the upcoming construction of the pilot plant in Eastern Germany is a crucial milestone.

It is therefore not surprising that the Heidelberg company is currently still in the red. According to preliminary key data, the net loss for the past financial year was reduced from EUR -874 thousand to EUR -618 thousand. At EUR 3.166 million, equity at the end of the year was significantly higher than the previous year's figure of EUR 972 thousand following the implementation of a capital increase.

The Company currently has a share capital of EUR 5.65 million, giving it a market capitalization of around EUR 5.7 million. According to company statements, the issuance of a "Green Bond" could be an option in order to stem future investments and limit dilution for existing shareholders. Major shareholder Deutsche Balaton is a helpful support for further growth.

SWOT

Strengths & Opportunities

- High level of expertise (technology and process experience) in the production of high purity alumina (HPA)

- Innovative approach to coating cathodes of lithium-ion batteries

- Industrial scale production = game changer

- High market potential for improved lithium-ion batteries: Increased battery performance and lifetime, as well as improved safety

- Potential cost leadership

- Purity of basic materials enables control options in the manufacturing process

Weaknesses & risks

- No industrial scale manufacturing proven yet

- High financing requirements

Conclusion

With innovative approaches to optimizing the performance of batteries, Altech Advanced Materials AG could shake up the market considerably and make a valuable contribution to the energy transition and electromobility.

The Company must achieve a crucial milestone with the construction of a pilot plant and prove that the innovative high-performance anode material is marketable and can be produced on an industrial scale.

If this succeeds, it will be a game-changer that would lead to a revaluation of the Mirco Cap. Currently, the Germans only have just under EUR 6 million on the stock exchange scales. According to the Company, the upcoming investments are to be financed primarily by borrowed capital, and the issue of a "green bond" is also an alternative. In this way, dilutions for existing shareholders are to be minimized.