New records with more than 38,000 BOE per day

The second quarter of 2024 was another step towards becoming a medium-sized producer, with the acquisition of around 13,000 BOE per day of production in southern Saskatchewan. The acquired projects host 96% high-margin crude oil and natural gas condensate and are an excellent fit with the Company's existing core project base. The recent acquisition in south Saskatchewan has laid the foundation for strong future free cash flow generation. For the Company, which continues to grow rapidly, this move also served as a catalyst to significantly improve its capital structure through the repayment of the senior secured term loan with the issuance of USD 650 million of senior notes with a coupon of 9.625%. The interest rate for the entire loan was reduced by a dramatic 40%. In addition, the Company concluded a loan agreement with a bank consortium for USD 150 million, which was not drawn down until June 30, 2024. The new debt structure is expected to reduce the Company's overall cost of capital and increase flexibility in financing its future capital expenditures.

barrels of oil equivalent/day is the new mark

CEO John Jeffrey puts it in a nutshell: "The changes made to Saturn's capital structure in the second quarter of 2024, combined with a major acquisition, will represent a turning point in establishing the Company as a leading independent, growing energy producer in Western Canada," commented John Jeffrey, Saturn's Chief Executive Officer. "In June 2024, the Company increased its crude oil production base by more than 50% and reduced the interest rate on debt by approximately 40%, strengthening Saturn's sustainable ability to generate free cash flow per share at a dramatically reduced cost of capital."

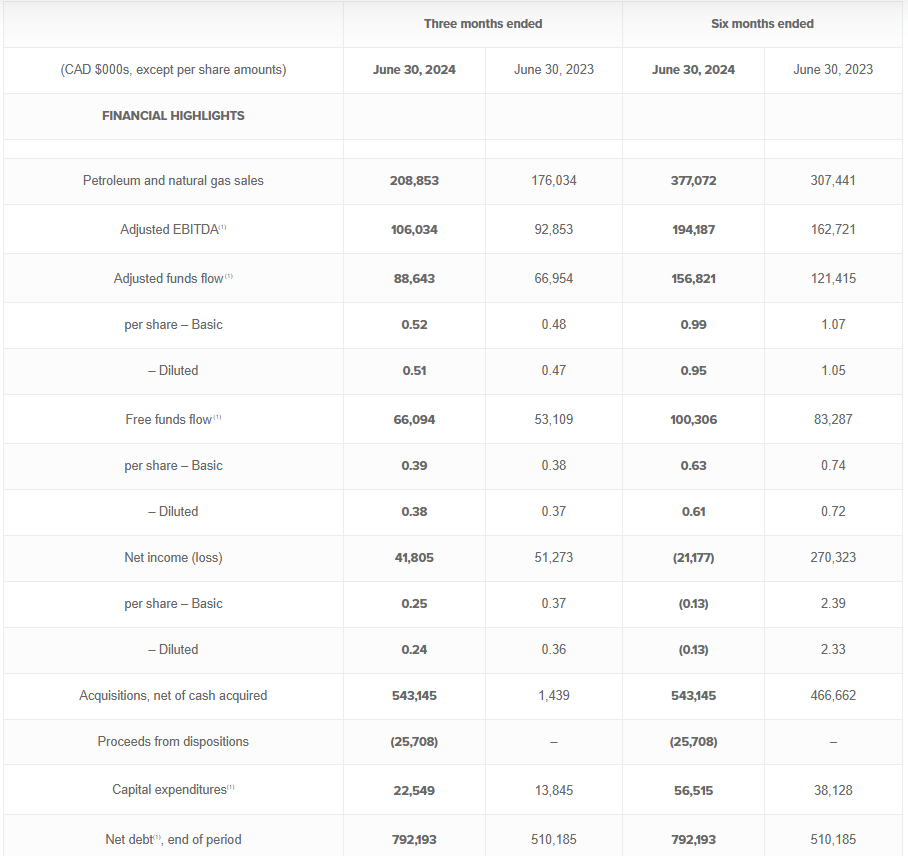

The figures for the second quarter at a glance

● Completed acquisition of two oil-focused projects with production volumes of approximately 13,000 BOE per day in existing core operating areas in southern Saskatchewan for a total cash consideration of approximately CAD 534.8 million

● Achieve initial production of approximately 38,300 BOE per day in the second quarter of 2024

● Exchange of the Company's long-term loan for a senior secured bond amounting to USD 650 million with an interest rate of 9.625% per annum, maturing on June 15, 2029

● Completion of a bought deal equity financing with total gross proceeds of CAD 100 million

● Conclusion of a credit facility in the amount of USD 150 million with a bank consortium, which had not yet been drawn by June 30, 2024

● Achieved record average production of 30,128 BOE per day, compared to 25,988 BOE per day in the second quarter of 2023

● Recognized oil and gas revenues of CAD 208.9 million, compared to CAD 176.0 million in the second quarter of 2023

● Record quarterly adjusted EBITDA of CAD 106 million compared to CAD 92.9 million in the second quarter of 2023

● Achieved quarterly adjusted cash flow of CAD 88.6 million, compared to CAD 67.0 million in the second quarter of 2023. Free cash flow landed at CAD 66.1 million

● Net debt was CAD 792.2 million at the end of the second quarter of 2024, representing a pro forma net debt to annualized quarterly adjusted cash flow ratio of 1.5

A new chapter: 50% premium compared to 2023

The acquired assets provide multi-zone development opportunities and significant operational synergies and further advance Saturn's growth strategy through the integration of approximately 950 identified gross drilling locations. The Company's existing drilling inventory secures development targets over the next 20 years with ample future reserve potential. The new properties promise high netbacks and cost savings as they can be operated with existing infrastructure and are located in close proximity to existing pumping stations. The experience gained to date in the development of the Viking and Bakken deposits will serve Saturn well in the expansion to Lower Shauna and the Flat Lake assets. Due to the high quality of the drilling inventory, current production levels can be sustained for more than 20 years at a drilling rate of 20 to 30 wells per year.

The acquired assets are expected to generate a net operating profit of approximately CAD 250 million over the next 12 months, which is approximately half of the acquisition price paid. The payback before development costs can, therefore, be realized within 2-3 years in an optimized view. Based on proven, developed and producing reserves, the total production potential on a present value calculation (discount rate 10%) is 44.1 million BOE with future net revenue of CAD 926 million. If the probable reserves are added, the discounted present value is calculated at around CAD 1.4 billion. Overall, the acquisition is expected to generate significant financial growth in the key performance indicators.

Outlook: Moving forward with big steps

Saturn has now commenced its largest drilling program in the Company's history, with four rigs simultaneously drilling horizontal wells targeting light oil. Two rigs are located in southeast Saskatchewan, one in west Saskatchewan and one in central Alberta. In total, the Company expects to complete approximately 82 (net) operated wells in 2024.

The objective is to increase production further in the range of 1% to 5%, with the primary goal of further reducing net debt through free cash flow generation. Saturn expects to continue to pursue strategic acquisition opportunities that complement the existing business with attractive development opportunities. The Company is, therefore, continuing to explore.

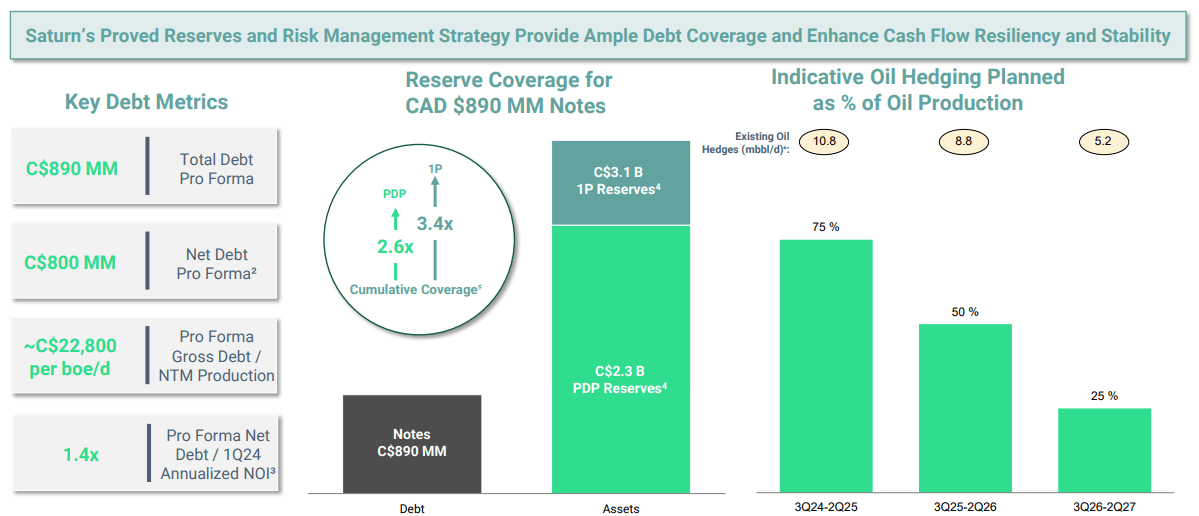

Interim conclusion: The outlook should put pressure on shareholders

Saturn Oil & Gas is making another evolutionary leap. The ratio of net debt to adjusted EBITDA is rising slightly, and the high cash flow will bring the much-noticed ratio down to around 1.0 to 0.9 on an annualized basis by June 30, 2025. It currently stands at around 1.4, with free cash of over CAD 66 million in the quarter. Should oil prices remain above the target mark of USD 80 (WTI), the plan is likely to be fully realized. To secure the interest and principal payments, Saturn will continue to sell at least 50% of its production forward until mid-2025. This means that a distribution to investors or a repurchase of shares will not be possible until 2026. The following chart illustrates the relationship between reserves and the continuously decreasing debt.

The price expectations of analysts on the Refinitiv Eikon platform recently ranged between CAD 4.50 and CAD 5.30 on a 12-month horizon. On average, five analyst firms expect a price of CAD 4.95 on a 12-month basis. However, with an annual adjusted EBITDA of almost CAD 700 million, debt will already fall to around CAD 620 million by the end of the year. This also reduces the prospective EV/EBITDA to around 1.2. Within the "mid-tier producers" of North America, this factor is around 3.6. In a sector comparison, Saturn's factor valuations are relatively low.

In the updated guidance, management continues to assume an average WTI oil price of around USD 80. At USD 77.40, this is currently slightly below this expectation. However, Saturn will maintain its recent hedging strategy and sell forward large parts of its production to meet financing requirements. This will ensure a healthy development of the balance sheet in the near future. A medium-term adjustment of the share value to the new proportions is, therefore, very likely, as the institutional share of investors will continue to increase due to the renewed commitment of the major investor, GMT Capital. Should a dividend payout come into focus at some point, Saturn Oil & Gas would be a solid addition to dividend-oriented funds. The medium-term outlook is focused on further production increases and significant debt reduction.

This update is based on our initial report 11/21