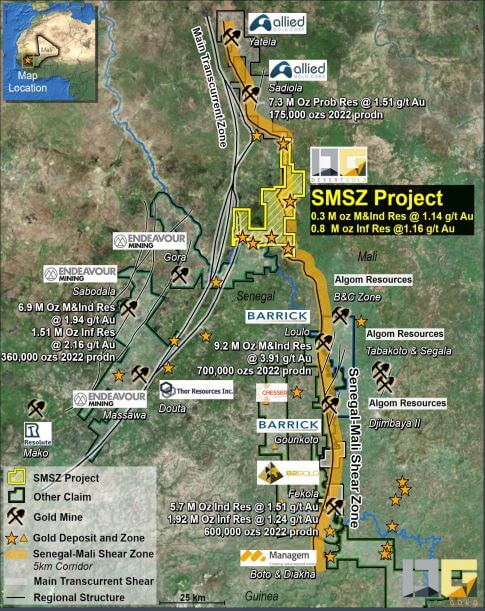

Surrounded by large gold producers

Desert Gold's (WKN: A14X09 | ISIN: CA25039N4084) exploration activities take place in the gold-rich basin of West African Mali. The historical gold activities here have numerous mines and a history of over 100 years. Years ago, Desert Gold secured some of the few remaining claims in a true gold basin. The prospective land area of the SMSZ project on the border of Mali and Senegal covers 440 sq km and is located in the world-renowned Senegal-Mali shear zone. The production of gold is one of the largest and most consistent sources of income for the West African country of Mali.

On the border with neighboring Senegal is the well-known Loulo-Gounkoto complex, where one of the world's largest gold deposits is located. In the past 12 months, gold production there has contributed more than USD 1 billion to the Malian economy. In addition to the still-young Desert Gold, the producing mines of Barrick and Allied Gold, Endeavour Mining, and B2Gold are already on site. Not far north of the Desert properties are the historically successful and now reactivated Yatela and Sadiola districts. They have been majority-owned by Allied Gold since 2021 and have historically produced 6.8 million ounces of gold. IAMGold sold 80% of the Sadiola mine to the new producer, Allied Gold. Over the next few years, it will be developed into one of Mali's largest reactivated mines.

The potential is huge.

In Mali, the gold is very close to the surface, which puts the average cost per ounce in the range of USD 850 on a sustainable calculation and also keeps drilling costs low. With total costs ranging from USD 130 to 150 per meter, they are among the lowest in the world. In gold-rich Quebec in Canada, the costs are significantly higher, at about USD 400 per meter, which is 2.5 times higher. According to Allied's management, output will increase from around 200,000 ounces Au today to around 400,000 by 2028. Allied is currently still producing at around USD 1,300 AISC per ounce due to the high level of investment, but here, too, costs are now falling from quarter to quarter. Desert Gold could become the next low-cost producer in Mali, with the first heap leach plant expected to be operational as early as 2025.

30,000 meters of drilling suggest resource expansion

The Barani East and Gourbassi West zones contain measured and indicated oxide and transitional mineral resources of 131,000 ounces of gold at a grade of 1.41 g/t gold (Au) and inferred mineral resources of 55,000 ounces of gold at a grade of 1.22 g/t Au. The results for the 1.6 km long Gourbassi West North zone could now be of interest. The oxide and transitional resources in all three zones will be part of the preliminary economic assessment (PEA) that is currently being carried out. Initial results have now been announced.

Three composite metallurgical samples weighing approximately 220 kg were sent to a metallurgical laboratory in South Africa. A drone survey and a photo mosaic of the three potential mining areas were carried out locally. This data is required for planning the locations for the potential mining infrastructure, including buildings, crushing facilities, leach pads, waste rock, etc. Assay results from the first 12 metallurgical drill holes are available. An initial resource estimate will now be prepared for Gourbassi West North. Recent drilling results include high grades of 3.54 g/t Au over 10.15 meters at Barani East and 6.62 g/t Au over 12 meters at Gourbassi West. The present mineralization could significantly expand the current resource potential.

CEO Jared Scharf commented: "I am very pleased with the progress of our PEA. The metallurgical drill holes have given us some pleasant surprises, with several unexpected zone extensions and higher than anticipated grades in some parts of the Barani East Zone. The potential addition of a new resource North of Gourbassi West could further improve the project's economics as we aim to finalize the PEA as soon as possible."

Consolidation is more than likely

The CEO of the newly formed Allied Gold Group, Peter Marrone, gave a lengthy presentation on the need for consolidation of African mines at this year's Mining Indaba commodities conference in Cape Town. In his opinion, the continent's 2,000 or so commodity miners will be absorbed into larger units over the next few years. While global gold mine production has increased by only 26% since 2010, it has increased by almost 60% in Africa and more than doubled in at least 10 African countries.

Barrick Gold CEO Mark Bristow commented on the current situation: "We are also looking for new growth opportunities in the Loulo region, including through a high-resolution airborne magnetic geophysical survey to complete the next generation of high-grade targets."

A true catalyst for Desert Gold's success could be the upcoming exploration activities of the major mining companies in the region. These companies are constantly looking for mine expansions and can finance further drilling from their cash flow. The Company's main objective is still to develop a Tier-1 gold project in the medium term, which puts it strongly in the eyes of its expansion-hungry neighbours.

Analysts see considerable potential

German GBC Investment Research recently evaluated the prospects for Desert Gold. Top analyst Matthias Greiffenberger points out in his report (Download) that the gold companies acquired in the Kenieba region over the past ten years have reported an average of 1.81 million ounces of gold and brought in a price of around USD 66.00 per ounce in the ground for the sellers or shareholders. In this context, the shares of Desert Gold are coming into focus, as the Company currently has a market capitalization of around USD 12.3 million or just under CAD 17 million. The Company's SMSZ project has already produced 1.08 million ounces of gold at a grade of 1.14 g/t. It is currently trading at USD 11.40 per ounce in the ground - a considerable discount compared to previous acquisitions in the region.

Operationally, it is estimated that the Barani East heap leach mine will produce 15,000 to 20,000 ounces of gold annually and has a life of over ten years based on current oxide resources. At a gold price of USD 2,300 per ounce, the expert expects annual revenues of approximately USD 40 million. The project, with estimated construction costs of around USD 15 million, is particularly notable for its low production costs and simple mining methods. Due to the high-quality ores and the expected production rates, the analyst expected a profit margin of over 50%, which means an annual free cash flow of USD 20 million. For shareholders, this would mean that the Company would be able to finance the exploration of the 440 sq km area from its own proceeds in future and would not require any further equity.

If Desert Gold's assets were to be sold at the above-average prices per ounce, the Company could be worth USD 71.4 million or CAD 97.6 million - equivalent to around CAD 0.43 per share issued. At over 400%, the potential is significant, and the analyst assigns a "Buy" rating.

Interim conclusion: Project progress creates excitement

CEO Jared Scharf believes that the Company is now on a solid path that will lead to an increase in value in the near future. He is convinced that both mining and exploration can be carried out simultaneously starting in 2025. Therefore, the heap leach plant's construction should be completed as early as 2025. Due to the current preparation of a PEA and the potential already confirmed by analysts, CEO Jared Scharf assumes that other major investors will become aware of the small Canadian company. The disparity in the size of the local mining companies makes integration of Desert Gold at some point in the resource definition highly likely. While neighboring companies such as Barrick Gold (EUR 30.9 billion), B2Gold (EUR 3.2 billion) and Allied Gold (EUR 618 million) already have substantial market valuations, the Canadians, with their new number of shares, have a market capitalization of just around EUR 12 million.

Desert Gold (WKN: A14X09 | ISIN: CA25039N4084) is on the verge of a technical breakout after a prolonged sideways phase. After the good gold performance of recent months, the major producers are now trading slightly higher but still well below their historical highs. The Desert Gold share is only just below its 1-year high of CAD 0.08. Around 45% of all shares are in the hands of management and insiders. California-based Merk Investments holds around 7%, and mining legend Ross Beaty is also on board with around 3%. Goldman Sachs recently raised its annual target for gold from USD 2,300 to USD 2,700 in its precious metals report. With a good PEA and a mine start in 2025, the Desert Gold share is clearly moving into the spotlight.

This update is based on our initial report 11/21.