Gold - The Big Picture

Gold was among the best performing asset classes in 2020, reaching an all-time high of USD 2,067 in early August 2020. Over the past twelve months, the precious metal price has ranged between around USD 1,685 and USD 1,950 at a lower level with noticeable volatility.

At a current price of around USD 1,860 per ounce, the precious metal is now taking aim at the USD 1,900 mark and the trend highs of the last 12 months. The low interest rate environment, rising inflation, demand as a crisis currency, a strong US dollar and the physical demand for gold for jewelry production or as an industrial metal argue for a higher price level in the medium term.

The low interest rate environment, rising inflation and demand as a crisis currency all point to a rising gold price.

The explorer market

The devil is in the details. There are several things investors should check off their mental checklist when investing in exploration companies. First and foremost, the project's quality, including its size and location, and access to infrastructure such as roads, power grids and water are important. Exploration companies need a lot of money to search for raw materials and later develop the projects and characteristically operate in the red. But with drilling data, a better understanding of resource deposits, and a more accurate assessment of the size of the resources and their value or the project's economics, these advances should have a significant positive effect on the bottom line for shareholders, despite dilutive capital increases.

Company Profile

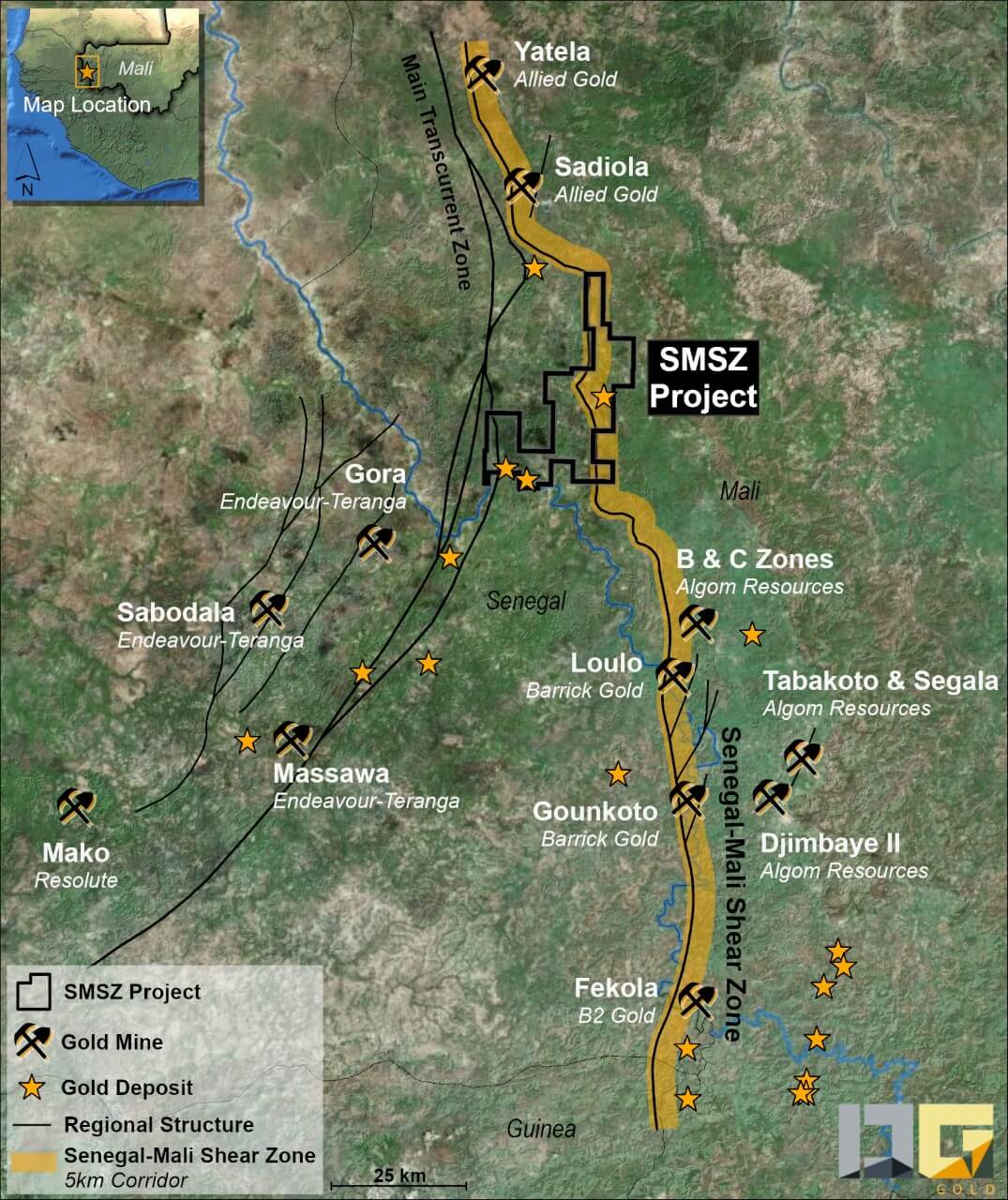

Desert Gold Ventures Inc. is dedicated to the discovery and development of gold projects in Africa. The company owns two gold exploration concessions in West Mali. Its largest asset is the 440 sq km SMSZ (Senegal Mali Shear Zone) flagship project, the region's largest non-producing land package.1 The Djimbala project is also located in West Mali. Mali is the third-largest gold producer on the African continent. 2 In addition, Desert Gold controls the Anumso Gold Project in the Ashanti Belt of Ghana and the Rutare Gold Project in Central Rwanda.

Jared Scharf, President & CEO Desert Gold: "Our success in drilling and acquiring properties in 2021 clearly demonstrates the exceptional exploration potential of our SMSZ project. Through drilling, we have both expanded existing gold zones and discovered new zones, such as our recent Gourbassi West North discovery."

Projects, Areas, Mines

Flagship Senegal Mali Shear Zone (SMSZ) Project

The 440 sq km SMSZ flagship project is located over a 43 km section of the prolific and total Senegal Mali Shear Zone of approximately 250 km in West Africa. There are several producing gold mines in geographic proximity. These are B2 Gold's Fekola mine, the Gounkoto and Loulo mines of Barrick Gold, and the Sadiola and Yatela mines.

Producing mines in the neighborhood

For the full year 2021, the Fekola mine remains on track to meet or exceed the upper end of its forecast production range of 530,000 to 560,000 ounces of gold at low costs (AISC) between USD 745 and USD 785 per ounce. 3

Barrick Gold's Loulo and Gounkoto mines are expected to produce 510,000 to 560,000 ounces of gold at costs (AISC) of USD 930 to USD 980 per ounce this year, according to guidance. The mines have deposits of 6.7 million ounces of gold (proven & probable), 9.0 million ounces (measured & indicated), and 2.0 million ounces (inferred). 4

Joint venture partners IAMGold and AngloGold Ashanti divested the Sadiola Mine in late 2020. Both partners acquired the historic Yatela Mine, which is geographically close, a year earlier. The mine is expected to return to production; in the past, 2.1 million ounces of gold were produced here. 5

Mali is Africa's third-largest gold producer

Most gold mineralization in western Mali and eastern Senegal is associated with the Senegal-Mali Shear Zone (SMSZ) and the Main Transcurrent Shear Zone (MTSZ), respectively. The Company's SMSZ project is one of the largest gold exploration projects in West Africa. With more than 20 open gold zones discovered to date to follow up and numerous targets yet to be tested, the SMSZ project has the potential for the discovery of one or more large gold deposits comparable to the region's Tier 1 gold mines. The neighboring mines' production of just over half a million ounces of gold annually for less than USD 800 per ounce cost (AISC) illustrates the region's high attractiveness.

Last year Mali's industrial gold production was 65.2 tonnes, slightly above the previous year's record production of 65.1 tonnes. According to statements from the Ministry of Mines, an additional 6 tons or so came from artisanal miners. The West African country is one of Africa's largest gold producers, with some 13 mines operated by multinational companies. For the current year, the country's Ministry of Mines expects production to continue to rise without quantifying this in more detail. 6

SMSZ: Good drilling data and extension acquisition

When assessing the potential for success of an exploration project, drill data and the resource estimates determined from it are important. As part of the most recently completed exploration program totaling 267 drill holes for 18,161 meters, Desert Gold released results from 25 drill holes. These include grades of 1.13 g/t gold over 42 meters, 1.12 g/t gold over 33 meters and 1.06 g/t gold over 29 meters. To note here is that drilling has proven gold in areas that Desert Gold had not previously shown. In 2022, the Company also plans new exploration drilling to follow up on the program completed in the summer of 2021. In total, more than 100 untested gold-in-soil anomalies exist.

The Company also recently expanded its already large footprint in the region. The Company reported the final step in acquiring the mineral exploration rights of the Kolomba license. The Company received all mineral exploration rights for three years.

Jared Scharf, President & CEO of Desert Gold, commented on the acquisition, "The gold zones at Kolomba are among the most prospective we have seen in the belt. Given its strategic location, for example, less than 20 km from our recent Gourbassi West discovery, the Kolomba permit will be a focus of our upcoming 2022 drilling campaign."

The SMSZ project in western Mali covers this huge area and is one of the largest non-producing gold properties in West Africa. With the Kolomba acquisition, the prospects of the project improve once again.

The Kolomba Project associated with the SMSZ is characterized by two significant gold zones where a total of 31,000 meters of historic drilling was completed between 1999 and 2003. Both zones are open at depth and along strike and returned some of the best drill results on the SMSZ project in terms of grade and width. Modeling of these zones is underway, with drill testing expected to commence early in the first quarter of 2022, accompanied by geological mapping and magnetic geophysics. Next year, the two new zones will be the focus of the drilling campaign.

The Company expects to significantly expand its resource base in the near term with the 30.6 sq km Kolomba concession. The area associated with the SMSZ was last worked about 18 years ago at a gold price of approximately USD 360 per ounce. It is estimated that there are several hundred thousand ounces in the ground there, which is now to be confirmed by a NI 43-101 report.

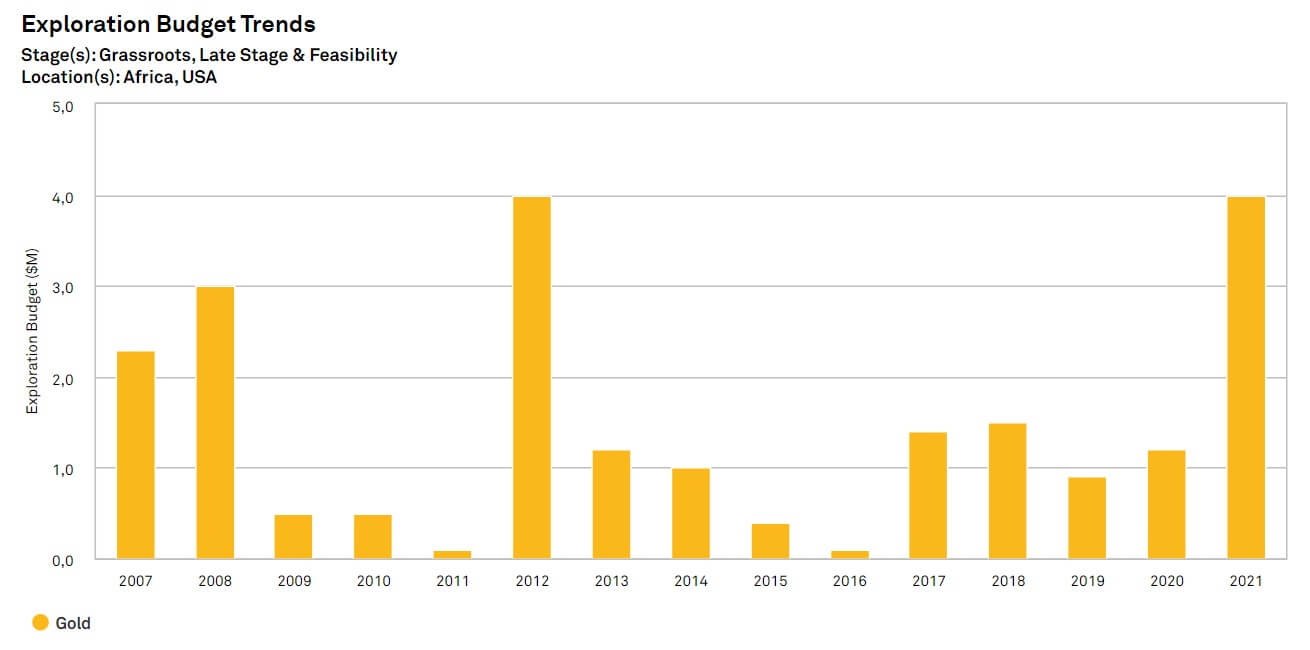

As the chart shows, Canadians have been spending heavily on exploration in 2021. They also plan to conduct extensive drilling programs next year. In the end, shareholders should be rewarded with significantly rising share prices.

Djimbala Project

The 100 sq km Djimbala project is located in West Mali, close to several large mines and deposits, including Hummingbird Resources' Komana mine and Endeavour Mining's Kalana deposit. The majority of the property has not been explored to date. Gold-in-soil anomalies will need to be further defined by future drilling. North of the property, high-grade intercepts up to 12.65 g/t gold over three meters have been reported.

Rutare Project

The project in Rwanda comprises a mining license for a 375-hectare area, which was granted on December 13, 2016, and expires on December 12, 2026. The deposit contains an inferred mineral resource estimate of 5.551 million tonnes grading 1.48 g/t gold, equivalent to 265,000 ounces of gold. However, the resource estimate is from 2011. The deposit is open along strike and at depth. Limited work following the resource estimate included the preparation of a draft mine plan. Desert Gold has applied for additional properties near the concession area.

Highlights

- largest non-producing land package in the region (SMSZ project: 440 sq km)

- geographic proximity to producing mines with annual production > 500,000 ounces of gold

- good drilling results

- catalyst end of 2021: resource estimate according to Canadian standard NI 43-101

- low company valuation

- potential takeover candidate

A conclusion on value

How to value an explorer?

Valuing an exploration company is always tricky. A key valuation anchor is the upcoming release of the NI 43-101 resource estimate later this year. In our opinion, this data will lead to a much higher valuation for the stock. Adjacent producing mines confirm the potential of the SMSZ project to build one or more Tier 1 gold mines. In addition, production costs (AISC) are expected to be below USD 800 per ounce, as is typical in the country. This means that the stock has the potential to outperform the market within a year.

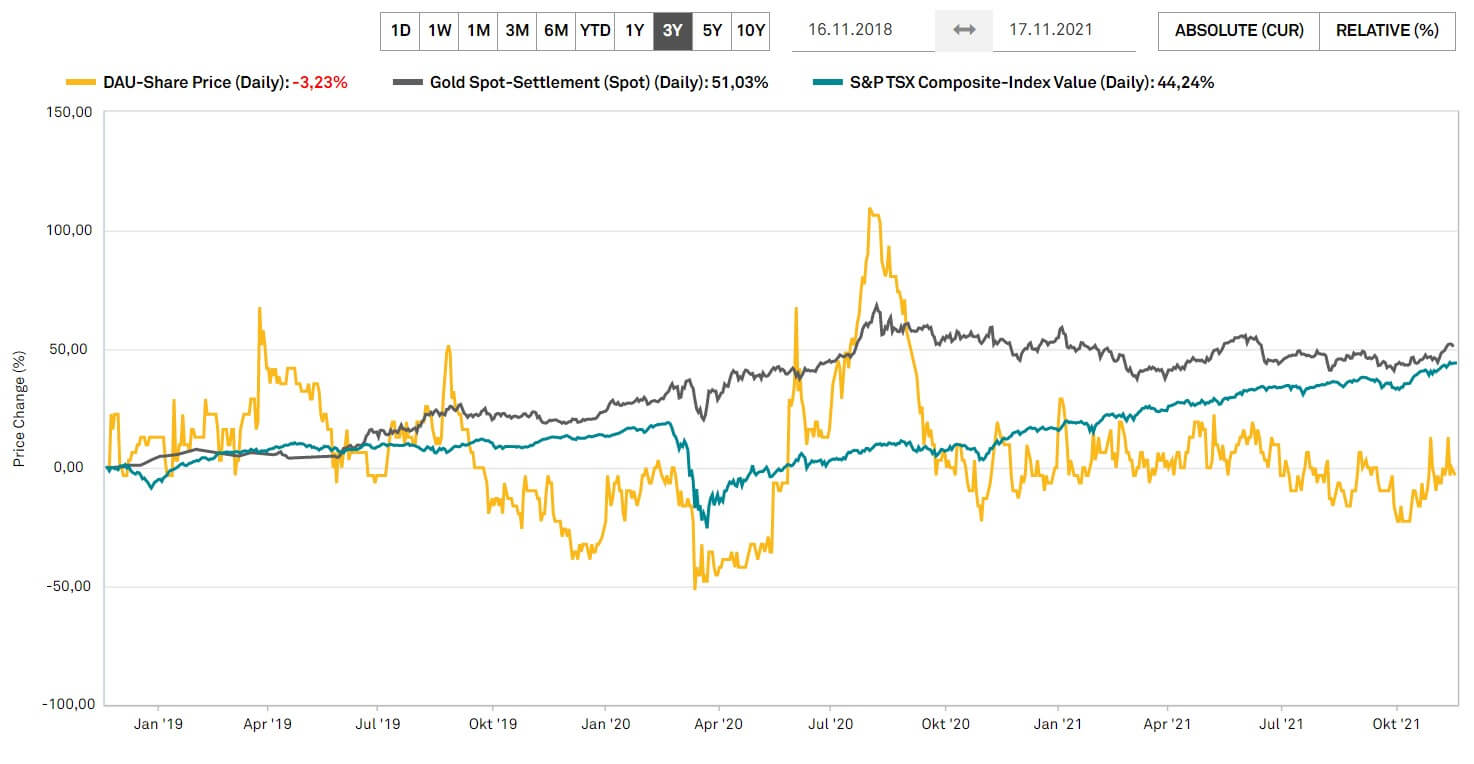

Over the past three years, Desert Gold's stock has only outperformed the gold price and the TSX-V selectively. In light of project progress and upcoming drill results, the stock should outperform going forward. Accordingly, a re-rating of the stock could begin.

With the upcoming resource estimate and the new drilling programs, the share price should be kissed awake.

Timing interesting

Especially under timing aspects, the share of Desert Gold can currently be a good investment idea. The Canadian explorer with the largest non-producing land package in West Mali should see a revaluation with the NI 43-101 resource estimate announced by the end of the year.

With the possible better estimation of the resource value and profitability, the current low company valuation of just CAD 21 million could soon be a thing of the past. The excellent project quality and size of the SMSZ project also make the Company a hot takeover candidate in the medium term. The big picture of a further rising gold price also offers perfect framework conditions.