China's historically established battery monopoly is faltering

A sobering reality for Western executives: dependence on China will continue to shape the landscape for years to come. China's dominance in the battery market is difficult to break. Around 95% of global graphite capacity and roughly 80% of cell production is located in China, led by CATL with 37% and BYD with 17% market share. At the same time, export controls on lithium compounds, LFP cathodes, and graphite ensure that Western companies remain heavily dependent. Even the EU's Critical Raw Materials Act has so far done little to change this, as Europe's share of raw material production is a negligible 7%. To bring about long-term change in this area, NEO Battery Materials (ISIN: CA62908A1003|TSX-V: NMB|FRA:1BC|WKN: A2QQBV) has stepped up. The Company provides patented silicon anodes, branded NBMSiDE® P200 and P300N, which increase energy density by 30-40% compared to graphite anodes while reducing charging cycles by 20-25%. This marks a strategic, investable alternative to China's battery monopoly, and a significant step toward energy independence.

Silicon revolution: NEO Battery breaks the boundaries of battery technology

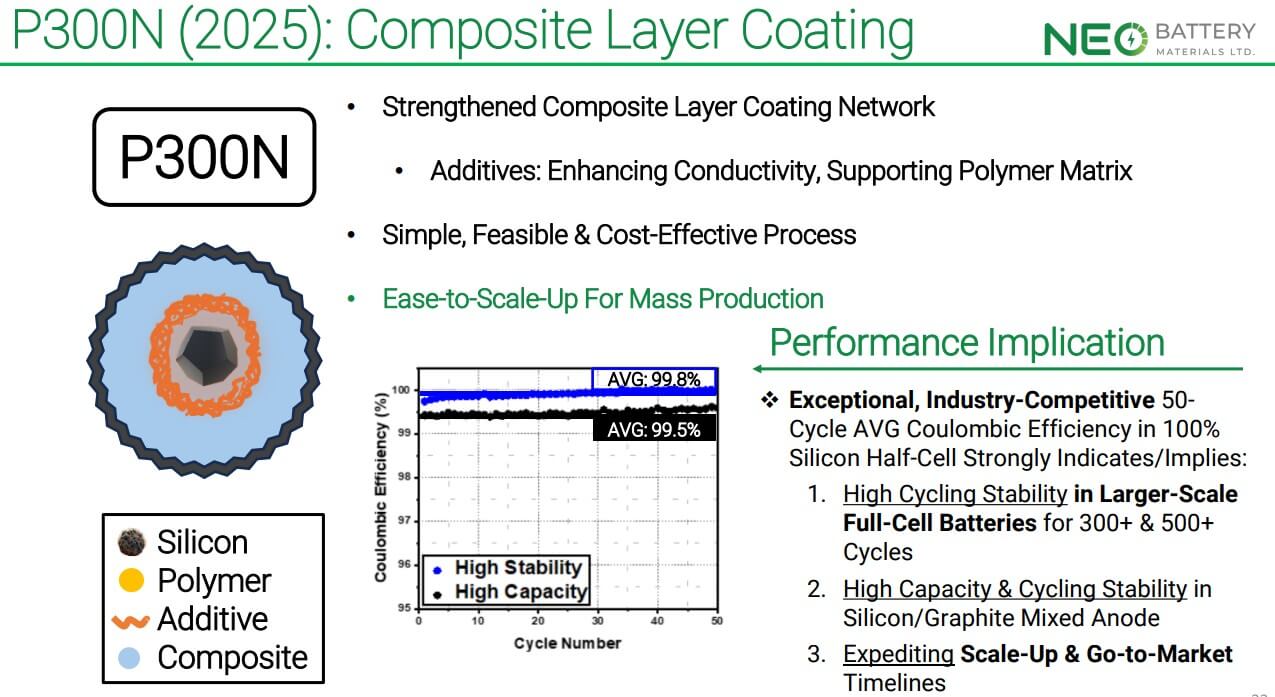

NEO pursues a clearly differentiated technology approach, backed by patents. Through a proprietary nanocoating process, the Company vulcanizes silicon particles in a "one-step" manufacturing process, which not only enables high storage capacity (> 2,000 mAh/g) and initial Coulombic efficiencies above 88%, but also reduces costs by more than 60% compared to competitors. In addition, system tests with mixed silicon-graphite anodes have demonstrated an increase in range of around 20% in electric vehicle applications, which highlights the commercial leverage and technological advantages. Western manufacturers have been waiting for years for comparable technological breakthroughs – the market is ready for innovation! At the same time, a four-year supply contract for 50 tons of silicon anodes has been signed with an undisclosed North American manufacturer of lithium-ion batteries. The customer focuses on high-performance applications in unmanned aerial systems (UAS), drones, and defense-related mobile systems. This anchor order offers a medium-term opportunity for significant volume growth and scaling. On one hand, it represents market and production validation; on the other, it provides a foundation for near-term revenue generation.

Secured orders: Growth with long-term predictability

NEO's order situation clearly demonstrates that future growth is not based on assumptions, but is already underpinned by contractual agreements. In addition to the previously mentioned four-year contract for 50 tons of silicon anodes – explicitly intended for high-performance batteries used in drones and unmanned systems – the Company secured a CAD 4.5 million order in September 2025 from an Asian drone manufacturer specializing in industrial cargo drones. This contract structure significantly reduces typical technology ramp-up and production series risks and demonstrates how NEO Battery is translating its innovative strength into tangible supply relationships, which is an essential quality feature for investors. Manufacturers worldwide rely on the stability of industrial supply chains, and new players like NEO can stand out through reliability, product quality, and customer focus.

Production offensive: Scaling to megawatt-hour levels

NEO not only demonstrates technological potential, but also focuses specifically on scaling. The acquisition of an existing manufacturing facility in South Korea and the development of a 3.2-acre production site for cylindrical and prismatic batteries in Canada demonstrate the move toward industrial implementation. The funds raised as part of a CAD 5 million capital increase will be specifically invested in machinery, production installations, and working capital - with the goal of being able to deliver over 20 tons of silicon anodes annually as early as next year and, in the medium term, offering batteries on a megawatt-hour scale. This marks the transition from prototype and small-series production to true manufacturing and delivery capability. Investors get the impression that everything is moving very quickly here and that the people at the forefront are acting in a targeted and decisive manner.

NEO recently succeeded in securing a core patent. CEO Spencer Huh commented: "We are pleased to announce that KIPO has granted one of the core patents related to NEO's cost-effective, one-step nanocoating technology for the production of active materials for silicon anodes. As South Korea is one of the largest battery-producing countries and a center for battery innovation, NEO Battery will continue to strategically expand its presence and development in this market."

The following interview with NEO conducted by Lyndsay Malchuk as part of the IIF provides deeper insights.

Broad market presence: From drones to AI energy storage

NEO addresses several megatrends simultaneously. Unlike many battery companies that focus primarily on the e-mobility sector, NEO addresses a diversified set of future markets. In addition to drones and unmanned systems, the Company is focusing on robotics applications for warehouse logistics and autonomous production facilities, as well as energy storage solutions for AI data centers and industrial electromobility. This strategic breadth allows the Company to grow without relying on a single market segment. The vertical integration from material development through cell production to the end product also creates a value-chain depth, which can help stabilize margins and increase supply chain control. Built on a strong conceptual foundation, the management team can be trusted to implement the global rollout within a reasonable timeframe. This would enable the Company to make the leap from niche player to mid-sized supplier.

Technological lead as a potential unique selling point

NEO Battery Materials' decisive competitive advantage lies in the performance of its NBMSiDE® technology. With capacities exceeding 2,000 mAh/g, initial Coulombic efficiencies greater than 88%, and at least 90% capacity retention after 300 charging cycles (P-300N variant) - well above the original target of 80% - the Company demonstrates a real opportunity for technological leadership. By combining a cost-effective metal-silicon precursor (MG-Si), nanocoating, and a simplified manufacturing process, NEO achieves both series cost reduction and a performance leap, a value proposition rarely seen in the battery materials sector. Here is an example of a performance comparison of peer companies within an expanded industry perspective with a focus on e-mobility.

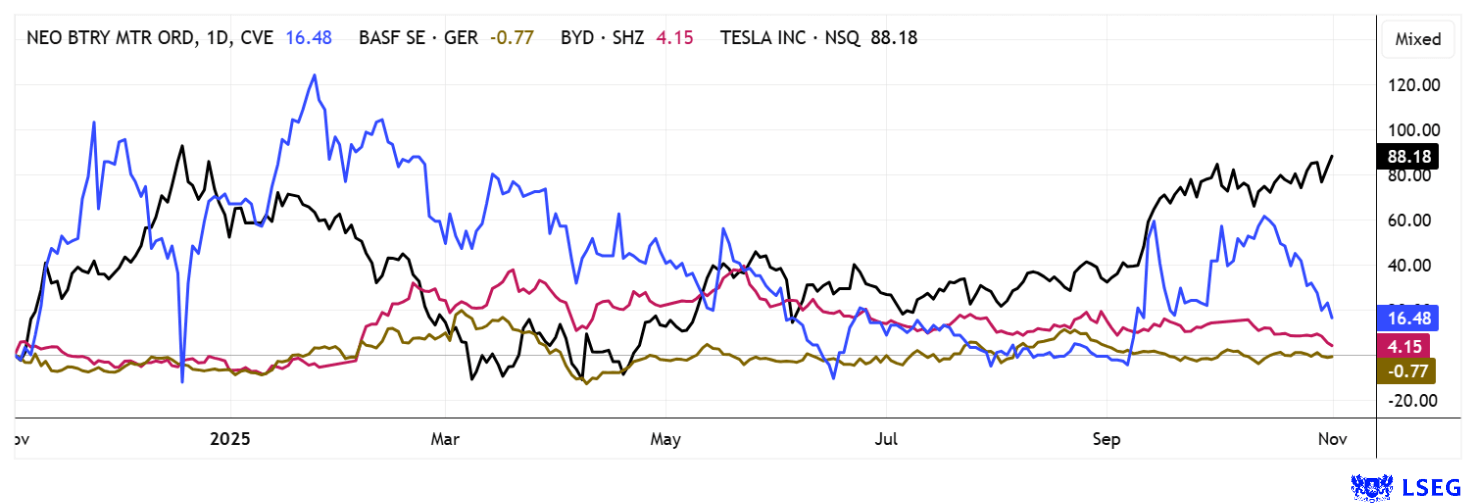

Conclusion: Good entry opportunity ahead of the next growth spurt

NBM shares have already rallied by over 100% this year. Uncertainty in the European e-mobility market led to profit-taking in the middle of the year, which slightly reduced the return. However, with just under 142 million shares issued, the market capitalization is only EUR 50 million. In return, investors gain a company with a high degree of technological advancement and optimal market access for its innovative battery technologies. The higher valuation could quickly gain momentum!