Business model with leverage: Globex's DNA is perfectly suited to the times

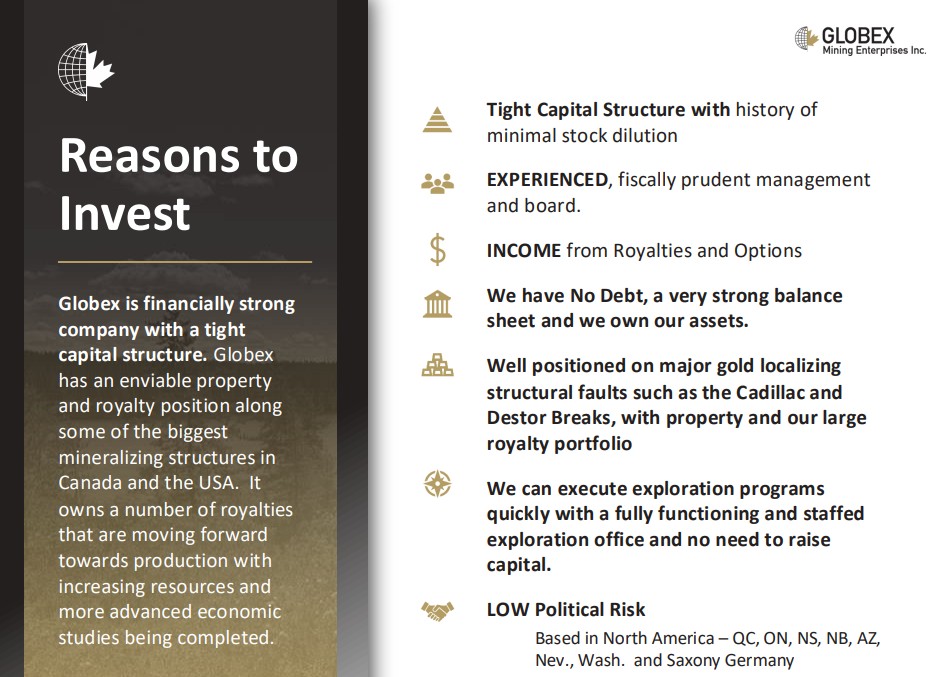

For over 40 years, Globex Mining has pursued a consistently countercyclical approach that differs significantly from that of traditional explorers. Instead of short-term drilling fantasies, CEO Jack Stoch focuses on systematically building a broadly diversified project portfolio. With 265 projects in various stages of development, a natural risk balance is created that greatly reduces individual project risks.

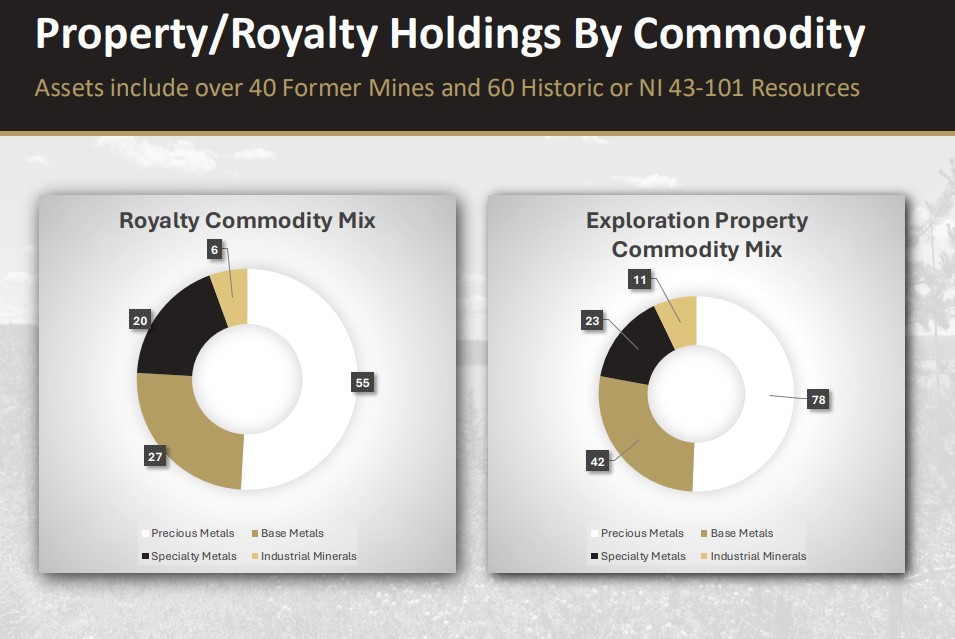

Broad diversification across precious metals, base metals, polymetals, specialty metals, and rare minerals. Over 100 royalties and multiple option agreements.

The 106 royalty and option models are particularly valuable, as they allow Globex to participate in the success without having to bear any operating costs. This model creates a kind of “commodity investment company” whose value increases with each exploration success of the partners. Especially in volatile market phases, this structure proves to be exceptionally resilient and scalable. With a portfolio of 265 active projects and broad diversification across precious, base, and specialty metals, Globex Mining is a sought-after value player and innovation driver in the North American commodities scene amid discussions about supply bottlenecks. Over the past 40 years, CEO Jack Stoch has steadily expanded his commodity holding company, with half of the projects attributable to the precious metals sector, including gold, silver, platinum, and palladium.

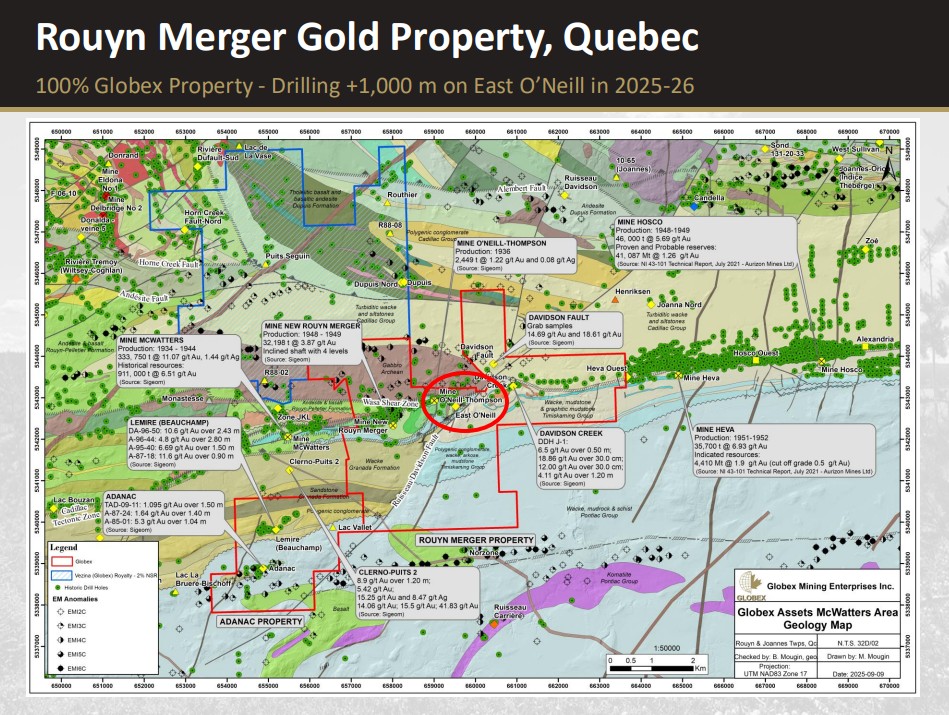

Gold exploration with substance: Rouyn-Merger and Abitibi Belt

The latest drilling results at the Rouyn-Merger project impressively confirm the geological quality of this property. Wide gold intervals with over 3 g/t Au in the immediate vicinity of the Cadillac Fault are a strong indication of a potentially larger system. The vertical proximity of the drill hits also indicates structural continuity, which suggests further resource expansion.

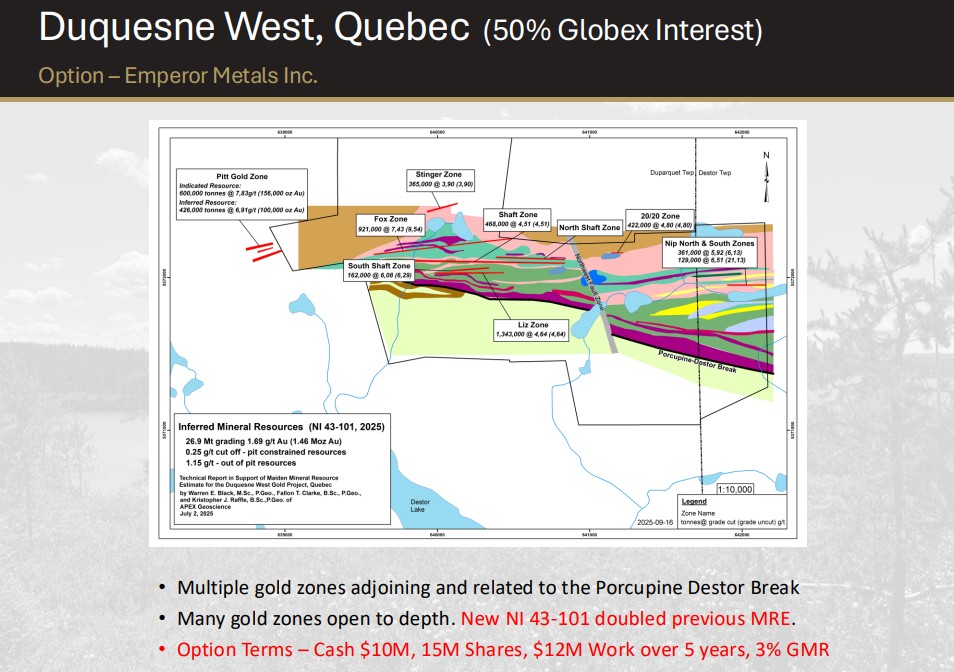

This picture is complemented by developments at Duquesne West, where partner Emperor Metals has more than doubled the historical resource to 1.46 million ounces of gold at an average grade of 1.69 g/t. Emperor Metals has raised an additional CAD 11 million in funds to explore another 10,000 to 15,000 meters. The combination of wholly owned projects and advanced partner-led exploration in the Abitibi Gold Belt significantly increases the hidden value within the Globex portfolio.

Globex is pleased with the progress to date and is delighted that Emperor has already more than doubled the historical resources. The company stated: “In 2025, the focus will be on exceeding the 2 million ounce mark and driving continued resource growth through systematic exploration from 1,000 feet depth to surface.”

Other royalty value drivers: Nordeau, Cartier, and visible gold

The Nordeau royalty is increasingly becoming a prime example of Globex's strategic approach. Cartier Resources has been able to identify extremely high-grade gold zones with visible gold there over several drilling campaigns. The existence of three parallel mineralized structures over several hundred meters suggests a long-lived, scalable system. Particularly relevant for Globex is that each resource expansion immediately increases the future royalty value without additional investment. In a rising gold price environment, such royalties act as a built-in price lever that is often underestimated in traditional valuations. This is precisely where a significant part of the hidden potential lies.

CEO Jack Stoch knows what he is doing and clearly enjoys it. (link: https://cdn.jwplayer.com/previews/CgRsPOId-ur02VgM2 text: In a recent video, he explains how partner Ironwood Drilling is systematically upgrading its gold resource from "inferred" to "indicated."

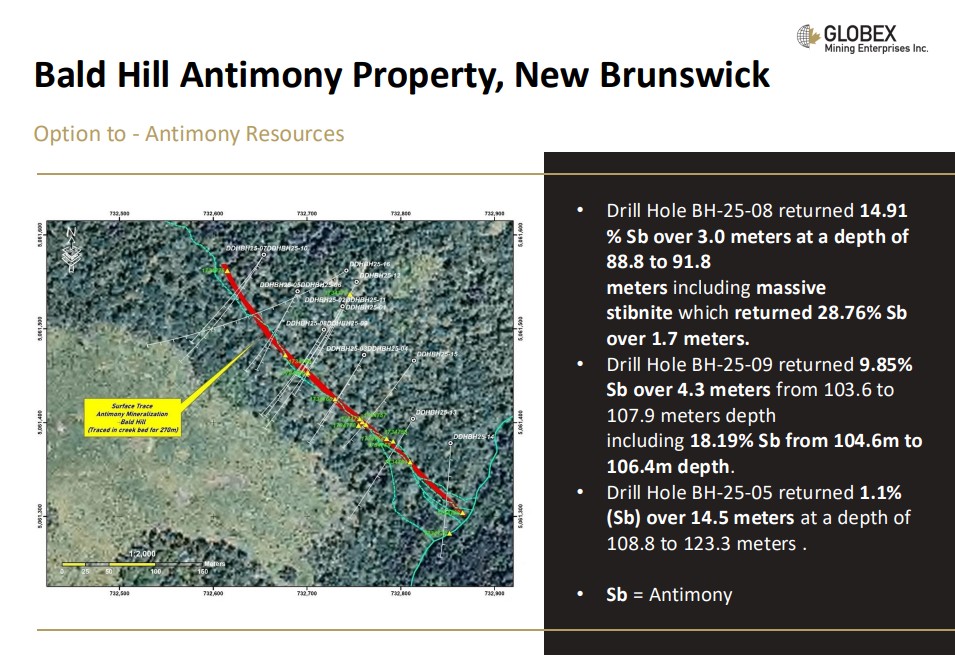

Focus on strategic metals: Antimony as a geopolitical trump card

Antimony is increasingly evolving from a niche metal to a geopolitically relevant commodity. Its use in ammunition, flame retardants, battery technologies, and semiconductors makes the metal strategically indispensable, while Western sources of supply are scarce. The high-grade drill results at Bald Hill, averaging 4 to 5% Sb, are therefore not only geologically but also politically relevant. Added to this is the Golden Pike project, where gold and antimony potential are being developed in parallel. Globex is positioning itself very early and proactively in a market segment that is increasingly subject to government support programs and security policy prioritization. This is likely to be a significant valuation factor for the coming years.

Broad metal base: Zinc, silver, and gold in Chibougamau

TomaGold's results on the Berrigan claims underscore the breadth of Globex's portfolio beyond gold. Broad zinc equivalent intervals with precious metal additions indicate an economically robust system that benefits from both industrial demand and precious metal prices. Of particular interest is the combination of thickness and grade, which suggests a potentially high-volume scenario. For Globex, the 2% gross metal license represents an additional, long-term cash flow option. Especially in a potential commodity supercycle, such polymetallic royalties have a stabilizing and value-enhancing effect.

Conclusion: An asymmetric investment in the commodity supercycle

Globex Mining Enterprises is a prime example of an intelligent commodity investment that goes beyond the classic explorer risks. The company combines financial stability, a debt-free profile, and high liquidity with a project portfolio built up over decades. Unlike many of its competitors, Globex does not operate purely as an explorer, but uses a licensing and participation model in which third parties pay for the development of the properties. Geopolitical developments, the increasing focus of Western countries on commodity security, and the structural supply shortage of many metals are providing long-term tailwinds. While the market still barely reflects the intrinsic value of many royalties, the economic leverage increases with every drilling success of the partners.

Simultaneously, global supply bottlenecks and a potential commodity supercycle provide strong tailwinds. Experts expect significant price increases in the coming years, particularly for metals such as gold, silver, copper, and rare earth metals. With 56.3 million shares, the market capitalization is currently around CAD 111.6 million. The share price is supported by a steady deal flow, recurring option income, and new royalty agreements. In addition, as of September 8, 2025, the Company had approximately CAD 35 million in available funds and valued company shares.

After a 58% gain over the past 12 months, GMX shares are trading at a multi-year high of CAD 1.90–2.00. With current price dynamics for gold, silver, and copper, the diversified portfolio could appreciate 200–300% in the near term. Our initial recommendations near CAD 1.20 are now up over 60%, and further purchases appear warranted - timing is critical!

IIF moderator Lyndsay Malchuk in conversation with David Christie (COO and President): How do you convert ownership of commodities with options and royalties into cash flow?

https://youtu.be/_62ouHrHrdE?si=ir2w7bP5KI6nY_-T

This update follows the initial report 11/2022.