Researchers: Supply risk for important raw materials

Iron, copper and tin, but also almost all other metals of the periodic table, make our modern civilization possible. Many elements are indispensable for modern technology, whether gallium, chromium or rare earths, because, without them, most technical applications would not exist - from cars and computers to televisions and cell phones. Conversely, this also means that if these raw materials become scarce, this could have fatal consequences for the economy and society. Experts from Yale University in New Haven have now, for the first time, comprehensively determined how critical the future supply of all 62 metals and transition metals of the periodic table is. At least for iron, zinc, copper, aluminum and some other metals that have been used for a long time, things look relatively good. However, gold, mercury and platinum group metals can only be mined with considerable environmental impact. As the study shows, the supply risk is particularly high for metals needed for highly specialized tasks in high-tech devices. This is not good news for efforts in the energy turnaround because the success of the measures adopted depends, above all, on the availability of raw materials. 1

Globex Mining Enterprises at a glance

Globex Mining Enterprises Inc. was founded over 70 years ago under the name Lyndhurst Mining Co. Ltd in 1949 to bring a copper mine into production. Then, in 1974, a new group of investors took control of the Company, and it was renamed Globex Mining Enterprises Inc. In 1983 current management took over and the company gained it’s first public listing as Globex in 1987. Unlike most other junior exploration companies, Globex wholly owns its properties, many of which are optioned to third parties or currently has Gross Metal Royalties on (89). Globex currently owns a broad portfolio of more than 200 property parcels and various commodities, all of which have resources or reserves, mineralized drill intercepts, untested geophysical showings, or a combination thereof. They are located in Quebec, Ontario, Nova Scotia, New Brunswick, Nevada, Washington, and Saxony.2

Investment Approach

The Company is often mistakenly named as an explorer, but on closer inspection it is not Globex itself which conducts majority of geological exploration of the properties, but a partner company with which an exploration or royalty deal is made. The Company's founder and CEO, Jack Stoch, acts as an incubator and investor, providing ideas and in-depth knowledge of commodities and mining in order to achieve the best results for his shareholders in selected properties. He is usually also involved in deals with his own company Jack Stoch Géoconseil (JSGC), which significantly increases the entrepreneurial clout and the will to implement.

Broad diversification in precious metals, non-ferrous and polymetals as well as special metals and rare minerals. 89 royalties and 8 active options.

A significant majority of the projects are located in eastern Canada, as the Company's geologists have specialized knowledge of the region there for years. In addition, the Company appreciates the stable mining law and low political risk in Canada. Globex rarely acquires grassroots or early-stage projects. Instead, the company focuses on properties that have already been previously explored and have a historical or NI 43-101 resource estimate or defined geological, geophysical or geochemical targets. Through this investment structure, there is less exploration risk and the Company generates valuable royalties and generates option income by passing on the rights. The Company also invests in abandoned mines and is engaged in their revitalization.

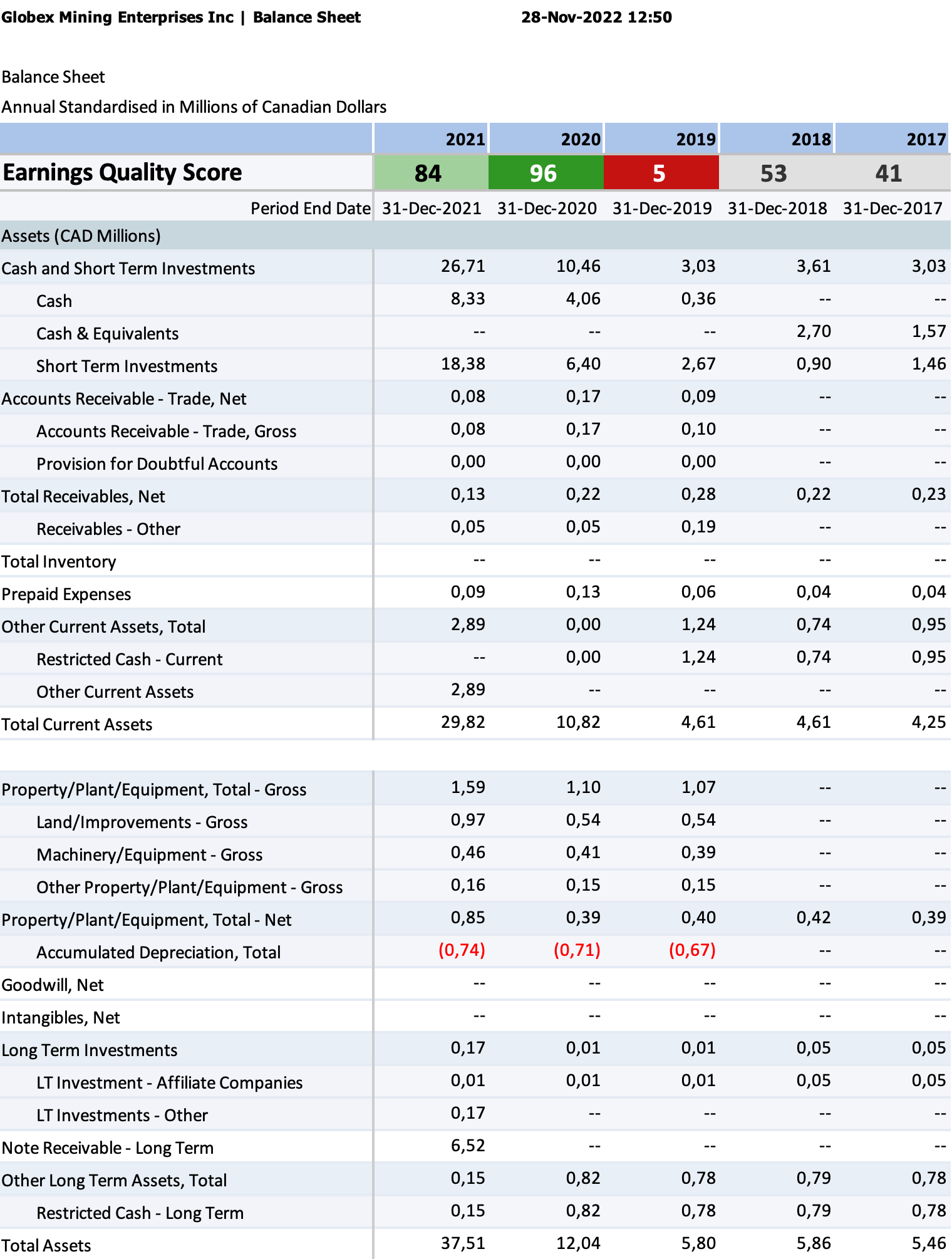

Globex has been in this business for a very long time, and industry veteran and CEO Jack Stoch is constantly and consistently developing his network. The Company's primary goal is not the investment-heavy development of a mining operation, but rather the optimization and portfolio maintenance of its broadly diversified properties. In addition to its many holdings in gold, silver, copper, platinum and palladium, as well as base and specialty metals, the debt-free company also has a well-filled treasury of approximately CAD 20 million, so that it can always increase its holdings or make new acquisitions if necessary. Globex has acquired over 100 projects in the last 10 years, usually not paying a lot of money. The value upside happens later at the negotiating table when an interested party wants to acquire and advance the property.

"Globex has no debt and owns everything down to the pencils."

Global networking, access to deals and the consistent will to sail on the pulse of the times make the Canadians very successful in their investment strategy and robust even in difficult times. The good diversification always allows for top-ups or new acquisitions when needed. Those who can buy now have good cards because the opportunities in the recently bombed-out resource sector are now greater than ever.

The current investment portfolio and its development

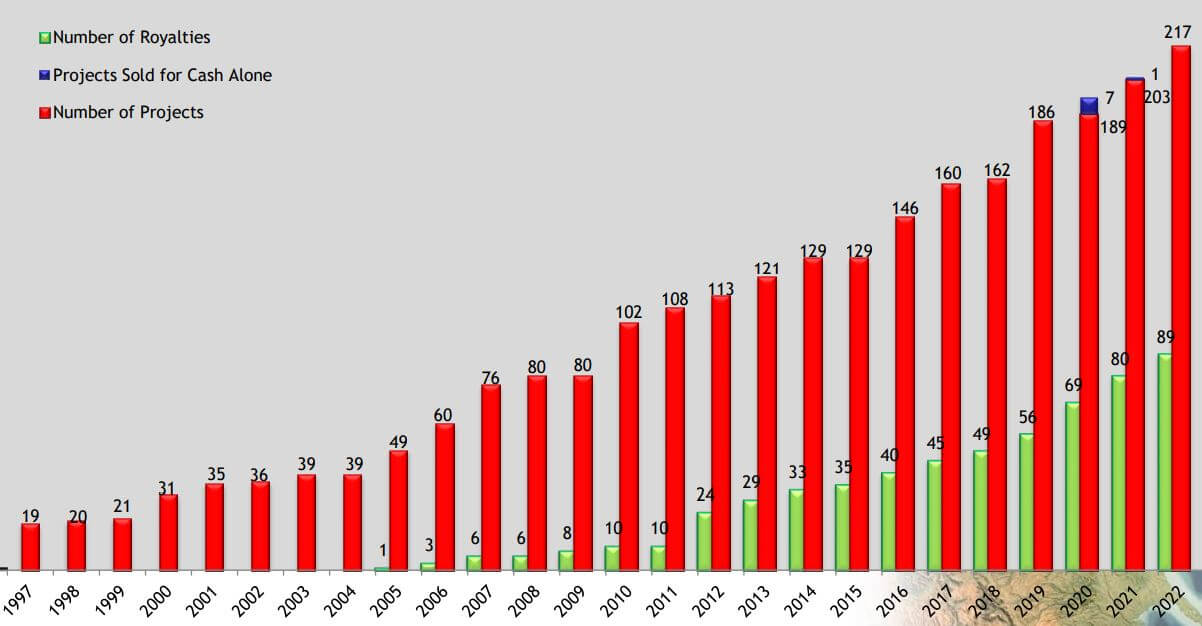

With over 200 projects and properties and 40 former mines, Globex has secured good holdings and benefits from consistent option payments over time through partnerships. Particularly in the exploration sector, a broad diversification can significantly increase investment success, as the various commodities often correlate negatively, thus keeping overall portfolio fluctuations low.

| All projects (total, as of November 2022) | 217 |

|---|---|

| Precious metals gold, silver, platinum, palladium | 111 |

| Non-ferrous & Polymetallic Copper, Zinc, Lead, Nickel (Gold, Silver) | 62 |

| Special Metals & Minerals Talc, Iron, Lithium, Beryl, Magnesium Oxide, Manganese, Mica, Molybdenum, Rare Earths, Titanium, Silica, Bismuth, Pyrophyllite, Vanadium, Antimony, Feldspar, Cobalt, Scandium, Diamond, Uranium, Dolomite | 44 |

| Royalties | 89 |

| Active options (pre-emptive rights) - Cash payments - Share payments - Exploration and development expenses - "Gross metal royalty" (gross metal value extraction fee) | 8 |

| Historical or NI 43-101 Resources | 55 |

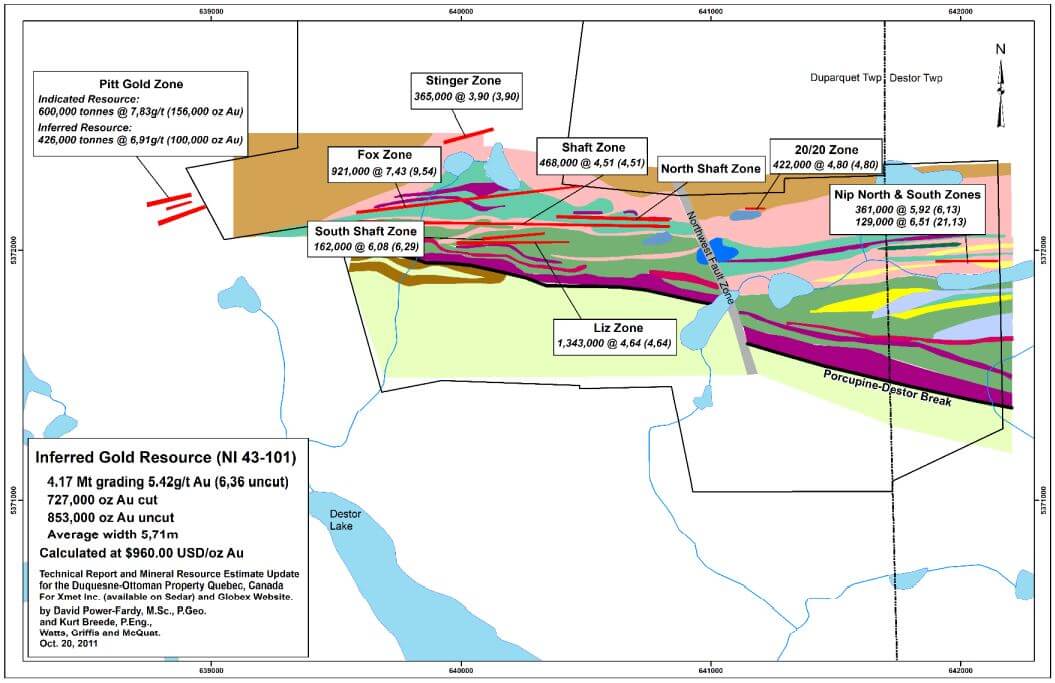

The Duquesne-West gold project is a prime example of how Globex generates revenue from a project. When Globex acquired 50% of the project in 1986 by issuing shares for the equivalent of CAD 20,000, it had a gold resource of only about 100,000 ounces. Since then it has been optioned to six different interested parties and each company that has worked on it with exploration has been able to add ounces to the project. That shows the ingenuity of the business model, because the primary goal does not have to be to bring a project into production as quickly as possible. The strategy can also be to keep generating cash flow with optioning and to let third-party development make the project more attractive for new deals.

In addition to acquiring and optioning properties, the Company also invests approximately CAD 1.5 million annually in the exploration of its own properties.

Since this system usually yields a 2-3% Gross Metal Royalty on a subsequent sale of production, optioning is used to earn money up front and temporarily outsource the risk to a partner. Globex's portfolio now includes 89 projects with royalty interests, which function as a perpetuity in the medium term. The option structure provides that if exploration targets are not met - or if cash and share payments are not made - ownership reverts to Globex. In the case of Duquesne-West, six companies - namely Noranda from 1990, Santa Fé in 1994, Kinross in 2002, Queenston in 2003, Diadem in 2006 and finally Xmet in 2010 - agreed to an option on this project, spending approximately CAD 30 million on exploration, adjusted for inflation, according to new optionee Emperor. However, the option has not been exercised on any occasion, and thus Duquesne-West has reverted to Globex and Jack Stoch Géoconseil (JSGC) each time for failure to fulfill option agreements. **The twist: According to the new NI 43-101 report, each time Globex and JSGC added an increased number of ounces in the ground, the next optionee had to pay a higher price for the option as the underlying resource continued to expand. The 100,000 ounces of gold became a property with 727,000 ounces at a 3g cut-off grade, a good seven times more than when purchased in late 1986, making Duquesne-West a significant project supported by continued growth of its mineral resources and high gold grades.

On October 12, 2022, Globex announced a new deal with Emperor that dwarfs all previous contracts at Duquesne-West. Another optioning for a full CAD 10 million cash plus 15 million shares at the respective minimum price of CAD 0.20. That results in revenues of CAD 13 million spread over five years. As the project at the time was still undergoing a huge expansion of unexplored acreage through the Ottoman area, it was also agreed that the optionee would have to spend the entire exploration costs of CAD 12 million within five years. A royalty of 3% has already been agreed in the event of production, of which 1% can be bought back for CAD 1 million in cash. From year 7 onwards, Globex will receive an advance royalty of CAD 100,000 per annum if production has not yet been achieved. Each 2.5 million shares will still be due if the next NI 43-101 resource report shows more than 1 million ounces and a PEA has been realized. Globex has a 50% interest in the entire business here, with the remaining 50% belonging to Jack Stoch's Géoconseil (JSGC). From pure discounting of current and future payments, this results in a project value of CAD 7 to 8 million for the Globex interest, with the possibility of production commencing in the relative near term. This property alone currently represents about 20% of Globex's market capitalization. 3

Further opportunities from current deals exist in the Francoeur/Arntfield gold project in addition to Duquesne-West. Complementing this are the other recoveries from past deals such as the Tennessee Zinc Mines project. The deals brought in over CAD 18 million in 2021 and over CAD 8 million had already flowed into Globex coffers in the form of royalties. The two projects, Nordeau and Magusi, are similar in nature, with the option holders having already spent tens of millions on exploration and, in the case of Magusi, mine development. Again, both of these projects have been able to greatly increase existing resources. The TTM, Parbec, Duvay/Fontana, Authier, Montalembert, Chibougamau Mining Camp, Bell Mountain, Mooseland, Poirier, Houlton Woodstock, Joan Beetz Feldspar, Pointe aux Morts, Silicon Ridge, Wood-Central Cadillac and Russian Kid properties also appear highly prospective. They should provide decent cash flows over the next 2-5 years and further enhance Globex's intrinsic value.

In addition to the properties mentioned above, the portfolio includes another 200 projects that have yet to be discussed in detail in the current listing. Analytically, Duquesne-West is a clear proof-of-concept for Globex Mining's business model, and the follow-up projects should also document this. On November 25, 2022, partner Emperor Mining announced a private placement of approximately CAD 5 million to finance the operating costs of the Duquesne West Gold Project. That secures the medium-term prospects for Globex Mining at this property.

Highlights

- widely diversified allocation across many commodities

- natural hedging of price fluctuations within the metals

- good pipeline and deal structures with revolving option and royalty returns

- long term experienced management with good track record

- low company valuation based on expected cash flows (DCF)

- potential takeover candidate

Conclusion on Globex Mining Enterprises Inc.

Excellently positioned, broadly diversified

Globex deal flow has increased significantly during the correction of junior resource companies, increasing the value of the holding in the medium term when the now low valuations correct back to normal. An investor benefits from the deep expertise of the management and the balanced distribution of assets. In the case of spin-offs from the portfolio, there is additional value generation via new listed companies. **Currently, Globex is valued at only about CAD 36 million, less than two times cash on hand, and continues to include over 200 invested projects. There is no fundamental reason why the share price should remain at this level.

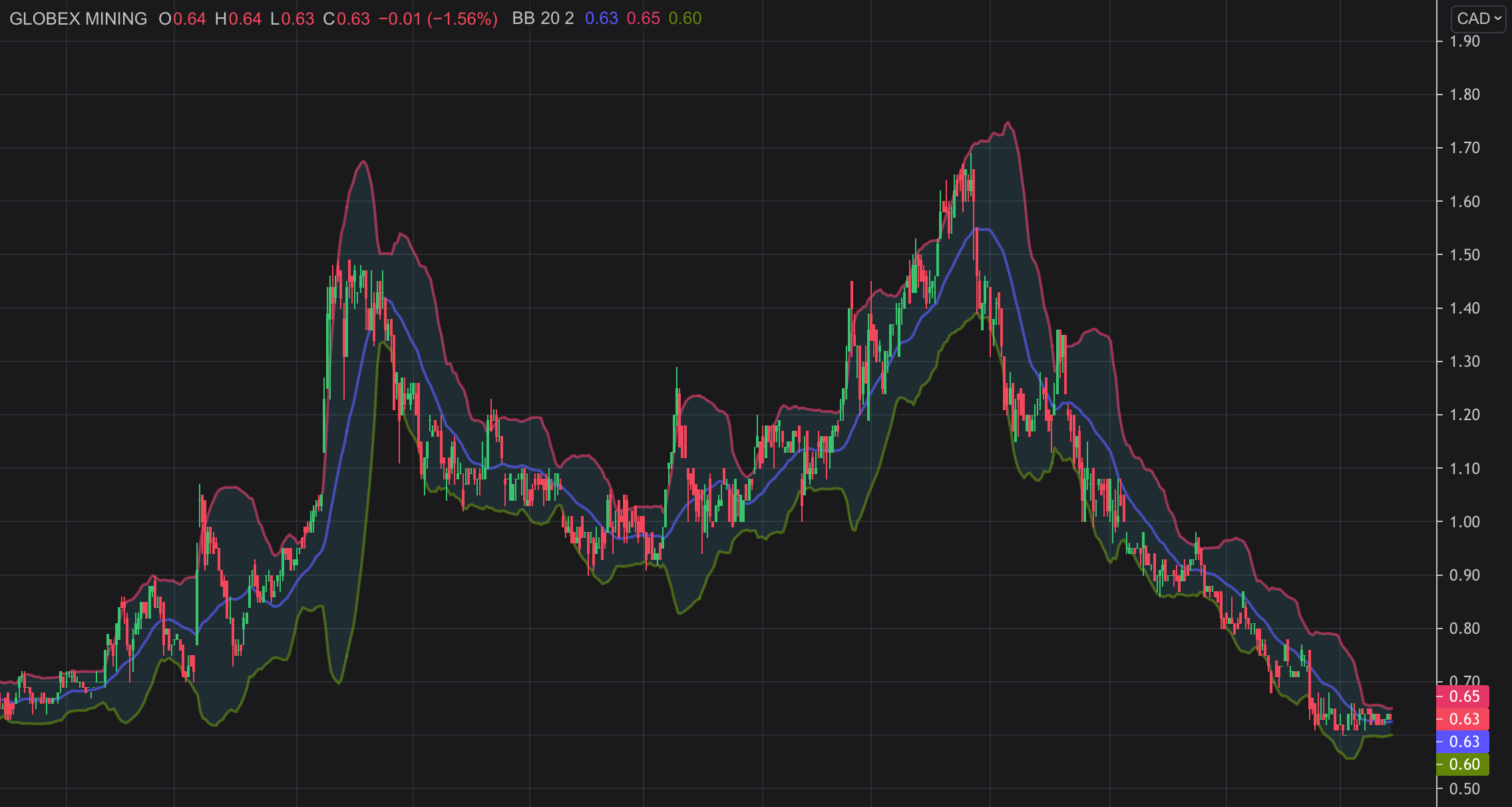

Good time to enter

The two-year price history of Globex Mining shares reflects the ups and downs of mining stocks in North America very transparently. It is striking that since the extreme interest rate hikes on the part of the FED in response to rising inflation rates, there has so far been no increase in the prices of small commodity companies. On the contrary, Globex Mining suffered significant losses of as much as 65% since the high of CAD 1.69 this year. This was due to sell-offs since summer and tax loss selling at the end of the year.

However, given the high project quality and reported progress in the investment portfolio, a significant outperformance could be expected over the next 24 months. In our view, the big picture of the sheer ongoing commodity scarcity and geopolitically continued tense supply chains indicates a perfect long scenario for Globex Mining.

Founder and CEO Jack Stoch will take questions from investors on December 7, 2022, at 15:30 CET on the occasion of the 5th IIF - International Investment Forum. Participation in the virtual event is free of charge. Click here to register.