Promising properties in Québec's famous Greenstone Belt

Formation Metals Inc. (CSE: FOMO; FSE: VF1; OTCQB: FOMTF) is a North American gold and base metal explorer focused on high-grade projects in prime mining regions. The Company focuses on drill targets with high discovery potential and clear growth paths for resource expansion. Its flagship project, the N2 Gold Project in Québec, hosts a historical resource of approximately 870,000 ounces of gold. The overall structure of the project comprises six zones, with the A Zone and RJ Zone in particular considered geologically highly mineralized and already open at significant strike lengths. Formation Metals currently has approximately CAD 12.7 million in working capital, no debt, and ample funding for multiple exploration phases. CEO Deepak Varshney aims to rapidly advance the N2 Project toward a NI 43-101 compliant resource estimate and, over the medium term, toward production readiness. In parallel, the copper and zinc potential is being systematically reviewed, which could give the Company additional strategic importance in the field of critical metals.

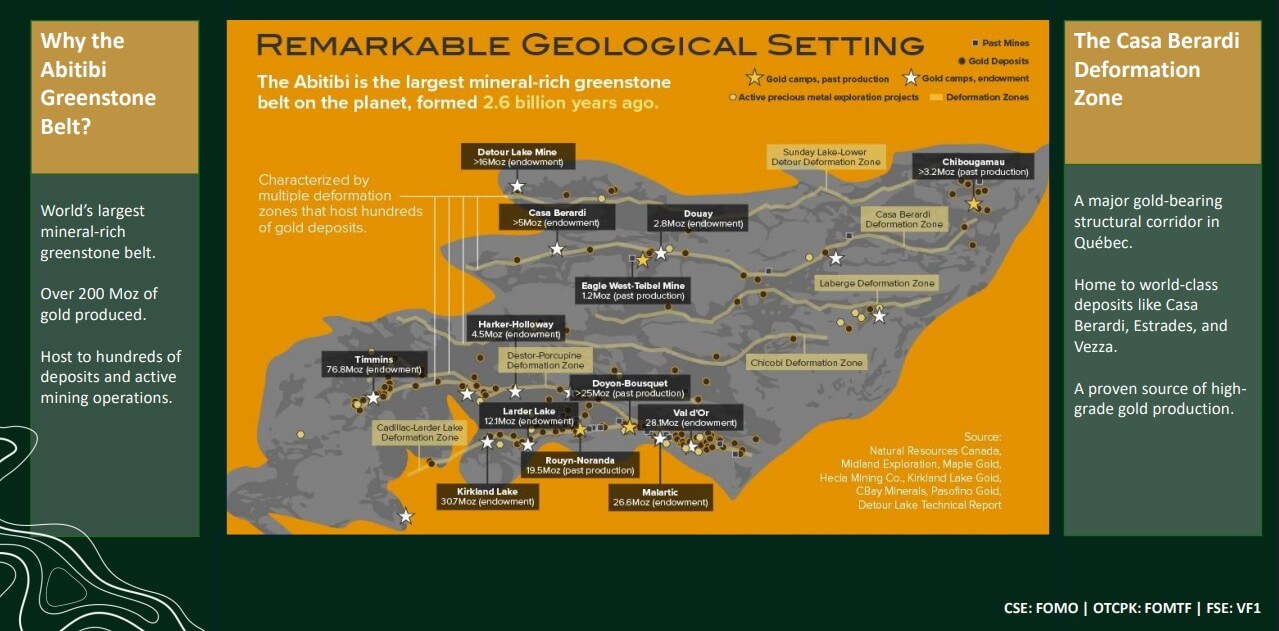

Perfect location and promising geology

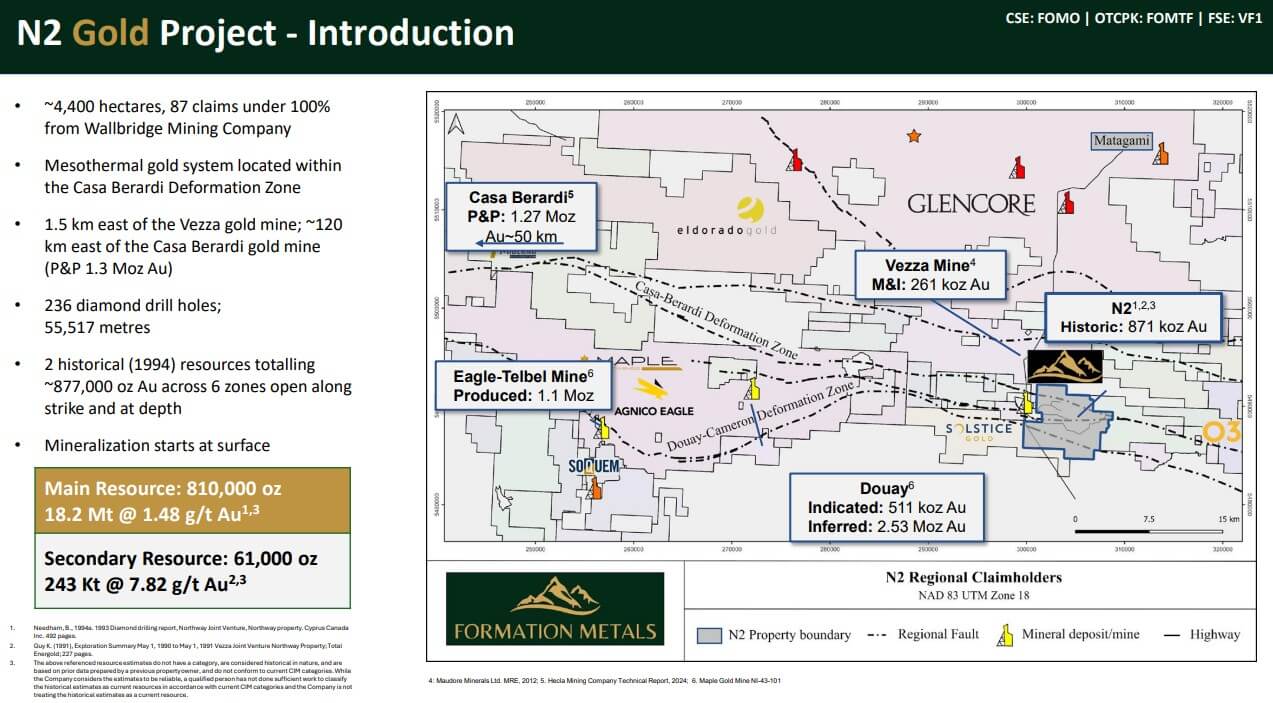

The N2 Project comprises 87 claims covering approximately 4,400 hectares in the Abitibi Greenstone Belt, one of the world's most productive gold regions with over 200 million ounces historically produced and an estimated 100 million ounces remaining in the ground. The historical gold resource within the license area comprises approximately 18 million tonnes at 1.4 g/t Au (approximately 809,000 ounces) across four zones, as well as an additional 243,000 tonnes at 7.82 g/t Au (approximately 61,000 ounces) in the RJ Zone. According to historical data, the A Zone has approximately 522,900 ounces at 1.52 g/t Au and extends over at least 1.65 km of drilled strike length, with a further 3.1 km of strike length open. Approximately 15,000 meters have been historically drilled, with 84% of the drill holes showing significant gold mineralization. The RJ Zone contains approximately 61,000 ounces at 7.8 g/t Au, with historical high-grade intersections of up to 51 g/t over 0.8 m and 16.5 g/t over 3.5 m. Just less than 1 km has been tested to date, leaving 4.75 km open for further exploration. The geological environment shows volcanic and sedimentary formations, indicating structural mineralization typical of gold and VMS systems. Historical drill cores also show copper (up to 4,750 ppm) and zinc values (up to 6,700 ppm). This means that N2 not only offers gold upside, but also potentially economically significant polymetallic components.

Exploration strategy and upcoming drill program

Formation Metals has planned and fully funded a multi-stage exploration program. Initially, a 20,000-meter drill campaign was planned, with a first phase of 10,000 meters that began on September 25, 2025. Following successful capital raising, the program was immediately expanded to 30,000 meters. Drilling will target resource extensions along known structures and the identification of new gold trends in the A, RJ, and Central zones. In addition, IP geophysics, structural modeling, and re-analysis of historical drill cores will be conducted. The goal is to define an updated NI 43-101 compliant resource and test over 7 km of open strike length. Management is also focusing on target areas that were identified by previous operators, such as Agnico Eagle (drilling in 2008 at a gold price of around USD 800), but never pursued further due to low gold prices. In parallel, the Company is evaluating metallurgical properties and base metal signatures to quantify potential by-products.

CEO Deepak Varshney comments: "Building on the successes of our predecessors, this 20,000-meter drill program will be critical in our goal of developing N2 into a near-surface multi-million-ounce deposit."

Successful financing significantly increases room for maneuver

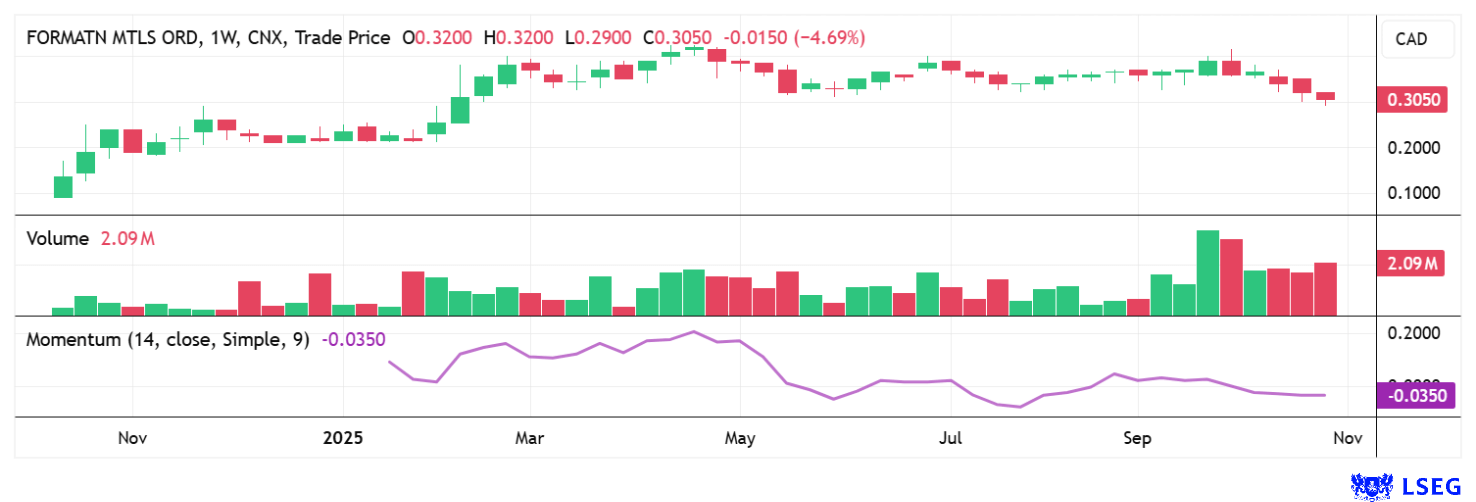

Formation Metals has successfully completed its latest financing rounds, raising a total of approximately CAD 16.7 million. In two tranches, 35.1 million units were issued at CAD 0.37 (LIFE) and 16.7 million units at CAD 0.54 (flow-through). The same number of warrants with exercise prices between CAD 0.54 and CAD 0.62 and a three-year exercise period were issued in each case. Following completion of the financing, the Company has approximately CAD 12.7 million in working capital and remains debt-free. Including tax credits from the Province of Québec, the exploration budget for 2025 to 2026 is approximately CAD 8.1 million. This will enable the expanded 30,000-meter drill program to be carried out without additional financing. Formation Metals is benefiting from the current positive sentiment in the junior mining sector and can now go full steam ahead.

CONCLUSION: Excellent opportunities and manageable risks

Formation Metals offers exceptional exploration upside in a Tier 1 region with historical data and large open zones. The combination of shallow gold mineralization, high-grade intersections, and potential polymetallic components creates multiple value drivers. The ongoing 30,000-meter campaign with active drilling progress ensures a continuous flow of news that, if successful, could lead to a significant revaluation, particularly with the release of current resource estimates and high-grade hits. Risks include typical exploration uncertainty, operational challenges, market volatility, and the fact that the historical resource is not yet NI 43-101 compliant. Drill results from a 30,000-meter campaign in one of the world's most successful gold regions could generate significant value, particularly if the A and RJ zones can be expanded both geologically and economically. The next six to twelve months are considered crucial: Will the mineralization be confirmed, and will there be new high-grade discoveries? Initial resource expansions and potential metallurgical data could turn the project into a multi-million-ounce story. For speculative investors focused on early-stage gold exploration, Formation Metals offers a highly positive risk-reward profile.

It would be great if CEO Deepak Varshney's vision from one of his recent interviews came true and he could sell the Company back to Agnico Eagle in a few years for 20 times its current value. Currently, with around CAD 20 million in cash and a market capitalization of just CAD 28.5 million, the Company appears to be completely undervalued. A rapid upward market reaction is therefore to be expected after the first operational reports!