Focus on multiple sclerosis – The well-known drug cladribine, administered in a new way

Around 0.3% of the German population, or around 280,000 people, live with a diagnosis of multiple sclerosis (MS), with women being affected significantly more often than men. The first signs of the disease usually appear between the ages of 20 and 40, but the disease is not limited to this age group. Internationally, over 2.8 million cases are considered confirmed, making MS one of the most common chronic inflammatory diseases of the central nervous system worldwide. Modern diagnostic and therapeutic procedures enable a significantly higher detection rate and early medical intervention, particularly in Europe and North America. This is in stark contrast to less developed regions, where MS is often detected too late or not at all.

The Canadian biotech company BioNxt Solutions (TSX-V: BNXT; WKN: A3D1K3; ISIN: CA0909741062) develops state-of-the-art drug delivery systems for autoimmune and neurological diseases and addresses markets of global relevance. Its lead project, BNT23001, is a sublingual dissolvable film formulation of cladribine. Traditionally, cladribine has been administered as a tablet (trade name Mavenclad, Merck KGaA), absorbed through the digestive tract. However, many MS patients suffer from dysphagia, or swallowing disorders, which make it difficult to take the medication. BioNxt elegantly solves this problem: the active ingredient is absorbed directly into the bloodstream via the oral mucosa, eliminating the stressful route through the stomach, intestines, and liver. This approach not only improves patient adherence but also enhances bioavailability.

CEO Hugh Rogers is enthusiastic: "We could develop a reformulated, patented drug in sublingual form in perhaps two to four years and for a few million USD." The timeline is important for investors because, in biotech investments, the implementation and marketing plan represents the path to profitability, which follows years of development and generates initial cash flows.

There is considerable market potential here, as a glance at the competition shows: companies such as Roche and Biogen generate billions in sales with MS drugs. In 2024, Roche generated around USD 7.6 billion with Ocrevus (ocrelizumab). Biogen's Tecfidera generated around USD 4.4 billion, but has been losing market share to generics since the patent expired. Biogen's Tysabri (approximately USD 2 billion in sales) and Novartis' Gilenya (also around USD 2 billion) are no longer patent-protected. This development intensifies competition and increases the strategic value of innovative approaches such as BioNxt's. If the bioequivalence study in Europe is successful, BNT23001 could quickly capture market share, especially in segments where established therapies have lost their exclusive protection.

Patent applications filed, now it's time for dose optimization

BioNxt has strategically secured its intellectual property rights in recent years and is simultaneously pushing ahead with dose optimization of BNT23001 as the final preclinical step before the planned human bioequivalence study in 2026. In early August 2025, both the European Patent Office (EPO) and the Eurasian Patent Organization (EAPO) announced their acceptance of the core claims for cladribine melt films, meaning that formal patent grants in the respective regions are expected in the coming months.

A Track One priority procedure is underway in the US, which typically allows the Patent Office to make a decision within twelve months, thus establishing IP security in a timely manner for clinical scaling. This means that BioNxt could already expect to have a US patent in the world's most important pharmaceutical market by spring 2026, significantly strengthening its negotiating position with potential partners. At the same time, further patent extensions have been initiated in Canada, Japan, Australia, and New Zealand, creating a tiered global protection network. Even more crucially, The patent not only addresses cladribine, but also acts as a platform “umbrella” for sublingual drug delivery across different drug classes and indications, opening up a window of protection well into the 2040s.

This IP architecture complements the clinical path of BNT23001, which, as a sublingual thin film, aims for faster absorption, potentially higher bioavailability, and greater ease of use compared to tablets. The focus is now on short-term data catalysts from ongoing dose optimization and the implementation of medium-term de-risking events through the human bioequivalence study. There has likely never been a more exciting time for BioNxt since the Company was founded.

The next move targets the semaglutide market

Novo Nordisk and Eli Lilly have set the benchmark with billions in sales: a weight loss solution for stubborn cases of obesity. With BNT24004, BioNxt is developing an oral dissolvable film for semaglutide, the active ingredient behind blockbusters like Ozempic and Wegovy. The GLP-1 receptor agonist market is booming, generating USD 29 billion for the pharmaceutical giants in 2024. These well-known preparations increase glucose-dependent insulin secretion, lower glucagon, slow gastric emptying, and suppress appetite via central GLP-1 receptors. The net effect is lower blood sugar and highly effective weight loss. Semaglutide-driven sales are projected to reach around USD 30 to 35 billion in 2026.

But what about people who are not eligible for injection or prefer sublingual administration? The potential appears to be significantly greater if the methods of consumption are made easier. BioNxt has addressed this issue and is in the final stages of formulation development and at the beginning of preclinical toxicity and pharmacokinetic studies in dogs. This will be followed by an assessment of patentability and preparation of the patent application for submission.

New Video on IIF: CEO Hugh Rogers in talks with Lyndsay Malchuk what investors can expect in the next months.

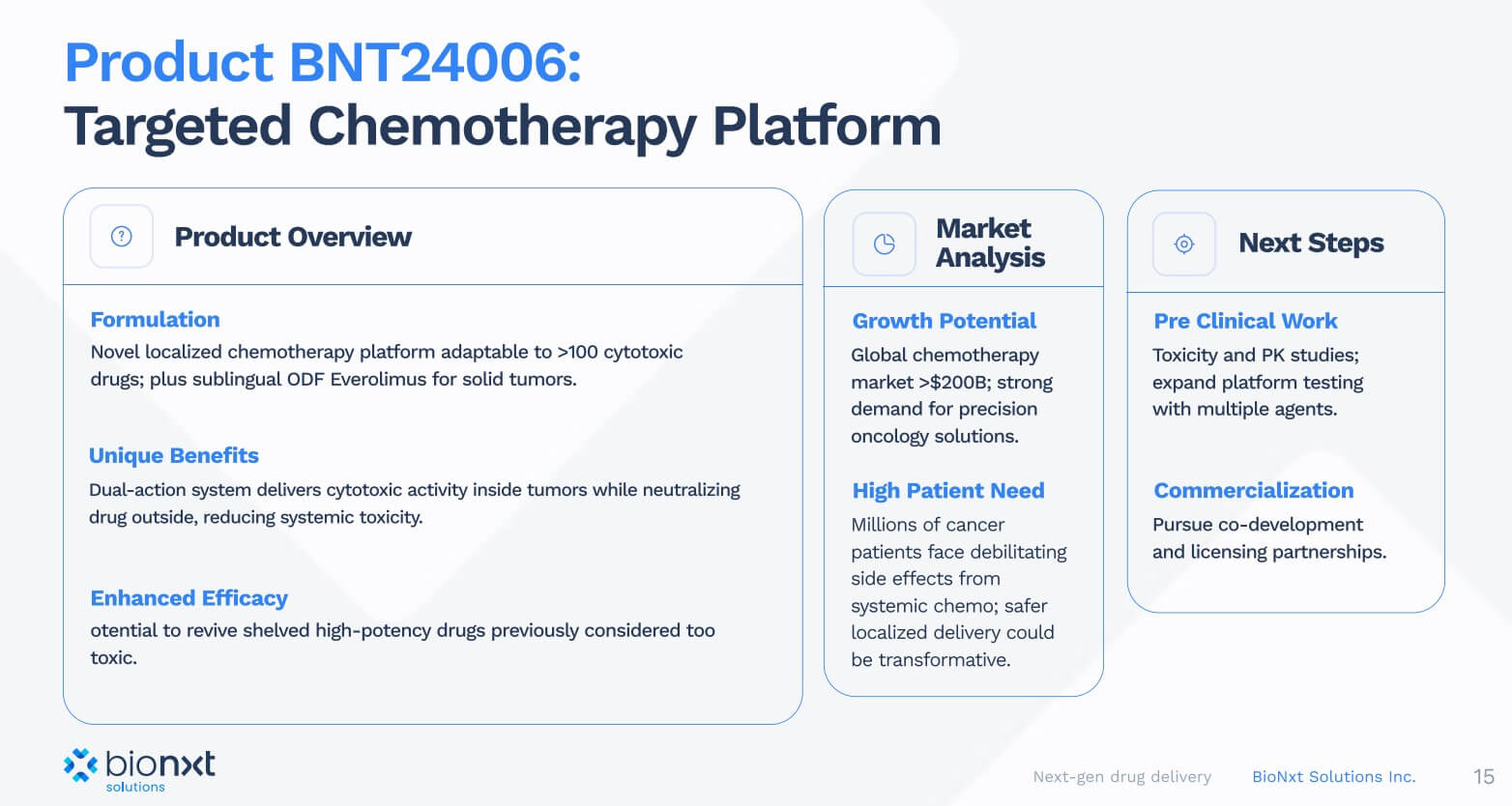

Oncological applications complete the pipeline

In addition to the MS and semaglutide projects, BioNxt is developing a novel platform for targeted chemotherapy, in particular for the targeted administration of cytostatic drugs. This technology makes it possible to concentrate chemotherapeutic agents precisely in or around tumors while minimizing harmful effects on healthy tissue. A dual mechanism of action ensures that the active ingredient is first activated in the immediate vicinity of the tumor, while free molecules outside the tumor are rapidly neutralized. In vitro data indicate up to a tenfold increase in therapeutic efficacy combined with improved safety.

Conclusion: Reformulation instead of lengthy development processes

BioNxt Solutions addresses large markets with a low-risk reformulation strategy and proprietary thin-film platform: Instead of new development, the company focuses on optimizing proven active ingredients for sublingual applications, which shortens development times and makes clinical milestones more predictable. The ongoing 15-day dose optimization for BNT23001 (cladribine thin film) is the final preclinical step. The comparative human bioequivalence study is scheduled for early 2026 and will be directly compared to the brand-name tablet. In parallel, BioNxt is consolidating its IP foundation: EAPO “readiness to grant” in eight states, Track One acceleration in the US, and further nationalizations create global protection and increase negotiating power for partnerships. In addition, BioNxt is expanding its addressable market beyond MS, e.g., through GLP-1 programs such as semaglutide ODF and oncology applications, opening up additional licensing and collaboration paths for the future.

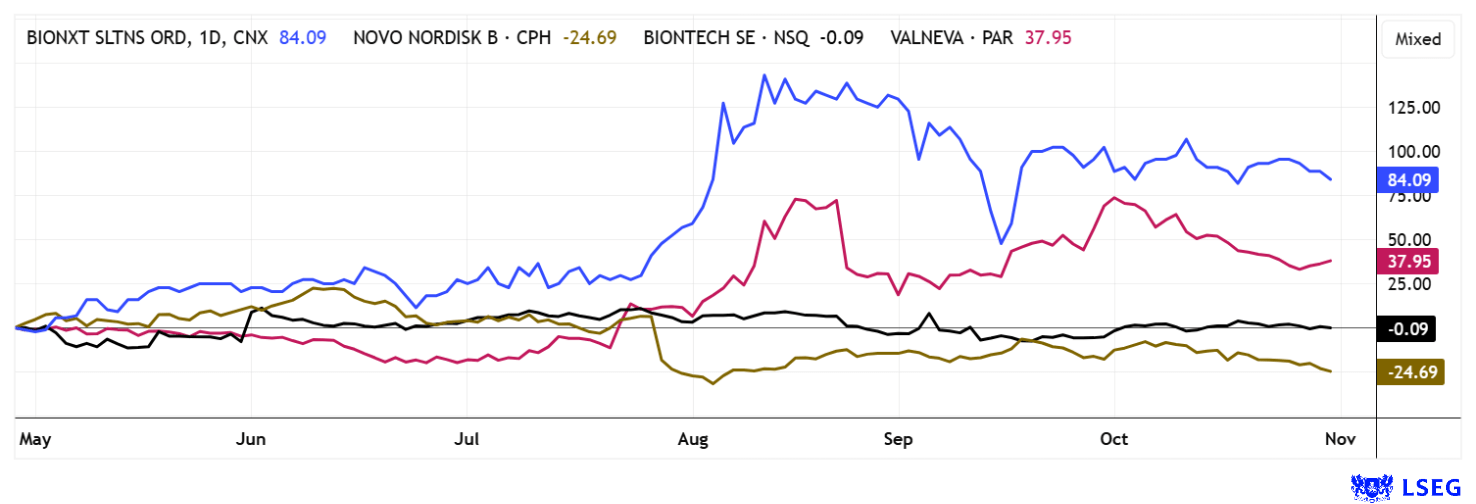

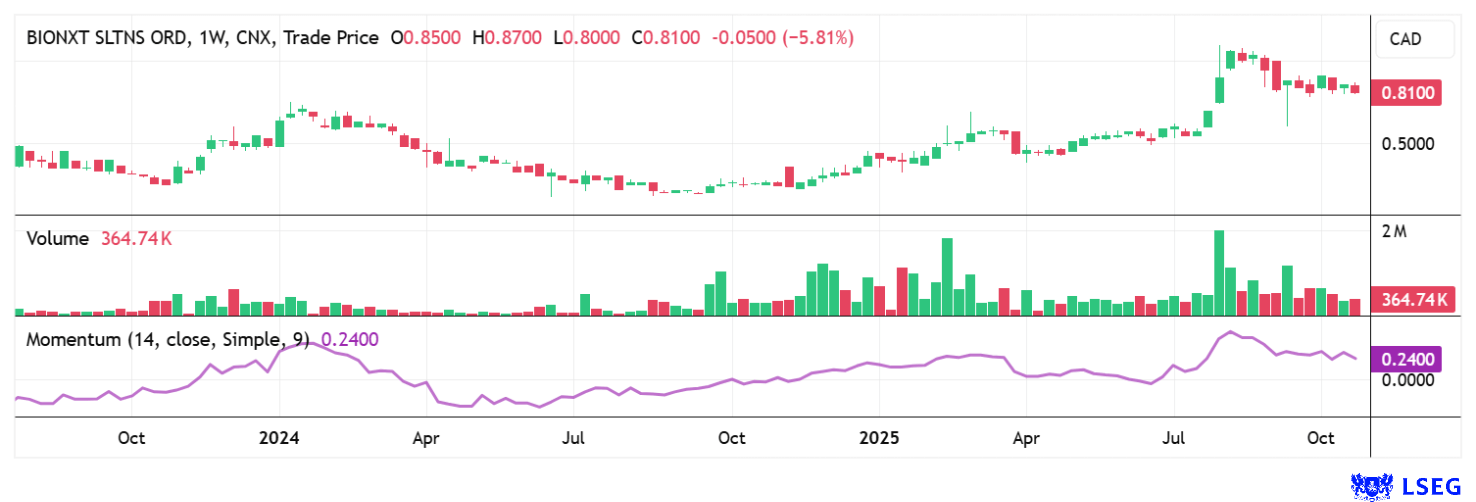

Compared to established competitors, BNXT shares have gained up to 120% over the past 6 months. Since October, the stock has maintained a stable 80% increase in the market. The coming weeks will be particularly exciting as progress from ongoing projects is reported.

Analysts at Black Research see a 12-month price potential of EUR 2.50, or the equivalent of approximately CAD 4.00. The stock is currently consolidating at around CAD 0.85. Trading volumes in Germany are now significantly higher than on the home exchange in Canada. Since August 2025 in particular, 7-digit trading volumes are no longer a rarity. With a market capitalization of more than CAD 100 million at times, institutional investors have now also taken notice.

Notes: This update follows the initial report dated April 15, 2025.