From exploration value to strategic polymetallic heavyweight

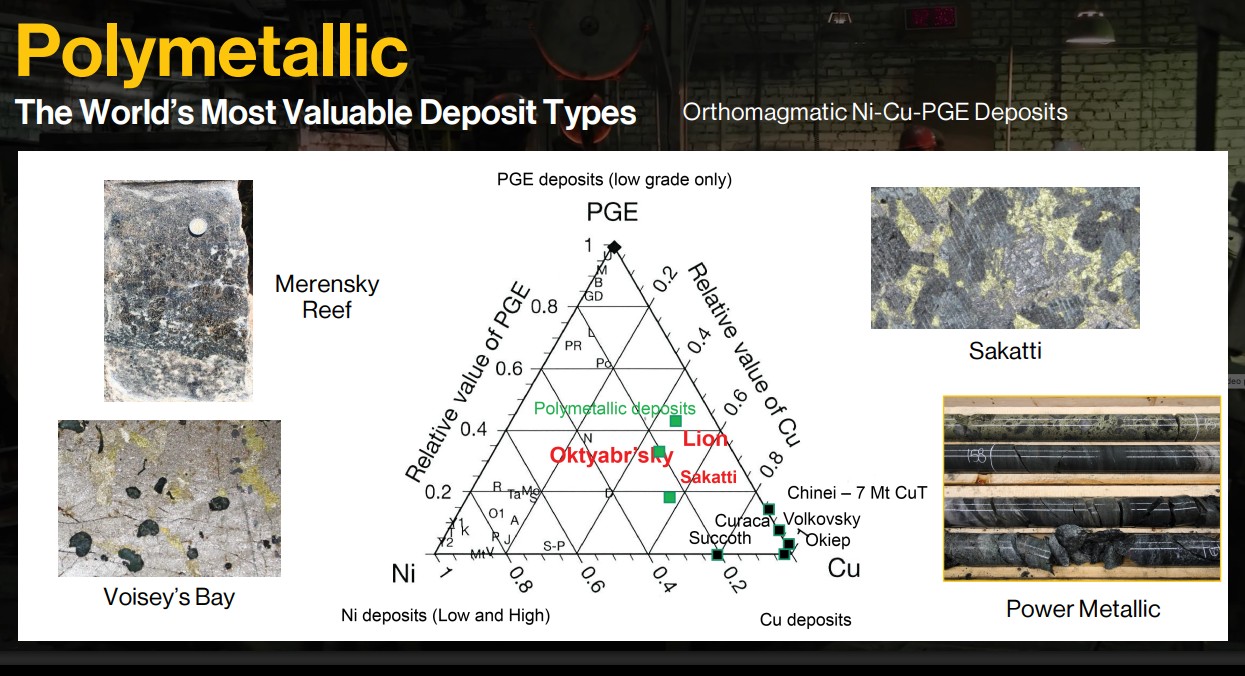

Power Metallic Mines has quickly become a serious player in the North American commodities sector. The Company concentrates on the exploration and development of polymetallic deposits with a clear focus on metals that are indispensable for the energy transition and high-tech industries: copper, nickel, cobalt, and platinum-group precious metals. At the heart of its activities is the NISK project in Québec, which is now considered one of the most promising polymetallic deposits on the continent.

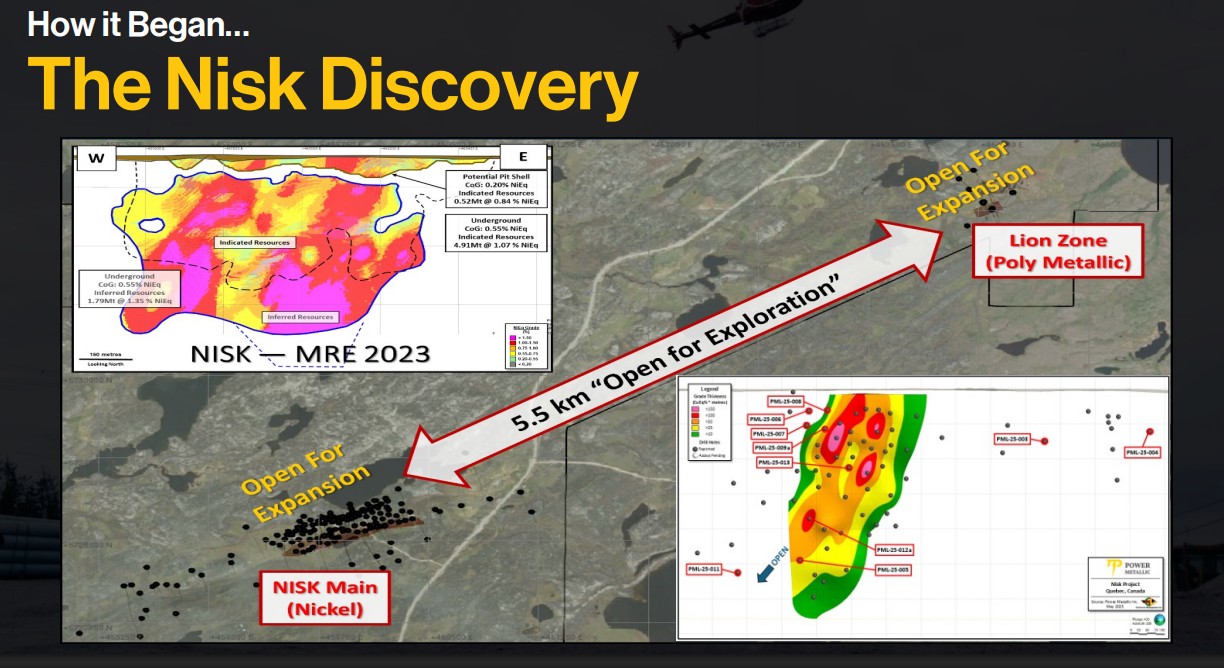

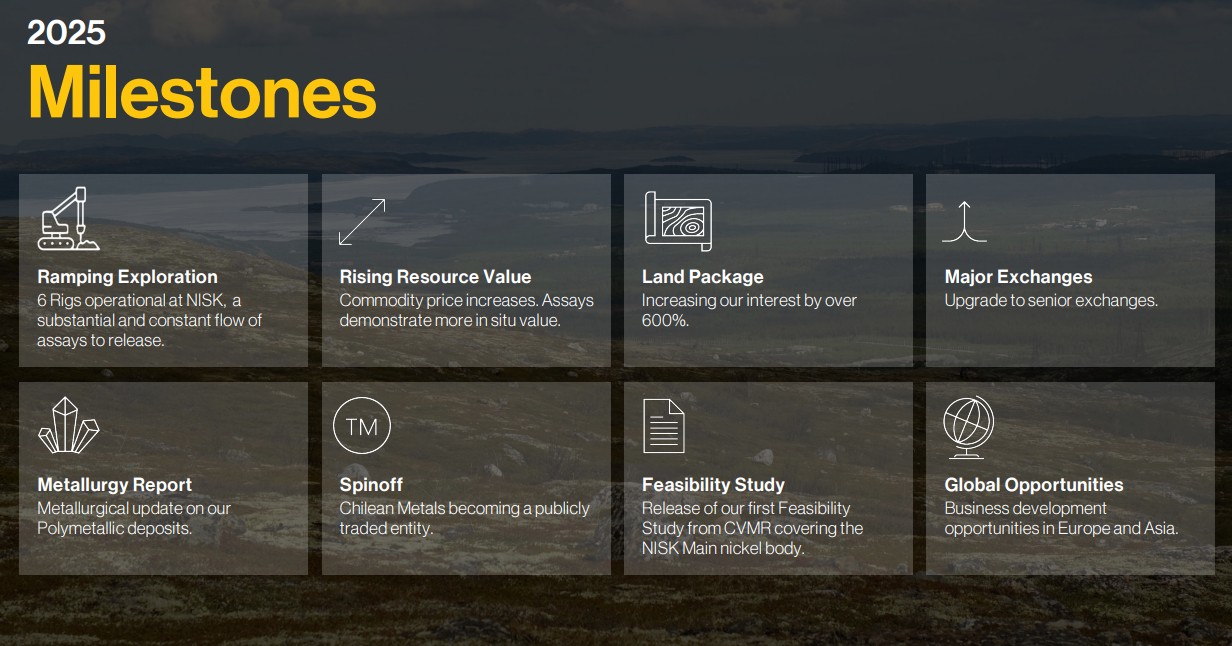

A decisive step for the future viability of the Company was the massive expansion of its land portfolio. Through the acquisition of several concessions from Li-FT Power and others, the project area was increased by over 600% to 313 km². With a 100,000-meter fully funded drill program, the Company is attracting further attention and will generate multiple news releases, which will provide catalysts for substantial growth. The investment community should not ignore the upcoming news.

High-grade drilling and growing confidence

The latest drill results from the Lion and Tiger zones confirm the extraordinary potential of the project. With copper equivalent grades of up to 16% over several meters, Power Metallic underscores the quality of its discovery. On November 4, the Company released another strong update from its summer drill program. Of particular note is drill hole PML-25-022, which returned 11.97% copper (16.35% CuEq) over 5.35 meters, one of the best single drill holes on the project to date. Additional intervals, including 6.85 m at 13.15% CuEq and 27.5 m at 2.75% CuEq, confirm the exceptional thickness and continuity of the Lion Zone. Infill drilling significantly increases the accuracy of the model for a future resource estimate, while step-out drilling continues to extend the zone westward.

CEO Terry Lynch spoke of "some amazing high-grade intersections" and announced that the current fall/winter program will employ more powerful rigs to target greater depth in order to extend the potential massive sulfide zones further. In addition, the previously restricted "Hydro-Ground" area has now been released for exploration through an agreement with the Québec government and support from the James Bay Cree. This is a significant success as the area covers the presumed continuation of the mineralized structure. More importantly, the results show that the resource area can be extended to the west and at depth. Even the zones with disseminated mineralization, such as 7 m at 1.41% CuEq, provide valuable clues for further exploration. Power Metallic enjoys the confidence of world-renowned investors, including industry giants Robert Friedland, Rob McEwen, and Gina Rinehart, who have already invested in this project in its early stages.

Land expansion and metallurgical validation

A decisive step for the future viability of the Company was the massive expansion of its land portfolio. The acquisition of multiple concessions from Li-FT Power and others increased the project area by over 600% to 313 km². Notably, the seller insisted on payment in shares, a clear sign of confidence in the management and project potential. Power Metallic now holds an area that not only secures the known resource but also offers room for new discoveries. CEO Terry Lynch also emphasizes that the best targets are still untouched.

With the expansion of electromobility, batteries will consume around 25% of nickel production as early as 2028.

Parallel to exploration, metallurgical testing at SGS Canada is progressing. The tests are designed to determine the recovery rates of copper, nickel, gold, silver, and PGEs, a crucial step on the road to economic evaluation. Initial samples indicate coarse sulfide mineralization with chalcopyrite and cubanite, which are ideal for conventional flotation processes. The Company expects the full results by early 2026. Positive results could significantly increase the economic value of the NISK project and accelerate the transition to the next phase of development.

Strategic relevance of raw materials in geopolitically volatile times

Power Metallic is gaining additional significance in the global context. China's recent export restrictions on critical metals highlight how urgently Western industries need stable supply chains. Even a Trump deal in exchange for soybeans does not help much. The geopolitical environment remains extremely fragile. A diversified metals project in a politically secure jurisdiction such as Québec is therefore of particular strategic importance. Copper, nickel, and PGEs are considered key building blocks for electromobility, renewable energy, and digitalization, markets whose growth potential is immense. Power Metallic is set to become a key pillar of North American raw material autonomy.

An exploration stock with large-scale project potential

Power Metallic Mines combines everything investors are currently looking for in the raw materials sector: clearly focused management, a growing project with exceptional metal grades, and a portfolio that capitalizes on global demand for critical metals. With ongoing land expansion, solid finances, and recent drilling results, the Company is at the beginning of a decisive phase. If the trend continues, PNPN could become one of North America's most exciting polymetallic growth stocks. The overview of milestones achieved clearly shows that CEO Terry Lynch is pushing for rapid implementation and has no intention of wasting time.

Conclusion: Financial strength and institutional attention

The CAD 50 million capital increase completed in the summer gives Power Metallic the financial leeway to complete the next exploration phases without pressure. Analysts also remain optimistic: Roth Capital Partners recommends the stock as a "Buy" and sees a 12-month target of CAD 3.00, while Red Cloud sets a price target of CAD 2.50. The experts agree that this is an extremely interesting opportunity.

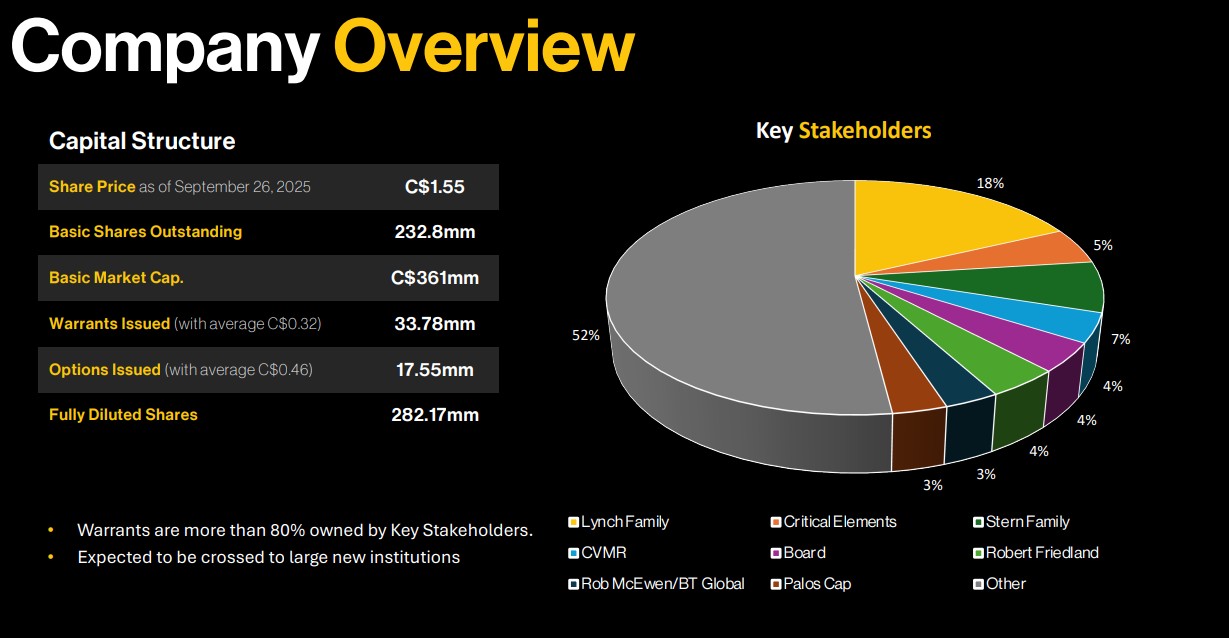

With a fully diluted share count of 282.17 million and a market valuation of approximately CAD 240 million, the explorer Power Metallic Mines entered a new league in 2025. The stock has now secured a firm position within the TSX-V commodity segment. According to current research reports, the PNPN share has solid upside potential of 150 to 200% at current prices of around CAD 1.03. The current market capitalization of around CAD 240 million still offers significant room for growth, while already reflecting the capital market’s recognition of the Company’s exceptional standing in the race for critical metals. This implies a medium-term revaluation. What is more, the current valuation level remains attractive for large mining companies looking to add a top-tier project to their portfolios.

CEO Terry Lynch discusses the current status of exploration work in Québec in an interview with Lyndsay Malchuk.

This update follows our initial report on the former Power Nickel, which changed its name at the end of 2024. Click here for the initial report.