Historical knowledge with a future – A powerful collection of data

Over the past seven years, the Australian B2B expert has undergone a remarkable transformation: a traditional publishing house with a combined brand history of over 560 years has evolved into a modern, next-generation media and data platform. Today, Aspermont (ASX: ASP, FWB: 00W) is considered a leading provider of digital B2B media in the mining, energy, and agriculture sectors. These are industries that employ around 22% of the world's population and generate about one-fifth of global gross domestic product.

At the heart of the Company is a database of 8 million contacts from decision-makers in key international industries. This valuable resource forms the foundation of a scalable business model that increasingly relies on data-driven products and recurring revenues.

While advertising used to account for the majority of revenue, today 67% of revenue comes from memberships, supplemented by events (7%) and marketing (26%). With over 3,000,000 active customers and an average revenue per customer (ARPU) of more than AUD 2,000, Aspermont has established itself as a digital platform with robust growth in just a few years.

From publishing house to digital AI platform "Mining IQ"

With the launch of the data intelligence platform Mining-IQ.com, Aspermont is opening the next chapter in its development. Mining IQ bundles global data sets and enables in-depth analysis of project pipelines, ESG performance, investor sentiment, and geopolitical risks. Integrated modules such as World Risk Analytics, Project Pipeline Index, and ESG Mining Company Index allow users to compare, filter, and dynamically evaluate the opportunities and risks of projects worldwide. Aspermont is thus increasingly positioning itself as a software and data provider (SaaS) for the commodities industry - a logical step following the successful digitization of its media platforms. The platform achieved its proof of concept in August 2025 with the launch of Version 1.

A quantum leap in information for premium users

The digitized archive data gives users unique access to historical information that was previously unavailable. It provides in-depth, machine-readable insights into topics such as project development, technologies, safety, and management trends. This equips decision-makers and analysts with data-driven benchmarks for operational and strategic decisions - a clear competitive advantage in a volatile industry where early indicators of price developments and supply chain risks can be critical. With this AI-driven information architecture, Aspermont is establishing itself as a leading data intelligence provider for the commodities industry. A key milestone was the first corporate data contract with Rio Tinto, a project worth around AUD 550,000, which impressively confirms the market acceptance of Mining IQ.

Nexus – Growth driver in the marketing segment

Parallel to the data and platform business, Aspermont's marketing and communications division, Nexus, is also developing into a real success story. In only its second year of existence, Nexus has secured high-profile partnerships with governments and corporations, including Saudi Arabia, Australia, BHP, Rio Tinto, thyssenkrupp, and, most recently, Timor-Leste. The latest collaboration with the National Mineral Authority (ANM) of Timor-Leste aims to position the country internationally as a responsible and competitive mining region. To this end, Nexus will implement investor campaigns, thought leadership programs, and communication strategies. Leveraging its combination of editorial expertise, proprietary data, and global access to over three million professional users, Nexus is establishing itself as a high-growth, stable-margin business within the Aspermont Group.

Managing Director Alex Kent emphasizes: "Nexus is becoming one of the most fascinating growth stories within Aspermont. With a strong partner network and scalable marketing solutions, we are not only increasing our reach but also the quality and diversity of our revenue streams. With Mining IQ and our AI partnership, a new era is beginning for Aspermont. We are evolving from a media and research company to a global provider of data intelligence solutions for the commodities industry."

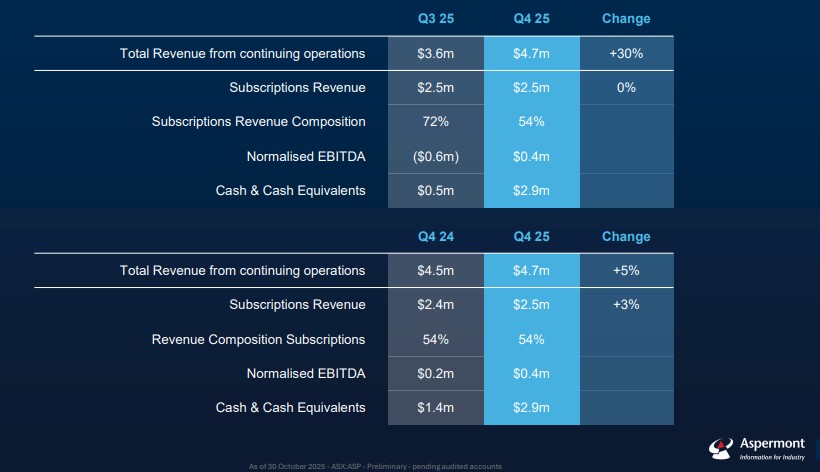

Strong quarterly figures (Q4 2025) – Data intelligence pays off

The fourth quarter of 2025 marks further progress for Aspermont. The Company reports growing subscription revenues for the 37th consecutive quarter and confirms significant progress in the expansion of its data intelligence business. Annual recurring revenue (ARR) rose to AUD 11.2 million, while total revenue from ongoing business increased by 5% to AUD 4.7 million. EBITDA was AUD 0.4 million, and net cash reserves increased to AUD 2.9 million through a AUD 1.75 million institutional placement with a 40% premium. The highlight of recent developments was clearly the first corporate contract with Rio Tinto worth AUD 550,000, which includes the digitization of historical archive data and the development of an AI-powered generative search and analysis platform. In the events business, the "Future of Mining Australia" mining conference saw a 20% increase in visitor numbers, demonstrating the steady expansion of the Company's reach in the physical space as well.

Conclusion: New strategy implies a jump in valuation

The geopolitical situation and ongoing deglobalization are increasing the need for reliable, data-driven networks. In this environment, Aspermont has established itself as an indispensable partner for resource-oriented industries. The stock has shown clearly improved momentum since the summer of 2025 and is increasingly benefiting from institutional interest. Given its solid fundamentals, growing SaaS revenues, and the successful market entry of Mining IQ, Aspermont remains one of the most exciting small-cap stories in the field of "data intelligence for the commodities sector."

With a combination of traditional media expertise, a unique historical data archive, and a high-growth data intelligence platform, the Company is now on the threshold of a dramatic revaluation. Strategic partnerships and a solid capital base are having a noticeably positive effect on the business. With a price-to-sales ratio (P/S) of 2.2, organic sales growth (CAGR) of approximately 11%, and gross margins of over 60%, the stock appears to be very attractively valued compared to the industry.

This update follows on from the initial report 01/2022.