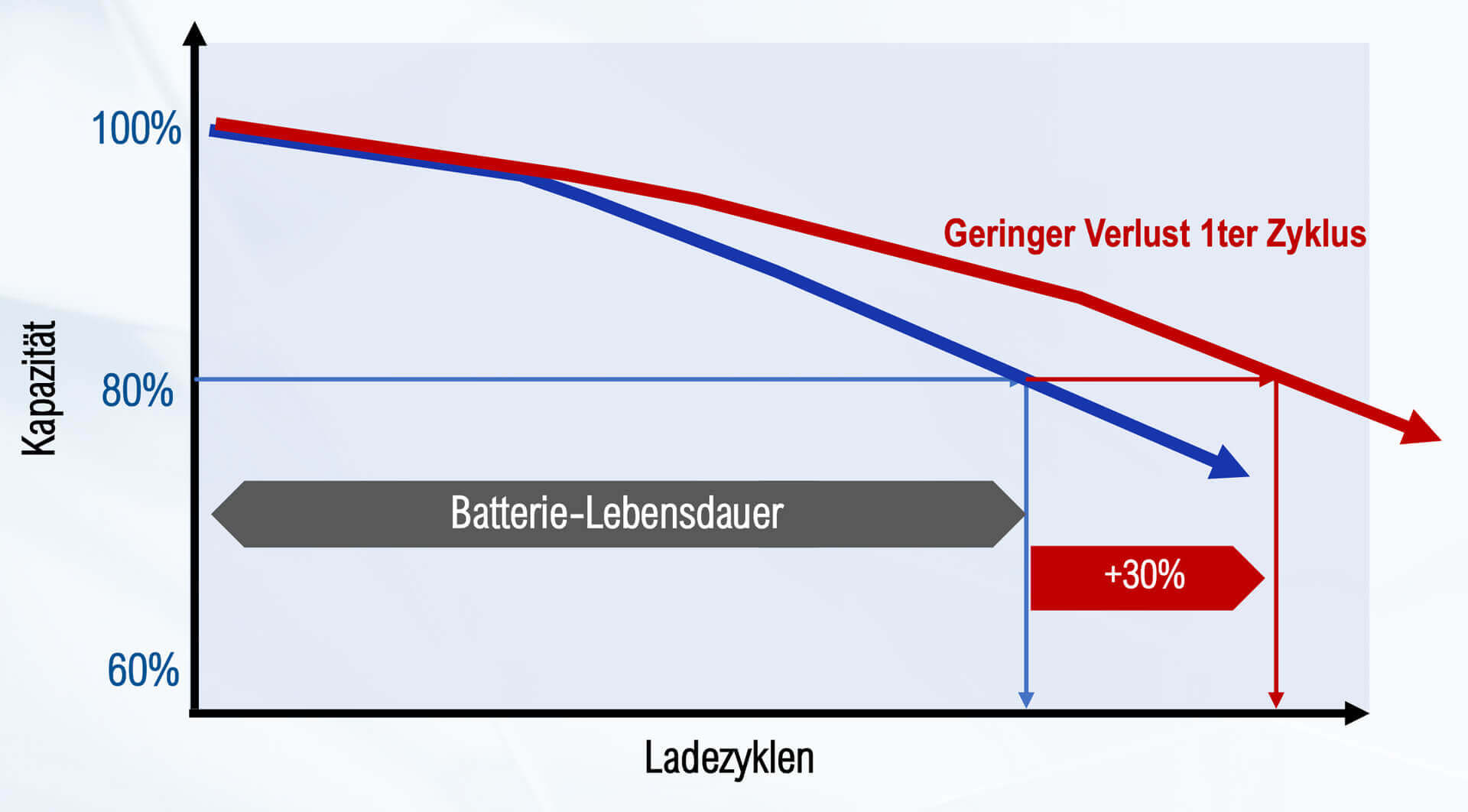

Altech Advanced Materials has set out to revolutionize the market for lithium-ion batteries. The Heidelberg-based company is relying on an innovative process that overcomes the disadvantages of conventional lithium-ion batteries, which lose up to 15% of their power after the first charging cycle. This power loss continues over the life of the battery. The reason for this is the formation of a boundary layer in which the lithium is bound.

With an ultra-thin ceramic coating of the anode material with aluminum oxide, this negative effect does not occur. Altech is developing anode coatings enriched with silicon to increase the energy density of lithium-ion batteries. The graphite anodes that are conventionally used have only about 10% of the charging capacity. Consequently, battery costs per charging capacity can be significantly reduced, and the range of e-cars significantly increased.

Patents and partnerships secure lead

In the future, Altech's anode material will be marketed under the proprietary Silumina Anode™ brand. Extensive patent applications protect the process of coating anode materials with nanolayers of aluminum, ensuring the Company a competitive edge for years to come.

In recent months, the Company has also entered into a strategic partnership with the Fraunhofer Institute for Ceramic Technologies and Systems IKTS, a global leader in the field of advanced ceramics. The aim is to accelerate the testing and qualification process for Silumina Anodes and to provide independent proof of their performance.

Next milestones: Pilot plant and planned production

A first milestone is the construction of a pilot plant. The company has already concluded a contract for this. The selected site is Schwarze Pumpe in Saxony, where industrial-scale production is to take place at a later date. The pilot plant is designed to produce 120 kg of the anode coating material per day. The product is to be supplied to selected European battery and automotive manufacturers for testing and qualification purposes.

The objective is to establish a production plant for ceramic coating of anode material for battery manufacturing with an annual capacity of 10,000t for Altech Industries Germany GmbH (AIG). AIG is a joint venture between Altech Advanced Materials and Altech Chemicals Limited, Australia. In the future, the anode material will be supplied to the European growth market of battery and vehicle manufacturers in Europe. To guarantee raw material security, the Germans have entered into a cooperation and supply agreement with SGL Carbon and the Spanish silicon manufacturer Ferroglobe.

High economic efficiency and great potential

A preliminary economic feasibility study (PFS), which the Company published back in April, attests to the high economic viability of the planned production project and thus underscores the great potential of the innovative battery material.

The analysis calculates a value (net present value at a discount rate of 8%) of EUR 420 million for the production plant of Altech Industries Germany GmbH, a joint venture of Altech Advanced Materials AG and Altech Chemicals Limited in Australia. The Heidelberg-based company owns 25%, corresponding to a pro-rata project value of EUR 105 million. This compares with a stock market value of only EUR 7 million.

Other parameters also confirm the positive picture. With estimated investments of EUR 79 million, the internal rate of return is high at 40%. Amortization of the capital employed occurs after only 3.1 years. At full capacity, annual sales of EUR 153 million and EBITDA of EUR 52 million are to be achieved. This corresponds to a respectable operating return of 34%.

"Our research and development results to date, together with the results of the pre-feasibility study, demonstrate the enormous technological and economic potential of our novel anode composite material and the targeted production in Schwarze Pumpe. We are convinced that this is a breakthrough technology for the future of lithium-ion batteries and it can give an enormous boost to European battery technology. Silumina Anodes have the potential to be a game changer in battery performance," elaborated Uwe Ahrens, CTO of Altech Advanced Materials.

Taking off with fresh capital

At the recently held Annual General Meeting, all items on the agenda were passed with a high approval rate. Central to the Company's future was the recapitalization of the Company resolved at the shareholders' meeting. Characteristic of an innovative company, Altech is in the red prior to the launch of its products. In the past fiscal year, a loss of EUR 877,000 was incurred, and a loss of this magnitude is also expected in the current fiscal year.

The Annual General Meeting voted in favor of a capital reduction at a ratio of 2:1, halving the number of shares to 2.825 million. It is to be followed by a capital increase of 4,237,500 shares at a price of EUR 1.00. In addition, resolutions were passed to increase the Company's share capital by a good EUR 3.5 million by issuing new shares by 2027, and to issue bonds with warrants or convertible bonds with a volume of EUR 7 million. With the fresh capital, the Company can take the next steps toward production.

Interim conclusion

Sales of e-vehicles are increasing rapidly, and with them, the demand for lithium-ion batteries. Altech has put itself in a good position to turn the market around with its innovative battery material. Research results support the superiority of the Heidelberg-based company's approach. The next important milestone is pilot plant production. In addition, the preparatory profitability analysis certifies a high economic potential. The calculated share value of Altech is EUR 105 million, representing a significant discrepancy to the current market capitalization in the mid single-digit million range. With the resolved provision of fresh capital, the Company is moving forward.

The update is based on our initial Report 02/2022.