Record profits thanks to pandemic

The Corona pandemic has given the pharmaceutical industry a warm windfall this year. After nine months of the current fiscal year, the top revenue earner is US-based Pfizer, which partnered with Germany's BioNTech to launch the first Corona vaccine. After three quarters, Pfizer's revenues totaled USD 57.65 billion, up nearly 91% YOY.

or 91% increase in revenue in the first nine months of 2021 alone for Pfizer vs. prior year

BioNTech was ranked 16th globally at USD 16.09 billion, even ahead of DAX company Bayer in 1st place. Its competitor Moderna was able to generate USD 11.26 billion. Both BioNTech and Moderna were able to multiply sales compared to the same period last year. The Corona business is not as noticeable for other industry heavyweights, such as Johnson & Johnson and Astra-Zeneca. The US company's sales grew 13.5% to USD 37.8 billion, while Astra-Zeneca grew much more dynamically, up 32.3% to USD 25.41 billion.1

Given this particular boom in the industry, two questions arise: what are the companies doing with their profits? Is the level of profits sustainable? Companies are using profits to develop new compounds, increase dividends and conduct share buybacks. In addition, M&A activity is expected to pick up.

In principle, the emergence of new mutations, the administration of booster vaccines, new vaccinations of young age groups, and the global advance of vaccination campaigns even in less developed countries suggest that pharmaceutical manufacturers' sales will remain high. But soon, they could decline again significantly as new competitors enter the market - some with vaccines in other drug categories.

Multiple paths to success: current and new vaccines

In Europe and Germany, there are currently four vaccines from two drug classes, approved against coronavirus. Both categories are gene-based, i.e. the genetic blueprint for the coronavirus spike protein is introduced into cells. These then produce the viral protein to provoke an immune response.

The so-called mRNA vaccines Comirnaty from BioNTech/Pfizer and Spikevax from Moderna have the greatest importance and the highest efficacy. In addition, there are the vector vaccines Vaxzevria from AstraZeneca and Janssen from Johnson & Johnson (single vaccination). The European Medicines Agency (EMA) is currently reviewing the approval of new preparations. In the approval process, US-based Novavax is ahead with its protein vaccine. Valneva's approach is considered very promising. The Group is the only supplier of a holistic inactivated vaccine.

All vaccines aim to provide the immune system with information about the nature of the virus. The approaches to delivering this viral nature information to the immune system vary widely.

These types of vaccines exist - an overview

-

In vector vaccines (AstraZeneca and Johnson & Johnson), only the genetic information of the spike protein on the surface of the coronaviruses is used as information for the immune system. The genetic material, the blueprint for the antigens, so to speak, is introduced with the help of harmless carrier viruses (vector viruses), which then dock onto the body's own cells and release the genes inside. Infiltrated cells then begin to produce antigens according to the blueprint and present them on their cell surface, which immediately triggers a response from the immune system to produce specific antibodies. This leads to vaccine protection against the pathogen in question in the vaccinated individual.

-

mRNA vaccines (BioNTech/Pfizer and Moderna) belong to a new class of gene-based vaccines. "mRNA" stands for messenger ribonucleic acid. In mRNA vaccines, only the parts of the viral RNA that contain the construction information for the proteins of the viral envelope (spike proteins) are used. This encoded information is synthesized ribosomally by target cells and presented on the cell surface as antigens, eliciting an immune response and providing sustained vaccine protection.

-

For Novavax's protein vaccine, spike proteins of the coronavirus are artificially produced, mixed with an adjuvant (excipient, usually an aluminum salt), and then injected. Here, therefore, the components of the virus that the muscle cells produce in the mRNA vaccines based on the construction instructions are administered directly. As with mRNA vaccines, the immune system forms an immune response to the spike proteins.

-

Dead vaccines are based on killed corona viruses, along with boosters. Unlike mRNA and vector vaccines, no genetic engineering is used in the dead vaccine. The immune system reacts by producing specific antibodies against the foreign substances. The vaccinated person then develops immunity to the pathogen in question. Inactivated vaccines have been used in medicine for a long time and have proven effective for tetanus, whooping cough, diphtheria and as an annual flu vaccination. To date, no inactivated vaccines have been approved for use as corona vaccines in the EU.

Vaccine market in upheaval

Market volume growing, weights shifting

According to GlobalData, the size of the COVID-19 vaccine market in the seven major markets of the US, Germany, France, Italy, Spain, the UK and Japan will grow from USD 13.6 billion to USD 19.5 billion in 2026. This figure is based on the assumption of annual vaccination. However, the most recent data from the Robert Koch Institute shows a rapid decline in vaccine protection after only six months, for all vaccines. This also explains the higher incidence of vaccine breakthroughs.

They offer a good alternative to the currently used gene-based vaccines and are based on killed corona viruses together with active enhancers. Inactivated vaccines have been used in medicine for a long time and have proven effective for tetanus, pertussis, diphtheria, and as an annual flu shot.

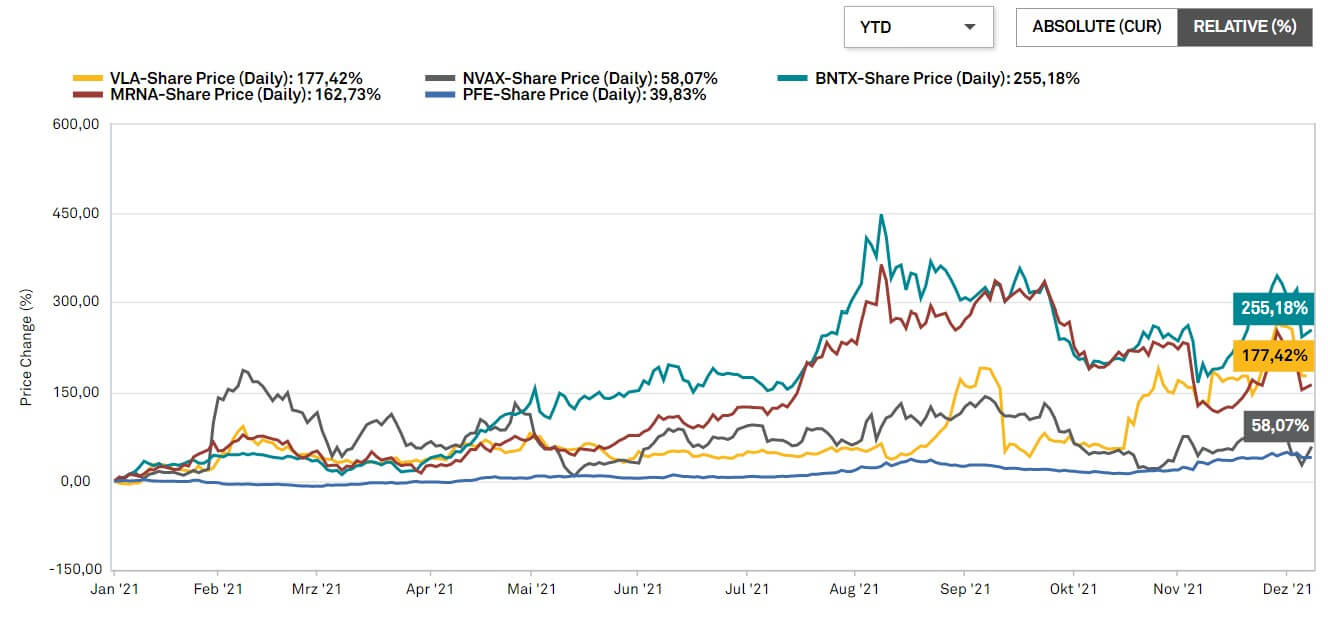

MRNA technology dominates with a 95.4% market share. Experts predicted in the summer of 2021 that by the end of the year Pfizer/BioNTech will have revenues of USD 9.5 billion and Moderna USD 3.5 billion. The latest quarterly data show that estimates of the size of the overall market are far too low. BioNTech alone generated sales of EUR 13.4 billion in the first nine months.2

mRNA share to decline

The share of mRNA technology is forecast to decline to 85% by 2026. If you look at the consensus estimates of equity analysts, they forecast sales declines of around 40% for BioNTech and Moderna from 2022 to 2023. The forecasts speak a clear language: competition is getting tougher and the position of the top dogs is gradually becoming less dominant due to the entry of new players, and the market launch of new vaccines. It is here where the opportunities for Valneva and others lie.

Company Profile

Valneva is a specialty vaccine manufacturer generally focused on developing and commercializing prophylactic vaccines against infectious diseases with high unmet medical need. Prophylactic vaccines are drugs that activate the immune system to protect against infectious diseases.

Multiple vaccines are in the development stage. Medial and in focus is the COVID-19 emergency vaccine. It has recently been submitted to the EMA for approval. In addition, vaccines against Lyme disease and Chikungunya are in development. These are the only Lyme disease vaccine candidate currently in clinical development and the only single-shot vaccine candidate against Chikungunya (tropical infectious disease transmitted by mosquitoes).

According to expert and analyst estimates, these are likely to lose significant ground as early as 2023. New suppliers will fill this gap. Valneva has good chances to profit from this situation.

Valneva also has two commercial vaccines for travelers: IXIARO/JESPECT for the prevention of Japanese encephalitis (a tropical disease caused by viruses) and DUKORAL for the prevention of cholera.

The group's strategy is based on an integrated business model that enables it to build a portfolio of differentiated clinical and preclinical products as well as a robust commercial portfolio. According to the Company, it is focused on leveraging its proven and validated product development capabilities to expeditiously advance its late-stage clinical programs to regulatory approval and commercialization."3

The Company is advancing its late-stage portfolio and remains focused on investing in the research and development pipeline to advance its early-stage assets and identify new targets and indications.

Collaborations are often key to success in research and biotechnology. Valneva has also entered into strategic partnerships with other established pharmaceutical companies to leverage clinical and commercial capabilities and optimize the potential value of selected assets.

The newcomers in Europe: Novavax and Valneva

In the near future, the vaccines from Novavax and Valvena have good chances of approval. Since February, an accelerated review procedure has already been underway at the European Medicines Agency (EMA) for Novavax's NVX-CoV2373; marketing authorization has been applied for and could be granted before the end of this year. The EU Commission already ordered 200 million doses of Novavax in August. The production of artificial spike proteins is complex. For the Novavax vaccine, the spike protein is first mass-produced in insect cell cultures and then combined with lipid nanoparticles. NVX-CoV2373 is not a classical dead vaccine but was developed on a protein basis.

VLA2001 from Valneva propagates the Sars-CoV-2 virus in so-called Vero cells. That is a unique cell line derived from African green monkey kidneys. Inactivated vaccines can be stored at refrigerator temperature for several years without any problems and are generally considered to be well-tolerated and suitable for all age groups and high-risk patients. Although inactivated vaccines generally elicit a broad immune response, this response is often weaker, necessitating the addition of boosters. In the case of Valneva, this includes aluminum hydroxide, a proven agent in vaccine production.

Newsflow

VLA2001 is currently the only inactivated adjuvanted whole virus vaccine candidate against COVID-19 in clinical trials in Europe. It is intended for active immunization of at-risk populations to prevent COVID-19 infection and symptomatic infections during the ongoing pandemic and potentially later for routine vaccination, including against new variants. VLA2001 is also suitable for booster vaccination, as repeated boosters have been shown to be effective with inactivated whole virus vaccines.

Valneva shares lost significant ground in early December due to poor performance of the vaccine in a booster study in the UK on people who had previously received Pfizer/BioNTech. Valneva performed worse than the competition here. The company classified the results, stating, "Valneva believes it is likely that the short interval between the second vaccination and the booster vaccination may have negatively impacted the results for VLA2001, as a longer interval is typically required for inactivated vaccines," according to the company's headquarters in Saint-Herblain, Loire-Atlantique, France.

In addition, good results were reported when the booster vaccination was administered 10 to 12 weeks after the initial vaccination with AstraZeneca's vaccine. Valneva also announced that it will test its experimental COVID-19 vaccine, VLA2001,**against the newly discovered omicron variant of coronavirus.

A look at strengths and weaknesses

Strengths

- Convenient liquid equipment

- Integrated business model

- Diversified portfolio: Development stage and commercialization

Opportunities

- Approval of the corona vaccine in the EU soon

- Increasing order intake

- Good alternative to prevailing gene-based vector and mRNA vaccines

Weaknesses

- Portfolio value and company value largely determined by Corona vaccine

- Still in the red

Risks

- Potentially poor suitability as a booster vaccine

- No data yet on efficacy against mutations

Current business development and outlook

On November 18, the Group last published key data, here on the first nine months of the current fiscal year 2021. Cash and cash equivalents stood at EUR 247.9 million at the end of September. The cash position is an important figure as biotech companies characteristically are in the red. The above balance sheet item includes gross proceeds of USD 107.6 million from the US IPO and the placement in Europe in Q2 2021. It does not include a further capital increase in Q4 with a gross volume of USD 102 million."4

[table: finval2)

Total sales (excluding COVID) increased by around 19% to EUR 69.8 million in the first nine months. Product sales were slightly down at EUR 45.5 million (- 1%), but other sales from collaborations, licenses and services almost doubled to EUR 24.3 million. The sales forecast for the current fiscal year has been adjusted slightly at the upper and lower ends. Now total revenues of between EUR 85 and 100 million are expected (previously: EUR 80 to 105 million). In addition, guidance for R&D expenses has been lowered to EUR 60 to 70 million (previously: EUR 65 to 75 million).

Valneva also confirmed important personnel decisions when presenting the key figures. Effective January 1, 2022, Peter Buhler will join the company as Chief Financial Officer, and Vincent Dequenne, previously Senior Vice President Operations, will also be appointed Chief Operating Officer.

Forecasts and company valuation

What analysts say

Based on the current fiscal year, analysts forecast sales to multiply, break-even to be reached and operating margin to increase significantly over the next two years. Sales are expected to more than quintuple from EUR 103 million (2021) to next year (2022: EUR 540 million) and then climb to EUR 858 million (2023). The operating result (EBIT) turns from loss (EUR -109 million) to profit with EBIT of EUR 177 million (2022) and EUR 463 million (2023). Thus, based on the forecast values for 2022 and 2023, the Valneva share trades with a revenue multiple of 4.3 (2022) and 2.9 (2023). In terms of EBIT, the multiples are 14.0 (2022) and 5.4 (2023).

A look at the Peer Group, consisting of BioNTech, Moderna and Novavax, provides interesting insights. Analysts see significant declines in sales and profits for all three companies starting in 2022. Only Valneva is forecast to continue its upward trend. Based on the multiples of the peer group, the Valneva share should currently be 50 to 100% higher. The French are also far from their competitors in absolute terms with a market capitalization of EUR 2.3 billion (Novavax: USD 12 billion, BioNTech: EUR 73 billion, Moderna: USD 124 billion).

Entry may be worthwhile

The recent drop in Valneva's share price offers an attractive entry level. Not long ago, the shares marked an all-time high at just under EUR 30 and are currently trading around 30% below that. The findings of unsuitability as a booster vaccination, which recently weighed on the share, can be put into perspective with an extension of the interval between vaccination and booster vaccination. The Valneva dead vaccine has the potential to convince many people who have not yet been vaccinated because of reservations about gene-based preparations. Inactivated vaccines have been used in medicine for a long time and have proven effective for tetanus, pertussis, diphtheria and as an annual flu vaccine. An initial order from the EU for 60 million vaccine doses has already been received. Approval of the vaccine should help the share price get back on track. The peer group comparison indicates an upside potential of up to 100%.