Milestone Achieved

Desert Gold announced the first pit constrained mineral resource from five deposit zones at its flagship SMSZ project. The zones are located within a 12km radius in the southern half of the 440 sq km area. The resource estimate totals more than 1 million ounces of gold.

Accordingly, the measured and indicated mineral resource totaled 310,300 ounces of gold at 8.47 million tonnes and a grade of 1.14 g/t gold. The majority was in the "inferred" category, i.e. associated with higher uncertainty, at 769,200 ounces of gold (at 20.7 million tonnes and a grade of 1.16 g/t).

Jared Scharf, President & CEO of Desert Gold, commented, "The release of this initial mineral resource is a significant milestone for the Company and represents an excellent starting point. We believe that with further drilling, the Company will be able to significantly expand these resources and develop new resource areas such as the Gourbassi North West discovery. We anticipate a busy 2022 working towards a 20,000+m drill program with high expectations for results."

SMSZ project: 440 sq km, more than 20 zones, proximity to producing Tier 1 mines

The flagship Senegal Mali Shear Zone (SMSZ) project is located over a 43km section of the prolific and total Senegal Mali Shear Zone of approximately 250km in West Africa. There are several producing gold mines in geographic proximity. These are B2 Gold's Fekola mine, Barrick Gold's Gounkoto and Loulo mines, and the Sadiola and Yatela mines. These each produce more than 500,000 ounces of gold per year at a very low cost of USD 800 per ounce (AISC).

The SMSZ project is one of the largest gold exploration projects in West Africa and has more than 20 open gold zones discovered to date. The project undoubtedly has the potential for further resource increases and the discovery of one or more large gold deposits comparable to the region's Tier 1 gold mines.

Visibility will increase

In recent years, Canadians have spent heavily on exploration. Past drill results, especially in the last year, confirmed the great exploration potential with the expansion of existing gold zones and the discovery of new zones.

The Company has completed its recently announced drill program on the prospective new discovery at Gourbassi North West. Along the originally planned strike length of 1.5km, 72 aircore holes were drilled for a total of 2,890m. Assay results are expected to be released in the coming weeks.

An additional exploration program consisting of approximately 17,000 drill meters is planned for 2022. Priorities will be given to the Gourbassi West and Mogoyafara South zones. Follow-up drilling is also planned on gold-bearing drill intercepts from 2021 and previous exploration programs. Recently, the Company secured nearly CAD 1.7 million in a capital increase. Desert Gold has a moderate market valuation of CAD 23 million.

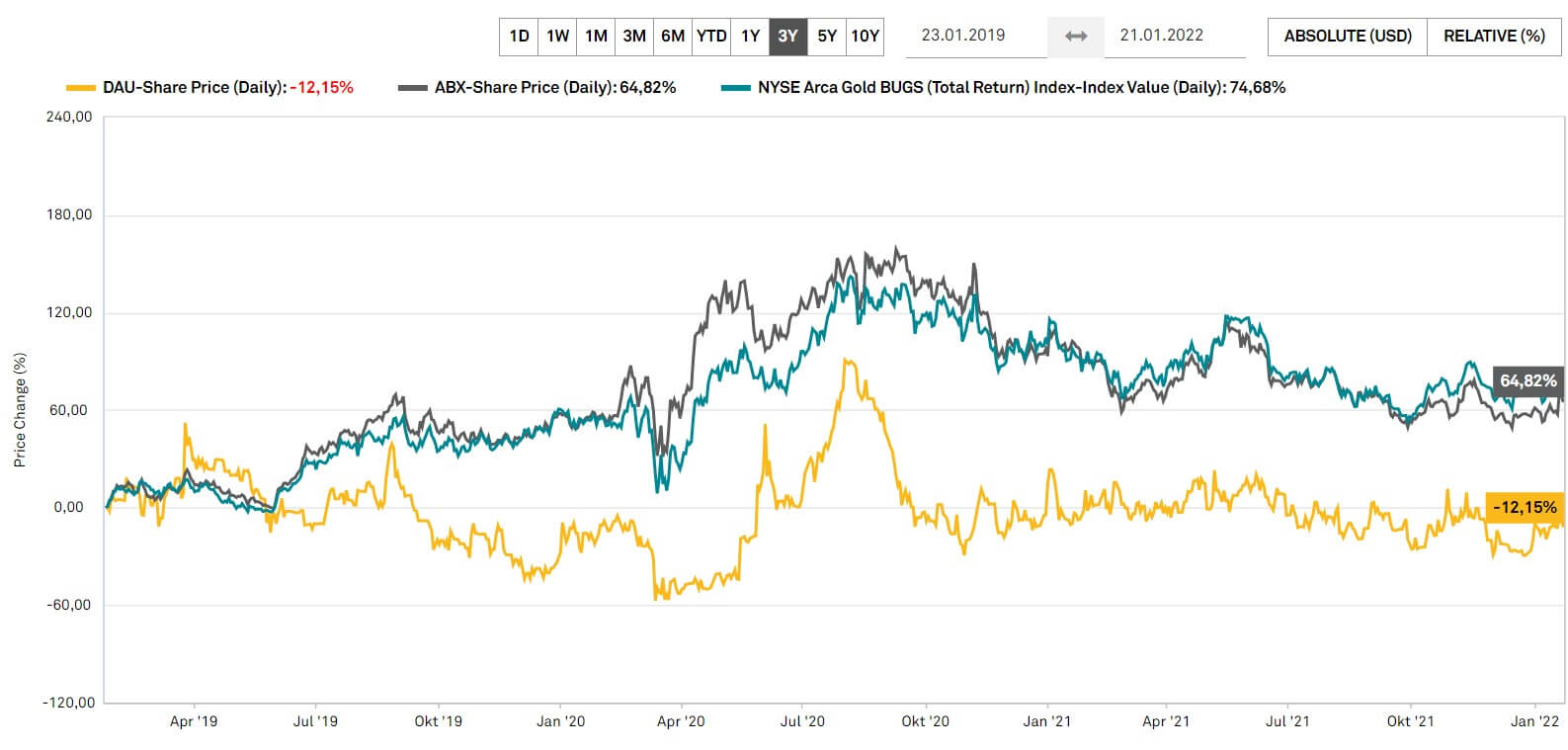

Interim conclusion: Delivered and so far ignored. The current situation at Desert Gold can be summarized in such a way, as already in the detailed Report to the enterprise from 11/2021 made out. Good investment chances for foresighted investors result from the progress not honored by the stock exchange. The list of why the share is a promising investment is long. The first determined resource of 1 million ounces of gold is an important milestone given the project's size of 440 sq km and more than 20 zones of gold mineralization. However - there are many more milestones to follow which should underpin the potential that the SMSZ project can produce one or more Tier 1 mines as they already exist in close geographic proximity. As the project progresses, the Company is increasingly a takeover candidate.