The big picture

Rising inflation and demand as a crisis currency are two fundamental reasons for a rising price.

Gold price and inflation

The low interest rate environment, rising inflation, demand as a crisis currency, a strong US dollar, and physical demand for gold for jewelry production or as an industrial metal argue for a higher price level in the medium term. At a current price of just under USD 1,800 per ounce, the precious metal went into reverse gear again in the short term.

Gold was one of the best-performing asset classes in 2020, reaching an all-time high of USD 2,067 at the beginning of August 2020. In the last twelve months, the price of the precious metal moved between around USD 1,685 and USD 1,950 at a lower level with noticeable volatility.

Canadian company searching for gold

Vancouver-based Barsele Minerals Corp. is a Canadian mineral exploration company whose sole, but highly prospective asset is the advanced Barsele gold project in northern Sweden. It is operated through a joint venture with major Agnico Eagle Mines Limited (TSX: AEM, market value: CAD 16.8 billion).

With 55% ownership, Agnico Eagle owns the majority, with Barsele holding the remaining 45%. It is a comfortable and low-risk position for Barsele, as Agnico Eagle bears the costs as operator. Barsele itself does not have to spend any cash until a pre-feasibility study is completed. However, with the completion of the pre-feasibility study, the major can acquire another 15% in the project, bringing it up to 70%. In recent months, both joint venture partners presented a letter of intent whereby Barsele Minerals could acquire the project outright.

The management team of Barsele, which is part of the Belcarra Group, has a good track record: it has proven several times how to discover and develop high- quality exploration projects and how to increase value for shareholders. The success list includes, for example, the discovery of Orko Silver Corp.'s La Preciosa silver-gold deposit in Durango, Mexico.1

The Environment - Mining in Sweden

Sweden has a long mining history and is among the best and safest jurisdictions in the world. According to the Geological Survey of Sweden (SGU), the number of mines has decreased since 1900 from 240 to the current 12. However, production volumes have increased significantly. Production is still dominated by iron ore (the largest producer in Europe). Zinc, copper, gold and silver also play a major role. The largest producing mine in the country is Aitik, owned by Boliden, the largest national mining group. Aitik produces copper and gold. Sweden is the second-largest gold producer in Europe after Finland. According to the most recent data from the SGU, gold production was 8,000 kg of gold and silver production was 400 kg per year.2

Zoom in: Barsele Gold Project

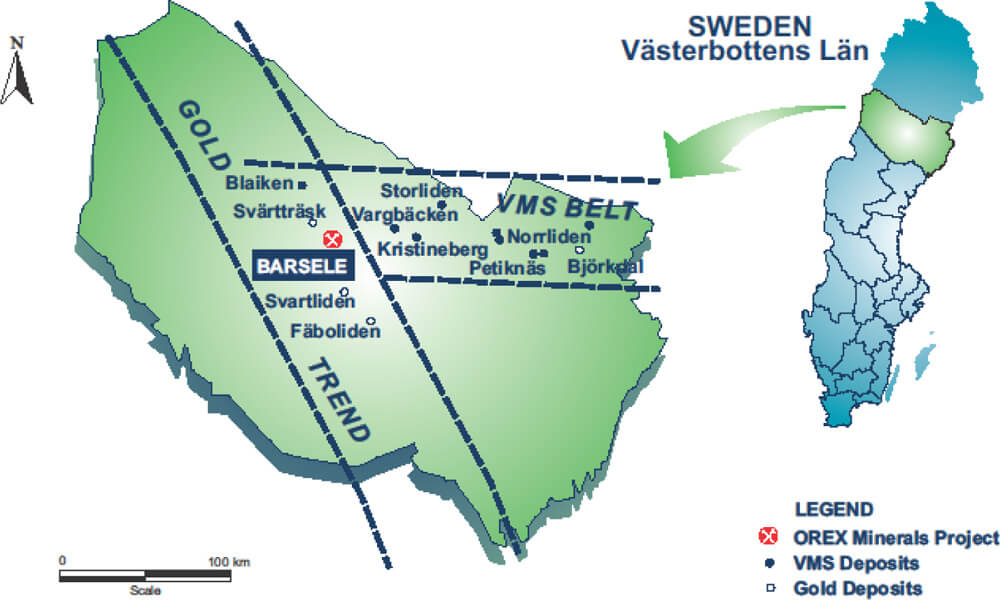

The Barsele project is located in the mining region of Västerbottens Län in northern Sweden, 600km north of Stockholm, and covers 34,500 hectares in the Fennoscandian Shield. It is located at the western end of the Proterozoic Skellefte trend, a productive belt of volcanogenic massive sulfide (VMS) deposits that overlaps with the Gold Line in northern Sweden. Current and past producers in the region include Boliden, Kristineberg, Bjorkdal, Svartliden and Storliden.

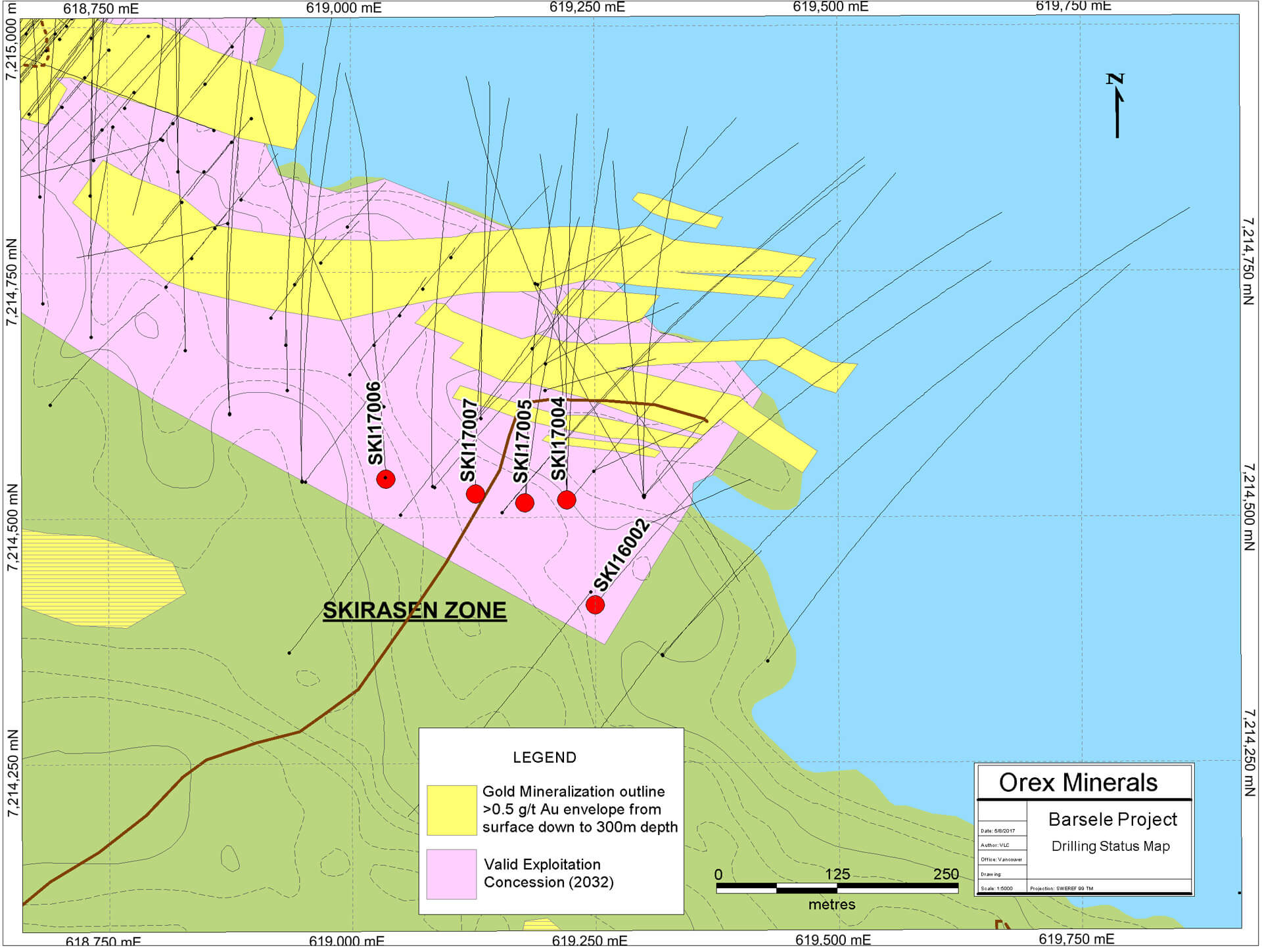

In recent years, Agnico Eagle, as the operator, has advanced exploration and drilled approximately 155,000m. A total of 404 holes were drilled. Then in 2019, Barsele released a resource estimate of 2.41 million ounces of gold, which was prepared by independent surveyor InnovExplo. Over the past two years, work has focused on the Avan-Central-Skiråsen (CAS) areas.

Over 2.4 million ounces of gold are contained in the project according to a resource estimate.

According to the Company, this is where the highest grade intersections of gold exist and where the work was intended to expand. Since the resource estimate was prepared, 93 drill holes have been created, and approximately 20,000m of drilling has been completed.

The resource estimate includes 324,000 ounces of gold in the indicated category and 2.09 million ounces in the inferred category. Some of the mineralization is near surface, which would allow for open pit mining. The drill programs returned impressive data. Highlights include the high gold grades from the drill hole. AVA-18003 came in at 35.72 g/t gold over a length of 9m. A 0.5m section even assayed 1,165 g/t gold at a depth of 258m. Deep drilling and geophysical analysis indicates that mineralization extends to a depth of 925m.

Current development

Effective September 30, 2021, the Swedish Geological Survey (SGU) has declared the land portions of the Avan-Central-Skirasen (CAS) orogenic gold system and the Norra VMS deposit to be a land and water area of national interest. It covers a size of 685 hectares and will impose higher requirements on the public and relevant planning authorities when awarding projects in the future. As the resources and substances have now been classified as "nationally valuable". **Barsele itself rated this development as very positive, because it makes it much simpler because it basically overrides any opposition to a mining permit.

Game Changer

As mentioned, the Barsele project is 55% owned by Agnico Eagle and 45% by Barsele. Agnico Eagle is the operator and can acquire another 15% in the Barsele project by completing a pre-feasibility study.

Back in May, there were signs of a huge opportunity for minority owner Barsele Minerals. At that time, the two JV partners agreed on a Letter of Intent (LOI), under which Barsele Minerals could acquire the Agnico shares in full. The exclusive agreement was extended several times. Then, in early November, it was reported that the LOI had been canceled due to "current market conditions." Gary Cope, President and CEO of Barsele, commented, "While both companies are disappointed that a transaction was not possible at this time, Barsele looks forward to continuing the joint venture with Agnico Eagle with respect to the Barsele Project. Barsele remains convinced of the potential of the Barsele project and will continue to work with Agnico Eagle."

The intended transaction was for USD 45 million. Agnico would have held approximately 15% of the shares of Barsele Minerals upon completion of the corporate action. In addition, a 2% NSR (net smelter return, i.e. a defined percentage of gross profit from a resource mine, less transportation costs, insurance and processing costs) was agreed for the major - plus bonus payments for every 1 million ounce growth in the resource. However, Barsele can reduce the NSR levy to 1% at any time for a payment of USD 15 million.

Although the Company has not commented on the explicit reasons why the LOI was terminated, it can be surmised that due to ongoing travel difficulties between North America and Sweden, due diligence on the project and on-site meetings with banks and financiers simply proved too time-consuming. The deal could still go through next year. Shareholders also do not seem to find the news from early November too dramatic, as the share price hardly reacted to it.

For them, the potential share increase by the Canadians would be a game-changer. According to the 2019 NI 43-101 compliant resource estimate, the property currently has about 2.41 million ounces of gold. Management believes a resource estimate of 3.5 million ounces of gold is realistic as a next stage target. This is expected to come from further drilling programs of 30,000m. A time horizon of 18 months is envisaged. A resource of 3.5 million ounces of gold fully owned by the Company would certainly justify an enterprise value of over USD 500 million. Currently, the Canadians have a market capitalization of about CAD 71 million, or the equivalent of USD 56 million.

Highlights

- Large project with high quality

- First class jurisdiction

- Experienced management with good track record

- Resource estimate of 2.41 million ounces of gold with potential for significant expansion

- Acquisition of 55% project interest from JV partner Agnico Eagle

- Significant undervaluation of the company

- Takeover candidate

Project value and analyst opinion

Back in 2016, the Royal Bank of Canada (RBC) conducted a valuation of the Barsele Gold Project for Agnico Eagle. At a gold price of below USD 1,350 at that time, the experts calculated a project value of USD 375 million. At that time, no resource estimate was available. The analysts calculated the value of the asset based on an estimated 2.5 million ounces of gold, for which they set a price tag of USD 150 per ounce of gold in the ground. Therefore, the value of the 45% stake is calculated to be USD 168.75 million, or about CAD 213 million today. Taking the fully diluted number of shares of 139.1 million of the Canadians as a basis, this results in a fair value per share of CAD 1.21. Currently, the share price is only around CAD 0.51. The share could thus more than double in value.3

according to analysts at RBC, this is the fair value of the Barsele project.

Important parameters have changed in favor of Barsele since 2016. The gold price is currently quoted around USD 500, which is about 40% higher than at the time of calculation. Potential production costs have also increased, of course, which should push the additional margin of USD 500, perhaps to USD 350 to 400. The bottom line is that the project value calculated by RBC should represent the absolute lower limit of a valuation even today. In addition, quite a few drill meters have been drilled since 2016, which delivered good, partly very impressive results. The 2019 published resource estimate of 2.41 million ounces of gold confirmed the assumptions of the RBC analysts.

The experts of the National Bank of Canada currently formulate a price target of CAD 0.75 for the share certificates, after all an upside of 50%. Nevertheless, in our opinion, the verdict is far too moderate, as the above values determined by RBC show.

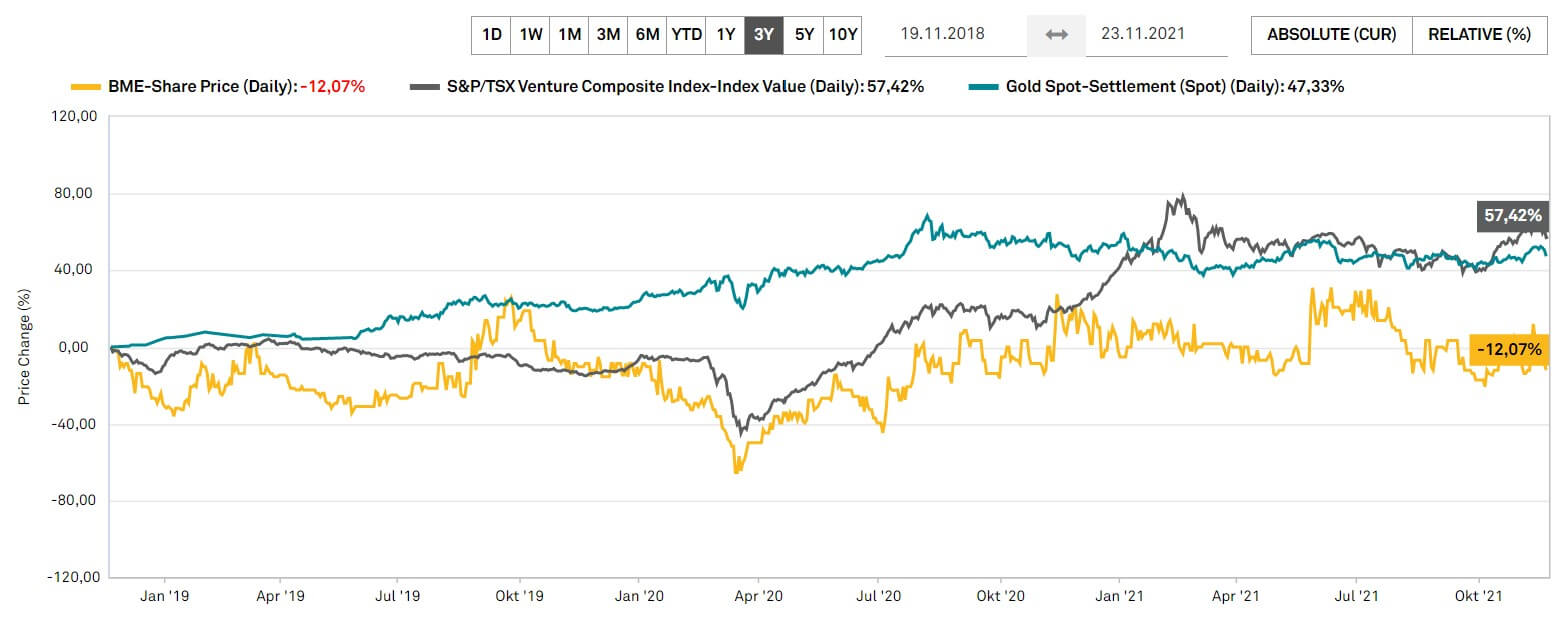

In an older company analysis from 2019, analysts at the National Bank of Canada attested that the Canadians had the highest gold price sensitivity within a peer group of 42 companies.4 In retrospect, however, this has not proven to be true. Since the beginning of 2019, the gold price is up 44%, while Barsele's stock is up only 36%5 . Another reason why the share could have significant catch-up potential.

The chart history of the last three years shows a clear underperformance of the Barsele share compared to the TSX-V index and the gold price. The share of the Canadians lost about 12% during this period, while gold increased by half and the benchmark index even by 57%. **Another indication of a possible catch-up.

Skin in the game

A big plus from an investor's point of view is the shareholder base at Barsele. Since management and insiders hold a quarter of the shares, their interests are aligned with those of the other shareholders. In addition, around half of the shares are held by institutional investors. These include US Global Investors, Ingalls and Snyder Brokerage Accounts, Donald Smith and Co Value Fund, and the Contrarian Group. Fresnillo Mining owns 4%.

Further development exciting

With the size and quality of the Barsele Gold project, it seems only a matter of time before the Canadians are acquired. RBC's 2019 calculations suggest a minimum project value of USD 375 million is realistic. Currently, however, the gold price is about 40% above the level at that time. The decisive factor now is that the acquisition of the 55% share of JV partner Agnico Eagle succeeds. The Company is currently valued at only CAD 71 million on the stock exchange. **A continuing increase in the gold price and the realistic expansion of the resource estimate from 2.4 million to 3.5 million ounces of gold should again have a significantly positive impact on the share price.