Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Kommentare von André Will-Laudien

Kommentar von André Will-Laudien vom 20.07.2022 | 04:45

BASF SE - The chemical giant is under pressure

Germany's energy supply is at risk. One of the major consumers is the chemical giant BASF, which uses gas throughout its production process as an energy and heat supplier, catalyst and indispensable ingredient in packaging and cosmetics. Gas is essential in over 50,000 products - due to the ongoing conflict with Russia, it is now threatening to become scarce in Central Europe. Overall, analysts calculate that a lack of gas supplies from Russia could reduce chemical production in Germany by a fifth by 2024. Some industry stocks are already trading below book value, and the stock market is downgrading Germany's competitiveness compared with the globalized market. Is there any hope for the scolded DAX stock?

Zum KommentarKommentar von André Will-Laudien vom 13.07.2022 | 04:45

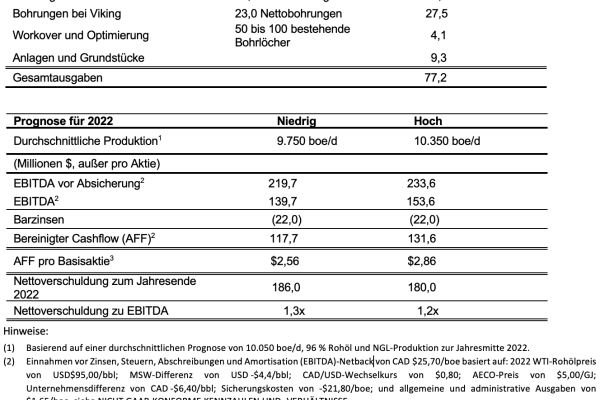

Saturn Oil + Gas - acquisition successfully completed

In recent weeks, concerns about the development of the global economy have put oil prices under pressure for the first time since the start of the Ukraine - Russia war. High inflation, coupled with the first stronger interest rate hikes by some central banks, is likely to dampen economic development and thus also reduce demand for crude oil. Oil prices are likely to have completed the first cycle of increases, with Brent prices recently reaching USD 135. Now a leveling off is taking place, which will have to find its way through the entire mix of strikes (Norway) and production interruptions (Kazakhstan). The fact remains that oil will have to remain an indispensable commodity for quite a while, because there are too few alternatives. Therefore, even in an incipient recession and continuing uncertain geopolitical conditions, a high oil price is to be expected. In Saskatchewan, Canada, the oil producer Saturn Oil & Gas is growing out of its infancy into a new dimension.

Zum KommentarKommentar von André Will-Laudien vom 09.06.2022 | 04:44

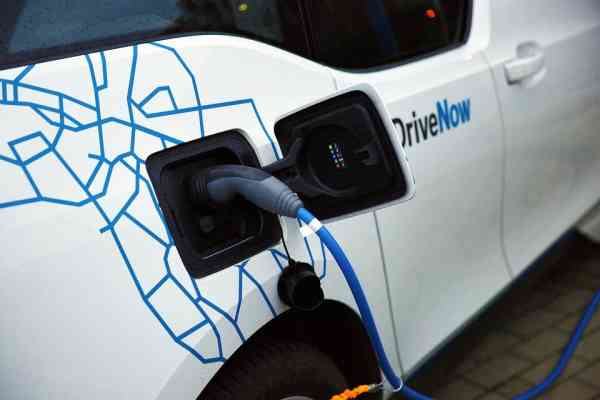

Infineon AG - Chips for the Next Generation

Stagnating supply chains and chip shortages: Because of a lack of semiconductors, between 7 and 10 million fewer cars will be produced than planned in 2021 and 2022, and the auto industry will miss out on billions in sales. When will the scare come to an end? The carmakers probably underestimated the situation from the start. A few months ago, they believed that there would soon be enough semiconductors for their vehicles again. But they were wrong - the chip shortage has become a permanent problem that has now hit the industry like a tornado. And this, of all things, at a time when manufacturers want to make a massive switch to e-mobility, for which even more specialized semiconductors are needed. The German technology group Infineon can hardly save itself from orders in the automotive sector. How is Germany performing as an industrial high-tech location?

Zum KommentarKommentar von André Will-Laudien vom 02.06.2022 | 07:31

Stock news: Saturn Oil + Gas - The next bang

Oil prices are spiraling upward every day, and now the EU is threatening to impose an oil embargo on the aggressor Russia. This is increasingly complicating Germany's situation because the already difficult gas supply situation for the coming winter is now being compounded by the alternative procurement of oil on the world markets. This is happening at prices that have recently climbed to a 14-year high. Germany was dependent on Russian energy supplies for around 40% of its energy needs until 2021. On the other side of the Atlantic, however, oil production is going from strength to strength. Saturn Oil + Gas from the Canadian province of Saskatchewan is pulling off another mammoth takeover, this time with a volume of CAD 260 million. Production can increase by 50% as a result of the deal. The Western procurement market is already giving thanks. We do the math.

Zum KommentarKommentar von André Will-Laudien vom 17.05.2022 | 08:30

Stock news: Saturn Oil + Gas expects EBITDA of at least CAD 90 million in 2022

The dramatic changes in the energy markets are now being eyed with suspicion by European governments, because dependence on Russian oil and gas supplies may mean considerable expenditure on a replacement strategy in the future. Even at the beginning of the COVID pandemic, the oil price fell below USD 35 - in the days since the Russian aggression, prices have been reported to exceed USD 130. By thinking about embargoes, theoretically 11% of the world's energy supplies fall under the table. Fortunately, it is not like that, because India and China are happy about the Russian exports at dumping prices and thus relieve the global markets somewhat. North America is seizing the opportunity and is on the rise again with fracking, as even oil fields with production costs beyond the CAD 60 mark are once again profitable. The Canadian Saturn Oil + Gas from Saskatchewan has undergone a complete transformation in the last two years, and today they are stronger than ever in the market. The company delivered approximately 7,500 barrels of oil equivalent (boe) per day in Q1 2022, this is an improvement of over 3,000% over the same period in 2021. The current share price development has not yet reflected the special development of Saturn Oil + Gas, because in addition to recent quarterly figures, there is now also an increase in guidance.

Zum KommentarKommentar von André Will-Laudien vom 16.05.2022 | 04:43

Stock news: VARTA with passable first quarter 2022

Varta puts a difficult quarter behind it. The battery expert continues to suffer from weak demand for the otherwise fast-growing lithium-ion button cells. Although growth in energy storage systems and interest in conventional household batteries remain high, this cannot currently compensate for the decline in small rechargeable button cells. The sales from the e-mobility sector that the stock market is eagerly awaiting are still a long way off. Consequently, confidence is fading and investors are becoming much more cautious. A poor chart performance and the current crisis in growth stocks are not helping either. More operational momentum is needed in the course of the year. Here is an update from Ellwangen.

Zum KommentarKommentar von André Will-Laudien vom 05.05.2022 | 11:31

Stock news: Nel ASA - Q1 below expectations, but not a major setback

The Ukraine crisis shows the vulnerability of European energy policy. Continuing as before not only jeopardizes supply but also political stability in Europe because a permanent doubling of energy prices would put an extreme strain on purchasing power and future growth. The sooner the EU switches to renewables, the sooner the community of nations will become more independent and the more it will gain control over its own energy system. The energy renewal plan recently presented by the EU Commission, called "REPowerEU," is a bold initiative. With REPowerEU, the climate policy gains another crucial justification: it is no longer only necessary to mitigate the serious consequences of global warming, such as droughts, floods, social conflicts and migration in emerging economies. It is now also clear that a consistent climate policy will be part of the coming peace policy.

Zum KommentarKommentar von André Will-Laudien vom 13.04.2022 | 04:44

Stock news: Saturn Oil + Gas - reserves estimate +668%

Since the beginning of the Russia-Ukraine conflict, oil and gas prices have been moving very strongly upwards. Currently, Brent and WTI spot prices are hovering in a narrow band of USD 95 to 112 per barrel. That makes it very difficult for large energy consumers such as industry or public utilities to make their price calculations over several months. Of course, the underlying trend in prices continues to be upward, as inflation now affects all types of goods. There are currently high spirits at the Canadian oil producer Saturn Oil & Gas because the financial transformation of the last few months has been completed, and there is now a resource estimate that beats all expectations. An update.

Zum KommentarKommentar von André Will-Laudien vom 31.03.2022 | 07:55

Stock news: VARTA below expectations

The Ukraine crisis and its humanitarian catastrophe have shown the Western industrial nations that a singular dependence on fossil raw materials can become a serious supply threat in the event of a conflict. Economic weapons are used as leverage in today's warfare; sanctions are followed by supply bottlenecks and supply shortages. Political decision-makers now have these points clearly on the table. All the more reason for industry and consumers to join forces: alternative energies must be put on the table even sooner than expected. Now, Europe in particular must show that an economic union can also consistently pursue common paths to crisis management. Varta AG represents the German art of engineering and can make a big splash with its innovative approaches to energy technology. An update from Ellwangen.

Zum KommentarKommentar von André Will-Laudien vom 15.03.2022 | 04:45

Stock news: Saturn Oil + Gas - Next leap forward

The armed conflicts between Ukraine and Russia have had a lasting impact on the commodity markets. In an already tense price situation, the US import ban on Russian oil is causing further distortions on the energy markets. The sharp sanctions imposed by many countries had caused Brent and WTI prices to rise to over USD 130 at times. It was not until the beginning of this week that prices eased again slightly to below USD 110. However, analysts and experts in conflict monitoring expect further uncertainties in the supply situation. The situation is aggravated by the fact that Iran is currently unable to increase its production due to stalled nuclear negotiations and OPEC is also still unable to significantly increase production. In the Canadian province of Saskatchewan, there is still one high-growth oil producer that is moving to new shores. Update.

Zum Kommentar