E-mobility picks up speed

The new study "Charging infrastructure after 2025/2030 - Scenarios for market ramp-up" by the National Charging Infrastructure Control Center describes the expected trend in e-mobility in Germany. It was commissioned by the Federal Ministry of Transport and Digital Infrastructure (BMVI) and conducted by the Reiner Lemoine Institute.1

According to the study, the number of electric vehicles may increase significantly more by the years 2025 or 2030 than assumed today - this is shown by confidential information from the car manufacturers surveyed. Up to 14.8 million electric cars and plug-in hybrids could be registered in Germany by 2030. Globally, this momentum will develop at different rates, but broadly with the same intensity. The trend toward zero-emission mobility is now unstoppable.

The demand on producers and suppliers is increasing

This is creating enormous pressure to innovate throughout the raw materials and automotive supply sector. Chinese manufacturers in particular have already cleverly circumvented the problem of supply chains by producing their most important components back in-house. This so-called in-sourcing reverses the trend of outsourcing and external production in individual areas. At the moment, regional sourcing is more promising than dependence on foreign transport facilities. The wheel of globalization is turning back.

The automotive industry is a clear victim in the Russian war against Ukraine. Meanwhile, not only is the mobility turnaround in jeopardy, but more is at stake for the German economy. Various global manufacturers have stopped deliveries to Russia, while other automakers have been forced to halt production due to a lack of components from Ukraine-based suppliers. Among the manufacturers affected so far are Renault, BMW, Jaguar Land Rover, Stellantis and VW Group. In 2021, Russia sold about 1.67 million passenger cars and light commercial vehicles. This puts Russia in 8th place among the world's largest automotive markets, after South Korea and ahead of France and the United Kingdom.

Market is waiting for the high-performance battery V4Drive

The wait is over. Tesla opened Germany's largest electric car factory in Brandenburg in mid-March. Elon Musk is pushing the pace and thus increasing the pressure on the domestic competition around Volkswagen & Co. 12,000 employees are to produce up to 500,000 vehicles in Grünheide in the future. A battery factory on the site is currently still under construction.

A place where German battery technology is being led to the forefront can be found in Stuttgart-Vaihingen. For three years, researchers from the Fraunhofer Institute for Manufacturing Engineering and Automation (IPA) worked here with battery manufacturer Varta to build the Center for Digitalized Battery Cell Production (ZDB). It was opened in mid-September 2021, and increased use of IT is intended to enable the leap to the very front: "Digitization is the key to the production of the future," says Varta CEO Herbert Schein. "With the help of artificial intelligence, we will take the production of our battery cells a big step forward."

At its so-called Capital Markets Day in early October 2021, Varta announced that it would expand its V4Drive technology to the overall battery electric vehicle market, meaning it would also manufacture larger formats. Varta saw the new "power cell" being put to good use primarily in electric sports cars and other premium vehicles. For example, the 21700 cell was to be charged in just six minutes and still perform well even at extremely low temperatures. Porsche had been rumored as the first customer in 2021. One may assume, however, that Varta is talking to all automakers. The market is eager to see whether the Swabian high-performance cell will be launched before 2024.

The financial figures for the year 2021

In its last guidance, Varta AG had announced sales of EUR 900 million and an operating EBITDA margin of 30%, or about EUR 275 million. This is expected to include sales of EUR 510 million in the Lithium-Ion Solutions & Microbatteries (LISM) division and EUR 390 million in the Household Batteries (HB) division. The margin in the first area is 38-39%, the Household Batteries area yields a lower 16-17%.

The figures now announced on March 31 are as follows: Total sales EUR 902.9 million, with EUR 514 million (down from 508) in the LISM segment and EUR 389 million (down from 361) in the HB segment, adjusted EBITDA margins were 42 and 17% in the divisions, respectively, or 31% in the group. Revenue growth was approximately 3.8% in 2021, with adjusted EBITDA of EUR 282.9 million and net income of EUR 126.0 million on the bottom line. A dividend of EUR 2.48 per share is proposed for shareholders. Overall, this is marginally above analysts' expectations.

Momentum present, but outlook remains cautious!

New customer projects with rechargeable lithium-ion cells for high-tech consumer products got off to a delayed start in the third quarter and thus had a lower impact on sales and earnings in the reporting year. In addition, price increases of raw materials had a negative impact, which could not be fully compensated by efficiency improvements and could only be partially transferred to customers. In hearing aid batteries, the global market position remains good. The Group is currently benefiting from its very robust business model and from the significant increase in demand for rechargeable lithium-ion cells. In the lithium-ion battery pack business, very high growth is continuing. VARTA Consumer Batteries significantly improved its profitability compared with the prior-year quarter by focusing on its branded business. The energy storage solutions business grew very dynamically in the fiscal year, doubling compared with the prior-year quarter and thus gaining further market share.

Due to the impact of the Ukraine war and the long-term consequences of the COVID-19 pandemic on customers' business, it is difficult for Varta to provide a concrete outlook. It expects 2022 sales between EUR 950 million and EUR 1 billion and adjusted EBITDA between EUR 260 million and EUR 280 million. **Both figures remain slightly below the most recently calculated expert consensus.

Interim conclusion

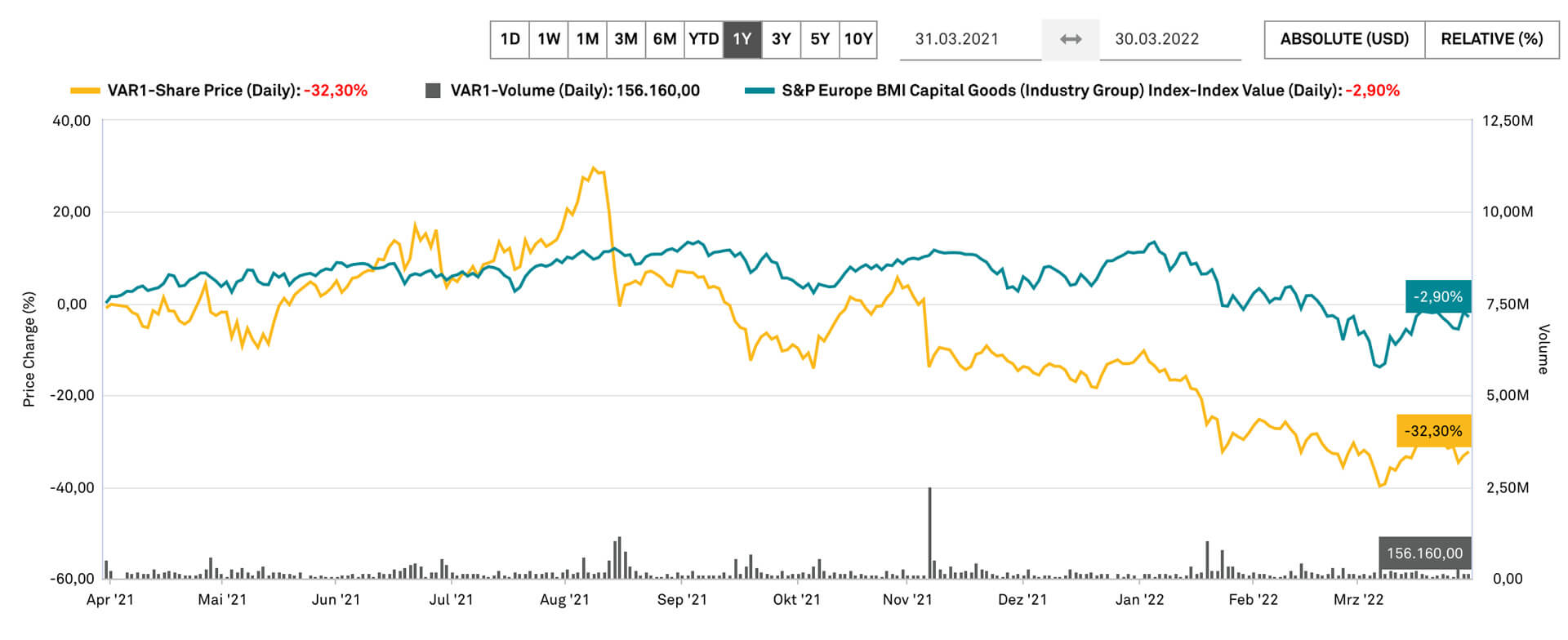

Operatively, Varta AG was only able to deliver in line with expectations in 2021. Despite all burdens, the Company looks optmistically into the future, the pilot production for large-format lithium-ion round cells is running according to plan. Negotiations with new customers are proceeding as expected, which in our view is a normal course of events in the current development phase. If the market was waiting for a surprise announcement on the high-performance battery V4Drive, today's announcement does not contain any surprise potential. With the current business plan, the share is still not cheap with a 2023 Price/Sales ratio of 3. The recently burdened chart situation and the great uncertainty about the development status are thus not yet off the table.

**It is not certain whether today's publication can ensure higher prices. Lang & Schwarz already rates the Varta share price significantly weaker at approx. EUR 86.2 after the announcement. From a chart perspective, the share should not fall significantly below the zone EUR 80 to 85, this mark would also be suitable as a medium-term stop line.