Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Kommentare von André Will-Laudien

Kommentar von André Will-Laudien vom 30.11.2023 | 04:45

Share news: dynaCERT - Certification in the making

Climate transformation depends on many factors. On the one hand, countries worldwide need to agree on a common approach, and on the other, they need guidelines and standards within which people and businesses can operate. A few years ago, a tradable price for "pollution rights" was created via climate certificates. This market is now experiencing explosive growth. The Canadian provider dynaCERT has technologies for reducing CO2 emissions and knows what this billion-dollar market is all about. As part of the increasingly important international hydrogen economy, dynaCERT is using a patented technology to achieve significant emission reductions in combustion processes. Soon, tradable emission certificates will be available for this. This makes environmental protection meaningful and enjoyable at the same time.

Zum KommentarKommentar von André Will-Laudien vom 09.11.2023 | 04:45

Share news: Saturn Oil + Gas - Another record quarter

More than CAD 100 million in free cash flow in the quarter - a new record for the Canadian oil and gas producer Saturn Oil & Gas Inc. While geopolitical conflicts rage, the Company excels in meeting expected oil production targets while developing new properties. This is no mean feat in a political environment that aims to gradually reduce dependence on fossil fuels. However, the Canadians remain undeterred because what ultimately counts in times of crisis is a consistent and reliable supply. We take a look at the past quarter.

Zum KommentarKommentar von André Will-Laudien vom 31.10.2023 | 04:40

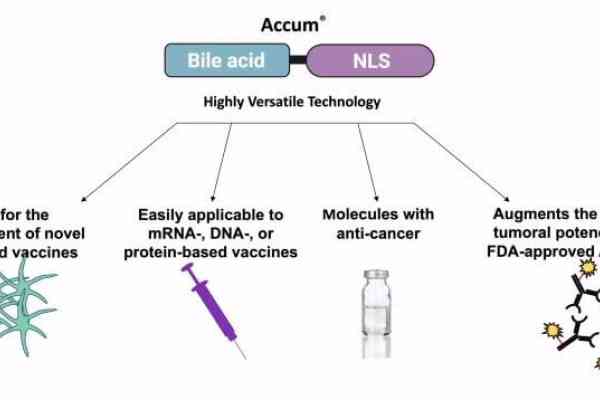

Share news: Defence Therapeutics - Amazing Discoveries

Fighting cancer poses major challenges for today's biotechnology. Canadian company Defence Therapeutics (DTC) has been showing great innovation and breaking new ground in recent years with its ACCUM® platform technology. Efforts are directed towards therapies in the fight against globally prevalent cancers such as lung cancer, breast cancer, and pancreatic cancer. With numerous patents and a new delivery technology, the Canadians are succeeding one hopeful step at a time. The global market for cancer therapies is estimated to grow at a CAGR of 8.4% from 2022 to 2030. Defence Therapeutics might already have a "silver bullet" in its barrel. However, various clinical phases still need to prove the encouraging results from animal trials in humans.

Zum KommentarKommentar von André Will-Laudien vom 16.08.2023 | 14:00

Stock News: Saturn Oil + Gas Inc. - Cash flow continues to climb!

The recent economic data from China has once again disappointed. In July, industrial production in the world's second-largest economy did not increase as much as expected; the central bank even reacted with an interest rate cut. There have been several instances of weak economic data from China recently, fueling expectations of reduced demand for crude oil. The price of WTI crude oil fell slightly from USD 82.50 to USD 80.50 within days. For the Canadian oil producer Saturn Oil & Gas, however, this is not a disaster because they were able to generate lush cash flows even in the challenging second quarter, despite the quarterly average for the WTI price declining to about USD 75. The Q2 figures were surprisingly good, with a new record cash flow and further increases in production.

Zum KommentarKommentar von André Will-Laudien vom 26.06.2023 | 04:44

Share news: ALMONTY INDUSTRIES - Supply of strategic metals

In times of crisis like now, the urgency in the supply of strategic metals becomes very apparent. Currently, China is the majority owner of these elements, with 70%. With further escalations in Ukraine and global instabilities, access to key resources is essential, as long-established supply routes can be suspended overnight. Rare metals are crucial for various modern technologies, from smartphones to wind turbines and defense equipment. China could impose an export ban on key raw materials to achieve its strategic goals in Taiwan and exclude the West from supply. This is political leverage that can only be softened by consistently building alternatives. Almonty Industries has 4 major tungsten properties in Spain, Portugal and South Korea. Soon the largest mine will go into production.

Zum KommentarKommentar von André Will-Laudien vom 05.06.2023 | 13:00

Share news: Nel ASA - Faster market entry with Giga Factories

Governments worldwide agree: Achieving a real turnaround in the fight against global warming requires joint, open discussions about existing technologies and necessary innovations for a more sustainable use of existing resources. The path to a CO2-free future is costly and requires extremely high investments. Green hydrogen is an important building block. The Norwegian pioneer Nel ASA has been well on its way as a global player for several years, but the Company is not yet profitable. However, recent blockbuster orders point to a noticeable acceleration. Here is an assessment of the situation.

Zum KommentarKommentar von André Will-Laudien vom 30.05.2023 | 12:30

Share News: VARTA AG - Some light at the end of the tunnel

Varta AG was one of the high flyers in the MDAX in 2020/2021. The rally led the stock price to over EUR 180 on the expectation of a battery revolution from Ellwangen. But things turned out differently. Problems with the supply chains due to the Corona pandemic, rising raw material and energy costs and sales problems with key customers caused the Group to stumble. Today, 2 years after the joyful rush, the Varta share price has plummeted by 90% and a tough restructuring course is on the agenda. A stocktaking.

Zum KommentarKommentar von André Will-Laudien vom 10.05.2023 | 04:44

Stock news: Saturn Oil + Gas - Good start to the year 2023

Despite all the announcements from Berlin, it is immediately clear to the listener that converting our energy supply from fossil fuels to CO2-free sources will first require a lot of resources to get the facilities, including infrastructure, that will be needed in the future, into place. A significant, environmentally damaging effort must first take place to install wind and solar power plants and integrate them into the grid. Canada has understood the problems of the world energy supply and is implementing the requirements of the current difficult times in a politically non-judgmental and consistent manner. Saturn Oil & Gas is an ESG-oriented energy company with strong growth in oil and gas production in Saskatchewan. There are now good drilling results to report for the first quarter.

Zum KommentarKommentar von André Will-Laudien vom 28.04.2023 | 04:44

Stock news: BASF - Keeps sails in the wind

Sentiment toward Germany as a business location has deteriorated significantly among major industrial companies in recent months. The sharp increase in energy and material costs, followed by high wage settlements, are putting pressure on operating margins. BASF is one of the most energy-intensive conglomerates in the country. Management is reluctantly responding with cost-cutting measures that call entire locations into question and mean a significant reduction in the number of employees. It is not only the worsening economic situation that is responsible but, above all, the anti-industry policies from Berlin and Brussels. Managers are therefore turning their attention to much cheaper foreign markets and investing many billions there. Here is an update from yesterday's Annual General Meeting.

Zum KommentarKommentar von André Will-Laudien vom 24.04.2023 | 04:45

Stock news: Morphosys AG - Study data brings the next boost

Biotech stocks have not yet been able to mirror the major stock market upswing since October 2022. The reason for this is the parallel rise in interest rates, which makes the refinancing of growth companies extremely expensive. MorphoSys acquired the US biotech company Constellation Pharmaceutical for USD 1.7 billion in 2021. Since this huge step, the share has lost 25% of its value. Now, however, the situation seems to be under control. A look ahead to 2023/2024 gives hope, and the share price may have recently reached a technical bottom. We analyze the current development.

Zum Kommentar