Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Kommentare von André Will-Laudien

Kommentar von André Will-Laudien vom 18.02.2025 | 04:45

NETRAMARK - Revolution in medicine: This AI technology changes everything!

The modern era has dawned! At breakneck speed, artificial intelligence models are penetrating all sectors of the economy. Business models that worked yesterday are disappearing from the market or being replaced by new ones. Data analysis now happens at lightning speed, with knowledge built over hundreds of years. The pharmaceutical industry is increasingly using artificial intelligence to make clinical trials more efficient and precise. AI is particularly effective in analyzing large amounts of medical data, recognizing patterns, and optimizing decision-making processes. The improvements in evaluation and interpretation are revolutionary. The Canadian technology company NetraMark Holdings Inc. (WKN: A3D5X9 | ISIN: CA64119M1059 | Ticker symbol: AIAI) is developing solutions for the pharmaceutical industry to use Generative Artificial Intelligence (Gen AI). The results so far indicate a quantum leap. Meanwhile, NetraMark's market value is still in its infancy. Time is of the essence!

Zum KommentarKommentar von André Will-Laudien vom 11.02.2025 | 04:45

Stock News: ALMONTY INDUSTRIES - This is the breakthrough!

The geopolitical climate is becoming increasingly frosty. What is a huge challenge for international politics in terms of safeguarding mutual interests is no less dangerous for industry. This is because power blocs are emerging that are increasingly turning away from the West and pursuing strict self-interests. In particular, it must be assumed that the Russia-China axis will remain strained in its relations with the USA under Donald Trump and its allies and that this will have an impact on other areas. It is not without reason that governments have put important metals on the strategic procurement list. Tungsten is the metal used for ultra-hard and heat-resistant surfaces and is part of a complex discussion about scarcity because 85% of the metal is mined in China. This marks a turning point for tungsten producers targeting the Western market. Almonty Industries Inc. (WKN: A1JSSD | ISIN: CA0203981034 | Ticker symbol: ALI) has been working for several years on the launch of a new mine in South Korea, which is now imminent. And the demand is high - customers are lining up for the output. Because currently, the rarer it is, the more expensive it gets. The stock price has already surged 100% in just two weeks – so a quick takeover could be on the cards. Now is the time to act!

Zum KommentarKommentar von André Will-Laudien vom 08.01.2025 | 04:45

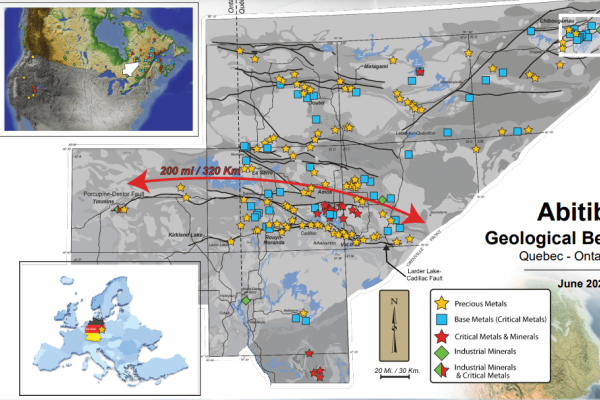

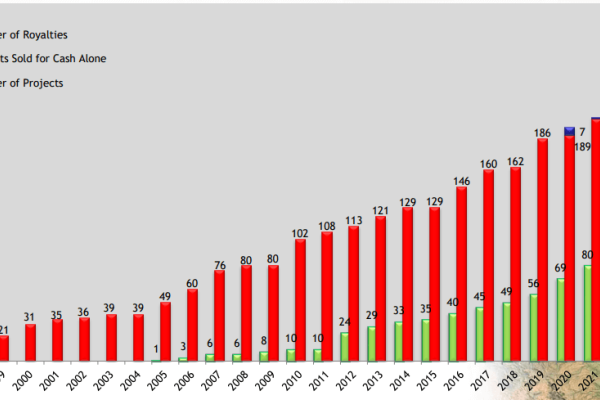

GLOBEX MINING - A perfect start to the year

The gold price rose by almost 30% in 2024. It thus outperformed most stock indices worldwide and was even able to keep pace with the NASDAQ 100. Both high inflation and the constant borrowing by governments to finance their overburdened budgets speak in favor of investments in precious metals. Since 2022, high defense and security spending has been added to this. Geopolitical uncertainties and flashpoints will remain with investors in 2025. So far, this has not deterred anyone from investing in securities of any kind. What could change, however, would be the focus on value versus insane growth expectations in the area of high-tech and artificial intelligence. Canadian resource asset manager and explorer Jack Stoch focuses on continuous growth and is very successful, as the Globex share (ticker symbol: GMX) also delivered 30% added value to shareholders' portfolios. The current year, 2025, is likely to be even more golden.

Zum KommentarKommentar von André Will-Laudien vom 27.12.2024 | 04:45

EUROPEAN LITHIUM LTD - The winning Trump share!

The EU has formulated ambitious goals and strategies to secure its supply of strategic raw materials and build sustainable supply chains. These goals are based primarily on the Critical Raw Materials Act (CRMA), which was introduced in 2023. The US is also pursuing similar goals to secure access to critical raw materials that are crucial for energy system transformation, technology production, and national security. On January 20, 2025, Donald Trump's second presidency in the US begins. The Republican is known for his "America First" approach. He wants to strengthen domestic industry, secure jobs, and challenge foreign competitors. For his plans, he needs resources - and he is eyeing Greenland. The Australian company European Lithium (WKN: A2AR9A | ISIN: AU000000EUR7 | Ticker symbol: PF8 | ASX: EUR) has secured a key role in the global raw materials landscape with its rare earth project in Greenland and lithium deposits in Ukraine. The Company's properties and current focus combine to form a unique treasure for a forward-looking portfolio. There is already a "Buy" recommendation from the research house First Berlin, which indicates a potential of over 500%. We offer a deeper insight.

Zum KommentarKommentar von André Will-Laudien vom 08.11.2024 | 04:45

SATURN OIL + GAS: Top-notch production figures

Donald Trump's victory has put the focus back on fossil fuels. The Republican is well known for his lack of enthusiasm for "climate change" and even for Greentech. At the same time, he wants to strengthen the industrial potential of the United States once again and reduce energy prices by 50%. This political course should support companies focusing on a cost-effective energy supply for North America. Canadian oil and gas producer Saturn Oil is sprinting from production record to production record, as it did in the last quarter. Incidentally, Canada is one of the countries that will close the German gas gap with future LNG deliveries since Russia's withdrawal. Saturn Oil has reached a company enterprise value of CAD 1.2 billion in recent months and is now playing in a different league.

Zum KommentarKommentar von André Will-Laudien vom 08.10.2024 | 04:45

Share news: dynaCERT – The race is on!

Climate transformation depends on many factors. On the one hand, countries worldwide must agree on a common approach, and on the other hand, guidelines and standards are needed within which people and the economy can operate. A few years back, a tradable price for "pollution rights" was created through climate certificates. The price for avoiding one ton of CO2 is around EUR 65, but it differs from region to region. In the current situation, the price is expected to rise explosively as the days approach when governments have finalized their "Net Zero" strategies. Those who do not make it within the required time frame must purchase on the market accordingly. The Canadian company dynaCERT has technologies for reducing CO2 emissions and knows what is at stake in this billion-dollar market. As part of the internationally increasingly important hydrogen economy, dynaCERT achieves significant emission reductions with a patented technology in combustion processes. With the recent certification by the international institute VERRA, customers will now receive tradable emission certificates. The attractiveness of a rapid implementation is now in place, which could mean a multiplication of revenues for dynaCERT. The race starts now!

Zum KommentarKommentar von André Will-Laudien vom 07.08.2024 | 09:05

DESERT GOLD - Now the hot phase begins

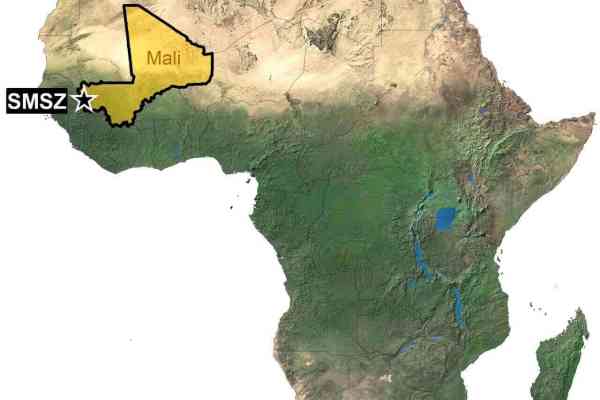

With the current market turbulence, gold is once again a sought-after asset. Despite all the stock market volatility, long-term investors have been able to achieve stable returns of 8.5% per annum with the yellow metal since the 1990s. Precious metals are rarely an object of speculation but rather serve to maintain purchasing power in times of central bank-fueled inflation. West Africa has emerged as a major player in global gold production in recent years. Several countries in the region are among the world's largest gold producers, and the mining costs are unrivalled compared to other locations. Mali is currently Africa's third-largest gold producer and supplies over 50 tons of the yellow metal every year. The Canadian gold explorer Desert Gold sits like a spider in the web of the Senegal Mali Shear Zone (SMSZ) and is surrounded by major gold producers such as Barrick, Allied, Endeavour and B2 Gold. In the current year, 30,000 meters are being drilled and a feasibility study for mine construction is in progress. A good 1 million ounces of gold have been identified so far. The major mining companies around are already taking notice.

Zum KommentarKommentar von André Will-Laudien vom 01.08.2024 | 10:30

SATURN OIL + GAS: Another new record

While green politicians outwardly condemn fossil fuels, new gas-fired power plants are being commissioned via the Habeck Ministry of Economics. Of course, these should also be able to burn hydrogen in the future, but it is not explained where the masses of green hydrogen are to come from, especially in power-scarce Germany. Investors should, therefore, focus on the essentials. The Canadian oil and gas producer Saturn Oil is sprinting from one production record to the next, as it did in the last quarter. Incidentally, Canada is one of the countries that will close the German gas gap with future LNG supplies since Russia's withdrawal, at a multiple of the price that would be charged for an overland supply, of course. The Saturn Oil share celebrated the good quarterly figures yesterday with a whopping 5% gain. The growth story continues unabated.

Zum KommentarKommentar von André Will-Laudien vom 10.07.2024 | 04:45

GLOBEX MINING - Two new gold properties added

Unrest in the Chinese and Japanese banking sectors and ongoing geopolitical uncertainties are keeping precious metal prices high. Europe just voted, but the results have not brought more stability. Quite the opposite: the world is divided, and then there is the upcoming election in the US. In the televised duel between candidates Trump and Biden, the fact-denier clearly wins over the distracted one. What should voters do now? Choosing a suitable candidate doesn't exactly jump out at the voter. Will there soon be a reversal of globalization and a return to isolationism? Will Ukraine withstand the Russian attack? Questions upon questions upon questions. Those looking to add some security to their portfolio should take a look at the 249 properties of Globex Mining. Here lies security and plenty of returns.

Zum KommentarKommentar von André Will-Laudien vom 14.06.2024 | 07:00

POWER NICKEL - Now the big players are buying

Canadian polymetallic expert Power Nickel is going from strength to strength. In the past few days, a new 8,000 m drilling program has been announced, and now a major player has joined in: Rob McEwen. He is best known as the founder of Goldcorp Inc., and under his leadership, the Company became one of the largest gold producers in the world. With his company, McEwen Mining, he was involved in several major projects, including the El Gallo Mine in Mexico and the San José Mine in Argentina. Now, he is involved with Power Nickel - and not without good reason. The top property, "Nisk" in mining-friendly Quebec, offers huge polymetallic deposits and still has plenty of potential for surprises.

Zum Kommentar