Raw materials from A to Z – The inventory delivers 252 projects

Iron, copper, and tin, as well as almost all other metals in the periodic table, are what make our modern civilization possible in the first place. Whether gallium, chromium or rare earths – many elements are indispensable for modern technology. Without them, most technical applications would not exist – from vehicles and computers to televisions and cell phones. Climate activists criticize the low rate of renewal of our supply cycles. In this context, it is easy to forget that the necessary resources must first be extensively searched for, their extraction approved, and ultimately efficiently extracted. The entire process of installing a mine, according to today's environmental standards, takes at least 5 to 10 years. Market experts know that, for example, the current shortfall in copper and lithium cannot be made up in the next decade despite all political and entrepreneurial efforts.

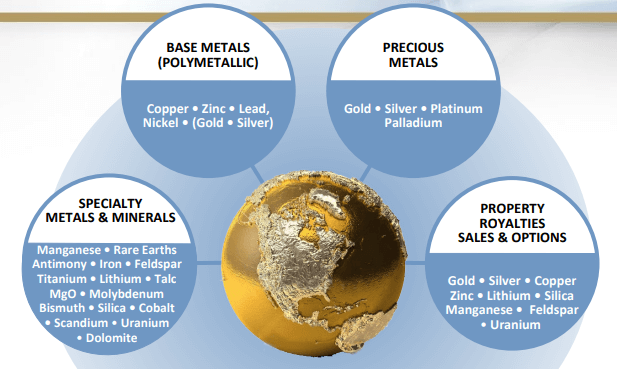

Broad diversification in precious, non-ferrous, polymetals, specialty metals and rare minerals. Over 100 royalties and some options.

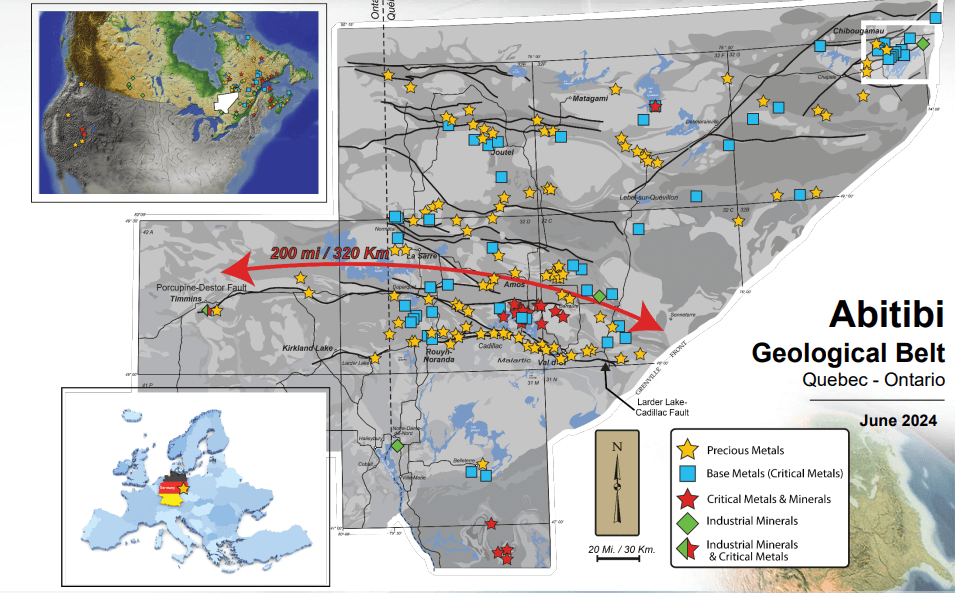

Globex Mining Enterprises Inc. was founded over 70 years ago in 1949 as Lyndhurst Mining Co. Ltd to bring a copper mine into production. CEO Jack Stoch specializes in acquiring and subleasing project areas with raw materials, primarily in Canada. Over the last 40 years, he has steadily expanded the resource holding company, and as of the third quarter of 2024, the Company has interests in a total of 252 resource projects. Half of the projects are in the precious metals sector, involving the metals gold, silver, platinum, and palladium. The other projects cover base metals, industrial minerals, energy metals such as lithium, uranium and cobalt, and rare earths, which are currently in greater demand again. Globex Mining already receives royalty payments from 106 projects in the project areas. The corresponding partner companies pay the agreed royalties to the resource conglomerate in the form of cash, shares and corresponding license fees. The CEO uses this steady cash flow to expand the portfolio and to buy back shares.

High level of activity at the end of the year

Shortly before the turn of the year 2025, the Company reported a transaction with Electro Metals and Mining Inc. regarding the 100% Globex-owned Magusi-Fab mine property. This property comprises 154 claims and one mining lease located in Hebecourt, Duparquet, Duprat and Montbray townships in Quebec, 55 km northwest of Rouyn-Noranda. Under the terms of the agreement, Electro will pay Globex CAD 3.5 million in cash over four years, including CAD 100,000, no later than January 31, 2025. It will also transfer 4 million shares of Electro common stock by the end of January and an additional 2 million shares on the fourth anniversary of the deal. Electro Metals will spend CAD 8.35 million on property development, including a minimum of CAD 650,000 in the first year. On commercial production, Globex will receive CAD 1 million indexed for inflation. When Electro acquires a 100% interest in the property, Globex will retain a 3% gross metal royalty (GMR), which can be reduced to a 2% GMR by paying CAD 2 million. In addition, Globex will retain payments of CAD 200,000 per year, half in cash and half in shares, payable starting on the sixth anniversary.

The Magusi portion of the property covers the Magusi River copper-zinc-silver-gold deposit, which has a total indicated resource of 2,429,000 tons grading 3.53% zinc, 1.54% copper, 3 7.2 grams per tonne silver and 0.99 grams per tonne gold, and an additional inferred global resource of 693,000 tons grading 0.50% zinc, 2.54% copper, 21.1 grams per tonne silver and 0.27 grams per tonne gold, both at a cut-off grade of US$60 per ton. The Magusi deposit could be expanded with additional drilling and there are several exploration targets on the large property which covers more than 11 kilometers of the horizons hosting the polymetallic Magusi River and Fabie Bay deposits.

Deal flow remains impressive

Globex Mining continues to report progress on its projects. Lincoln Gold Mining Inc. noted that it is conducting a small financing to complete its acquisition of the Bell Mountain gold project in Nevada from Eros Resources Corp. and will also use the funds for Bell Mountain exploration and development. Lincoln also stated: "As we work to complete the final steps with the TSX Venture Exchange to complete the acquisition of Bell Mountain, we remain focused on bringing the Bell Mountain project to production." Globex retains a sliding GMR on the project, which at current metal prices represents a 3% GMR.

An extension has been granted to Tomagold Corp, who are now obliged to pay Globex CAD 15,000 by June 30, 2025, and to make investments of CAD 150,000 in the Gwillim property west of Chibougamau. Furthermore, Globex has terminated the option agreement for the Bald Hill antimony property in New Brunswick with Superior Mining International Corp., which was announced on September 10, 2024, as the initial option conditions were not fulfilled in time. The Bald Hill antimony property and the nearby Devil's Pike antimony-gold property are now both available for option.

In early January, Globex reported further drill hole assay results from the Ironwood Gold Zone on the Company's Wood Gold Mine/Central Cadillac Mines property, 2.6 km east of Cadillac, Quebec (Abitibi Goldbelt). Globex has completed nineteen drill holes, which have vertically intersected the Gold Zone from the footwall to a depth of approximately 225 meters. The program's objective was to define the limits of the deposit and confirm the high-grade nature of the zone. Results are now available from five additional drill holes, in addition to previous releases: Holes NIW-24-09, NIW-24-10 and NIW-24-11 intersected three gold zones, three gold zones and four gold zones, respectively, while holes SIW-24-06 and SIW-24-07 each intersected a broad high-grade gold zone. Grades ranged from 3.3 to 29.3 g/t Au over widths of 0.74 to 5.85 meters. A detailed table is posted at the following link (https://www.stockwatch.com/News/Item/Z-C!GMX-3639103/C/GMX text: Meldung GMX vom 07.01.2025)).

Manganese X Energy Corp. has announced that Eric Sprott has agreed to subscribe to shares worth CAD 2 million, subject to TSXV approval and disinterested shareholders. The funds will be used primarily to advance the Battery Hill Manganese Project, including the pre-feasibility study. Globex holds 11 million shares of Electric Royalties, which in turn holds a 2% gross metal royalty (GMR) on the project and an additional 1% GMR held directly by Globex. Globex also receives an annual royalty advance of CAD 20,000.

CONCLUSION: Globex Mining Benefits from the New Commodity Super Cycle

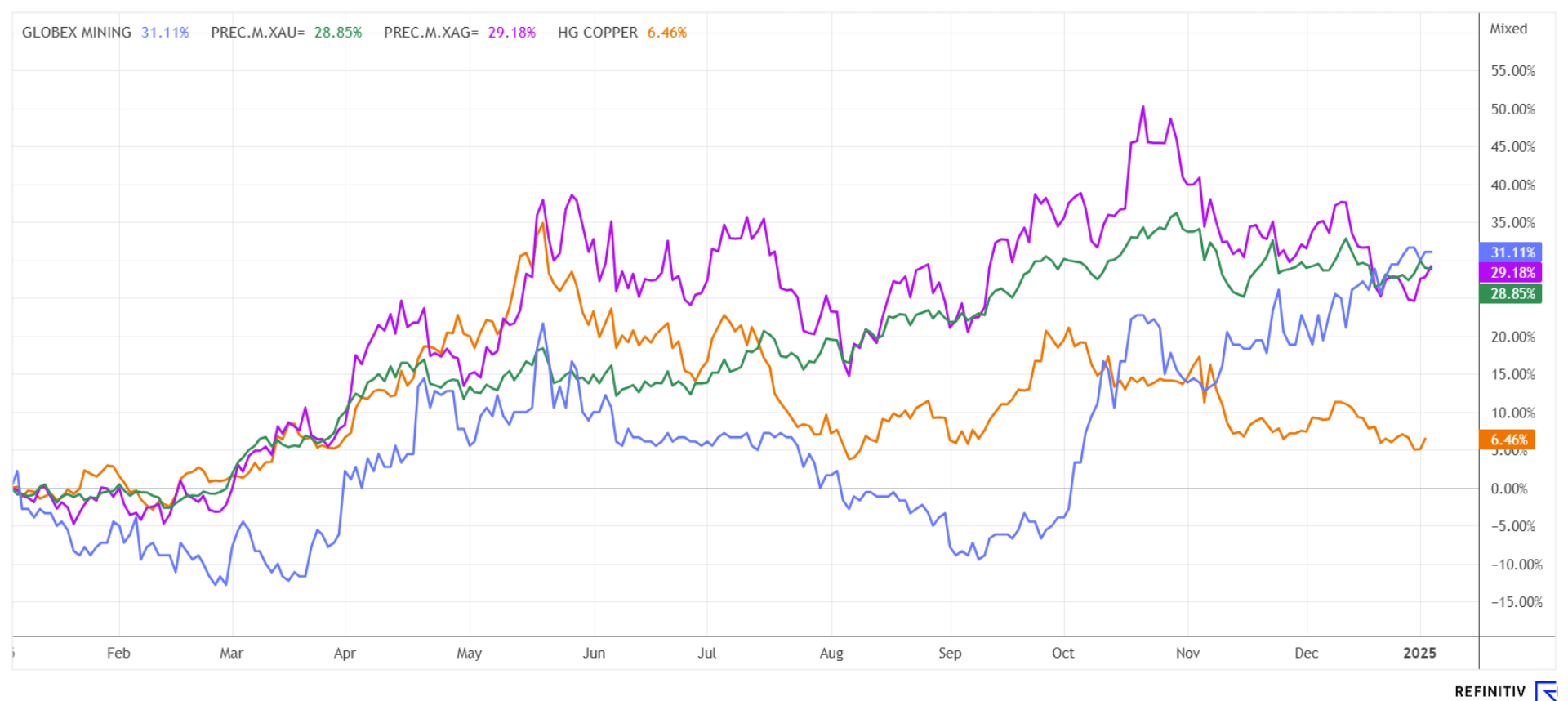

According to analysts, a new super-cycle for commodity markets is expected in the coming years. Limited exploration and development, largely due to high refinancing costs, have created supply gaps for strategically important metals. These shortages could lead to significant increases in spot prices. For Globex, this positive sentiment is crucial. There are clear signs, particularly in North America, that politicians and investors are focusing on this issue, heralding the onset of a new investment cycle. Major geopolitical uncertainties are directing investors' attention to safe jurisdictions like Canada and the United States. Commodity experts also see precious metal prices continuing to rise. Analysts see a price range of USD 2,850 to 3,150 USD for gold, while its smaller brother, silver, is expected to reach USD 350 to 450. With these price forecasts, Globex's current portfolio could see an appreciation of 200 to 300%.

GMX shares are consistently moving upwards in the range of CAD 1.16 to 1.20 after a good 30% increase in the last 12 months. The volume supports this positive development, and due to the size, institutional investors should soon take more notice. With 56.07 million shares, the market capitalization is currently around CAD 66.4 million. The price is boosted by a constant deal flow, sustained option income, and new royalty deals. In addition, as of September 30, 2024, the Company had approximately CAD 25 million in available funds and valued company shares. The intrinsic value of the investments and cash is currently 44.50 cents per share. With an investment in Globex Mining, resource investors can benefit from the decades of experience of CEO Jack Stoch. Due to the large number of high-quality projects, GMX shares should continue to outperform the resource sector. In the last bull cycle, the share price reached CAD 1.70. We expect the next upswing to deliver a significantly higher valuation!

This update follows the initial report 11/2022.