The production guidance range is now 39,000 boe

Saturn delivered record results across several key metrics this quarter, including production averaging over 39,000 boe/d (barrels of oil equivalent/day), adjusted EBITDA of approximately CAD 136 million and adjusted funds flow of over $94 million. This was driven by the continued above-average performance of the production wells, disciplined cost reductions and a strategic cash flow generation plan. The Company ended the quarter with over CAD 110 million in cash on hand and is actively executing a share buyback program, which has resulted in the cancellation of 2.2 million shares to date. It is the Company's clear objective to continue to grow value per share.

Third Quarter 2024 Highlights

Production averaged 39,049 boe/d, 30% higher than Q2 2024 and 49% higher than Q3 2023. This now includes the Battrum and Flat Lake assets acquired in mid-June 2024, as well as volumes from new developments. Adjusted EBITDA reached a company record of CAD 135.8 million, 28% higher than the second quarter of 2024, despite realized oil prices being 9% lower. Net income rose to CAD 101.6 million, or CAD 0.50 per share, last quarter. The key metric of adjusted funds flow (AFF) reached CAD 94.1 million, also a quarterly record. The figure included a one-time payment of CAD 20 million for the early termination of old WTI oil hedges. Saturn opportunistically chose to unwind these hedges as oil prices fell, and the cost of monetizing them became significantly less. Development capital expenditures totaled $80.8 million for a total of approximately 41 new sites. Free funds flow of $9.7 million was generated in the third quarter, reflecting an active capital expenditure program during this period as well as the one-time hedge book enhancement costs mentioned above.

The reduction in net debt is progressing

Net debt of CAD 779.0 million at quarter end was 2% lower than in Q2 2024, providing the Company with substantial liquidity and financial flexibility, including approximately CAD 113 million in cash and an undrawn CAD 150 million revolving credit facility. Saturn's leverage ratio currently reflects 1.4 times the ratio of annualized quarterly adjusted EBITDA. Share buybacks have reduced the number of shares outstanding to 202.0 million common shares. Due to the primary debt being in USD, management has decided to enter into swap contracts to fix the exchange rate for the next three years. This provides better security for the debt capital.

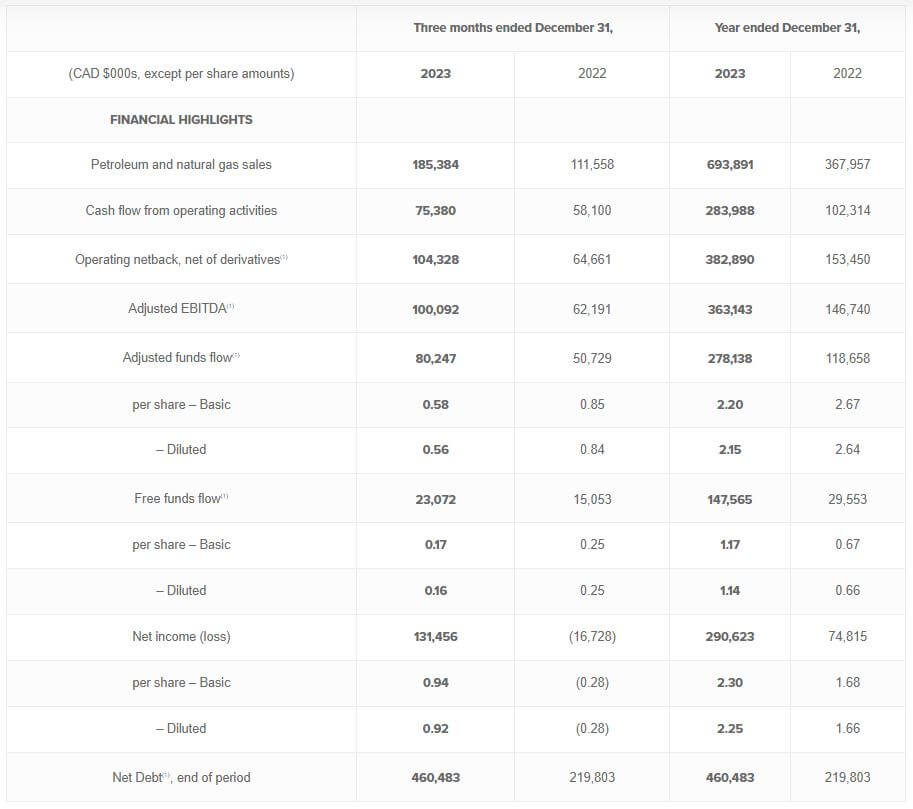

The following is an overview of the operating figures for the third quarter of 2024 and 2023 by comparison:

The work on site delivers good results

Operational performance in Q3 2024 was driven by strong production efficiency and the performance of new production wells. Southeast Saskatchewan is the cornerstone of the production base, with stable, multi-zone light oil plays complemented by promising development opportunities through new technologies. In Q3 2024, production in this area averaged 19,695 boe/d, almost 50% higher than in Q2 2024. Building on its success in utilizing multilateral uncased wells (OHML) in the Bakken formation, Saturn is now applying this expertise to the Spearfish formation at Manor. New production from this well is expected to come online in the coming weeks. Prior to drilling, Saturn secured additional adjacent land to expand its inventory of drill locations. OHML drilling in southeast Saskatchewan is not only one of the most capital-efficient plays, but several wells will also benefit from the new government-mandated royalty exemption for the first 100,000 barrels of production.

barrels of oil equivalent/day is the new benchmark

Saturn's Western Saskatchewan area achieved average production of 7,904 boe/d in the third quarter of 2024. The Battrum projects are geologically concentrated in the prolific Success and Roseray formations. Considering the technical complexity of this area, extensive geological and geophysical work has been completed at Battrum. Overall, management is identifying further opportunities in the Viking area to increase production and reserves. Work in Central Alberta is also proceeding according to plan. Given the continued strong results in developing new reserves, particularly in the Cardium area, Saturn completed a strategic tuck-in acquisition in Brazeau shortly after quarter end, adding 63 drill locations across the asset package, along with production of approximately 700 boe/d. The acquired assets are adjacent to the Company’s four best producing wells and are consistent with the "core-up strategy" aimed at securing additional acreage in areas where the greatest technical successes are achieved.

The outlook shows a lot of potential

For the remainder of the year, Saturn will have four rigs simultaneously drilling horizontal wells targeting light oil, with two rigs in southeast Saskatchewan, one rig in western Saskatchewan and one rig in central Alberta. Average production of 39,000 to 40,000 boe/d is expected in the fourth quarter of 2024, which is at the upper end of the previously announced forecast. This is based on capital expenditures of CAD 90-95 million, which is earmarked for the planned drilling of approximately 20 wells along with production optimization, capital expenditures on facilities and the conversion of 10 production wells to injection wells to facilitate secondary production at Flat Lake in the fourth quarter.

Interim conclusion: Despite record figures, the share price has been range-bound

Saturn Oil & Gas can grow from quarter to quarter. The Company is focused on reducing the ratio between net debt and adjusted EBITDA , and the high cash flow is anticipated to cause the much-watched ratio to fall to around 1.0 to 0.9 by June 30, 2025. It is currently around 1.4. The low WTI price, which has been hovering around USD 70 (WTI) for weeks now, appears negative for Saturn but is somewhat offset by the weaker Canadian dollar. In order to secure interest and principal payments, Saturn intends to hedge at least 50% of its production over a rolling 12 months period. Contrary to expectations, Saturn has already started its share buyback program. This shareholder-friendly measure will be continued in the coming quarters. The medium-term efforts are aimed at further enhancing per share metrics and reducing debt.

The price expectations of analysts on the Refinitiv Eikon platform recently ranged between CAD 3.75 and CAD 7.50 over the 12-month horizon. On average, six investment dealers expect an average price of CAD 5.57 over the 12-month period. With third quarter 2024 annualized adjusted EBITDA of over CAD 540 million, net debt is forecast to be reduced. Depending on the level of investment, the prospective, EV/DACF is also expected to increase relative to peers. Within the "mid-tier producers" of North America, this factor is on average around 2.7x, while Saturn trades at an estimated 1.9x. In a sector comparison, Saturn's relative valuation is rather low, which suggests the potential for a rerating upwards in the future. A medium-term adjustment of the share's value to the Company’s larger production and reserves base is likely, as the institutional share of investors continues to rise due to the recent commitment of the major investor, GMT Capital. Should a dividend come into focus at some point, Saturn Oil & Gas would be a likely addition to dividend-oriented funds. Due to the growing Adjusted funds flow and free funds flow, and a continuous reduction in net debt, an increase in value is a reasonable expectation in 2025.

This update is based on our initial report 11/21