Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Kommentare von André Will-Laudien

Kommentar von André Will-Laudien vom 24.06.2025 | 04:45

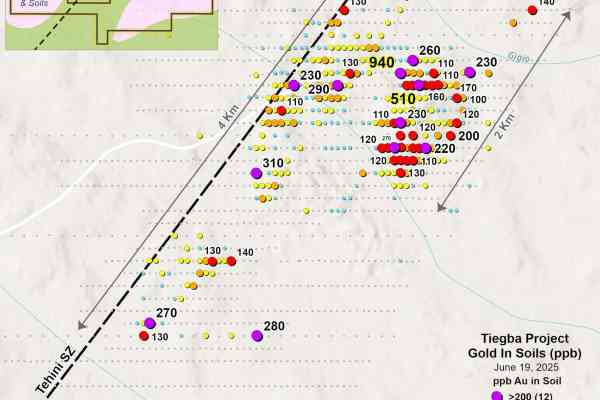

DESERT GOLD - A new top-tier gold project added

Wars, inflation, and ever-increasing public debt are strong arguments for investing in precious metals. Gold, in particular, has demonstrated its ability to preserve value in recent months. While currencies like the US dollar continue to depreciate, the gold price has increased over 30% since the start of the year. By comparison, the highly acclaimed Nasdaq-100 index has lost around 5% since January. Canadian explorer Desert Gold has now significantly expanded its portfolio with an option in West Africa. With the Tiegba Project, the Company is now present in Ivory Coast, alongside major mining companies such as Barrick, Allied, Endeavour, and B2Gold. Analysts now need to do their sums carefully, as a feasibility study for mine development in Mali is in progress. In addition to the 1 million ounces of gold already identified, there are now another 297 square kilometers of unexplored territory added. And all this for just EUR 12.5 million. This dramatic undervaluation is unlikely to last much longer!

Zum KommentarKommentar von André Will-Laudien vom 18.06.2025 | 04:45

FIRST HYDROGEN – Hydrogen and SMRs as game-changers

In the climate transition, researchers are not only looking at alternative energies such as solar, wind, and water but also increasingly back toward nuclear power. While the EU is only cautiously expanding its nuclear capacity, the outlook in North America, China, and India is far more aggressive. A total of 440 reactors are online worldwide, 113 of them in North America alone, and approximately 80 new plants are in the planning stage. US President Donald Trump makes no secret of his love for nuclear energy. For the current legislative term, he has announced a wave of new approvals aimed at significantly strengthening America's nuclear base. In light of the energy transition, resourceful companies are setting out to combine the advantages of nuclear power with the benefits of hydrogen. Canadian technology company First Hydrogen (EUR 0.51 | WKN: A3C40W | ISIN: CA32057N1042) aims to launch small modular reactors known as SMRs. One of the key goals is local green hydrogen production. A potential game-changer is on the horizon!

Zum KommentarKommentar von André Will-Laudien vom 12.06.2025 | 04:45

VOLATUS AEROSPACE – How drones are revolutionizing entire industries

The drone market is growing exponentially. When the first tech-savvy kids started flying their new, noisy aircraft over their neighbors' gardens a good 10 years ago, no one imagined the enormous potential for civilian and military applications. However, the rudimentary propeller-driven machines quickly evolved into high-precision aircraft with optical capabilities in the Ultra HD range. Today, they are connected to a complete data analysis center via a ground station, and image and AI-controlled pattern recognition make these agile aircraft perfect surveillance applications. In an age of geopolitical conflicts, overarching security requirements, and empty budgets, they now offer a reliable substitute for mobile emergency services day and night. Artificial intelligence accelerates these processes, and this is where the big game changer lies for many service providers. Volatus Aerospace (TSX-V: FLT; WKN: A2JEQU; ISIN: CA92865M1023) has worked hard to build up its business in recent years. Now, it is time to reap the rewards.

Zum KommentarKommentar von André Will-Laudien vom 11.06.2025 | 04:45

ALMONTY INDUSTRIES - The hot phase begins now

Tariff gestures and delivery restrictions on critical metals have become the daily bread of long-suffering investors. The Western industrial world is facing enormous challenges, as the pace is increasing daily in sectors such as high-tech and defense. NATO-related orders alone have increased fivefold in recent weeks compared to 2024 – and there is no end in sight. Today's industry managers need to have a clear understanding of where they can source manpower, raw materials, and especially critical metals - and which non-sanctioned markets they can then supply. The pressure is mounting as availability declines and verbal threats escalate on both sides of the Atlantic. Almonty Industries (WKN: A1JSSD | ISIN: CA0203981034 | Ticker symbol: ALI) has positioned itself uniquely, demonstrating remarkable foresight. The tungsten producer already operates mines in Spain and Portugal, and a major deposit in South Korea will be added within a few months. In addition, the Company is planning a US expansion and a Nasdaq listing to signal that the time for a revaluation has come. The research firm GBC has responded to the current scenarios and adjusted its price target upward. Here is a summary of the current facts.

Zum KommentarKommentar von André Will-Laudien vom 17.04.2025 | 04:45

ALMONTY INDUSTRIES - The next steps are clear

The daily escalation of the US trade dispute with almost all economic zones worldwide is not going unnoticed, especially in China. For reasons of national pride, Chinese Premier Xi Jinping is demanding more respect for his country. Not only have punitive tariffs been met with counter-punitive tariffs, but China has now also drastically restricted exports of critical metals and rare earths. This is a nightmare scenario for Western industrialized nations, as export controls exacerbate global commodity insecurity. For the high-tech industry, this means significantly higher prices, pressure to innovate, and increased geopolitical risk. At the same time, the current crisis is accelerating the establishment of new supply chains, the necessary technological restructuring, and the relocation of strategic manufacturing worldwide. Almonty Industries Inc. (WKN: A1JSSD | ISIN: CA0203981034 | Ticker symbol: ALI) has been working for several years on another mine start-up in South Korea, which is now imminent. And customers are lining up when it comes to output. Because right now, the rarer it is, the more expensive it is. The stock is becoming a blockbuster on the German and Canadian stock exchanges, with a gain of over 150% in just six months. The rally is likely to continue!

Zum KommentarKommentar von André Will-Laudien vom 15.04.2025 | 05:00

BioNxt Solutions Inc. – All systems are go

Despite all advancements, scientists are still largely in the dark when it comes to many diseases - in particular, neurodegenerative diseases such as Alzheimer's, Parkinson's, ALS, or multiple sclerosis. However, new forms of therapy offer methodologies to treat the affected patients more efficiently. Technologies that can deliver active ingredients directly to the brain and release them effectively there could mean a breakthrough for diseases that are still too difficult to treat today. There is demand for methods that enable targeted, more effective, and safer delivery of drugs to the central nervous system (CNS) – i.e. the brain and spinal cord. The market in this area is highly innovation-driven, experiencing strong growth, and has recently been massively accelerated by the use of artificial intelligence. The Canadian biotech specialist BioNxt Solutions (TSX-V: BNXT; WKN: A3D1K3; ISIN: CA0909741062) is an innovative life sciences company specializing in next-generation drug delivery technologies. Its research is well advanced – the next leap in growth is now within reach!

Zum KommentarKommentar von André Will-Laudien vom 09.04.2025 | 04:45

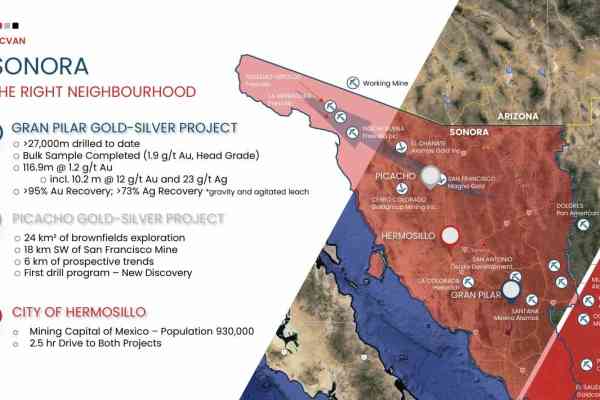

TOCVAN VENTURES - Sonora's Gold and Silver Treasure

The world is in turmoil. Geopolitical conflicts, displacement and migration, and economic and political upheavals are the order of the day. With the new US President Donald Trump, transatlantic partnerships are changing, and even long-standing institutions like NATO are no longer a reliable parameter. The capital markets have to cope with the new uncertainties. This means high volatility for stocks and other assets. Investors are looking for safe havens - traditionally, gold and silver at least offer long-term value compensation for losses in purchasing power. Regions with a centuries-old tradition in precious metals are once again coming into focus, offering a potential anchor of stability in uncertain times. The Canadian resource explorer TOCVAN VENTURES (CSE: TOC; FRA: TV3; WKN: A2PE64; ISIN: CA88900N1050) is currently making a name for itself as the Company enters the home stretch in 2025.

Zum KommentarKommentar von André Will-Laudien vom 26.03.2025 | 04:45

dynaCERT: 300% Potential with Cleantech!

Bernd Krüper, the new president and director since summer 2024, is looking hopefully toward the upcoming bauma trade fair in Munich. Energy efficiency and the climate transition are at the forefront of the public eye. Companies with high energy usage are actively seeking ESG-compliant solutions. Since 2004, the Canadian company dynaCERT has focused on the development of hydrogen-based diesel auxiliary devices. These optimize combustion processes, making them cleaner and reducing fuel consumption. In 2024, the Company received certification from the world-renowned VERRA Institute for its technological solutions. With a positive result, the sales rollout is accelerating because the underlying ESG topic and the acquisition of emission certificates are important control components, especially for companies in the public spotlight. The analyst firm GBC Research has done the math and voted "Buy" - the price is taking off. It is a perfect setup for a multiplier in the portfolio.

Zum KommentarKommentar von André Will-Laudien vom 12.03.2025 | 04:45

dynaCERT: The dawn of a new era in clean drive technology!

Carbon dioxide (CO2) plays a central role in the atmosphere and has both natural and man-made impacts. It is a significant factor in air quality, climate change, and ecological balance, particularly in large cities. Governments worldwide meet once a year to advance climate transformation, but local implementation often fails due to a lack of finances and the necessary innovations. A few years back, a tradable price for "pollution rights" was created through climate certificates. The price for one ton of CO2 reduction is currently just under EUR 70, but it varies significantly from region to region. In 2023, the International Energy Agency (IEA) published an updated Net-Zero Roadmap that outlines a detailed global pathway to achieve the 1.5°C target by 2050. This plan takes into account developments since 2021 and emphasizes the need for accelerated action in various sectors. The Canadian company dynaCERT has technologies for reducing CO2 emissions and understands what is at stake in this billion-dollar market. With a patented and certified technology, significant emission reductions can be achieved in combustion processes. The internationally recognized institute VERRA laid the foundation for the sought-after emission certificates. The attractiveness of a quick implementation is now in place and could mean a multiplication of revenues for dynaCERT. The starting signal is now!

Zum KommentarKommentar von André Will-Laudien vom 04.03.2025 | 04:45

GLOBEX MINING - Gold gives you wings

The price of gold continues to rise sharply in 2025. In February, at USD 2,950, the yellow metal reached its highest level ever. Gold outperformed most stock indices worldwide and even came close to keeping up with the NASDAQ 100. The high inflation rate and the persistent borrowing by governments to finance their overburdened budgets speak in favor of investments in precious metals. Since 2022, high defense and security spending has also been added. Geopolitical uncertainties and crisis zones will remain with investors in 2025. So far, this has not deterred anyone from investing in securities. What could change, however, is the focus on value versus growth expectations in the area of high-tech and artificial intelligence. The Canadian resource asset manager and explorer Jack Stoch focuses on continuous growth and is very successful with this approach, as the Globex share (ticker symbol: GMX) also delivered a 76% increase, effectively doubling gold returns for shareholders. The current year, 2025, promises to be an exciting one.

Zum Kommentar