Record production volumes in Q4

While still excluding the subsequent transaction, Saturn Oil & Gas had most recently been able to present record production volumes in the final quarter. At the same time, the 2022 drilling program was completed. The 2022 capital expenditure program resulted in total expenditures of approximately CAD 89.1 million. 80% of the expenditures were for horizontal drilling at Saturn's two operating locations, Oxbow and Viking.

All wells drilled in 2022 resulted in production expansions

The remaining capital expenditures were directed toward facility upgrades, rework and optimization projects, and concession acreage purchases. A total of 57 horizontal wells were completed, all of which were brought into production. Production in Q4 2022 is estimated at 12,514 boe/d, in line with the production guidance targets announced when the Viking site was acquired in May 2022, reaching a top of 13,128 boe/d in December 2022.

"In 2022, Saturn recorded the most active and effective capital expenditure program in its history. We are very pleased with the overall results of the drilling program as they exceed our forecast guidance curves and expand our geomodel. As a result, we are able to capture additional light oil resources for future development," commented Justin Kaufmann, Saturn's Chief Development Officer. "As we begin the 2023 drilling campaign, we hope to build on our successes in 2022 and capitalize on the experience we have gained in developing the concession areas and drilling locations we have rapidly expanded."

The Ridgeback transaction has closed

As previously announced on January 20, 2023, Saturn has successfully completed the full acquisition of Ridgeback Resources Inc. with a transaction value of approximately CAD 516 million. This represents an approximate 140% increase in the production rate of roughly 17,000 boe/d of additional oil and natural gas produced. Future production output will thus reach a rate of over 30,000 boe/d (82% crude oil and NGLs).

"With the completion of the Ridgeback acquisition, Saturn has diversified its light oil production base with a comprehensive and sustainable portfolio of development opportunities," said Saturn CEO John Jeffrey. "We now have a total inventory of over 940 captured drilling locations to sustain Saturn's production over a decade."

The financial details

Cash expenditures for the Ridgeback acquisition included cash of CAD 475 million and the issuance of 19,406,167 common shares of the Company. The cash portion of the purchase price was funded by net proceeds from the previously announced "bought deal" of CAD 125 million and proceeds from an amended credit agreement with the Company's existing lender, which increased the Company's loan commitment accordingly, and additional proceeds of CAD 375 million. Net debt at closing is now CAD 545 million, with total enterprise value increasing to just under CAD 900 million. The financing was completed by way of a prospectus supplement to the Company's base shelf prospectus. It was secured by Echelon Capital Markets as sole bookrunner and co-lead, Canaccord Genuity Corp. as co-lead, and with an underwriting syndicate including Eight Capital, Beacon Securities Limited and Paradigm Capital Inc. The Company received strategic lead assignments from GMT Capital Corp, Libra Advisors, LLC and two other institutional investors.

Under the terms hereof, each of the Company's Rights Certificates issued pursuant to the financing was exchanged for one common share concurrently with the closing of the Ridgeback Acquisition. The Trust released net proceeds of approximately CAD 117 million to fund a portion of the purchase price of the Ridgeback Acquisition. No action is required by the holders of the Rights Certificates to receive the underlying common shares. The listing of Rights Certificates will be delisted from trading on the TSX Venture Exchange at the close of business on March 1, 2023. The number of Saturn shares issued ("SOIL") will increase to 138.5 million. The new shares issued in connection with the transaction are subject to a 12- to 15-month hold period from closing.

Operational details

The Ridgeback Acquisition adds synergistic assets to the existing light oil production of the Oxbow asset in southeast Saskatchewan, comprising approximately 5,000 boe/d of net cash-flowing production - Saturn's production in the region increases by over 65%. The Ridgeback integration more than doubles the light oil production of Saturn's existing and adjacent core growth asset in southeast Saskatchewan.

140% production increase from Ridgeback acquisition

After completion of the Ridgeback acquisition, approximately 40% of Saturn's production will be located in Alberta, allowing for diversification of its highly economic light oil-focused drilling operations. Overall, Saturn's entry into the Alberta Cardium creates a new core area within North America's largest and most economical oil pool with over 300 development drilling locations and light oil production of approximately 8,700 boe/d. The assets acquired from Ridgeback benefit from a very well-executed site management program to date. The numbers speak for themselves. The recent transaction increases production by a further 140% to up to 30,000 boe/d. At the same time, the net present value of the proven reserves of the properties is approximately CAD 1.8 billion.

Interim conclusion: Valuation will follow the new set-up in the medium term

Saturn Oil & Gas also shows with this transaction that it will stick to its strategic direction and is not afraid to integrate very large units into the Company. From a current production level of just under 13,000 BOE, the acquisition will immediately take it into the 30,000 BOE range. The Ridgeback acquisition thus doubles light oil production from Saturn's existing and adjacent core growth project in southeast Saskatchewan, targeting Frobisher and Midale light oil development and increasing the Bakken regional light oil business. The Ridgeback concession areas in southeast Saskatchewan are directly east and adjacent to Saturn's existing production and development area. This makes them a perfect synergistic fit, operating out of Saturn's Carlyle operations center.

With projected capital expenditures of about CAD 161 million, free cash flow should reach more than CAD 230 million. This assumes an average WTI price of USD 80 for the coming year. With this, Saturn already achieves a significant debt reduction to about CAD 345 million in 2023/24. The free cash flow yield (FCF Yield) increases to 70% or CAD 1.84 per share.

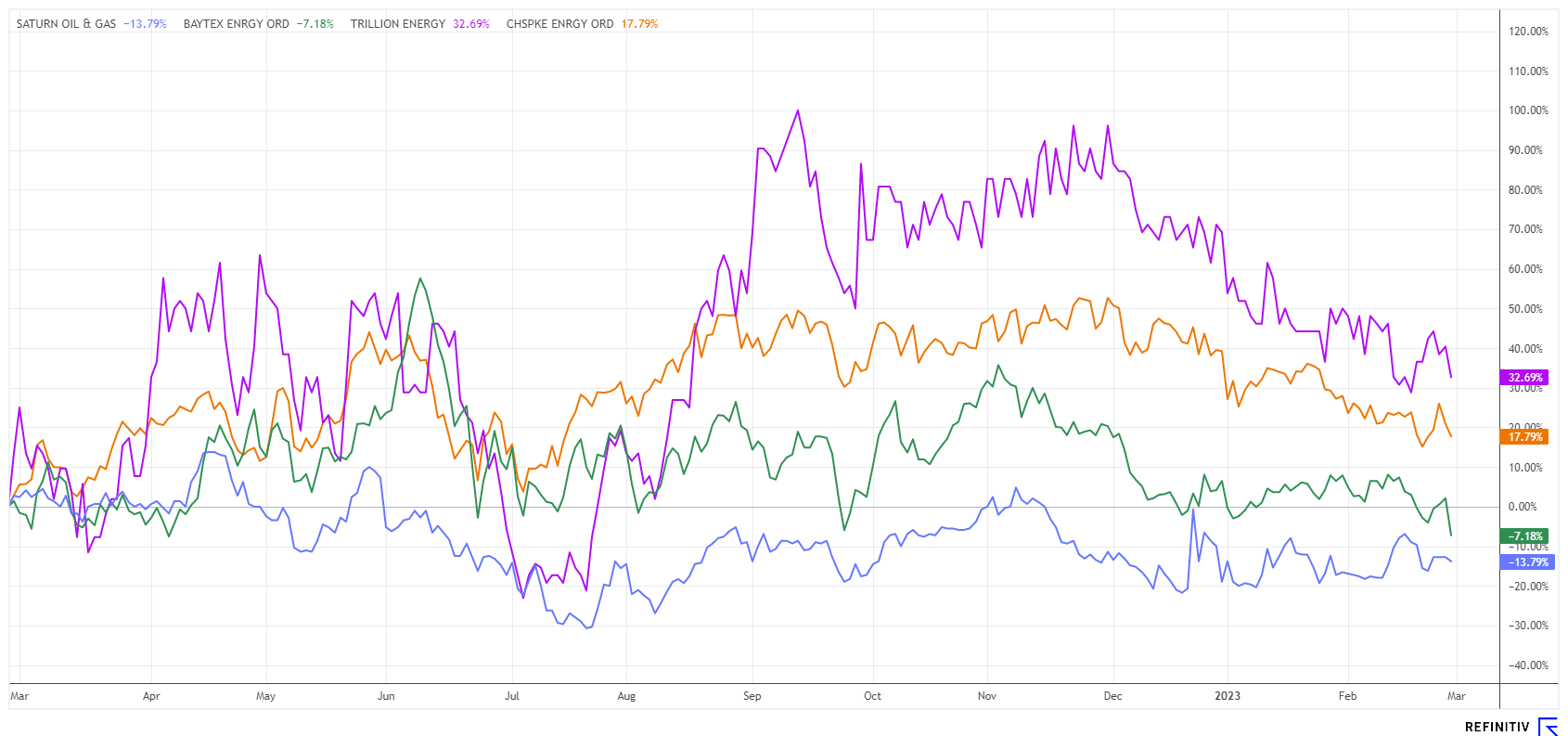

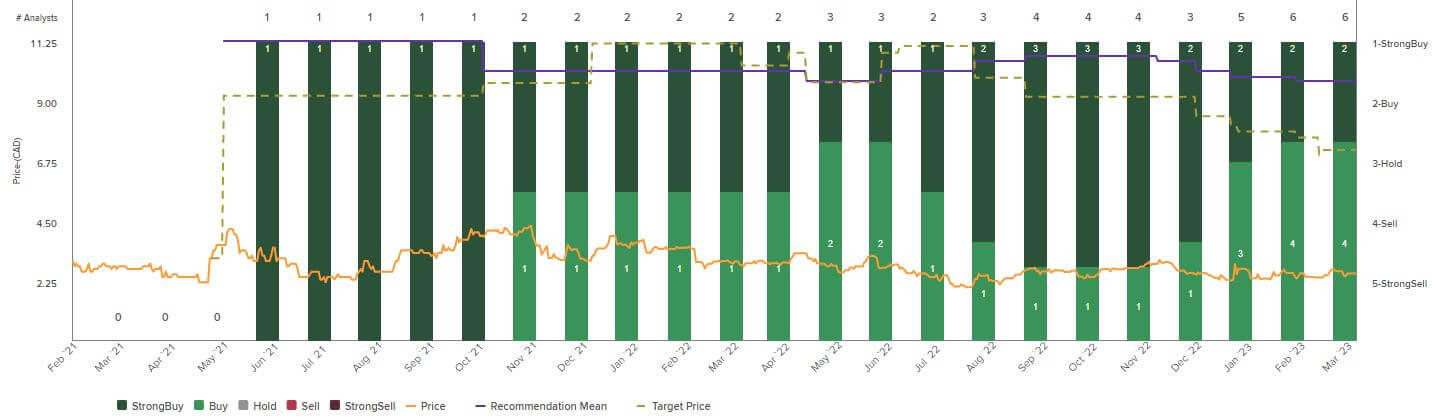

This transformation opens up the opportunity for Saturn Oil & Gas to gain entry into institutional portfolios. This increases the share of important, long-term investors compared to the recently volatile traded free float. Fundamentally, Saturn trades at an EV/adj EBITDA ratio of about 1.5 after the transaction, making the Company one of the cheapest oil and gas producers in the entire North American oil sector. Broker recommendations published with research range from CAD 7 to CAD 11 for the price target. An overview is provided by Refinitiv Eikon with 2 Strong Buy and 4 Buy ratings as of 02/28/2023.

With this transaction, Saturn Oil & Gas demonstrates its qualities as a growth-oriented oil producer in Canada. The valuation GAP is expected to close at a factor of 3.5 to 5 times EV/adj EBITDA in the medium term. From today's perspective, this would be a fair value per share of around CAD 10.00. Before the transaction, the research house Beacon had already issued a Buy rating and a 12-month target of CAD 9.00, while Eight Capital issued a Buy rating and a target price of CAD 7.50 on February 13, 2023. The calculated price targets are likely to adjust further upwards with the further doubling of production in the study updates.

The update is based on the initial report 11/21