The German site is a concern for BASF

The founding site is still the heart of BASF, but in the medium term, it is clear where the journey is heading. Because from today's perspective, the input costs for energy-intensive production in Asia or North America are significantly lower than in Europe, and there is also an energy and industrial policy from Brussels that is not very attractive in perspective. This is why BASF is considering new sites in order to achieve extensive cost reductions throughout the Group. With more than half of the planned savings, the headquarters in Ludwigshafen will also be affected. This is not good news for Germany's competitiveness in an international comparison since 39,000 of the total 111,000 employees worldwide work here. But since innovation and research are the drivers of future business, BASF cannot do without a large research division.

production sites worldwide, including 6 Verbund sites

The crux of the matter: In the future, investments will likely be made abroad. Management had just approved a new site for around EUR 10 billion in China - a slap in the face for German industrial policy and a medium-term loss of valuable jobs. Because of the difficult conditions in Europe, BASF's management also set up an austerity program to be implemented from 2023 to 2024. The cuts are intended to reduce annual non-production costs by a massive EUR 500 million, and the Company is not ruling out job cuts in the process.

One of the world market leaders in battery materials

The Ludwigshafen-based chemical group is one of the largest suppliers of starting materials for the Greentech industry. Substances are produced and mixed here with high energy input, important chemical precursors for high-tech manufacturers in the alternative energy and e-mobility sectors. At the end of 2022, BASF added an important customer and has become a strategic supplier of cathode materials for e-car battery cells from Prime Planet Energy & Solutions (PPES), the battery joint venture of Toyota and Panasonic. The materials will be supplied by BASF's majority-owned joint venture BASF Toda Battery Materials (BTBM), a newly developed product from the portfolio for high-performance cathode materials. BASF's formulation remains a secret as a race has broken out worldwide to find the most powerful battery for e-mobility to persuade larger groups of buyers to purchase an e-vehicle.

A novel hydrometallurgical process from Israeli company Tenova Advanced Technologies (TAT) is to be used in BASF's planned battery recycling at its Schwarzheide site in Brandenburg, Germany. Plans call for a prototype plant for recovering lithium using this process to be commissioned before the end of this year, according to a joint statement from the two companies. Together, the two companies aim to optimize the hydrometallurgical recycling process using TAT's novel lithium recovery process, which includes lithium solvent extraction (LiSX™) and lithium electrolysis (LiEL™). This is based on the belief that with a rapidly growing number of electric cars, battery materials will become scarce and expensive.

"Producing battery materials from recycled metals can reduce CO2 emissions from batteries by about 25% compared to using virgin metals," says Daniel Schönfelder, head of Battery Base Metals and Recycling at BASF. "We will close the loop from spent batteries to the production of new batteries and meet the growing demand for key metals for electromobility with an exceptionally low carbon footprint. By working with Tenova, we can test new approaches to optimize the recycling process."

"BASF's Catalysts division is the world's leading supplier of environmental and process catalysts."

The successful commissioning and operation of the prototype plant is an important milestone for BASF to expand battery recycling and the recovery of valuable metals such as nickel, cobalt and lithium. **With the investment in Schwarzheide, BASF supports a European value chain for battery production and is part of the "Important Project of Common European Interest (IPCEI)" approved by the European Commission in December 2019 under European Union state aid rules.

High write-downs on Wintershall DEA

BASF subsidiary Wintershall DEA is pulling out of Russia, leaving its parent company with a billion-dollar loss for 2022. The bottom line left BASF with a loss of around EUR 1.4 billion, mainly due to write-downs of EUR 7.3 billion on Wintershall DEA. The subsidiary complains of a de facto expropriation of its holdings there in Russia. It is planning a complete withdrawal from the country in compliance with legal requirements. "Continuing our business in Russia is not sustainable," says Mario Mehren, Head of Wintershall DEA.

The Ukraine war has completely destroyed cooperation between Russia and Europe. In addition, the Russian government has restricted the activity of Western companies in the country. "The joint ventures have been de facto economically expropriated," Mehren said. Wintershall DEA referred to Russian regulations from late December. There, the Ministry of Economy retroactively reduced the prices at which the joint ventures could sell their produced hydrocarbons to Russia's Gazprom. Wintershall DEA plans a complete, orderly withdrawal from Russia in compliance with all applicable legal requirements. Accordingly, Wintershall DEA's interests there have been revalued, and impairment charges have been taken on the Company's European gas transportation business, including a full write-down of its interest in Nord Stream AG. In future, Wintershall DEA will no longer report the key figures of its Russian joint ventures in the consolidated financial statements.

The preliminary figures for the full year 2022

BASF presented preliminary figures for the full year 2022 at the beginning of February. In terms of sales and income from operations (EBIT) before special items, the Group is expected to be in the previously forecast ranges of EUR 87.3 billion and EUR 6.87 billion, respectively, and in line with average analyst estimates for 2022.

BASF Group EBIT in 2022 is expected to be EUR 6.5 billion, below the prior year and below analyst consensus for 2022 (Vara: EUR 6.8 billion).This includes non-cash impairment charges on an asset in the Chemicals segment. Earnings after taxes are expected to be EUR -1.37 billion, compared with EUR 5.52 billion in profit in the previous year. The losses result, in particular, from the deconsolidation of the Russian exploration and production activities of Wintershall DEA due to the extensive loss of actual influence and economic expropriation.

SCHEDULE: The Company will release the full report for 2022 on Friday, February 24, 2023, at 07:00 a.m. and will elaborate on it during a virtual conference for analysts, journalists and investors.

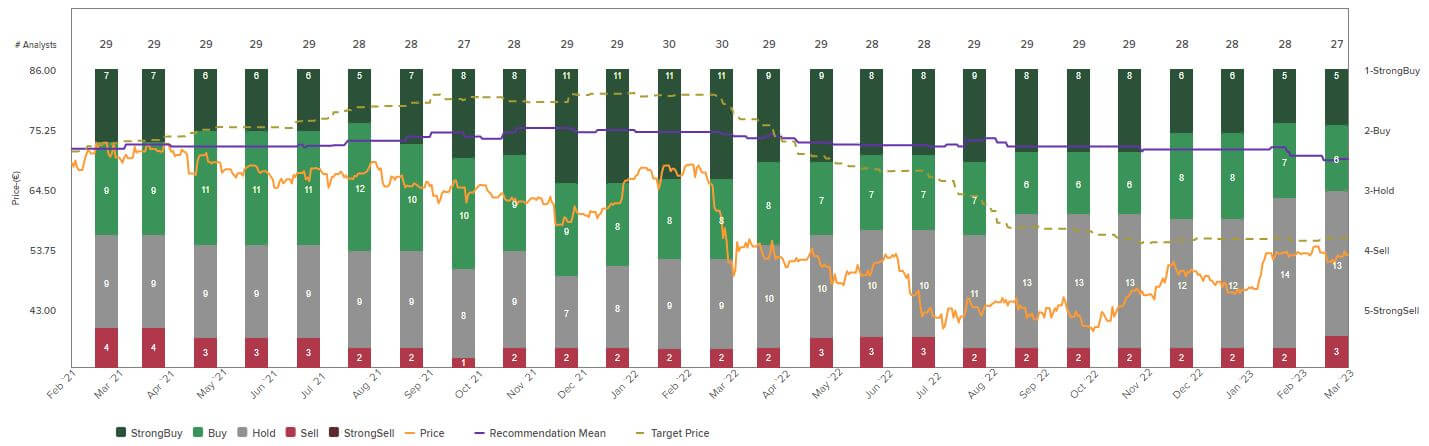

Outlook: Slight decline in sales in the fragile environment

Analysts surveyed by Refinitiv Eikon expect a decline in revenues of approximately 5% in fiscal year 2023, i.e. skepticism about current growth opportunities remains high. Due to permanent cost pressure and difficult pass-through, the experts even see a declining EBIT margin. Should the economy experience a dip due to high energy and procurement prices, BASF is also likely to experience stronger revisions from 2023 to 2025. The build-up of new production capacities in China and the partial closures at the Ludwigshafen site will initially weigh on the cost side. Fundamentally, the figures also show that the valuation is currently in the book value range. However, the expected dividend yield, currently calculated at more than 6%, is a reconciling factor, although this is subject to continuity and profit growth.

Interim conclusion: First rays of hope discernible

With the start of the Ukraine crisis in February 2022, the stock market priced the energy risk very strongly into the share price. Turnover in the share reached almost historic dimensions, indicating a sell-off among funds and institutional investors. The next few months should show whether this is already an under-investment. **Analysts are currently evaluating various aspects of the chemical industry, however, because, on the one hand, input prices on the raw materials side have increased drastically. However, due to its extraordinary market position in chemical raw materials for the processing industry, BASF has been able to pass on its increased costs to a large extent.

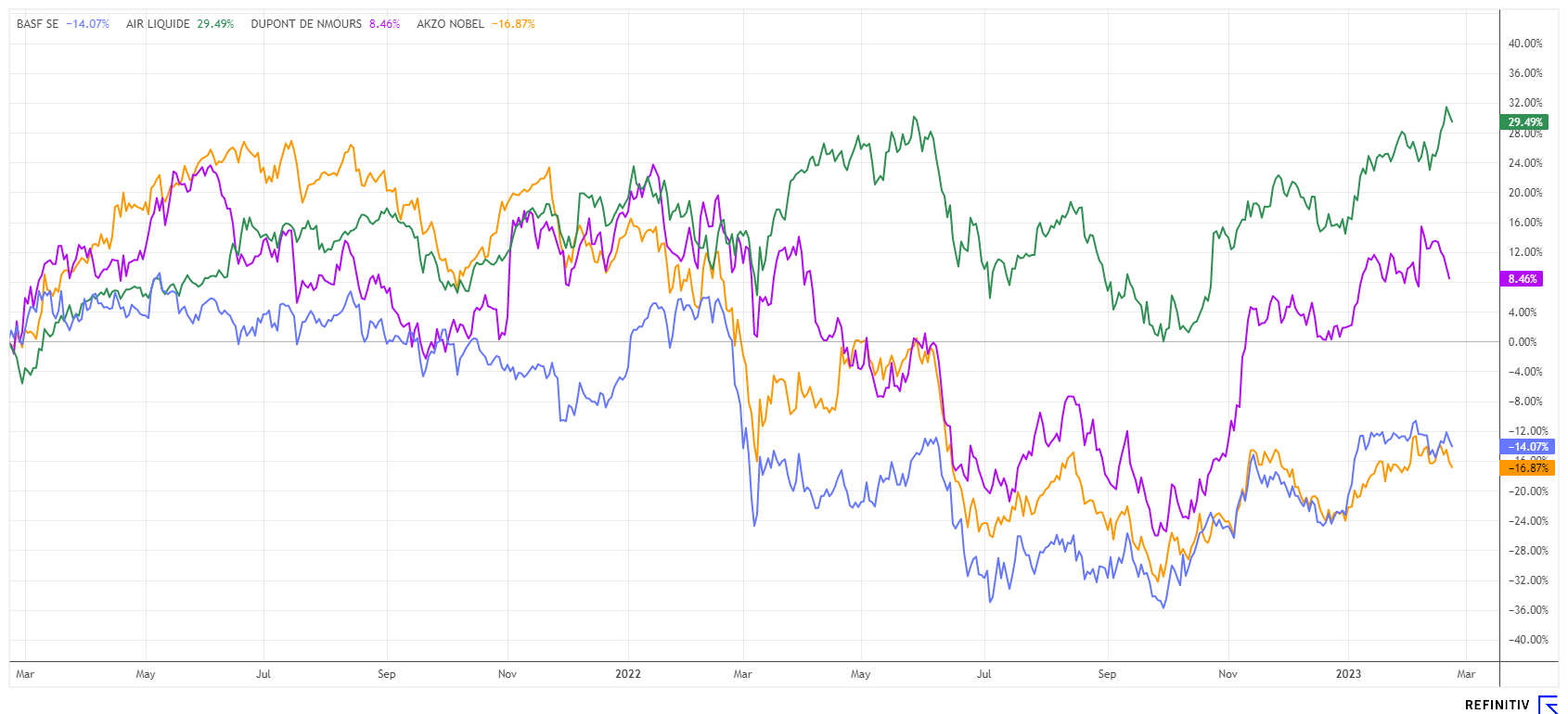

The 2-year performance of the BASF share compared to its sector peer group shows large gaps, especially compared to Air Liquide and DuPont. The special charges in Russia can, of course, be cited as a reason. Should the economy actually turn upward in 2023, contrary to what many economists believe, BASF's sails would be set. Barclays expert Alex Stewart recommends the shares of the Ludwigshafen-based company with a price target of EUR 68 but has left his rating at "Equal-weight". There are initial recovery signals for the industry, which is why he is positive overall on a twelve-month view. However, the analyst said that, unlike the past three up cycles, investors should be prepared for the risk of stagflation in the economy in the medium term.

BASF shares had to give up around 24% in 2022 but have regained the EUR 50 mark. Fundamentally, the stock trades at a 2023 P/E of 11.2 and offers a yield of more than 6%. Furthermore, the DAX stock trades close to its book value and reflects only 60% of forecast sales in the share price. International diversification leads to different cost ratios in the medium term and strengthens the business in Asia. Long-term investors should keep the stock on their close watchlist and re-evaluate it as momentum in the global economy returns.

The update is based on the initial report 07/2022.