BASF SE - Chemical history made in Ludwigshafen

BASF SE, headquartered in Ludwigshafen am Rhein, is a listed chemical company and a member of the DAX40 index. The Company has its origins in the "Badische Anilin- & Sodafabrik " founded in Mannheim in 1865. Because no suitable site was available there, the new plant was built in the same year on the opposite bank of the Rhine in Ludwigshafen. Over the last decades, this has become one of the largest industrial sites in Europe.

The world's largest chemical company by sales

BASF is represented in 90 countries and operates 238 production sites. 111,047 employees generated total revenues of EUR 78.6 billion in 2021, making BASF the world's largest chemical company in terms of sales. In the last fiscal year, BASF generated 17% of its sales with "Chemicals " and 19% with "Materials" such as plastics, polyamides and basic chemicals such as acids. On the one hand, the Chemicals segment includes petrochemicals such as ethene, propene and industrial gases, as well as plasticizers. On the other hand, this segment also includes intermediates for the pharmaceutical, construction, textile and automotive industries as well as for other divisions of the BASF Group.

29% of sales were attributable to products and services of the "Surface Technologies " segment, such as exhaust gas catalysts for automobiles, materials for lithium-ion batteries, automotive and automotive refinish coatings, paints, and surface technology for metal, plastic and glass substrates. A further 8% is generated by the Nutrition & Care segment, which produces ingredients for food (flavors, omega-3 fatty acids, enzymes for baked goods), pharmaceuticals (ibuprofen, dexpanthenol) and personal care products (e.g. surfactants, enzymes, water-soluble polymers, biocides, optical brighteners, stabilizers and methanesulfonic acid for detergents, superabsorbents for diapers and fragrances). The Group already generated 11% of its revenues in the relatively young "Agricultural Solutions" segment with seeds, crop protection products, urease inhibitors, nitrogen stabilizers, and films for use in agriculture.(source: Wikipedia)

production sites worldwide, including 6 Verbund sites.

Indispensable in chemical products worldwide

BASF recently acquired a new acetylene plant to replace the nearly 60-year-old old plant at its Ludwigshafen Verbund site. It can produce 90,000 metric tons of the versatile chemical annually. About 20 plants at the Ludwigshafen site use acetylene as a versatile chemical building block and starting material for many everyday products. BASF customers use it to produce pharmaceuticals, plastics, solvents, electrochemicals and highly elastic textile fibers for the automotive, pharmaceutical, construction, consumer goods and textile industries, for example. The integration of the plant into BASF's Verbund concept offers the advantages of efficient use of resources, excellent production synergies and short supply routes. BASF is thus further enhancing the competitiveness of the Ludwigshafen site in the long term. As a precursor supplier, BASF is positioned worldwide and offers a unique product range.

Sword of Damocles remains the external energy supply

The linchpin of the current set-up remains the chemical producer's heavy dependence on energy. Last year, BASF consumed around 37 terawatt hours of natural gas at its Ludwigshafen site, half as a raw material for production, the other half for electricity and steam generation. This makes BASF the largest single consumer in Germany, and the volume consumed is equivalent to the heating requirements of more than one million single-family homes. The future supply situation in Germany is still unclear. **The threat of an undersupply of gas could lead to production cutbacks at European sites in the event of an emergency.

However, one long-term project offers hope: BASF and MAN Energy Solutions have agreed on a strategic partnership to drive forward the construction of a large-scale industrial heat pump at BASF's Ludwigshafen site. It is intended to establish the use of low-CO2 technologies in chemical production and significantly reduce gas consumption at the site. The planned large-scale heat pump will enable the production of steam with the help of electricity from renewable sources, using waste heat from BASF's cooling water system as a thermal energy source. With its integration into the site's production infrastructure, it is expected to generate up to 150 metric tons of steam per hour - equivalent to a thermal output of 120 megawatts. The project is expected to reduce CO2 emissions at the site by up to 390,000 metric tons per year. As a first step, the project partners are conducting a feasibility study, which is to be completed by the end of 2022.

Direct investment for climate protection

BASF takes the topic of "climate protection" seriously, as demonstrated in its investment division. The subsidiary BASF Venture Capital GmbH is investing in Climentum Capital's first venture fund. The fund has a total volume of EUR 150 million. Both organizations will enter into a strategic relationship that promotes knowledge sharing, deal sharing and co-investment opportunities. The fund is supported by other renowned corporate investors, banks and industrial conglomerates as well as prominent family offices and successful tech entrepreneurs. The common goal is to address climate change by investing in disruptive technologies. Venture investments focus on decarbonization, circular economy, AgTech, new materials, digitalization and new disruptive business models. All investments are subject to the EU's Article 9 Fund ESG guidelines.

Electromobility is the key technology for climate change

Movement comes at a price. There will be around 1.5 billion vehicles on the roads worldwide in 2025. Most of these will be internal combustion engines moving around major economic centers. Air pollution and CO2 emissions are therefore two key issues for shaping global mobility. Automotive trends such as electrification require the industry to innovate continuously. Consumers demand safe and affordable cars that offer long ranges and short refueling times. In the field of e-mobility, a large share depends on chemistry.

Around the world, many countries have not only committed themselves to climate protection, but have also set ambitious climate targets for transport. For example, China presented its "Energy-saving and New Energy Vehicles Technology Roadmap 2.0" in 2020. Among other things, it envisions a 20% reduction in CO2 emissions from China's automotive industry by 2035 compared to 2028. With its "Fit for 55" climate package, the European Union plans to reduce CO2 emissions from new cars by 55% below 2021 levels by 2030, and new cars are to be emission-free from 2035.

"The battery is at the heart of electric cars. And at the heart of the battery are innovative battery materials from BASF."

Many automakers have set their own strategic roadmaps for electric cars, and as a global chemical supplier to the automotive industry, BASF will benefit greatly from this development. The battery is at the heart of electric cars. It will determine whether electric cars become established on the roads as quickly as governments around the world are planning. The modern lithium-ion battery consists of an anode and cathode. Between these two lies the electrolyte, a special liquid through which electrically charged ions pass from one electrode to the other. All of this is pure chemistry, and this is where BASF's innovative strength comes into play. The Company has a modern plant for battery materials in Schwarzheide. BASF will additionally build a plant there for recycling black mass from batteries on an industrial scale. The site is ideal for setting up recycling activities, as there are many manufacturers of electric cars and cell producers in Central Europe. The investment will create about 30 new jobs in production, with commissioning planned for early 2024.

Oil and gas subsidiary Wintershall DEA comes back into focus

Anyone thinking about the 72.7% subsidiary Wintershall DEA could fall victim to a mental contradiction. Although the Group explores for and produces natural gas and crude oil worldwide, it does not currently have the necessary assistance potential compared to its parent company BASF. According to its own presentation, the group is a leading supplier of energy with a primary focus on gas. Unfortunately, the BASF Group is only a small customer of Wintershall. Due to the majority shareholding, the subsidiary will nevertheless play a major role in the future, because Germany as a production location with its abundant gas and oil reserves is now once again in the public focus. Should the political discussion also allow the topic of "fracking" to be addressed again, Wintershall DEA would certainly be one of the European market leaders in this field. For BASF, of course, this would mean special income through its participation and, through new purchase agreements, also an opportunity for supplies to Ludwigshafen. This is certainly still political speculation from today's perspective, but at least Germany as an industrial location is very much dependent on the security of energy supplies.

Operating performance in the first quarter of 2022

Significantly higher energy and raw material prices and supply chain disruptions characterized the Ludwigshafen-based company's first quarter of 2022. Sales increased by EUR 3.7 billion year-on-year to EUR 23.1 billion. Higher prices, particularly in the Chemicals and Materials segments, were the main driver of sales growth. Positive currency effects in all segments supported the sales trend, while slightly lower volumes overall had a counteracting effect.

EBIT before special items increased by EUR 497 million to EUR 2.8 billion, mainly due to the significant earnings growth in Chemicals, Industrial Solutions, Materials and Nutrition & Care. Headwinds were felt in the Surface Technologies segment, where EBIT before special items fell significantly, mainly as a result of significantly lower demand from the automotive industry.

Net income after taxes and non-controlling interests amounted to EUR 1.2 billion, compared with EUR 1.7 billion in the same quarter of the previous year. This was due to impairment charges at Wintershall DEA, which were recognized as a special charge in income from participations at a 72.7% share of around EUR 1.1 billion. These impairments were caused by the war in Ukraine and related political consequences. In addition to the loan to Nord Stream 2, it mainly affected assets in Russia and in the gas transport business. Second quarter figures are expected on Wednesday, July 27, 2022. They should indicate the negative impact the Ukraine war will have on BASF's balance sheet.

SWOT analysis

Strengths

- Worldwide networking and global sourcing

- Strong industrial base in Germany

- Broad positioning across many sectors

- Integration of horizontal and vertical value chains

Weaknesses

- Very high energy dependency on Eastern Europe

- Rising producer prices due to scarce raw materials

- Price pass-through due to inflationary pushes takes place with a delay

Opportunities

- Euro devaluation could facilitate exports

- Solid balance sheet quality enables M&A activity

- Future market battery materials

- Establishment of ESG-compliant production standards

Threats

- Impending recession causes declining sales

- Further lockdowns due to a renewed pandemic outbreak

- Burden still noticeable in supply chains

- Policy focus on climate change has a restrictive effect on the chemical industry

Outlook: Near future could be bumpy

For the outlook, management remains cautious. The economic framework data expected is a GDP for Germany of +3.8%, an oil price of USD 75 and a USD/EUR ratio of 1.15 on average for the year. As these target figures are likely to deviate considerably from reality, it is difficult to quantify the real effects on the operating figures. The market environment also remains characterized by exceptionally high uncertainty for the time being. Further risks lurk for BASF in the dependence on gas described above. Here, it is crucial how Russia behaves in terms of supply and how long the Ukraine conflict will drag on. Furthermore, there are risks in the renewed flare-up of the pandemic, especially through lockdowns in China. The stock market has already made corresponding price reductions in response to the mixed situation. **Since the last quarterly report on April 24, 2022, the BASF share price has fallen by a further 18% to currently EUR 44.70.

| BASF SE (in EUR million as of Dec. 31 in each case) | 2021 | 2022e | 2023e | 2024e |

|---|---|---|---|---|

| Sales | 78.598 | 76.345 | 81.932 | 83.269 |

| EBITDA | 11.348 | 10.645 | 9.997 | 10.657 |

| EBIT | 7.821 | 6.966 | 6.031 | 6.674 |

| EBIT-Margin in% | 9,95 | 9,12 | 7,36 | 8,01 |

| Net income (GAAP) | 5.523 | 4.923 | 4.243 | 4.601 |

| Earnings per share (EPS) | 6,01 | 5,26 | 4,94 | 5,35 |

| Book value per share (BVPS) | 44,41 | 44,24 | 46,46 | 47,41 |

| Price/sales ratio (MCAP/sales) | 0,41 | 0,42 | 0,46 | 0,45 |

| P/E ratio (current) | 7,5 | 8,6 | 9,2 | 8,6 |

Analysts surveyed by S&P Capital IQ expect revenues to increase by only 6% by fiscal 2024, i.e. skepticism about current growth opportunities is high. Due to the permanent cost pressure and the difficult rollover, the experts even see a declining EBIT margin. The figures also show that the valuation is currently just below book value. However, the expected dividend yield, which is currently calculated at more than 8%, is a reconciling factor, although this is of course subject to continuity and profit growth. Should the economy experience a dip due to high energy and procurement prices, BASF will likely experience stronger revisions from 2023 onwards.

Conclusion - Well positioned but vulnerable when it comes to energy!

BASF SE has actually had very good years. Sales developed steadily upwards and reached the EUR 80 billion mark in 2021. Through the acquisition of Bayer's agricultural chemicals business, it was also possible to expand very promising business areas further. If the general demand for standard chemical products should decline due to a slowdown in the economy, there are several growth areas in the fields of food production and climate change that BASF can actively support through innovations. Due to the dramatic fall in the external value of the single currency EURO, global diversification is now paying off, although supply chain issues are again having a negative impact. The further developments in decarbonization round off the increasingly green overall picture of the BASF Group. However, the sword of Damocles for major losses would be the loss of Russian natural gas supplies, which can only be remedied by enormous efforts over a timeline of 3 years. For BASF, gas is both an energy source and a basic raw material for a large number of important precursors and intermediates for industrial customers.

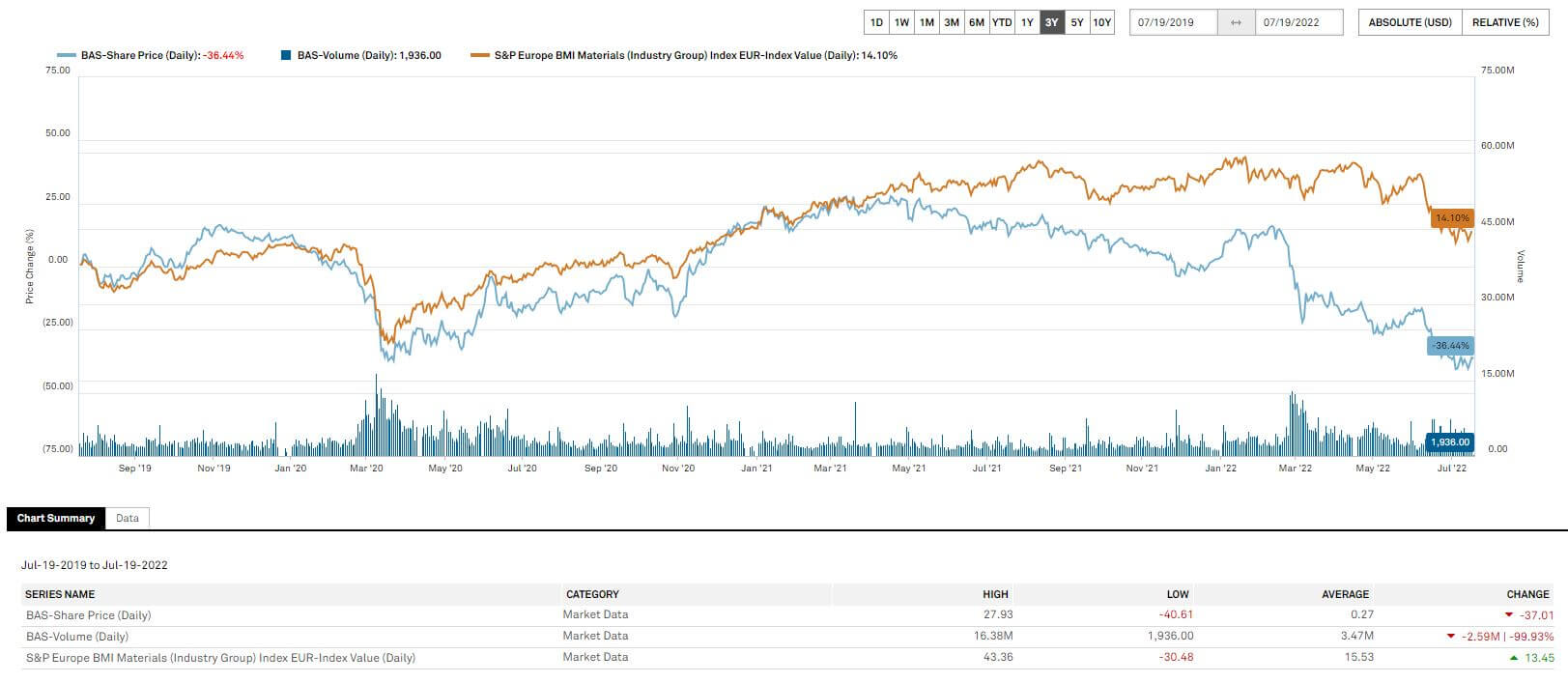

The three-year performance of BASF shares compared to the S&P Europe BMI-Materials EUR-Index Value (Daily) shows a relative underperformance of 50% over a period of 3 years. The chart continuity until March 2021 was subsequently completely abandoned. With the start of the Ukraine crisis in February 2022, the stock market priced the energy risk very strongly into the share price. Turnover in the share reached almost historic dimensions, indicating a sell-off among funds and institutional investors. Whether this already indicates under-investment, the next months should show.

The Bank of America expert Matthew Yates recommended the papers of the Ludwigshafen-based company with a price target of EUR 50 and thereby made a turnaround after the last skeptical assessment. The market fails to recognize the hedging transactions of the oil and gas subsidiary Wintershall, said Yates. Both Swiss bank Credit Suisse and analyst firm Warburg Research lowered their price targets for BASF, but left their ratings at "outperform" and "buy," respectively.

BASF SE's share price has already been through a long ordeal. The current prospects for growth stand or fall with the armed conflicts in Ukraine. The valuation is currently at the lower band, but even the analysts have not yet written off the German industrial pearl. **Yesterday's announcement that Russian gas supplies will be resumed as of July 21, 2022, should ease the pressure on the share price for the time being.