Globex Mining Enterprises: Commodities from A to Z

In the exploration sector, there are those that explore only a handful of properties, letting their investors fund them from one drill section to the next. But there are also multi-explorers who acquire many claims with little money and have them explored by local partners via options contracts. In addition, there is a corresponding royalty (net smelter royalty), which is then due when production begins on the mining property. Globex Mining Enterprises, based in Quebec, calls itself a "Mineral Property Bank" because of its many properties and different commodities. For starters, please refer to our detailed company analysis dated 11/29/2022.

There are a number of good deals to report

CEO Jack Stoch has been in this business since the 1980s, and today the industry veteran is constantly developing his network. The Company's primary goal is not the investment-intensive development of a mining operation but rather the optimization and maintenance of the broadly diversified properties. Currently, the book value of all shares and warrants adds up to more than CAD 20 million. The 650,000 shares in Yamana Gold could be exchanged for cash and shares in Agnico-Eagle as well as Pan American at a high book profit.

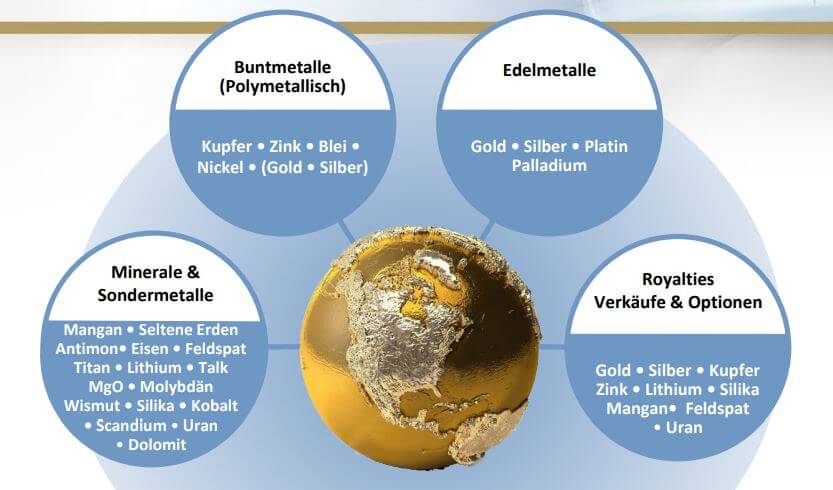

Broad diversification in precious metals, non-ferrous and polymetals, special metals, and rare minerals. 89 royalties and some options.

Globex Mining has recently reported some exploration successes from its partners, with Orford Mining Corp. identifying a new gold-bearing zone 150 meters north of the South Gold Zone on the Joutel Eagle property. Hole 23-JE-007, 201 metres in length, returned 1.3 grams per tonne Au over 16.1 meters, including higher grade intercepts of up to 4.5 g/t Au over 1.1 meters, in a previously untested area of the property. Most assay results from the recently completed 2023 drill program are pending. David Christie, Orford's President and Chief Executive Officer, commented: "The 2023 drill campaign on our Joutel Eagle property has proven that the property has tremendous value potential with the discovery of a new zone 150 meters north of the South Gold zone."

Also fitting into the picture are drill results from Maple Gold Mines Ltd. on the Eagle property. The Company has now released results from the final 20% of samples from the previously completed 14,720 meters of drilling. The district is optioned by Globex Mining and is located in the Telbel mining district of the Joutel project, which is owned by a 50/50 joint venture between Maple Gold and Agnico Eagle Gold Mines Ltd. The last 7,000 meters of drilling continue to demonstrate a continuity of mineralization northwest of the former Eagle Mine. The Eagle-Telbel mine produced a total of 1.1 million ounces at 6.5 grams per tonne gold from 1974 to 1993 when gold prices averaged approximately USD 350 per ounce. In the first year of the joint venture (2021), all historical mining, adit and drilling data was digitized to create a new 3-D geological model. The Company's drilling to date at Eagle has confirmed that gold mineralization is not limited to a narrow stratigraphic interval, but covers a much broader area of over 100 meters.

The discovery of larger deposits enhances the prospects for resuming mining activities at these projects. The terms of the option agreements allow work to continue over several years. Progress through its partners' activities in these areas is a catalyst for further speculative upside for Globex. As new projects are successively acquired, the intrinsic value of Globex shares increases along with them. The recent share price momentum reflects this gradual improvement in value.

Fiscal 2022 and first quarter highlights

In fiscal 2022, Globex generated revenues from sales, option income and upfront royalties from numerous properties of CAD 2 million in the form of nearly CAD 1 million in cash and interests in optionee companies with a fair value of CAD 1.06 million. The bottom line was an after-tax loss of CAD 4.13 million, or CAD 0.07 per share, due to high exploration costs of CAD 1.82 million and property write-downs of CAD 3.64 million. The cash position decreased from CAD 8.33 million to CAD 1.52 million as of December 31, 2022, with short-term investments reported at CAD 8.94 million. The period under review was marked by the sale of the Des Herbiers uranium project and the optioning of the Duquesne West/Ottoman gold property to Emperor Metals. In the area of royalties, there was a further increase from 9 to currently 89 agreements. In the first quarter of 2023, Globex optioned the Lac Escale property in the James Bay area to Brunswick Exploration Inc.

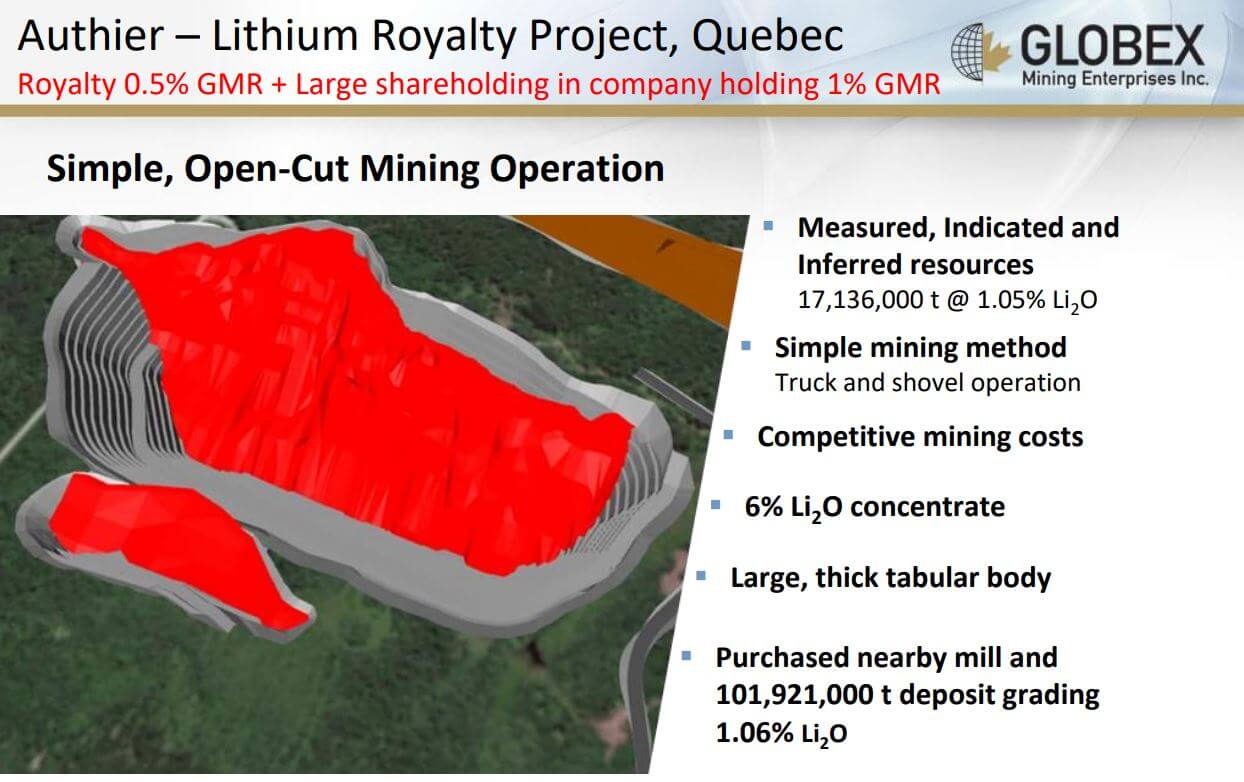

A really big deal beckons with the Authier lithium project, where the voluntary environmental impact assessment by owner Sayona is currently underway. The feasibility study from 2019 provided a potential revenue of CAD 1.4 billion over 14 years, but to date, the lithium price has tripled and was even significantly higher four months ago. This would bring mine revenues from lithium today to just under CAD 4 billion. Globex owns various land rights with a calculated interest of approximately 0.5%. Thus, if Sayona were to implement the project, it could result in annual revenues of about CAD 1.4 million for Globex. The likelihood of realization has increased significantly with Sayona's acquisition of the nearby North American Lithium (NAL) operation in 2021, as spodumene lithium production is expected to resume here shortly.

Interim conclusion: revaluation has started

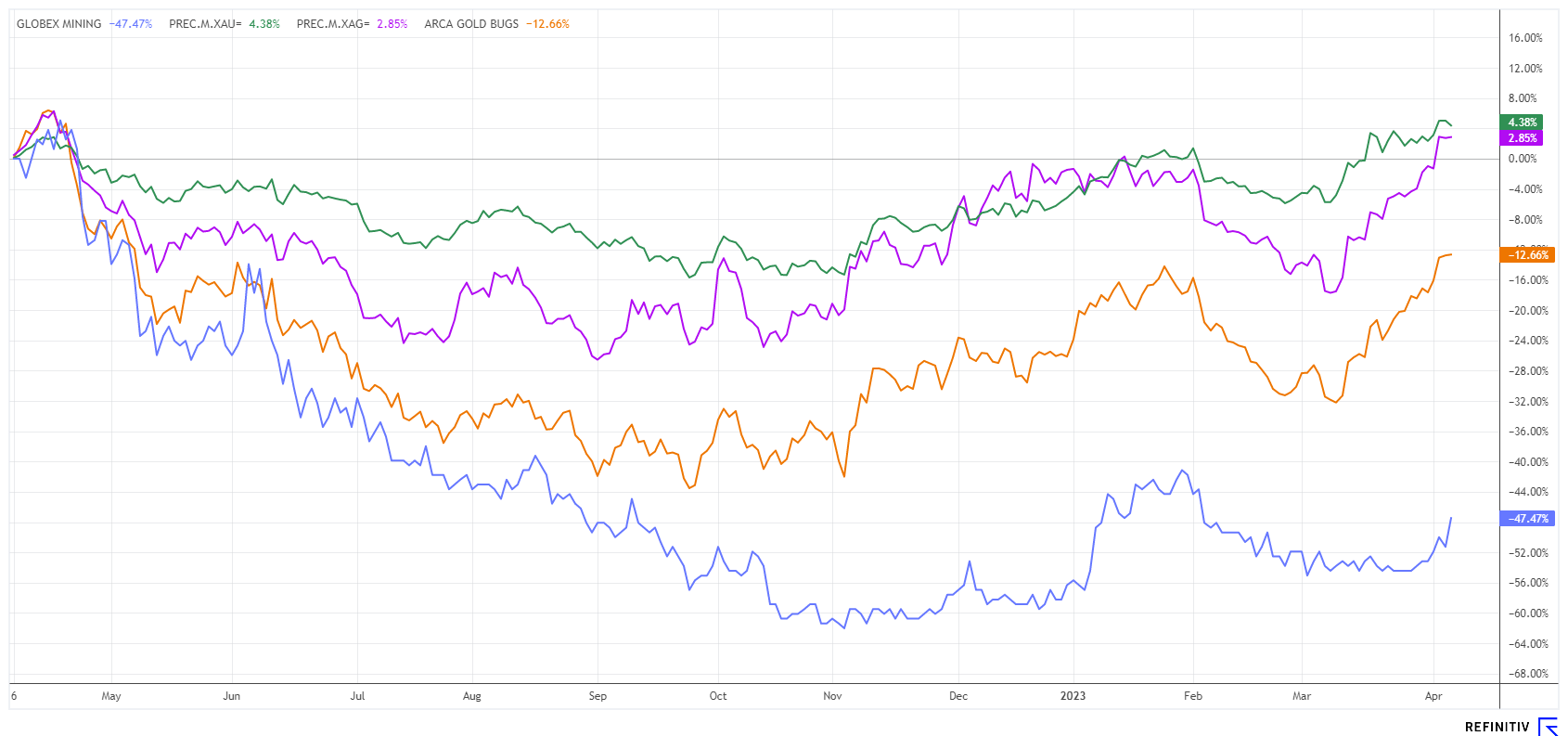

The following chart plots Globex Mining against the broad NYSE Arca Gold BUGS Index (HUI) and metals prices. While precious metals spot prices have already reached positive territory, mining companies, large and small, are just beginning to rebound. One reason for the reluctance of market participants is the cost explosion across the sector, which has increased exploration and producer prices in precious metals by about 20% to 30%. Many mines have already been severely affected by Corona and can only gradually recover from this shock.

Since our initial analysis in November 2022, there has already been a brightening in the value of Globex by about 40%. The GMX share has recently moved significantly from its lows around CAD 0.60, while the market capitalization has risen from CAD 36 million to CAD 48 million within six months. The share price is supported by a constant deal flow, continued option income and new royalty deals. In addition, the Company has a good CAD 10 million in available funds to take advantage of opportunities. Based on high project quality, several promising deals and reported progress in the investment portfolio, Globex can be expected to outperform the junior market over the next 24 months.

The update is based on the initial report 11/2022.