Sonora - A historical place for gold and silver

Sonora is Mexico's best-known state when it comes to the mining industry in the Central American nation. The region has long been the world's largest producer of silver, but gold can also be found in industrially recoverable quantities. Locally, several well-known mining companies like Fresnillo, Argonaut Gold, and Minera Alamos are bustling about.

These parameters provide a small hedge against inflationary spikes and wildly fluctuating metal prices. Resident producers at the San Antonio, La Colorada and San Francisco properties are operating at grades ranging from 0.4 to slightly above 1.0 g/t Au, according to the latest published NI 43-101 reports, with recovery rates ranging from 50% to 90%. The results already determined for the Pilar project are above the regional average by comparison. Good conditions for Tocvan to gain a foothold in the region with profitable production.

Rapid progress in the concession areas

At the Pilar gold-silver project in Mexico, Canadian company Tocvan Ventures recently started large-scale sampling. The gold- and silver-bearing material is to be collected and prepared for the heap leach process. A rock grinding mill and conveyor belt system are already in place. In parallel, the soil will be prepared for heap leaching and neatly sealed to prevent contamination. For this purpose, a gravel bed will be backfilled as drainage after soil sealing. **The supervision for this phase of the project will be carried out by the experts of the Laboratory of Technological Metallurgy (LTM), which is also ISO certified, located in the city of Hermosillo.

Work is entering the next phase

This major project aims to lay the foundation for future gold and silver production so that the rock can be optimally opened up and the maximum amount of gold and silver can be extracted. In parallel, the Company continues to explore the property and plans to collect additional trench samples to identify the next 83 drill locations. The concession obtained will provide access for planned infill and step-out drilling along the 1.2 km trend that remains largely untested at Pilar. Information from the samples will be used to plan and permit on-site mining and processing facilities at Pilar.

The first results are in

Over 1,200 tons of material have been stockpiled and the first material shipments have been completed. The crushing, screening circuit and laboratory set-up have been completed, and now the screening of the material is starting. Independent of the bulk sample, the results of the initial diagnostic leach tests for precious metals indicated high-grade mineralization, with the 5 samples in question averaging 6.2 grams Au, 7.6 g/t Au, 1.3 g/t Au, 11.1 g/t Au and 7.6 g/t Au, respectively. Preliminary results of the study indicate that free gold is present in the samples and were visually confirmed by testing sieved material. A gravity concentrator unit is used to formally test for the presence and abundance of free gold in the finer grained fraction. At Pilar, trenching associated with the bulk sample exposed several underground workings along quartz vein structures, another indicator of the robust mineralized system and a useful tool for mapping new high grade structures.

"This is a very exciting time for us as we prepare for the first bulk sample of surface material from Pilar. This will set the stage to move Pilar towards development and present the expected maximum grades and recovery rates in our key oxide zones." CEO Brodie Sutherland said.

The work will be facilitated by excellent infrastructure that allows full access. Pilar is located 130 km southeast of Hermosillo, the capital of Sonora. It takes only 150 minutes to reach the project site near the town of Suaqui Grande on a mostly paved road. The El Picacho concession area is located about 145 km north of Hermosillo and can be reached within 2 hours. The long mining history in Sonora has led to the settlement of industry experts, enabling rapid mine development. The permitting process with local authorities and jurisdictions is simple and has not caused any problems to date.

High interest at the PDAC mining exhibition

In early March, CEO Brodie Sutherland presented further progress on Tocvan's projects in Sonora, Mexico." The experts at the International Investment Forum inquired directly with the board and published the following interview:

Good shareholder structure and still few issued shares

The low number of Tocvan shares issued, totaling 38.76 million, and the manageable amount of options (2.7 million at an average of CAD 0.54) and warrants (10.1 million at an average of CAD 1.18) are convincing. The Company has had little dilution to date, with significant blocks of shares (10%) held by founders and management. With a current share price of approx. CAD 0.73, the stock is currently on the upswing. Before the turn of the year, the share price had slipped to CAD 0.36 due to tax-induced sales ("tax-loss season").

However, the times of gloom are now over. That is because the continuation of the drilling programs means that there is more transparency about the level of the resource in the properties. In the evaluation of the latest drill programs, Tocvan has enlisted the help of a local major. In our opinion, this is not without greater background. The high attractiveness of the examined zones can very quickly lead to a strategic deal, which will certainly attract attention again in the promising mining zone "Sierra Madre Gold Silver Belt". A sale of the properties would immediately make the current discount to intrinsic value transparent.

Interim summary: Fast rally, but more to come

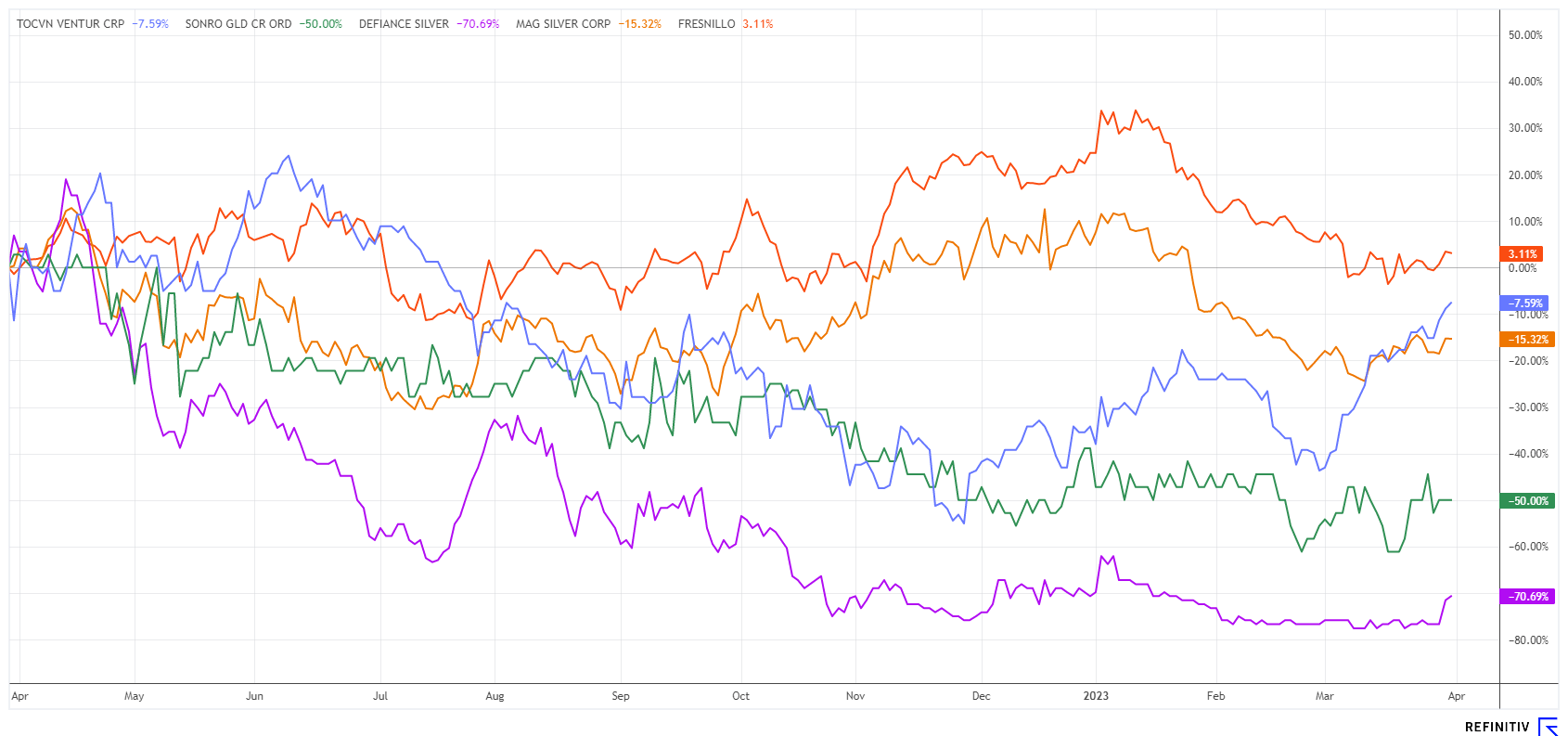

In a 12-month performance comparison, TOC stock is only slightly behind major Fresnillo and even ahead of MAG Silver, which has been mining successfully in the area for years. Sonoro Gold and Defiance Silver are other juniors operating in Mexico. They are still clearly behind in price development.

Precious metals have already gotten off to a good start in 2023 and are technically at important marks. Gold, for example, is only a short distance from its major technical resistance at USD 2,050, currently around USD 1,980, which suggests a lot for the coming months. With the good interim results in the exploration sector, Tocvan shares should also continue to advance. The stock is relatively liquid, trading over 300,000 shares on good days. It is listed in Canada and Germany and is well-known within the sector.

The update is based on the initial report 09/2022