Mexico - Searching for Gold since the Aztecs

The history of gold in Mexico dates back more than 600 years. After Columbus discovered America in the 15th century, he heard about the fabulous treasures of the indigenous people, especially the Aztecs, who ruled in what is now Mexico. Gold already possessed a magical attraction at that time, spreading not only across the Aztec empire but also from South America to the Incas and Mayas. The first Spanish sailors kept getting shiny gifts from the Aztecs; thus the greed for gold was awakened among the Spaniards. The Aztec gold made the Spanish one of the richest countries in Europe at that time. Then, in the 16th century, the Spaniard Hernandez Cortes landed near what is now Vera Cruz, where he was repeatedly showered with gifts of gold by the Aztec king Montezuma. **The gold that came from the Pacific coast was brought with pack animals across today's Panama, in the course of the later built canal, to the Caribbean coast and from there shipped to Spain. Later, the conquistadors completely wiped out the Aztec people, and the search for gold spread throughout the country.

Mexico is still an important gold and silver state today because of its turbulent history of European conquerors. In terms of silver, it is currently still among the top three producers, but reserves are also declining sharply. In 2021, the country produced 5,600 tons of the precious metal, followed by Peru with about 3,000 tons. Recoverable reserves were estimated by the United States Geological Survey (USGS) at 530,000 tons worldwide in January 2022. Of this, Peru accounted for 120,000 tons, Australia for 90,000 tons, Poland for 67,000 tons and Russia for 45,000 tons. Together, these four countries hold about 61% of the world's reserves. The range of the reserves is still just under 23 years.1

Gold and silver production declines slightly

Due to restrictions during the COVID pandemic, world gold and silver production declined slightly in recent years. For example, gold production fell from a record 3,652.5 tons in 2018 to 3,560.7 tons in 2021. The world market price for gold and silver has now returned to the USD 1,670 and USD 19 zone after peaks of USD 1,950 and USD 48 in 2011 and USD 2,050 and USD 29 in 2020, respectively.

This is how much gold was produced in 2021.

Worldwide, production costs average USD 1,150 or 16.50, and with the sharp rise in energy costs, producer prices for precious metals are likely to be significantly higher again in 2022. Thus, more suppliers will successively disappear from the market, and the circulating gold volume could continue to decline. Mexico offers the possibility of cheap open pit mining in most parts of the country, which allows even low-grade mineralization to still be mined profitably.2

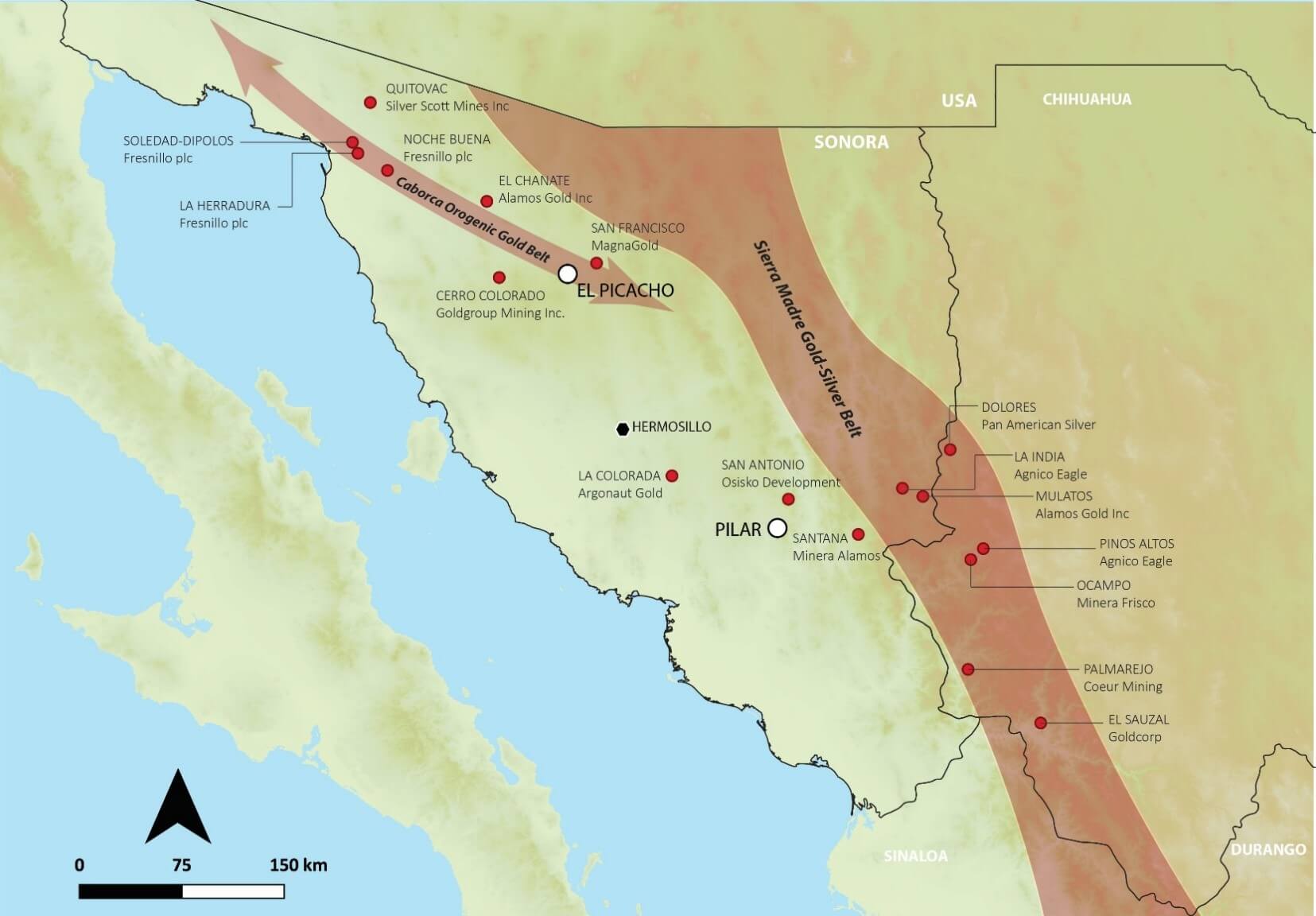

Sonora - In the desert lie the treasures

Sonora is Mexico's best-known state when it comes to the mining industry in the Central American nation. The region has long been the world's largest producer of silver, but gold can also be found in industrially recoverable quantities. Locally, a number of well-known mining companies, such as Fresnillo, Argonaut Gold and Minera Alamos, are bustling about. With its barren landscape and desert-like structure, Sonora is known for low-cost, open-pit, leachable deposits. These parameters provide a small hedge against inflationary spurts and wildly fluctuating metal prices. Resident producers at the San Antonio, La Colorada and San Francisco properties are operating at grades ranging from 0.4 to slightly above 1.0 g/t Au, with recovery rates varying from 50% to 90%, according to the latest published NI 43-101 reports. The results already determined for the Pilar project are above the regional average by comparison. **Good conditions for Tocvan to gain a foothold in the region with profitable production.

Tocvan Ventures - In the thick of things instead of just being there

Tocvan Ventures has secured two gold projects on site called Pilar and El Picacho and has already done some exploration work since 2020. Trenching work has already been done on Pilar, rock sampling has been done, geophysical analysis has been done, and most importantly, drilling has been done. Almost 23,000 meters of drilling have already been completed and the results are more than impressive. The last drill program delivered up to 1.6g gold over a length of 94.6m. A section of this drill hole even came to 10.8g gold and 38g silver over a proud 9.2m. These are outstanding values, considering that an economic open pit mine can be operated here as well as across the Nevada border from as little as half a gram of gold per ton. **Some of the results from Tocvan's drilling teams are better than those from the already producing Argonaut and Minera Alamos mines.

The mineralization at Pilar occurs at surface in a highly fractured and oxidized host rock. The gold and silver oxides are heap leachable. Metallurgical studies show that gold recovery is above the regional average, this makes the Company very confident about bulk sampling. The work is facilitated by excellent infrastructure that allows full access. Pilar is located 130km southeast of Hermosillo, the capital of Sonora. It takes only 150min to reach the project site near the town of Suaqui Grande on a mostly paved road. The El Picacho concession area is located about 145km north of Hermosillo and can be reached within 2hrs from Hermosillo. The long mining history in Sonora has led to the settlement of industry experts, enabling rapid mine development. The permitting process with local authorities and jurisdiction is simple and has not caused any problems to date.

Gold recovery rate is well above average.

Both of Tocvan's projects are located near producing mines or major projects moving towards development. At Pilar alone, there are three major projects within a radius of up to 80 km: Osisko Development's San Antonio Project, Minera Alamos' Sanatana Mine, and Argonaut Gold's La Colorada Mine. The El Picacho property is located within the "Caborca Orogenic Gold Belt", also referred to as the Mojave-Sonora Megashear. This trend hosts large deposits such as Fresnillo's LaHerra dura mine and Magna Gold's San Francisco mine. The Company is well positioned to attract a major regional development partner.

Recent results from Pilar and El Picacho convince

The Pilar gold-silver concession has recently achieved some of the best drill results in the region. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is poised to become a potential producer. Pilar is interpreted to be a structurally controlled epithermal system with low sulfidation hosted in andesite rocks. Three primary zones of mineralization have been identified in the northwestern portion of the concession area from historical surface work and drilling. They are designated the Main Zone, North Hill and 4-T. The Main Zone and 4-T trends are open to the southeast, and new parallel zones have recently been discovered. To date, nearly 23,000m has been drilled and assayed.3

- 2022 Diamond Drilling Phase III Highlights include (all lengths are drilled thicknesses):

• 116.9m @ 1.2 g/t Au, of which 10.2m @ 12 g/t Au and 23 g/t Ag

• 108.9m @ 0.8 g/t Au, of which 9.4m @ 7.6 g/t Au and 5 g/t Ag

• 63.4m @ 0.6 g/t Au and 11 g/t Ag, of which 29.9m @ 0.9 g/t Au and 18 g/t Ag - 2021 Phase II RC drilling highlights include (all lengths are drilled thicknesses):

• 39.7m @ 1.0 g/t Au, of which 1.5m @ 14.6 g/t Au

• 47.7m @ 0.7 g/t Au of which 3m @ 5.6 g/t Au and 22 g/t Ag

• 29m @ 0.7 g/t Au

• 35.1m @ 0. 7 g/t Au - 2020 Phase I RC drilling highlights include (all lengths are drilled thicknesses):

• 94.6 m @ 1.6 g/t Au, including 9.2 m @ 10.8 g/t Au and 38 g/t Ag;

• 41.2 m @ 1.1 g/t Au, of which 3.1 m @ 6.0 g/t Au and 12 g/t AG;

• 24.4 m @ 2.5 g/t Au and 73 g/t Ag, of which 1.5 m @ 33.4 g/t Au and 1,090 g/t Ag - 15,000 m of Historic Core & RC drilling. Highlights include:

• 61.0m @ 0.8 g/t Au

• 16.5m @ 53.5 g/t Au and 53 g/t Ag

• 13.0m @ 9.6 g/t Au

• 9.0m @ 10.2 g/t Au and 46 g/t Ag

Recently, there has been completion of data collection and surface evaluation of the San Ramon prospect within the El Picacho gold-silver project. Historical underground sampling conducted by Timmins Gold in 2008 returned 23 1-2m rock chip samples with values ranging from 0.3 to 22 g/t AU and silver values up to 26 g/t AG. Subsequent sampling in 2016 by Millrock confirmed the high-grade results, as five rock chip samples returned values ranging from 2.0 g/t AU to 18 g/t AU.

Underground mining is believed to have been completed between the 1950s and 1970s. Overall, high-grade gold values were recorded at surface at San Ramon over a 500m trend along a regional overthrust fault contact. The priority drill target area includes this trend and the down-dip extension along the fault at depth to the west for 500m. From the results, it can be concluded that the regional fault is an important conduit for mineralization. Here, the older Precambrian gneiss and the younger Jurassic sediments below the fault show strong alteration and high-grade mineralization.

The El Picacho gold-silver concession is interpreted to be an orogenic gold system within the regional Caborca Orogenic Gold Belt known for producing gold mines that include La Herradura (>10 Moz AU) and San Francisco (>3 Moz AU). The 24 sq km project is located 140 km north of Hermosillo and only 18 km southwest of the producing San Francisco mine. Five primary zones of mineralization totaling over 6 km of prospective trends have been identified throughout the concession area. Surface sampling and historical workings have identified high-grade gold and silver values. The project to date has only seen widely spaced reconnaissance drilling with no follow-up, but the entire district could represent a multi-million ounce deposit.

Where do we go from here technically in the fall of 2022?

With the end of the rainy season approaching, the Company plans to first begin drilling at El Picacho for the San Ramon prospect area. Initial drilling is targeting the 500m x 500m area that has revealed high-grade gold at surface and in underground workings the potential for a near-surface bulk tonnage target. After that, exploration at Javali and Cornea will move to the next round. A total of 15,000m of drilling and 2,000m of trenching are planned.

Planning is underway at Pilar for the next exploration and development phase. This involves 2,000m of infill drilling and 3,000m of step-out drilling. A bulk sample is scheduled to be assayed starting in October, using a local heap leach facility to process material from Pilar. The on-site testing facilities are already fully permitted. Therefore, more details should follow as early as year-end 2022.

What seems very technical here may represent a real valuation leap for Tocvan. For El Picacho, the Company is appropriately confident: they believe it represents an "opportunity for the discovery of a multi-million ounce area." Assuming that the appropriate grades can be proven to a large extent, this assumption is not to be dismissed.

SWOT Analysis

Strengths, Opportunities

- Very good positioning in the Mexican state of Sonora

- Good infrastructure, access to skilled personnel and first-class jurisdiction

- Immediate proximity to producing mines

- Open-pit operation and heap leaching keeps costs low

- Strategic partnerships facilitate further exploration steps

- Potential acquisition candidate

Weaknesses, Threats

- Dependence on rising precious metal prices

- High cost pressure due to high energy prices

- Continuing weak stock market trend at Juniors

Shareholder structure convincing, share price offers good entry opportunity

Given the strong exploration results and assessments gained over the past year, CEO Brodie Sutherland is optimistic: "We look forward to continuing the initial large-scale sampling at Pilar to further confirm the grade and recovery of gold and silver. This information will facilitate our permitting of our own pilot plant at Pilar. At the same time, drilling will commence at our El Picacho project, initially targeting our prospective San Ramon area, one of several target areas already permitted for drilling. Pilar still has expansion potential and will remain a focus for us as drilling continues on several trends that remain open to the southeast. Over the past two years, our success has attracted corresponding interest from major regional producers. We look forward to building on that success and establishing strong relationships during the upcoming operating season and beyond," CEO Brodie Sutherland said.

CEO says interest from producers is present.

The low number of Tocvan shares issued, totaling 36.27 million, and the manageable amount of options (1.68 million at an average of CAD 0.38) and warrants (1.37 million at an average of CAD 0.72) are compelling. The Company has had little dilution to date, with significant blocks of shares (15%) held by founders and management. With a current price of approx. CAD 0.67, the stock is in the lower third of the 12-month price trend, but low buying activity in recent days already shows considerable price premiums of 20%. Approximately 1.244 million expiring warrants with a basis of CAD 0.72 were extended by another six months in September, which secures the Company additional financing possibilities at higher price levels.

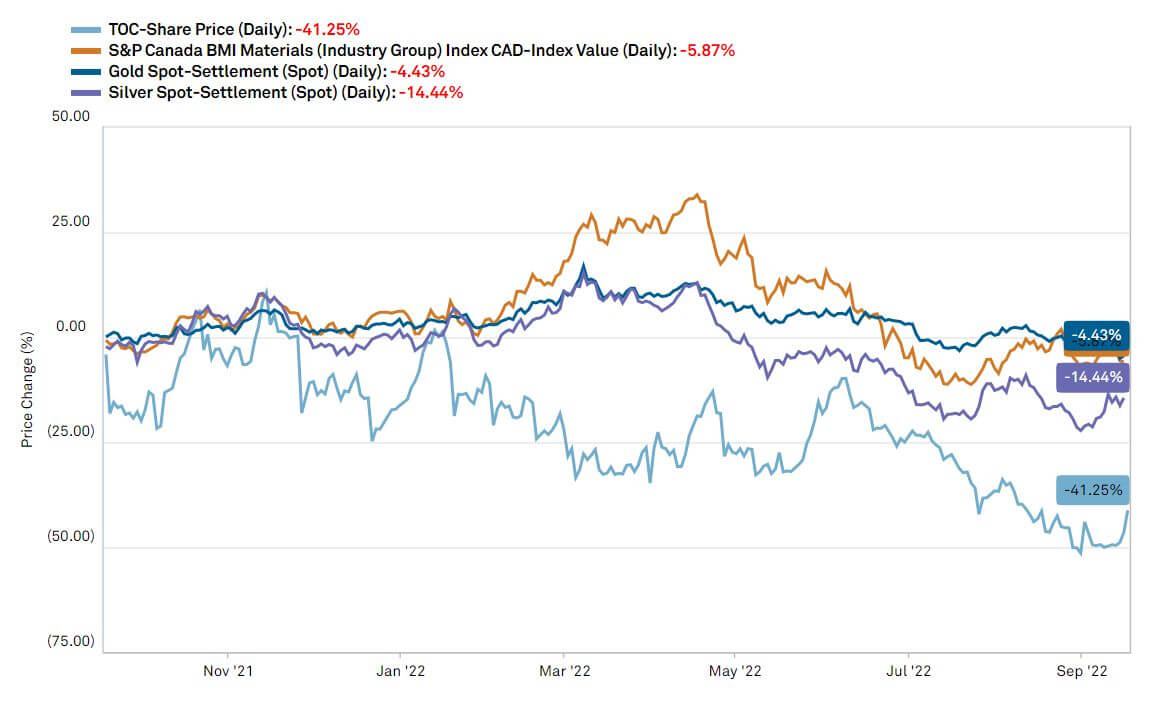

In a 12-month performance comparison, TOC stock is still underwater by about 40%. However, the trajectories of gold and silver also still remain in negative territory over the period under review. Within the junior sector, the TOC share has good comparative parameters in the sector comparison "Explorer Mexico " The share is relatively liquid and trades over 200,000 shares on good days. It is tradable in Canada and Germany.

Conclusion: Very good projects, the strike rate is increasing

Tocvan Ventures is noticeably increasing its current strike rate. With the continuation of drilling programs, there is more transparency on the number of resources in the properties. In evaluating the latest drill programs, Tocvan has enlisted the help of a local major. In our opinion, this is not done without a larger background. The high attractiveness of the examined zones can very quickly lead to a strategic deal, which will certainly attract attention again in the promising mining zone "Sierra Madre Gold-Silver Belt".

For the moment, precious metals prices remain somewhat depressed, hovering in the lower quartile of recent months. Nevertheless, high-inflationary periods have always led to a pickup in gold and silver prices. The overall stability in the value of precious metals is documented by the 8.2% appreciation per annum over the past 24 years. The performance of the mine operators nevertheless lags behind the spot prices of the precious metals. The current chart performance of the Tocvan share looks more like a lower reversal, especially since the last sell-off spurts in the metals have not led to further sell-offs. A convergence of the share price to the 12-month moving average at CAD 0.80 to 0.90 is very likely from the current upward momentum of the price (mean reversion). If the Company can also come up with a strategic deal, the share price should go much higher and lure out the holders of the warrants with an exercise price of CAD 0.96. This brings further growth capital on board and clears the way for a revaluation.

Note: The Company is presenting at the Discoveries Mining conference in Hermosillo on October 5. researchanalyst.com will continue to follow the Tocvan Sonora story closely.