Germany's largest universal bank is back in business

Key financial targets for 2022 have been achieved

After challenging years of transformation and overcoming the banking and sovereign debt crisis from 2008 to 2017, Deutsche Bank has regained its 2007 earnings level in 2022. Pre-tax profit increased by 65% YOY to EUR 5.6 billion. This was driven by 7% higher revenues and a 5% YOY reduction in non-interest expenses. The cost-income ratio improved to 75% from 85% in 2021.

After-tax profit more than doubled YOY to EUR 5.7 billion. The result included a positive tax effect of EUR 1.4 billion due to a valuation adjustment on deferred tax assets. That was due to the bank's continued good business performance in the US. After-tax return on average tangible equity (RoTE) increased to 9.4% in 2022, up from 3.8% in the previous year. Earnings per share improved by 154% to EUR 2.37, up from EUR 0.93 in 2021. The dividend will be increased from EUR 0.20 to EUR 0.30, raising the dividend yield to around 2.5%.

Over the entire transformation period, adjusted costs excluding restructuring costs and bank levies, were reduced by more than EUR 3 billion, with personnel expenses falling by around EUR 1 billion as the bank has cut around 3,000 jobs and adjusted the structure of its workforce since 2019. Furthermore, IT costs were reduced by around EUR 0.5 billion, despite cumulative expenses of around EUR 15 billion over the course of the transformation. In addition, there was a reduction of around EUR 0.5 billion in the cost of consulting services and more than EUR 1 billion in other savings, including building costs, operating taxes and insurance, and travel and marketing expenses.

Restructuring unit continues to reduce risks

From 2019 to the end of 2022, the Capital Release Unit (CRU) has positively contributed around 45 basis points to Deutsche Bank's Common Equity Tier 1 ratio. In this context, the cumulative positive effect from the reduction in risk-weighted assets (RWA) has exceeded the charges from CRU losses over this period. The net effect from the reduction of the leverage position made a positive contribution of approximately 55 basis points to the improvement in Deutsche Bank's leverage ratio over the same period. "Our 2022 results illustrate the progress we are making in transforming Deutsche Bank," said Chief Financial Officer James von Moltke.

The middle market winds its way out of the crisis

In the corporate bank, earnings rose by 23% YOY to EUR 6.3 billion. Net interest income increased by 39%, while net fee and commission income rose by 7%. Higher interest rates, strong operating performance, higher business volumes and positive exchange rate effects contributed to this. All business areas of the corporate bank contributed to the earnings growth. In Corporate Treasury Services, revenues increased by 24%, Institutional Client Services by 22%, and Business Banking by 19%. Deposits increased by 7% or EUR 18 billion during the year, while at the same time, average gross loans were 7% or EUR 9 billion higher than in the previous year.

Provision for losses on loans and advances increased to EUR 1.2 billion in 2022 from EUR 515 million the previous year. This was due to the more challenging macroeconomic environment against the backdrop of the war in Ukraine. In contrast, the previous year had benefited from an economic recovery following the easing of pandemic-related restrictions. As a result, the allowance for losses on loans and advances for 2022 was 25 basis points of average loans. The allowance for non-performing loans was EUR 1.0 billion, spread across all regions and loan categories. Additions to loans that continued to be serviced were EUR 204 million - this was due to macroeconomic forecasts becoming gloomier for much of the year.

Further steps towards greater sustainability

Sustainability is an important pillar of Deutsche Bank's transformation program. While improving sustainability criteria also requires investments, e.g., expanding expertise, increasing internal ecology or introducing ESG data technology, the bank is publishing concrete figures for these investments for the first time.

To systematically develop the bank's business toward sustainable investments and financing, around EUR 500 billion in lending and deposit business is to be subject to the sustainability principle. The focus here is on CO2 neutrality and building up green assets.

"By taking a pioneering role in ESG, we are also becoming more attractive to investors in a rapidly growing market. As a global universal bank firmly rooted in Europe, we believe we are very well positioned for this rapidly evolving environment."

By 2050, loan and investment portfolios are to be entirely carbon neutral (Net Zero Banking Alliance). Lending to carbon-intensive sectors of the economy is to be subject to stricter guidelines.

Deutsche Bank wants to be a role model in its actions and shape the necessary cultural change within its transformation. This entails involving all stakeholders in decision-making processes and creating a robust set of rules for dealing with social and environmental issues.

Outlook: Targets for 2025 firmly in sight

Deutsche Bank has confirmed its financial and capital targets for 2025. It aims to achieve an after-tax return on average tangible equity (RoTE) of more than 10%, annual revenue growth of 3.5% to 4.5%, and a cost/income ratio below 62.5%. Furthermore, the bank aims to maintain a permanent hard core capital ratio of around 13% and distribute half of the after-tax profit attributable to shareholders from 2025. **Analysts see earnings per share rising to around EUR 2.55 by 2025, meaning the expected dividend could almost triple.

Interim conclusion - Back in the focus of investors

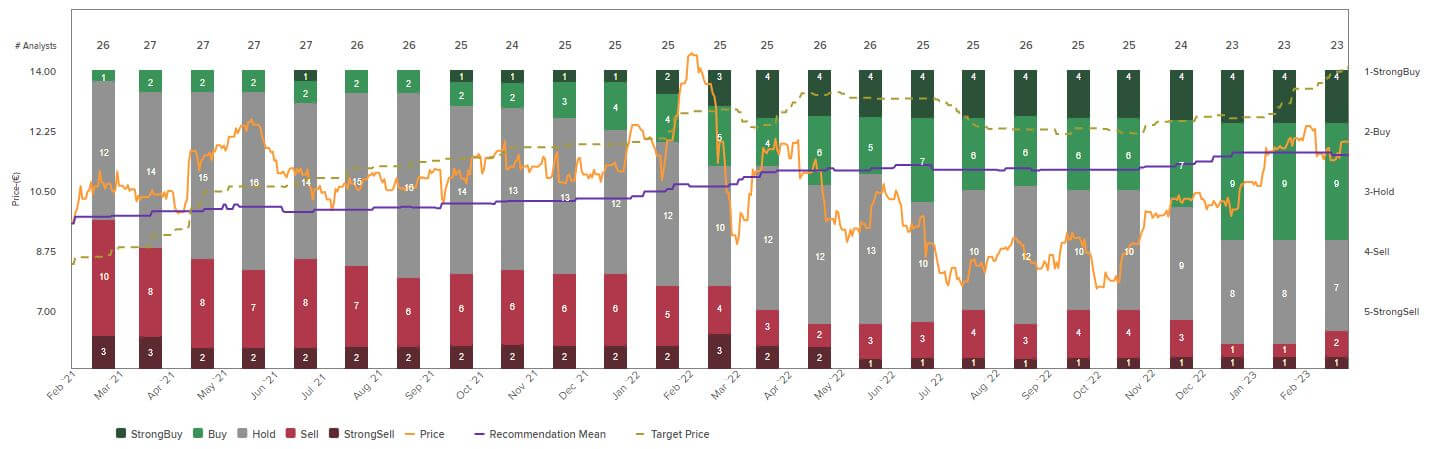

Rising analyst ratings

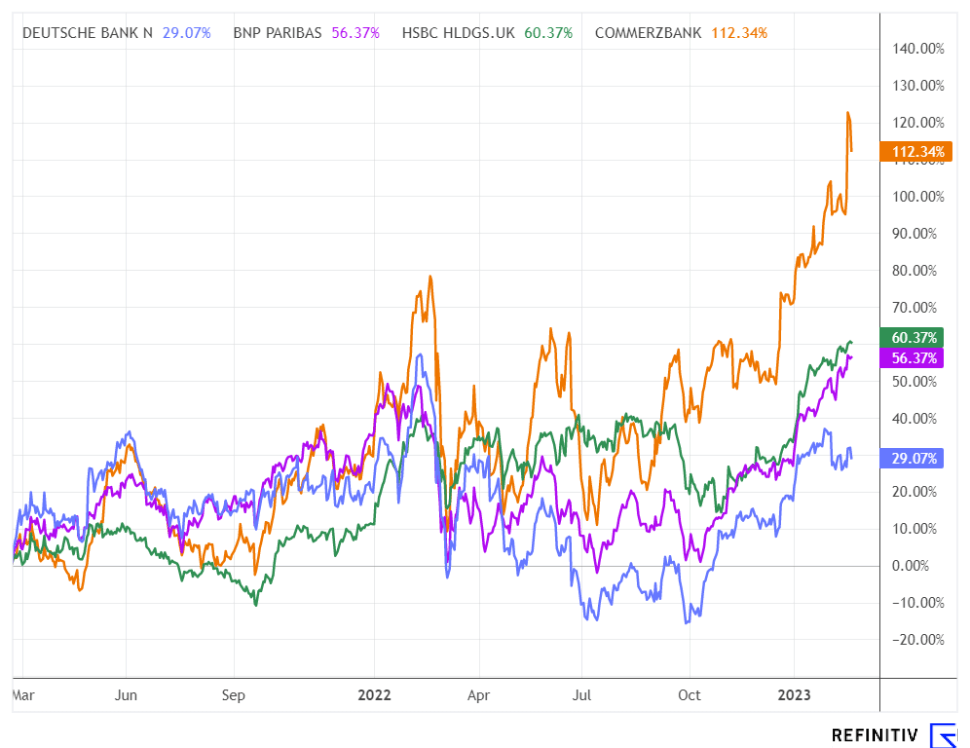

Assuming a largely stable capital market environment, net interest income can be expected to show a strong upward trend in the years 2022 to 2025. The low-interest rate environment has returned to normal; thus, earnings in the traditional banking and investment sectors are also rising. Investment banking could become a revenue pillar again as the financial market climate improves. Overall, Deutsche Bank is very well positioned in the competitive European environment.

The valuation discount to the peer group is currently still too large. Nevertheless, the recommendation rate of analysts has been gradually improving for a year. In the meantime, the analyst firms have adjusted their estimates upwards and, on average, expect a price target of over EUR 14 on a 12-month horizon.

From a current perspective: Still undervalued

A lot has happened fundamentally since our initial analysis in February 2022. With net income doubling to EUR 5.7 billion, the core capital ratio reached 13.4% last year. Starting from a 52-week low of EUR 7.25 in October 2022, the share price has already risen by almost 70%, which is one of the best share price performances in the DAX 40. Nevertheless, the bank is valued very low in international comparison. With a market capitalization of EUR 24.2 billion, Deutsche Bank is far behind in international size comparison and only ranks 11th in Europe.

If no unexpected negative scenarios impact the share's consolidation trend, the Deutsche Bank share can become one of the best performers from the DAX Index. While there are risks from the increasing number of insolvencies in the middle market financing segment, asset management and the private client's sector make a solid contribution to profits.