One of the largest gold producers in the world

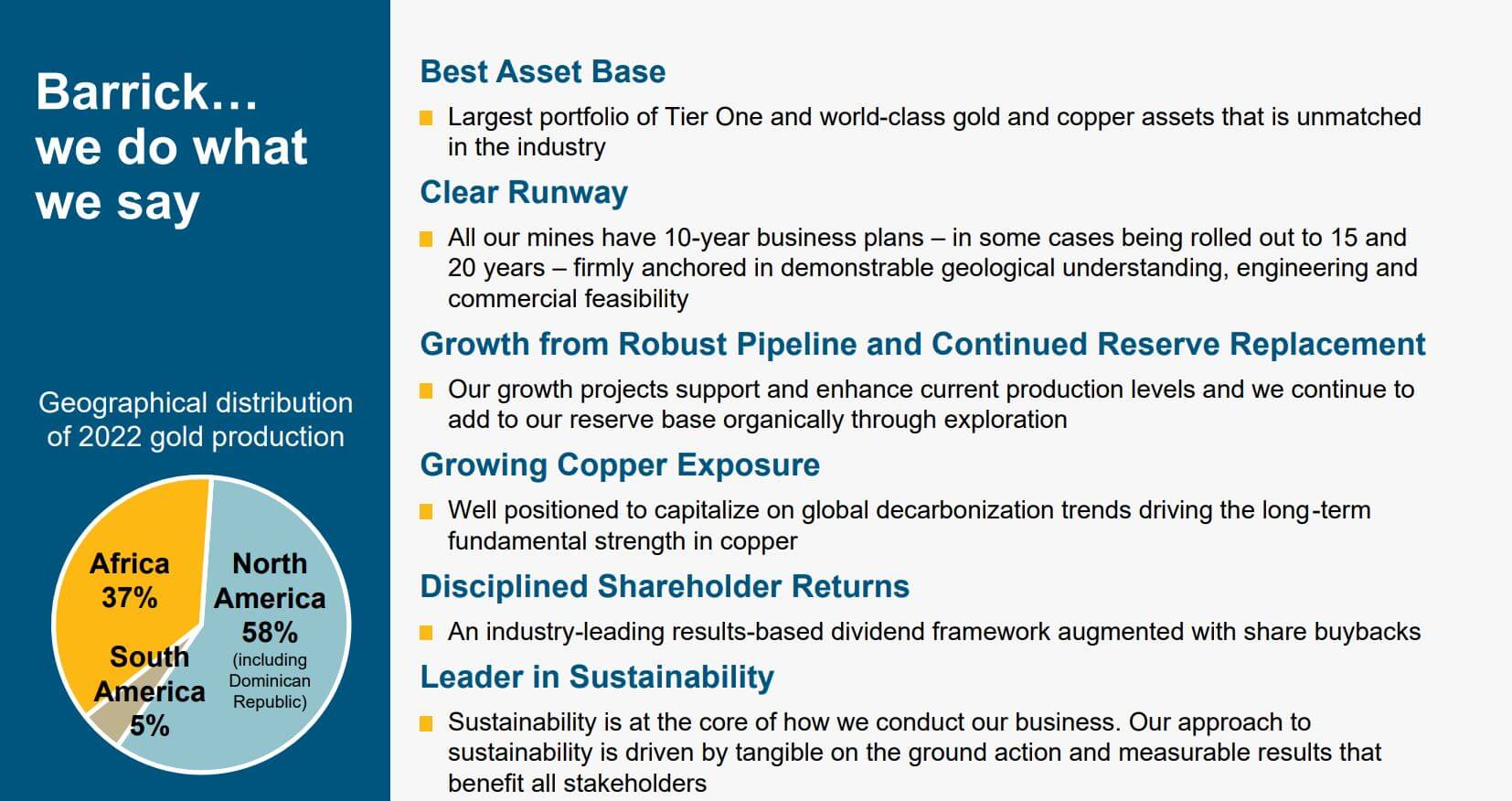

Canada's Barrick Gold Corporation, headquartered in Toronto, is one of the world's largest gold producers, along with Newmont Mining and Agnico-Eagle. Its properties are located primarily in North and South America and Africa. Negotiations are currently underway to acquire a large gold mine in Pakistan, and the idled operation in Papa New Guinea is about to reopen. Barrick Gold has undergone a long consolidation after implementing a debt-heavy acquisition strategy shortly after the financial crisis that put the group in dire straits with the subsequent gold price decline in 2015. High financial discipline under new chief executive Mark Bristow (since 2019) has reduced net debt to zero and achieved record gold and copper production.

Production record in difficult 2022

Barrick Gold can be more than satisfied with its results in 2022. A brilliant final spurt of plus 13% in the 4th quarter surprised even the skeptics. The final gold production for the full year of 4.14 million ounces was 1% below the previously forecast 4.2 million ounces. Still, the group overcame all the challenges of a difficult year. Copper production of 440 million pounds landed in the expected range of 420 to 470 million pounds, confirming the recently announced copper offensive.

Barrick delivers another production record in 2022

The average realized market price for gold in the fourth quarter was USD 1,726 per ounce, and for copper, USD 3.63 per pound. Due to good recoveries at the Cortez, Carlin and Tongon gold properties, Barrick achieved its historic best production result. Compared to the third quarter, production costs per ounce were actually 2.2% lower in the final quarter, with all-in sustaining costs (AISC) per ounce reaching an annual average of USD 1,222. Thus, Barrick earned operationally about USD 500 per ounce delivered, which is also a historical record. Copper production in the fourth quarter was significantly lower than in the third quarter due to higher stripping, lower throughput and lower grades at Lumwana. In addition to lower sales at Lumwana, Zaldívar also incurred higher input and operating costs. The average producer price (AISC) landed at USD 3.18 per pound. Group operating cash flow reached USD 3.48 billion, down from USD 4.38 billion a year earlier. The annual dividend was nevertheless raised from USD 0.37 to USD 0.65.

The following table contains the final annual figures for 2022 and guidance for next year:

Continued operations possible in Papua New Guinea

Worldwide, project mineralization grades are declining. In addition, there is an increasing lack of high-quality development projects and declining reserves at active mines. Major producers such as Barrick are, therefore, increasingly focusing on acquisitions in addition to the further development of their own projects and exploration activities. Experts expect a significant increase in M&A activity in this area, as rising gold prices lead to stronger cash flows. This means that substantial funds are available for acquisitions, and the Company's own securities serve as a robust currency in share swaps.

Barrick scored a major success on the Porgera Mine in Papua New Guinea. The Government of Papua New Guinea (PNG), Barrick Niugini Ltd and New Porgera Ltd signed a long-awaited agreement to resume operations at the Porgera gold mine. The mining operation is one of the largest gold mines in the world and was closed during the Corona pandemic. It is believed that reserves of another 10 million ounces may exist there. Barrick anticipates annual production of about 700,000 ounces once the Wanigma pit is ramped up again. However, the Company is not solely entitled to the production. New Porgera's equity is shared 51% by stakeholders in Papua New Guinea, plus local landowners and the Enga provincial government. Therefore, the economic benefit is shared 53% by PNG stakeholders and 47% by Barrick Niugini Limited. But even the nearly 350,000 ounces of gold that could be attributed to Barrick represent an 8% increase in production for the group. Porgera nevertheless remains excluded from the 2023 forecast for the time being. The production data will only be included after the final agreements for the implementation of the Commencement Agreement and the schedule for the resumption of full mine operations have been completed.

Analysts' views are mixed

Significant cost increases on the production side have prompted analysts worldwide to lower their expectations for the resource sector. Nevertheless, Barrick's share price has risen 16% since the Company announced its 2022 annual results. The median consensus expectation for 2023 is for revenue to increase from USD 11.05 billion to around USD 11.58 billion. Operationally, earnings (EBIT) are expected to settle in the USD 2.97 billion range, rising to around USD 3.6 billion in 2024. The resulting net profit is estimated at around USD 1.15 billion and will only rise again to around USD 1.60 billion in 2024 due to persistently high costs. A cheapening on the energy side is expected.

Barrick wants to set new standards in copper

Barrick's guidance for gold production is 4.2 to 4.6 billion ounces or 420 to 470 million pounds of copper. Input costs are expected to remain unchanged in 2023. Important to management is the transformation of energy requirements to a sustainable dimension. These transformations will impose costs but are a prerequisite for the mining group's green credentials. Globally investing funds pay strong attention to ESG compliance and continuous evolution towards sustainability. A solar plant has been installed at one of its largest mines Loulo-Gounkoto, which reduces CO2 emissions by 62,000 tons per year - a welcome step!

Interim conclusion: The road to the north has been taken

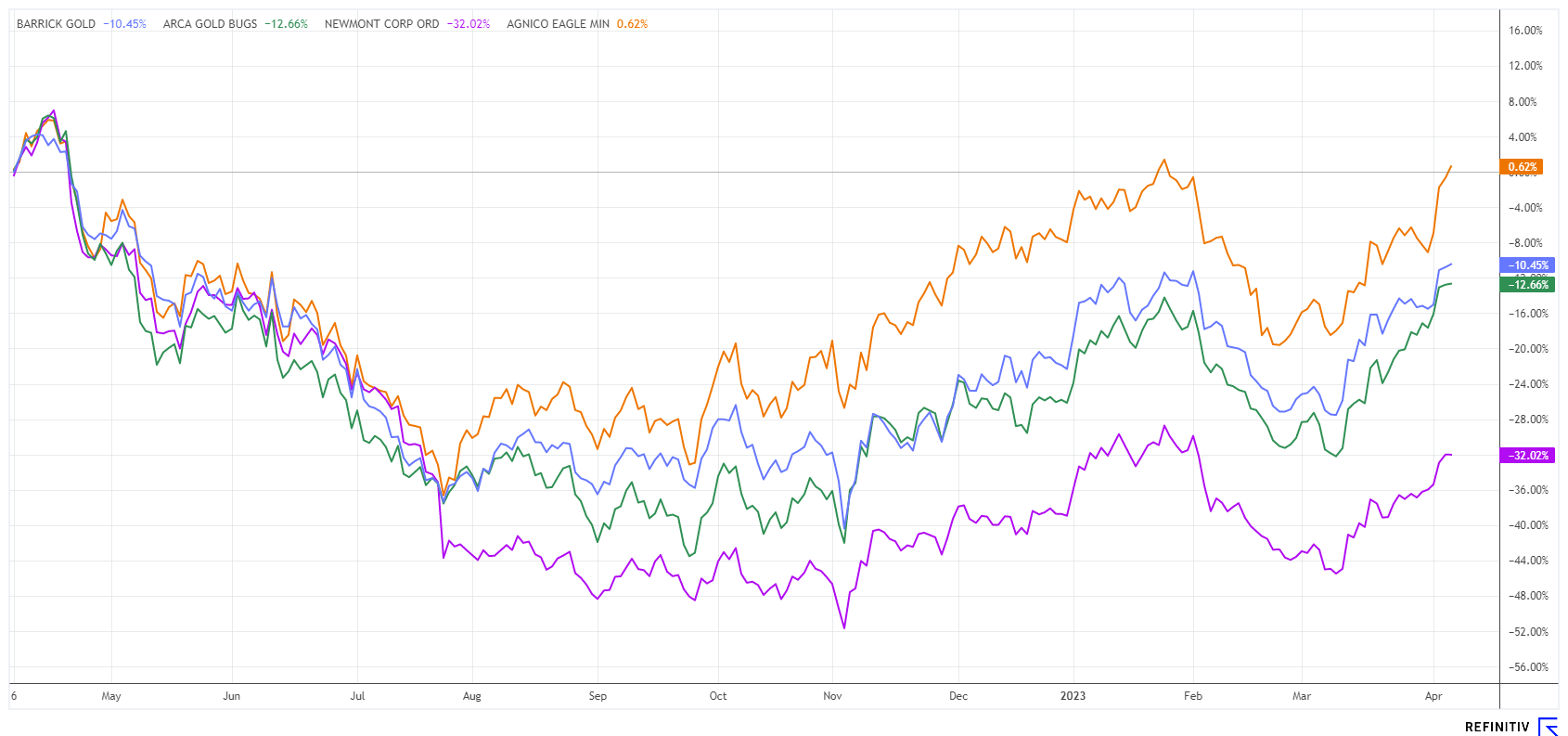

Worldwide, mining stocks are still underrepresented in investors' portfolios after years of underperformance. Under the premise of declining economic momentum, energy prices, which are important for mines, should trend downward more strongly again. In the short term, rising operating costs are still putting pressure on balance sheets, but this trend should abate for the abovementioned reasons. This is rapidly improving the operating picture for the major mining companies.

In terms of climate protection, Barrick is a sought-after supplier of the red metal through its copper assets, for which experts predict a 30% undersupply of the market in the next few years. Balance sheet quality has significantly improved in the last 5 years, as Barrick was already able to report zero net debt in 2021. Payouts to shareholders in the form of buybacks and dividends reached USD 1.6 billion in 2022, with an additional USD 1.0 billion equivalent of shares to be repurchased in 2023.

Of 17 analysts on the Refinitiv Eikon platform, 10 rate Barrick shares a "buy," but 6 experts recommend only a neutral positioning. The consensus 12-month price target is calculated at CAD 29.70, which is about 14% above the current quote. Due to the high momentum in the commodity sector, some analysts may have to revise due to increased selling prices. After some upgrades, the Barrick share price should quickly adjust upwards. Investments in the mining sector should always be made with diversification across several stocks, as the individual value risk is naturally relatively high.

The update is based on the initial report 11/2021