Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Kommentare von André Will-Laudien

Kommentar von André Will-Laudien vom 04.11.2025 | 04:45

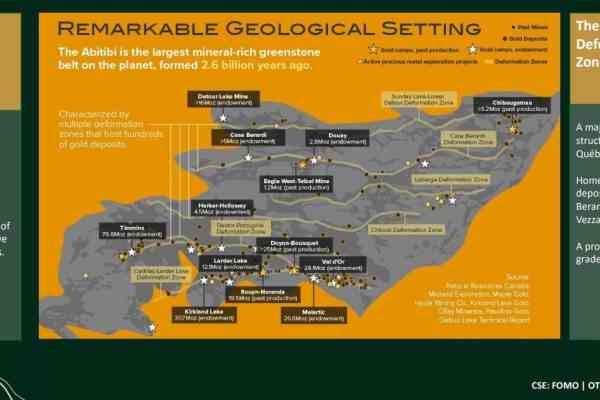

FORMATION METALS - Massive gold potential in Québec

The rally in the gold price recently peaked at USD 4,350 and then came to a halt for the time being. However, the current technical setback to around USD 4,000 does not change the strong medium-term prospects or the fact that gold mines worldwide are operating at production costs of between USD 1,150 and USD 1,650 per ounce. Gross margins have therefore never been higher. This provides a great incentive to reactivate historic properties or even to accelerate the development of new mines. Tight inventories on the futures markets are currently unsettling the precious metals sector, with the shortage of physical silver recently coming to a dramatic head. This environment is an Eldorado for speculators, but also for investors looking to find the right entry point now, as investment banks are forecasting gold prices of up to USD 6,000. Formation Metals Inc. (CSE: FOMO; FSE: VF1; OTCQB: FOMTF) is well-positioned with its properties in the Abitibi Greenstone Belt in Québec. In the heart of this historic mining region, well-known players such as Agnico Eagle Mines (LaRonde and Val-d'Or regions) and Osisko Mining (in the Malartic area) are mining. The resulting peer effect suddenly turns well-financed explorers like Formation Metals into liquid market participants with comparable visibility. With excellent infrastructure, historical mine production, and technologically highly skilled personnel, every new drill section offers a significant catalyst opportunity.

Zum KommentarKommentar von André Will-Laudien vom 03.11.2025 | 04:45

BIONXT – Innovation breakthrough for major pharmaceutical challenges

Humankind's battle against serious diseases spans centuries. Medicine and alternative healing methods have achieved numerous successes, and technological development and innovation are continuing at an accelerated pace. Large pharmaceutical companies leverage their abundant cash flows to develop new drugs, yet not all areas are effectively addressed. In contrast, smaller biotech companies are creative and inventive. They dare to explore new approaches. When they succeed, investors can see multiples of their invested capital returned, making the sector particularly compelling. The Canadian biotech company BioNxt Solutions (TSX-V: BNXT; WKN: A3D1K3; ISIN: CA0909741062) develops state-of-the-art drug delivery systems for autoimmune and neurological diseases and addresses markets of global relevance. The latest developments are now putting BioNxt squarely in the spotlight.

Zum KommentarKommentar von André Will-Laudien vom 31.10.2025 | 04:45

FIRST HYDROGEN - Innovations for the energy transition

Amid global efforts to transition to renewable energy, nuclear power is experiencing an unexpected renaissance. Alongside traditional pillars such as solar and wind power, it is increasingly coming to the fore as a key technology. While Europe still hesitates, North America, China, and India are pushing ahead with expansion. Around 440 plants currently supply electricity worldwide, and over 80 new projects are in the concrete planning stage. President Donald Trump has indicated that strengthening national nuclear capacities is a priority for him, with numerous new approvals intended to consolidate US energy independence. Companies that build bridges between nuclear and hydrogen technology are benefiting particularly from this development. The Canadian company First Hydrogen (EUR 0.28 | WKN: A3C40W | ISIN: CA32057N1042) is working on compact, modular reactors – known as SMRs – that could make local hydrogen production clean, safe, and economical. This creates a connection that could significantly change the energy system of the future. First Hydrogen is at the forefront!

Zum KommentarKommentar von André Will-Laudien vom 29.10.2025 | 03:45

European Lithium – The rush for critical metals

Securing supply chains for critical metals is at the heart of global strategies. Greenland, once a scientific backwater, is now at the center of geopolitical interests with its deposits of rare earths, nickel, cobalt, and graphite. These metals are indispensable for batteries, electronics, and defense technologies. While the EU is strengthening its autonomy with the Raw Materials Act passed in 2023 and new partnerships, the US government under President Trump is focusing on protectionist control and direct access to resources. The announcements from the White House sound rather aggressive in this regard. Market participants should assume that, in case of doubt, the US will make a clean sweep – even in the most remote locations that allow access. European Lithium (WKN: A2AR9A | ISIN: AU000000EUR7 | Ticker: PF8 | ASX: EUR) is positioning itself in this environment with two key deposits: rare earths in Greenland and lithium in Europe, including Ukraine. The Company thus connects two geostrategic hotspots and is considered a potential winner in the new race for raw materials.

Zum KommentarKommentar von André Will-Laudien vom 20.10.2025 | 04:45

VOLATUS AEROSPACE - The AI revolution takes flight

Drone technology has undergone breathtaking development in recent years. What once began as a futuristic toy has now become a central component of modern industrial and security concepts. Simple flying objects with cameras have evolved into sophisticated, AI-powered systems capable of collecting and evaluating data in real time and making targeted decisions. Drones have long been connected to analysis platforms and cloud networks and perform surveillance, logistics, and defense functions. In recent years, this was only possible with manned units. In times of geopolitical tension, they are increasingly replacing traditional forces thanks to their cost efficiency, flexibility, and continuous learning through artificial intelligence. The existing momentum across the entire sector is accelerating innovation worldwide and is also shaping commercial applications in surveillance, infrastructure, and rescue logistics. Volatus Aerospace (TSX-V: FLT; WKN: A2JEQU; ISIN: CA92865M1023) is one of the companies that recognized this technological upheaval early on and implemented it consistently. Now, the phase of exponential growth is beginning for investors!

Zum KommentarKommentar von André Will-Laudien vom 03.09.2025 | 03:45

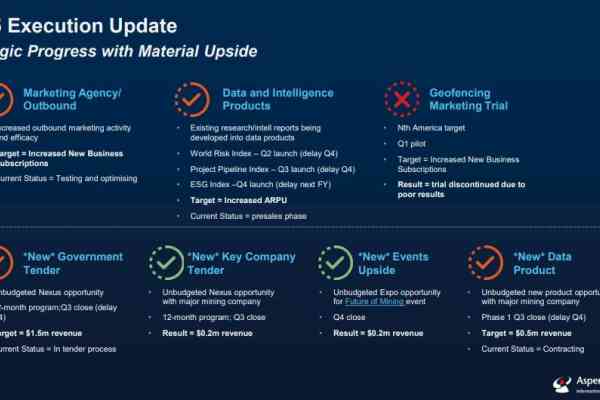

Aspermont: From media company to data intelligence pioneer

Information is the oxygen that keeps the capital markets alive. In an era with rising inflation, geopolitical uncertainties, and disrupted supply chains, international networking is more crucial than ever. With the launch of the Mining-IQ data platform and the strategic partnership with Rio Tinto, Aspermont is undergoing a profound transformation in 2025 to become a global data intelligence specialist for the raw materials industry. The Company now aggregates all mining data worldwide in an AI-powered platform that analyzes risks, ESG performance, and project developments, setting new standards for data-driven decision-making in the sector. With the digitization of two centuries of industry archives for Rio Tinto and the recent capital increase from institutional investors, Aspermont is optimally positioned financially and technologically for international growth and innovation. The new direction creates scalable, subscription-based revenue models. It gives decision-makers a head start in market and investment decisions - a quantum leap from traditional media provider to digital industry architect.

Zum KommentarKommentar von André Will-Laudien vom 01.09.2025 | 03:45

BioNxt Solutions Inc. – Full pipeline propels share price skyward

BioNxt Solutions (TSX-V: BNXT; WKN: A3D1K3; ISIN: CA0909741062) is on the verge of a significant breakthrough: achieving market readiness. The Company develops state-of-the-art drug delivery systems for autoimmune and neurological diseases, addressing markets of global relevance. Particularly in focus is multiple sclerosis (MS), a chronic, inflammatory disease of the central nervous system in which the immune system mistakenly attacks the body's own nerve fibers. Depending on the patient, this can lead to muscle weakness, coordination problems, and even memory issues—a serious medical challenge that urgently calls for innovation. The pharmaceutical and biotech industries are therefore working intensively on improved therapies. BioNxt has developed a patented sublingual oral film technology that not only enhances the effectiveness of drugs but also significantly improves patient convenience. The global tailwind could hardly be more favorable: the market for MS therapies already reached a volume of around USD 21.1 billion in 2024 and is projected to grow to nearly USD 39 billion by 2032, representing a compound annual growth rate (CAGR) of 7.9%. The stock has gained a whopping 80% over the past 6 months, but this could just be the beginning!

Zum KommentarKommentar von André Will-Laudien vom 14.08.2025 | 04:45

ALMONTY INDUSTRIES - Growth surge on the horizon

Tariff barriers, export bans, and supply restrictions on critical metals are no longer the exception; for many investors, they have become a daily topic of conversation. Western industries are increasingly under pressure, as order volumes are rising rapidly, particularly in strategic areas such as high-tech components and defense technology. In the NATO environment alone, order volumes have increased fivefold within just a few weeks compared to 2024, and there is little sign of this trend coming to an end. Today, company leaders need to know exactly where they can source skilled workers, raw materials, and, above all, hard-to-obtain metals, while also ensuring that their sales markets are not blocked by sanctions. The situation is particularly critical for international tech manufacturing, which is heavily dependent on imported specialty metals in parts of Asia. Any new trade barrier can disrupt supply chains within days. Against this backdrop, Almonty Industries (WKN: A414Q8 | ISIN: CA0203987072 | Ticker symbol (FRA/USA): ALI/ALM) has positioned itself with remarkable foresight.

Zum KommentarKommentar von André Will-Laudien vom 08.08.2025 | 04:45

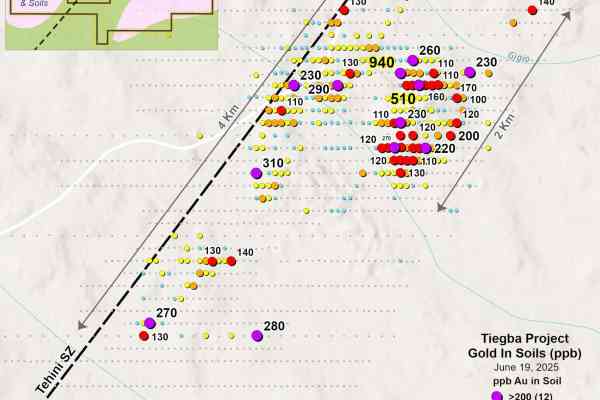

Stock news: Striking Gold with Numbers – Desert Gold impresses with positive PEA

Following recent acquisitions, Canadian explorer Desert Gold has reached the next milestone in its SMSZ project in Mali. With a fresh Preliminary Economic Assessment (PEA), the Company is now set to begin the construction of a small processing plant. With production of approximately 5,500 ounces per year, annual gross cash flows in excess of USD 5 million are expected from 2026. At the same time, the Company has recently expanded its portfolio significantly with an option in West Africa. With the Tiegba project, Desert Gold is now also active in Côte d'Ivoire, alongside major mining companies such as Barrick, Allied, Endeavour, and B2Gold. The vision is clear: to extract easily accessible ounces at low cost and use the generated surplus for exploration of the high-grade properties in Côte d'Ivoire. The key point: Less than 10 % of the 440 square kilometers of SMSZ land area was actually evaluated in the study. The setup should excite investors and make the current valuation history!

Zum KommentarKommentar von André Will-Laudien vom 22.07.2025 | 04:45

GLOBEX MINING – The treasure trove among commodity players

At a time when gold prices are hitting record highs and political uncertainty dominates the global markets, Globex Mining is attracting attention as a broadly diversified resource owner. Founded in 1949 and led by CEO Jack Stoch, the Canadian company is focused on the acquisition, development, and strategic leasing of resource-rich properties, primarily in Canada and the US. With currently 258 concessions and a broad diversification across gold, silver, base metals, and specialty metal projects, Globex is benefiting not only from the current precious metals boom, but also from political developments such as resource scarcity and trade tariffs. The Canadian commodity asset manager is committed to continuous growth and is very successful in this regard, with Globex shares (ticker: GMX) delivering a respectable return of 31% over the past 12 months. The current year 2025 is likely to hold a few surprises in store.

Zum Kommentar