An overview of the current state of development

The Canadian company First Hydrogen (EUR 0.28 | WKN: A3C40W | ISIN: CA32057N1042) is positioning itself as a flexible pioneer in hydrogen-based logistics, partnering with industry leaders such as Amazon and technology providers like Ballard Power. Particularly noteworthy is the recent practical success: modern H₂ delivery vehicles have already been tested in Amazon's real-world logistics operations in the UK, a decisive proof of concept. First Hydrogen provides the design, while the finished vehicles come from OEM partners, Ballard Power supplies the fuel cells, and the Canadians integrate and operate the complete system, including the H₂ infrastructure. These collaborations demonstrate that hydrogen-powered transporters are feasible in everyday delivery operations and can be refueled quickly, offering a logistical advantage over battery-electric vehicles in time-critical fleet applications. The technology is now set to go into series production in an advanced version by 2028, with a target range of up to 1,000 km. In addition, First Hydrogen is working on building a holistic ecosystem encompassing vehicles, electrolysers, filling stations, and H₂ delivery, while expanding the application to trucks, boats, agricultural machinery and emergency power systems. Amazon's parallel deployment of 20,000 hydrogen forklifts across more than 100 centres highlights the industrial scalability of such solutions. With the growth of the e-commerce giant, new technologies have the opportunity to scale rapidly.

Why First Hydrogen sees the future in Europe and Canada

Following the election of Donald Trump, who openly questions climate policy goals, the hydrogen industry is increasingly focusing on Europe as a stable location for innovation and funding. Against this backdrop, First Hydrogen's expansion into the EU was a strategically sound move. The German office was operational by 2024. CEO Balraj Mann summed up the approach at the time: "Europe has shown a strong commitment to transitioning from its dependence on fossil fuels to clean hydrogen. First Hydrogen is now bringing hydrogen-powered fuel cell vehicles to Germany. We were the first on the market with successful trials with various fleet operators across the UK."

At the same time, First Hydrogen is continuing to drive forward its service model. With its "Hydrogen-as-a-Service" approach, the Company plans to initially supply customers in the Montreal–Quebec City corridor with green hydrogen, thereby enabling the first completely emission-free supply chains. In addition, another component is gaining importance in the wake of the global energy crisis: SMRs, or compact small modular reactors. Major technology companies are preparing billion-dollar investments in these new modular reactors, which could serve as regional energy sources and also support the production of green hydrogen in the long term. First Hydrogen is thus tapping into an ecosystem that could, in the future, rely on both renewable energy and new, scalable nuclear technologies.

SMRs as a new growth driver for hydrogen

Nuclear energy is back in focus in the wake of global net-zero targets, and has also been classified as "climate-friendly" in Brussels. Countries and corporations are now investing in nuclear power again to generate large amounts of low-carbon electricity. Examples such as Samsung's order to Nel ASA for the supply of electrolysis technology illustrate the trend: surplus nuclear power is increasingly being used for hydrogen production. First Hydrogen is also investigating the use of small modular reactors (SMRs) to produce green hydrogen independently of the power grid. The small reactors are to be built where energy is scarce and difficult to obtain, and will supply regional H₂ filling stations. As the EU classifies nuclear power as sustainable and taxonomy-compliant, and the SMR market could grow to around USD 300 billion over the next two decades, the Company is positioning itself early and has also founded its own subsidiary called "First Nuclear." The name says it all, as the Canadian government is also stepping on the gas in this field: the first commercial SMR power plant is scheduled to begin operations in Darlington, Ontario, by 2030.

Research partnership in Canada with a focus on data centers ("AI energy")

Prime Minister Mark Carney plans to promote the new Darlington nuclear power plant project in Ontario as one of the first projects to be fast-tracked under Canada's new Major Projects Office. The federal government's decision to designate Darlington's small modular reactor (SMR) as a national priority underscores Canada's ambition to become the first G7 country with an operational SMR. This is a milestone that directly supports First Hydrogen's green strategy. These SMRs are designed for factory-based manufacturing and small-scale modular deployment. The first SMR in Darlington could provide enough energy to power 300,000 homes.

To pick up the pace, First Hydrogen is collaborating with Prof. Muhammad Taha Manzoor from the University of Alberta. The goal is to further develop SMR concepts, particularly material research and design optimization. A key driver behind this initiative is the soaring energy demand from AI data centers, which consume up to ten times more power than traditional IT infrastructure. Goldman Sachs Research predicts that global electricity demand from data centers will increase by 50% by 2027 and by up to 165% by the end of the decade. In addition, an estimated USD 720 billion in investment in the power grid could be required by 2030.

In the future, SMRs are expected to provide a reliable, low-carbon source of electricity for various applications, from powering grids to supporting industry and remote communities. The technical design has already been decided, as SMRs using molten salt as a coolant are considered safe and efficient and enable a constant power supply for H₂ production. With global investment in computing power expected to exceed USD 5 trillion by 2030, First Hydrogen is ideally positioned to serve this energy trend.

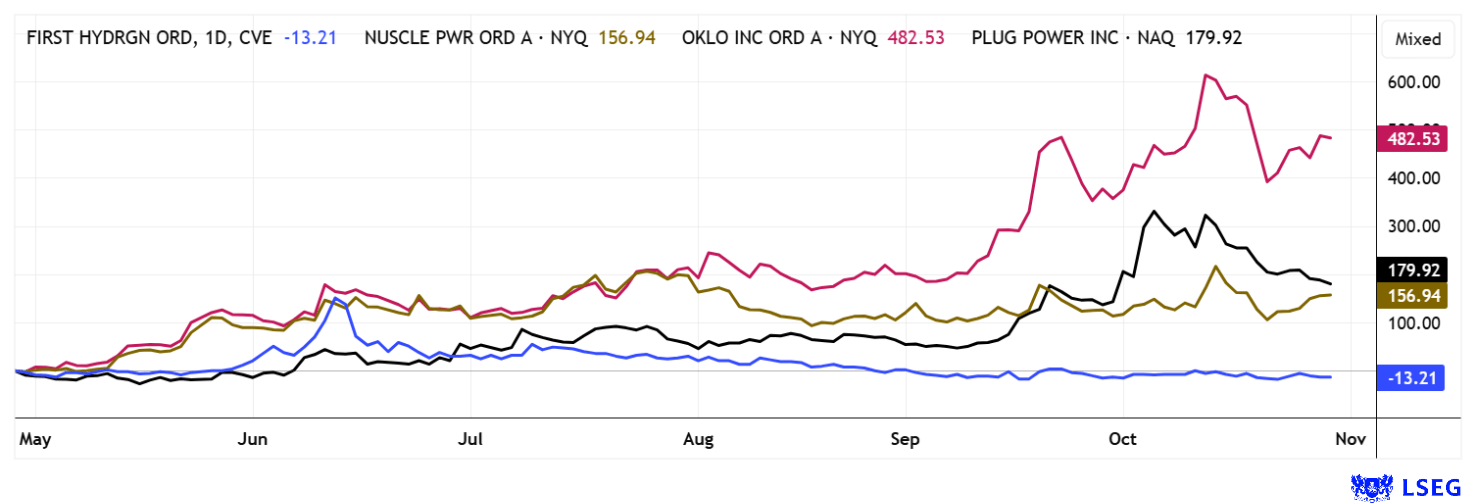

The peer group is already in motion

The entire sector has seen strong gains in recent months, and a new megatrend appears to be emerging. Oklo Inc. has been particularly in the spotlight after receiving a letter of intent from the US Department of Defense to supply power from SMRs for a military base in Alaska. This makes it clear that it is not just about civilian power supply, but also high-security and military applications, which is a large and growing market given current geopolitical uncertainties. It therefore looks as if the starting signal for the global deployment of SMR technology has been given. By establishing a specialized unit and targeted partnerships, First Hydrogen is positioning itself strongly to benefit from the coming surge in market demand. The relative strength of the sector to date, combined with its long-term growth prospects, makes further price appreciation a realistic scenario.

Conclusion: First Hydrogen rehearses the starting lineup

So far, the market has yet to see any tangible progress over the past few months. The technical movement of the FHYD share, therefore, resembles a prolonged consolidation. However, since trading volumes have dropped significantly, it can be assumed that CAD 0.46 represents a solid base for an initial upward move. Often, when trading volume declines, it is precisely the specialists who are quietly accumulating valuable shares. The market capitalization of only CAD 34.5 million could also soon attract potential buyers. Very exciting!

This update is based on the initial report 07/2022