Climate neutrality at any price

In order to achieve climate protection goals and become independent of fossil energy imports, the share of renewable energies in gross electricity consumption is to increase to at least 80% by 2030. As a result of the Ukraine conflict, the already ambitious climate targets have been accelerated even further to minimize future supplies of oil and natural gas, especially from Russia. Their share must therefore almost double within less than 10 years, and the rate of expansion is to triple.1 .

National hydrogen strategies are ramping up

Hydrogen, there is no question, will be one of the most important energy sources of our "green future." With the adoption of the National Hydrogen Strategy (NWS) on June 10, 2020, the German government set the course to establish a rapid market ramp-up of green hydrogen and its downstream products as a key technology for the energy transition, thus contributing significantly to the achievement of climate targets.

As can be read in the Report of the Federal Government on the Implementation of the National Hydrogen Strategy, policymakers see hydrogen as an important building block for the decarbonization of transport, especially where battery-electric propulsion is not suitable, particularly in light and heavy commercial vehicles as well as in buses, trains and in air and sea transport.

Utility Vans to be delivered by First Hydrogen from 2026 p.a.

The advantages over battery-powered vehicles were explained in an earlier report.

The swing towards a clean mobility sector based on hydrogen and fuel cell technologies is also being enormously promoted in other countries across the globe. In Canada, for example, the "December 2020" program defined the goal of green hydrogen meeting 30% of the North American country's energy needs by 2050, and in the UK, the "10-Point Plan" was launched. 2 In addition, in April 2022, the UK government announced plans to double hydrogen production to 10 GW by 2030, of which at least 5 GW should come from green production.

Transport sector facing show of force

The climate targets that were anchored in Europe with the European Green Deal 2019 assume climate neutrality as early as 2050. Among other things, the interim target for the mobility sector was to reduce emissions from passenger cars by at least 55% by the end of this decade, and from lorries by 30% compared to 1990 levels.

the price of green hydrogen is expected to fall by 2050 in conjunction with the expansion of wind and solar energy, according to Bloomberg NEF.

Currently, over 90% of transportation in Europe is still based on petroleum. According to First Hydrogen's company presentation, there are 29 million vans in Europe alone that need to be replaced or converted to fuel cell technology, and around 3.9 million vehicles in the UK. The current average age of vans of 10.9 years, with an optimal fleet replacement of 5 years, indicates a medium-term shift to alternative powertrains. Last year, spending on zero-emission vans in the UK alone is estimated to have exploded 50% to around £16 billion compared to 2020. In the United States, growth over the past 5 years has already been 16% p.a., while in Canada the increase has been 6% p.a.

Battle for pole position

Due to the enormous demand from the logistics market alone, the market research institute Allied Market Research expects annual growth of 21.4% by 2027 for the global hydrogen fuel cell market to then reach USD 41.2 billion. In order to meet climate targets, transport companies such as DHL, Amazon and UPS are facing major challenges. On the other hand, established manufacturers are accelerating the development of their zero-emission fleets. Next to Stellantis, Renault or the Korean automotive group Hyundai, First Hydrogen stands out as a young company that uses the best technologies from different suppliers to develop a hydrogen-based mobility system that is new and clean from the ground up.

Best-of is a company philosophy

First Hydrogen's "Utility Van" could be the surprise in the light-duty vehicle market for a simple reason. Contrary to established competitors who face OEM legacy fossil fuel or previous EV investments when retooling, a team of globally recognized and experienced executives is building an entirely new and innovative vehicle. They are doing so by combining the best-of technologies from the leading developers and manufacturers of zero-emission, hydrogen-powered utility vehicles.

The advantages of the 'best-of strategy' are obvious. By implementing existing technologies and a proven chassis, both significant cost and time benefits can be realized. Along the way, the Company is manufacturer and technology neutral, resulting in flexibility in the use of available components from preferred global suppliers.

In the fast lane with Ballard Power and AVL

A significant contribution to the success story is likely to come from the far-reaching partnerships concluded last year between the Company's wholly-owned subsidiary First Hydrogen Limited UK and global market leaders Ballard Power and AVL Powertrain UK. Ballard Power, one of the world's leading providers of innovative clean energy and a hydrogen fuel cell fleet that has already covered over 50 million km globally by 2020, has been recruited to develop the fuel cell technology. AVL Powertrain Limited, the world's largest independent automotive engineering, simulation and testing company, is responsible for the design.

The cooperation was launched before the end of 2021 with the development and construction of two hydrogen-powered light commercial vehicles (LCV) for demonstration purposes. This involved evaluating the vehicle concept, architecture and production in close cooperation with AVL. The vans, for which the MAN eTGE serves as a so-called "donor vehicle ", are equipped with the latest generation Ballard FCgen LCS fuel cell, which gives the vehicles a range of over 500km. First Hydrogen's two demonstration vehicles are scheduled to be tested and commissioned in the UK as early as the next few days. In addition, the LCVs are expected to be road-ready in Q4 2022, and real-world testing by customers should begin in early 2023, according to management.

Thus, another milestone has been reached without any major delays. In the long term, management is clearly planning in other dimensions. Last year, CEO Balraj Mann announced his vision of becoming the leading developer and manufacturer of zero-emission, long-range hydrogen-powered commercial vehicles in the UK, the EU and North America. In doing so, the executive estimates being able to produce and deliver between 10,000 and 20,000 units of the First Hydrogen Utility Van per year starting in 2026. If one only calculates the lower limit of just 10,000 vehicles and a unit price of around EUR 50,000, sales would be EUR 500 million. The current stock market value is a modest EUR 110.00 million.

Quantum leap in the Company's history

Parallel to the announcement of the tests of the two demonstration vehicles, a milestone in the still young company's history could now be celebrated. In the process, the subsidiary First Hydrogen Ltd. was accepted into the British "Aggregated Hydrogen Freight Consortium" (AHFC) and is in the select circle with global players such as Air Products, Anglo American, Hyundai, Toyota and BOC - a company belonging to the Linde Group. The aim of this consortium is to bring together operators of the UK's largest van and truck fleets and key members of the hydrogen industry, including hydrogen producers, hydrogen suppliers and vehicle manufacturers. In doing so, the AHFC, which is led by Element Energy, is partnering with major U.K. fleet operators to accelerate commercial deployment of fuel cell vans and trucks and refueling station infrastructure. Element Energy, in turn, has two decades of experience in hydrogen and fuel cell technology and has been instrumental in initiating and coordinating many of Europe's largest strategic hydrogen transportation projects.

In this regard, according to information, there is already keen interest from ten fleet operators across industries to participate in the testing of First Hydrogen's two demonstration vehicles. Interested parties include telecommunications companies, express services, national utilities and national infrastructure companies, a UK national supermarket chain, a national towing and recovery association, an ambulance fleet, as well as a national fleet leasing group and a carbon-free technology group.

Covering the value chain

One problem besides the still-high price of the gas is the lack of hydrogen refueling stations. Globally, the number grew to 685 at the end of 2021, with another 252 in the pipeline. 3 Europe had 228 refueling stations at the end of the year, 101 of which were in Germany. While this makes Germany the European market leader, future demand for H2 filling stations is likely to far outstrip supply.

the global hydrogen and fuel cell market is growing until 2027.

In order to complete the value chain, an agreement has been signed with FEV Consulting GmbH of Aachen, Germany, under which the partners will design and build a prototype for a customized hydrogen fueling station for the hydrogen mobility market. First Hydrogen's goal is to sell hydrogen-related technology to its customers in the future, driving the adoption of hydrogen as the primary fuel for the light to heavy mobility sector.

In addition, the Canadians are seeking opportunities to produce and sell green hydrogen in the UK and other locations. In this regard, two green hydrogen production projects have been submitted for an initial round of funding to the UK government's Net Zero Hydrogen Fund through its subsidiary First Hydrogen Limited. The two projects have an initial capacity of 40 MW each and are to be located in Carrington in Greater Manchester and in the Thames Estuary area. The goal is to supply the Company's automotive customers with a majority of their green hydrogen needs from production to fuel their fleets of First Hydrogen fuel cell-equipped light commercial vehicles. Together, the projects are expected to produce over 7,100t of green hydrogen p.a. at full capacity. 4 The Company plans to have up to four sites, each of which will have a fueling station for commercial vehicles and passenger cars. Initial production capacity estimates for the four sites range from 80 MW to 160 MW. To further expand the "Hydrogen-as-a-Solution" business, Afkenel Schipstra has been brought on board from multinational utility, ENGIE, as the new Chief Operational Officer.

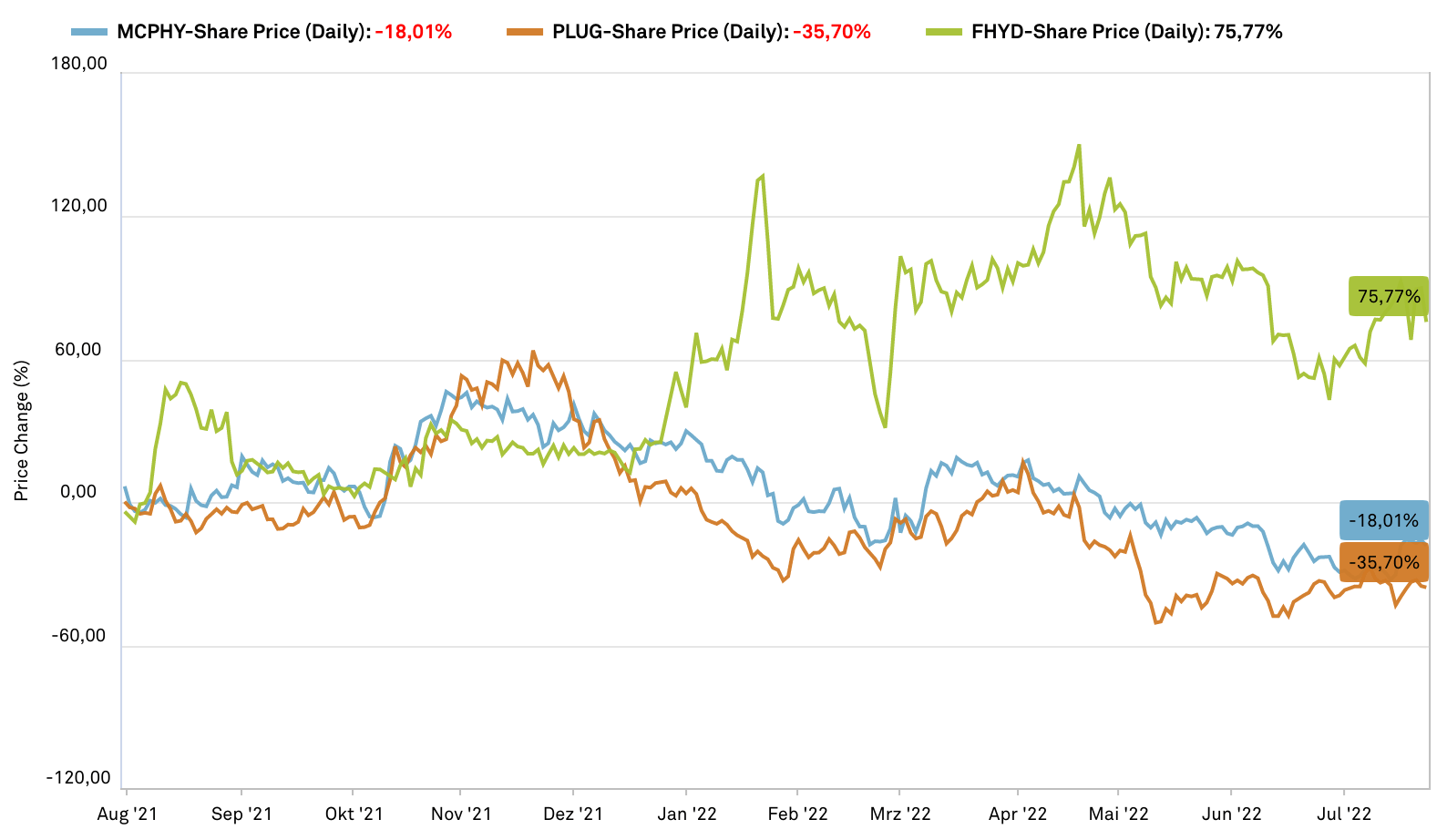

High valuations despite correction

The year 2020 was the stock market year for hydrogen and fuel cell companies. As a result, they set out on a rally reminiscent of the dot.com bubble days of the early new millennium. By contrast, even the market leaders are still looking in vain for operating profits. The pioneer of fuel cell technology, Plug Power, has never even come close to breaking even in any quarter of its 25-year history. With price-to-sales ratios beyond 25, even after a stronger correction, there is still quite a bit of fantasy priced in, which hardly justifies the billion-dollar valuations.

McPhy Energy comes closest to First Hydrogen in the peer group comparison. The stock market value of the French company, which also focuses on hydrogen production and distribution facilities, is EUR 424.20 million, about four times the market capitalization of the Canadians. According to S&P Capital IQ Pro, McPhy 2021 had revenues of EUR 13.13 million and a net loss of EUR 23.57 million. In addition to its market leadership, the high valuation is justified by its planned growth. Accordingly, analysts expect sales of EUR 19.30 million in 2022, EUR 38.80 million in 2023 and an estimated EUR 82.72 million in 2024. Thus, the price-to-sales ratio based on 2022 is a high of 32.31.

In relation to this, First Hydrogen is at an earlier stage, provable figures and a business plan over the next few years are not yet available, but the partnerships with the global players mentioned, the development of the Utility Van as well as the other sectors could level out the discrepancy in the company valuation in the medium term. In addition, First Hydrogen has a broader value chain with self-developed utility vehicles, the development of a hydrogen refueling station infrastructure, and the future production and distribution of green hydrogen.

SWOT analysis

Strengths

- Development of own hydrogen infrastructure, Hydrogen-as-a-Solution model.

- Collaboration with global market leaders

- High level of expertise and experience at the executive level

- Establishment of a new hydrogen mobility system (utility van) without OEM legacy.

- Manufacturer- and technology-neutral business model

Weaknesses

- Strong competition from established automotive companies

- Low capitalization

- Growing competition in the service station network sector

Opportunities

- High level of investment by policymakers in the clean hydrogen economy

- Rapid market entry due to manufacturer neutrality

- Gaining significant market share in booming logistics market

- Possible takeover candidate

Threats

- Delays in the development of the utility van

- Supply chain problems

- Rising raw material prices squeeze margins

Strong partners with good positioning

The shift from fossil fuels to alternative energies is being accelerated significantly by politicians due to the Ukraine conflict. Achieving climate targets, especially for the problem child of transport, is a top priority and is being promoted with programs worth billions. Hydrogen fuel cell technology is currently favored for light and heavy commercial vehicles. In the light truck sector, there is enormous demand due to the transformation from fossil fuels to alternative energy sources. In Europe alone, 29 million vans on the road need to be replaced or converted to fuel cell technology.

Alongside the established vehicle manufacturers, First Hydrogen stands out with its "best-of strategy". A new milestone could be reached; moreover, the admission to the "Aggregated Hydrogen Freight Consortium" promises enormous potential. With the establishment of its own value chain through the development of its own H2 filling station network and the planned production and distribution of green hydrogen, the Company is ideally positioned. First Hydrogen is still at an early stage, but the potential is enormous, as are natural risks to growth. With positive, further development, especially of the utility van, a takeover by a larger competitor would also be conceivable.