The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Kommentare von Stefan Feulner

Kommentar von Stefan Feulner vom 11.06.2024 | 06:00

Share news: First Hydrogen - What is going on with Amazon?

The e-commerce giant Amazon has been focusing on sustainability in its vehicles for years. It is pursuing a clear plan to reduce its environmental footprint and optimize its logistics processes by developing and implementing new technologies. Together with Global Optimism, the "Climate Pledge" was founded in 2019 with the aim of being climate-neutral in all business areas by 2040. The Seattle-based company is also focusing on hydrogen fuel cell technology as part of its comprehensive strategy to reduce CO2 emissions. Successful test drives have now been completed with the developer of light commercial vehicles for the logistics sector, First Hydrogen, representing a milestone for the innovative company.

Zum KommentarKommentar von Stefan Feulner vom 07.05.2024 | 05:10

Share news: First Hydrogen - Big Logistics Players Enter the Scene

Logistics companies around the world are in a tight spot. On the one hand, they have to meet the climate targets set by governments, while on the other, e-commerce continues to drive growth in the delivery market. Stellar Market Research has calculated that this sector will likely grow from USD 486.47 billion in 2023 to USD 648.84 billion by the end of the decade. The consequences are clearly defined. The industry needs more delivery vehicles on the roads, which will drive emissions even higher. Hydrogen innovator First Hydrogen offers the solution with its hydrogen fuel cell-powered light commercial vehicles. After successfully completing the first test runs with renowned fleet operators in the UK, multinational logistics companies are now throwing their hats into the ring.

Zum KommentarKommentar von Stefan Feulner vom 26.12.2023 | 05:10

Share news: First Hydrogen - Hydrogen pearl on special offer

From a business perspective, 2023 could not have gone better for the hydrogen specialist based in Vancouver and London. In addition to successfully completing the first series of tests of its hydrogen fuel cell-powered light commercial vehicles under real road conditions, in which ranges of over 630 km were achieved on a single tank of fuel, First Hydrogen continues to build coverage of the entire hydrogen value chain. Regardless of this, the Canadian company's share price also suffered in the course of the general market correction in the sector. Due to the high potential and positive future prospects, the current share price should offer a long-term entry opportunity.

Zum KommentarKommentar von Stefan Feulner vom 22.12.2023 | 05:10

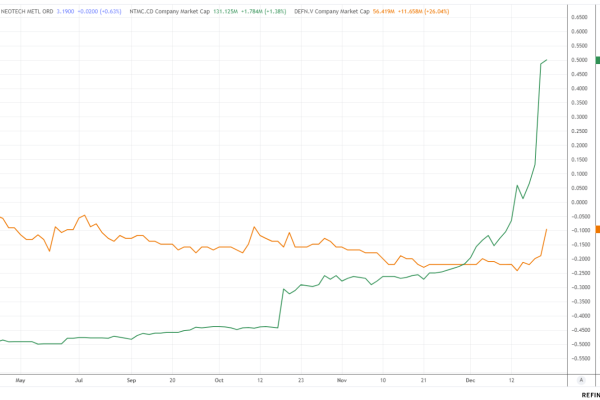

Share news: Defence Metals - World upside down

Rare earth metals are becoming increasingly important in today's world. In addition to their use in renewable energies to achieve climate targets, demand from the defence industry has also increased since the outbreak of the Ukraine conflict, aiming to ensure the military security of the West. However, the challenge with the procurement of critical metals is the fact that China controls the entire value chain from mining to production. Suitable deposits outside the Middle Kingdom are rare. One of the beacons of hope is the Wicheeda project in British Columbia, Canada, owned by Defence Metals. However, its potential has yet to be fully realized on the stock market. If one compares the market capitalization of Defense Metals with projects of much lower substance and at a much earlier stage of development, the massive discrepancy in the Company's valuation should be apparent at first glance.

Zum KommentarKommentar von Stefan Feulner vom 14.09.2023 | 04:35

Stock News: Smartbroker Holding AG - The cheapest broker with the best offer

Good things come to those who wait! After obstacles and delays with regard to the launch of SMARTBROKER+, interested parties were given access to the completely newly developed trading platform and thus also to the long-awaited app for the first time at the end of August as part of an Early Access phase. The capitalists put all their energy into a state-of-the-art frontend for iOS, Android and web, as well as an excellent user journey. The unbeatable price-performance ratio, however, remains the same. SMARTBROKER+ is the only provider in Germany to combine the extensive product range of traditional brokers with the extremely favorable conditions of Neobrokers.

Zum KommentarKommentar von Stefan Feulner vom 11.09.2023 | 05:10

Stock News: Altech Advanced Materials - The calm before the storm

Already last year, the investment company Altech Advanced Materials positioned itself as a company for novel battery technology. Thanks to the investments in the project companies SILUMINA ANODES and CERENERGY, it has succeeded in gaining a foothold in the growth markets for e-mobility and stationary battery storage with novel materials and groundbreaking technologies. In this context, the further goals are clearly defined. Together with the Group's partners, the Heidelberg-based company wants to make a positive contribution to the energy transition and thus participate in the rapidly growing market for battery systems. Three milestones expected before the end of this year could push the share into higher territory.

Zum KommentarKommentar von Stefan Feulner vom 15.08.2023 | 05:05

Stock News: First Hydrogen - Over 100% better than the competition

The start of testing under real road conditions for the Canadian hydrogen innovator's hydrogen fuel cell-powered light commercial vehicles got off to a furious start and clearly demonstrated the advantages over both battery-electric vans and internal combustion engines. Admittedly, the "Light Commercial Vehicles" have only been tested by two of the sixteen major fleet operators participating in the British "Aggregated Hydrogen Freight Consortium". However, the impressive results already suggest that the internal target of selling between 10,000 and 20,000 units in 2025/2026 is no utopia. In the best case, the sales volume would amount to EUR 1 billion. Currently, the market value of the First Hydrogen share stands at EUR 90.84 million.

Zum KommentarKommentar von Stefan Feulner vom 25.07.2023 | 13:54

Stock news: Smartbroker Holding AG - Raised to a new level

The countdown is on! Despite many imponderables and detours, the latest generation broker, Smartbroker+, is about to be launched. As of today, users can explore the future brand world. In the process, the already successfully running Smartbroker was expanded with new functions and optimized according to the latest customer experience requirements, which should attract new, especially younger target groups in the future. On the other hand, the unique selling proposition of the Next Generation Broker will be retained. Like its predecessor, Smartbroker+ combines the extensive product range of traditional brokers with the favorable conditions of a new broker.

Zum KommentarKommentar von Stefan Feulner vom 18.07.2023 | 05:10

Bitcoin Group SE - A latecomer to the crypto spring

After a bitterly cold crypto winter last year with price losses of up to 78% for Bitcoin alone, the asset class has become one of the best performers on the market, with a gain of 90% since the beginning of 2023. Companies from this segment, such as MicroStrategy, Coinbase, Hut 8 Mining and Bit Digital, were able to more than double in this period. In contrast, the German Bitcoin Group, which operates the trading platform for digital currencies, bitcoin.de, with its subsidiary, has some catching up to do. However, the holding company has significantly more substance than comparable competitors.

Zum KommentarKommentar von Stefan Feulner vom 28.06.2023 | 05:10

Share news: First Hydrogen - Next heavyweight at the start

The first series of tests under real road conditions went better than expected for the hydrogen innovator based in Vancouver and London, clearly demonstrating the advantages of hydrogen fuel cell-powered light commercial vehicles with a range of over 500 km compared to battery-electric vans and internal combustion engines. Following in the footsteps of fleet management provider Rivus, which is responsible for managing over 120,000 light commercial vehicles and trucks annually, utility company SSE, which currently maintains one of the largest vehicle fleets in the UK, is now entering the test series. If the results continue to confirm the positive trend, First Hydrogen faces a golden future in the billion-dollar market for climate-neutral vehicles.

Zum Kommentar