Share in vacation mode

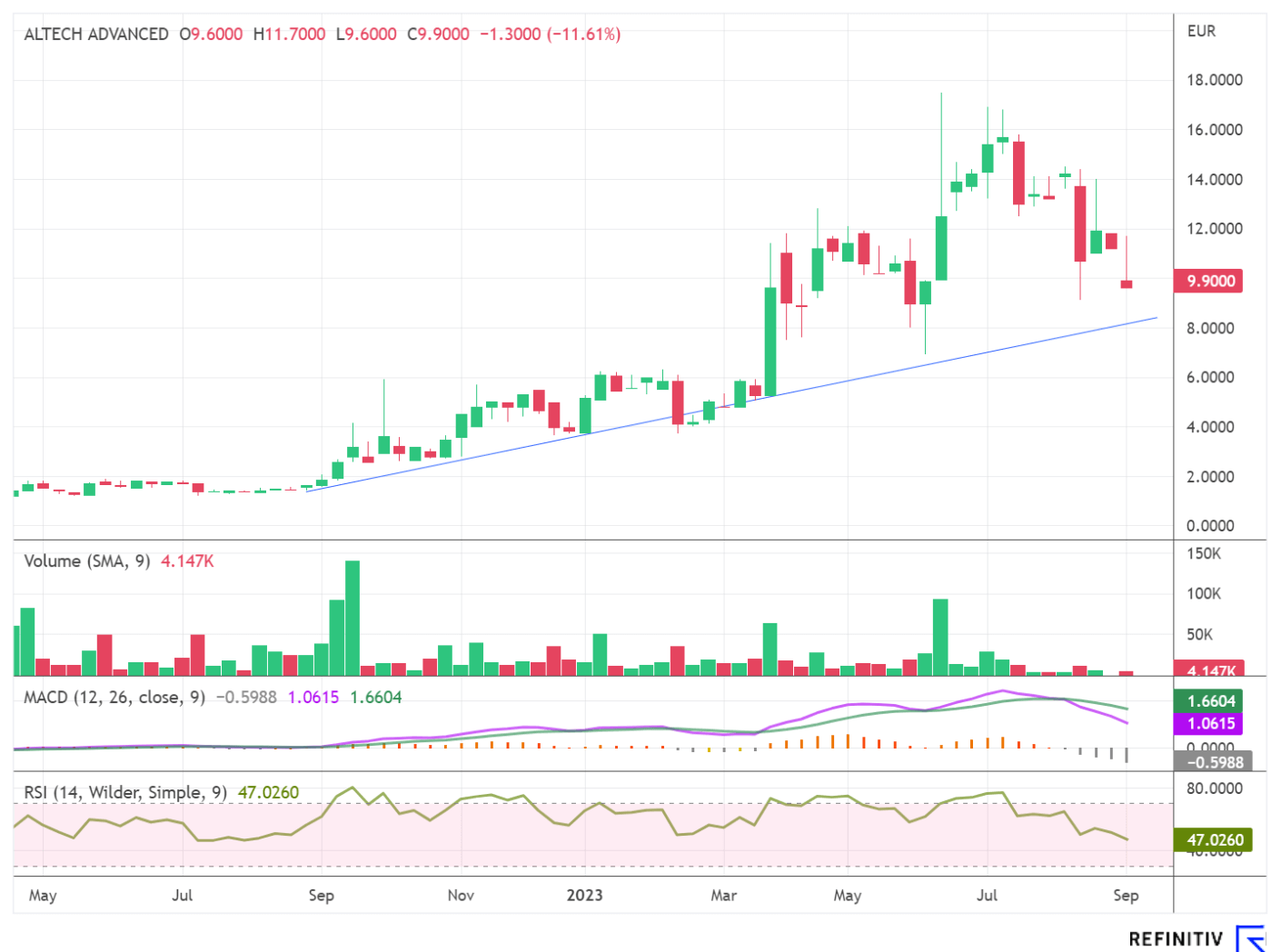

The news situation at Altech Advanced Materials remains quiet. This is mirrored by the development of the share, which was included in Xetra trading in mid-July. Since mid-June, the share price has corrected from its all-time high of EUR 17.50 under low volume to currently EUR 9.90. Nevertheless, the innovation leader in anode composite materials for lithium-ion batteries as well as for environmentally friendly stationary energy storage systems based on sodium-alumina solid state batteries has been one of the market outperformers since the beginning of the year, with a gain of 164%.

The upward trend established since the end of August 2022 is currently at EUR 8.30. It is quite possible that this trend could be tested again in the short term due to the low trading activity and the summer lull in the markets. However, due to the milestones already planned by management in both business areas, a new upward momentum could be ignited at any time this year, which could initially lead the share towards old highs.

Game changer potential exists

As we have mentioned in previous reports, both technologies have the potential to revolutionize the market in their respective segments. Of course, it should not be forgotten that both CERENERGY and SILUMINA ANODES are still in the development phase. However, further important steps towards commercialization could be taken by the end of the year.

In the area of stationary grid storage, Altech Advanced Materials was able to position itself optimally last year through a newly established joint venture with the Fraunhofer Institute for Ceramic Technologies and Systems IKTS. The global market for battery energy storage systems is expected to grow exponentially from USD 4.4 billion in 2022 to USD 15.1 billion in 2027. The collaboration, in which the Heidelberg-based company holds an 18.75% stake, is aimed at industrial production and commercial distribution of a sodium-alumina solid state battery.

The advantages of CERENERGY batteries over conventional products are outstanding. The revolutionary batteries are to be produced at the Altech site in Schwarze Pumpe, Saxony. In the future, the European market for renewable energies and grid storage will be served from there. The plant is to be designed for an annual production capacity of 100 MWh, corresponding to an initial standardized production line that can then be rapidly scaled up, according to management. The detailed feasibility study that will ultimately define the plant's design is scheduled for completion this year. Altech also started production of two prototypes of the CERENERGY Battery Pack 60 KWh, which will be produced by the Fraunhofer Institute IKTS in Hermsdorf. These, too, are to be made available to the clientele for testing by the turn of the year at the latest.

The target markets for the distribution of CERENERGY batteries are in the renewable energy sector. Additionally, the innovative technology could also be used as a temporary storage solution for the production of green hydrogen and CO2 reduction in steel production and cement manufacture.

Innovation driver of electromobility

In addition to the joint venture with the Fraunhofer Institute, the production development of the ceramic-coated high-performance anode material Silumina Anodes at the Schwarze Pumpe site is also proceeding according to plan. Altech Advanced Materials holds a 25% stake in this project company, while the major piece of the pie here belongs to the Australian technology partner Altech Batteries. The latter was able to achieve performance increases of 30% and more in lithium-ion batteries by adding silicon in laboratory tests. In addition, a significant increase in energy capacity, improved energy density, and charging capacity were achieved.

Silicon has the ability to store ten times more energy than the graphite conventionally used. Until now, certain disadvantageous properties of silicon, such as reduced lifetime and rapid power loss over time, have hindered its economical integration into anode materials. However, Altech Batteries has been able to revise the negative points, making SILUMINA ANODES one of the most promising materials for future applications in lithium-ion batteries, especially in the field of electric mobility.

In view of the planned commissioning of its pilot plant in the third quarter of 2023, Altech Group is intensifying its efforts to conduct a comprehensive feasibility study. This study, which contemplates the production of 10,000 tons of anode material per year, is being conducted in parallel with the current construction of the pilot plant.

Interim conclusion

The two projects offer Altech Advanced Materials AG and its shareholders the opportunity to participate in the rapidly growing market for lithium-ion batteries in the future of electromobility and the expected strong market development for stationary energy storage. Although both projects are in the start-up phase, the commissioning of the pilot plant at SILUMINA ANODES, the preparation of the detailed feasibility study and the production of the two prototypes of the CERENERGY Battery Pack 60 KWh will set an important course towards commercialization. The market capitalization of Altech Advanced Materials is currently EUR 72.72 million. When these planned steps are achieved, the consolidation phase of Altech's stock will likely come to an end. However, interested market participants should consider placing a limit order due to the stock's low liquidity.

The update is based on the initial report 02/2022.