The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Kommentare von Stefan Feulner

Kommentar von Stefan Feulner vom 07.11.2022 | 05:11

dynaCERT - With hydrogen into the mass market

Time is of the essence. Climate change is the most fundamental challenge of our generation. With the amendment of the Climate Protection Act 2021, Germany, for example, has tightened the requirements even further and anchored the goal of greenhouse gas neutrality by 2045. For the transformation of transport, which is responsible for around 20% of greenhouse gas emissions according to the German Federal Environment Agency, this means a tour de force that is almost impossible to implement in practice. The hurdles are particularly high in the transport sector. In addition to horrendous investments by the commercial vehicle industry, the lack of charging and refueling infrastructure is an obstacle to being able to bury the internal combustion engine in a timely manner. In a joint declaration at the end of last year, European truck manufacturers such as Daimler, Scania and MAN announced their intention to stop producing diesel trucks by 2040 in order to be climate-neutral by 2050. However, an immediate solution is offered by the Canadian company dynaCERT, which achieves significant emission reductions with its patented HydraGEN technology. With the successful completion of a pilot project, nothing now stands in the way of entry into the mass market.

Zum KommentarKommentar von Stefan Feulner vom 31.10.2022 | 05:11

Stock news: BYD - The lighthouse is wobbling

For months, the Chinese technology company BYD was able to escape the general market correction. While the competition around the former top dog Tesla had to struggle with closures of their production facilities due to the Corona pandemic, the Shenzhen-based company was largely spared and secured its place in the sun in Chinese electric car sales, which it was able to expand significantly in the course of the year. However, since the sale of a block of shares by Berkshire Hathaway, the investment firm managed by Warren Buffett, became known, the BYD share price went steeply downhill, losing around 40% of its value at the end of August. Even strong figures for the third quarter could not stop the downward spiral.

Zum KommentarKommentar von Stefan Feulner vom 18.10.2022 | 05:11

Stock news: First Hydrogen - Global hydrogen strategy

Politicians worldwide are committing themselves to increasingly ambitious and binding targets for the share of alternative energies in the overall energy mix. Corresponding green projects are being promoted with programs worth billions. For the transport and traffic sector, the European Commission has now prescribed a reduction in greenhouse gas intensity of at least 16% by 2030. The key to achieving the climate targets here lies in the switch to green hydrogen as an energy carrier. To ensure that production can start immediately, European Commission President Ursula von der Leyen announced the creation of a new "European Hydrogen Bank" and released a budget of EUR 3 billion from the existing Innovation Fund. First Hydrogen covers the complete value chain with its "Hydrogen-as-a-Service" model and is expected to benefit in all business areas.

Zum KommentarKommentar von Stefan Feulner vom 07.09.2022 | 04:45

Stock news: Smartbroker Holding AG - crash and realignment

This news even drowned out the disastrous start to the season of the "Big City Club" Hertha BSC in the capital: The group of companies, formerly known as wallstreet:online AG and now renamed Smartbroker Holding AG, parted company with its CEO Matthias Hach with immediate effect. According to founder and new boss, André Kolbinger, the reason was a difference of opinion regarding the future implementation of "Smartbroker 2.0". The launch of the major project has now been postponed to mid-2023, and a profit warning has already been issued. As a result, the share plummeted by more than 50%. As the new management undoubtedly expects the "online broker for the next generation" to take off, the current level could offer a long-term opportunity for disproportionate share price gains.

Zum KommentarKommentar von Stefan Feulner vom 29.08.2022 | 05:06

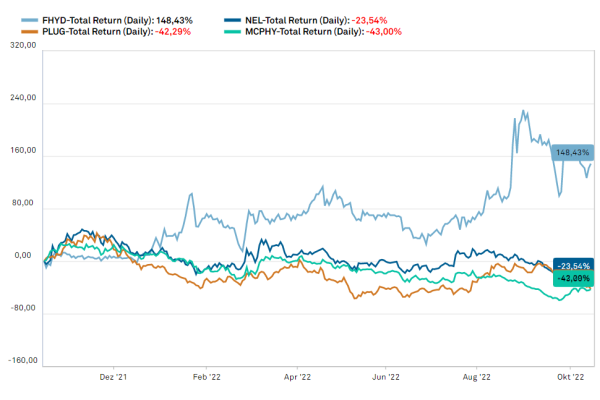

Stock news: First Hydrogen - The hydrogen high-flyer

The quest for independence from Russian oil and gas is pushing politicians to come up with forward-looking alternative solutions. An agreement has now been concluded between Canada and Germany that is likely to represent a quantum leap for the hydrogen industry. The joint declaration of intent to invest in hydrogen and establish a transatlantic supply corridor between Canada and Germany marks the beginning of Canada's establishment as a major hydrogen producer. One of the biggest beneficiaries is likely the Canadian company First Hydrogen. CEO Balraj Mann already announced that "our 'Hydrogen-as-a-Service model' will be an emissions-free ecosystem solution for Canada and the rest of the world." The opportunities for this are excellent. At the same time, First Hydrogen is valued at a market capitalization of CAD 208.79 million and is still far from the billion-dollar stock market values of its competitors.

Zum KommentarKommentar von Stefan Feulner vom 09.08.2022 | 05:00

Stock News: Blu Horseshoe loves Aspermont

Following its successful transformation from a venerable publishing house to a leading global provider of digital business-to-business media in the mining, energy and agriculture sectors, the signs at Aspermont are clearly pointing to expansion. Thanks to its highly scalable platform technology, the company from Down Under is growing strongly, both vertically and horizontally. With the launch of the financing platform "Blu Horseshoe", a quantum leap and the entry into the lucrative fintech market could now be celebrated. Although comparable projects were recently valued at a multiple of Aspermont's stock market value, the share chart of the Australians has been running sideways for months.

Zum KommentarKommentar von Stefan Feulner vom 26.07.2022 | 11:02

First Hydrogen - advancing to the top class

Profound changes are underway in the global energy industry. Governments, industry and consumers are in the process of building a climate-neutral economy in which clean hydrogen occupies a key position as a raw material, energy carrier and fuel. In the transport sector in particular, far-reaching transformations are of elementary importance. There have been hardly any resounding successes in recent years, especially in this sector, which is so important for the climate turnaround. Vancouver and London-based First Hydrogen Corp. is a newcomer to the market, specializing in zero-emission vehicles and the production and distribution of green hydrogen. Through its unique "best-of strategy", the experienced management has been able to set clear scent marks in the recent past. A milestone has now been reached with the inclusion in a leading consortium in the UK, which has, however, received little attention from the broader market.

Zum KommentarKommentar von Stefan Feulner vom 19.07.2022 | 05:11

BYD - From the Tesla hunter to the hunted

Electromobility is considered a key technology in the transformation of the transport sector. In 2021 alone, the number of new registrations and the market share of battery-powered vehicles more than doubled. Sales growth was led by the People's Republic of China, which accounted for more than half, with 3.3 million vehicles. In the Middle Kingdom in particular, the battle for market share is in full swing. BYD, the technology company based in Shenzhen in southern China, left the class leader Tesla behind in the latest sales figures. It is likely to further expand its leading position based on its positioning and battery expertise, which is likely to be reflected in further increases in stock market quotations.

Zum KommentarKommentar von Stefan Feulner vom 29.06.2022 | 05:11

Stock news: wallstreet:online AG - The next stage ignited

The past business year was extremely successful for Germany's leading "next generation broker" in terms of client assets under management, the Smartbroker. Although wallstreet:online AG, which will operate under the name Smartbroker Holding AG in the future, intends to grow by around 25% in 2022, the current year is considered a transitional year. Currently, the Berliners are working at full speed on Smartbroker 2.0. With the presentation of the "Case Study 2026" at the recent Annual General Meeting, the optimized model was presented - the potential became clear. Due to the significant correction of the share in recent months, this is a more than interesting entry opportunity at a reduced level.

Zum KommentarKommentar von Stefan Feulner vom 01.06.2022 | 17:14

Stock News: wallstreet:online AG - Insiders are buying!

Sometimes it is a paradox on the capital markets: While the operating business is developing better than ever and all segments are rushing from record to record, the share price is falling drastically. This can be clearly seen at wallstreet:online AG, on the one hand Germany's leading neobroker operator by assets under custody and also by far the largest publisher-independent financial portal operator in the German-speaking world. After share price losses of up to 50% since June of last year and a positive outlook for the year as a whole, the management is now buying in addition to the supervisory board and founder.

Zum Kommentar