Transformation in the transport sector accelerated

Europe is to become climate neutral by 2050 and save at least 55% of greenhouse gases by 2030 compared to 1990 levels. With the "Fit for 55" package, EU legislation has been tightened once again. The problem child of the energy turnaround, the transport sector, which accounts for around one-fifth of all greenhouse gas emissions in the European Union, has a special role to play here. According to the Federal Statistical Office in Germany, emissions in the Corona year 2020 were 690 million metric tons of CO2 equivalents, an increase of 11% compared to 1990. Heavy trucks and buses accounted for around 28% of this, and light commercial vehicles for a further 11%.

With the goal of promoting rail as a low-emission mode of transport and shifting the transport sector from road to rail, the EU has failed miserably, at least as of today. For example, rail's share of EU-wide freight transport at the beginning of the decade was 17%, down from 18% in 2010. The transport of goods by ship also declined, with its share falling from 7% to 6% within 10 years. In contrast, transportation by road continued its trend, increasing from 75% to 77% over the same period. 1

Switch takes too long

Experts agree that reversing the trend in the next few years will be difficult. For one thing, the expansion of the rail network is not progressing. Even if today's freight transport performance by rail were doubled by 2030, road transport would still account for around 60% of total freight transport performance. Tightening the CO2 fleet target for heavy-duty vehicles in 2030 to -48% compared to 2019 is probably only possible with faster electrification of transport or the use of synthetic fuels, which seems almost impossible due to the lack of infrastructure in charging and refueling facilities in this period. 2

Bridge technology with economic advantages for the commercial vehicle industry.

Ambitious, but less far from reality, European truck manufacturers formulated their goals with regard to the possible end of fossil drives. In a joint declaration in December 2020, the producers organized in the European Automobile Association (ACEA) with scientists from the Potsdam Institute for Climate Impact Research (PIK) pledged to stop selling fossil-fueled trucks in the EU by 2040, with the goal of achieving climate neutrality by 2050. In about 18(!) years, according to the truck builders' declaration, only vehicles that run on electricity, hydrogen or biofuel are to be produced. However, the signatory ACEA members DAF Trucks, Daimler Trucks, Ford Trucks, Iveco, MAN Truck & Bus, Scania and Volvo Group tied this ambitious target to demands on politicians. In addition to investments by the industry, political decisions and the development of a dense network of charging and refueling facilities are the basic requirements for a successful undertaking.

Whether this more than ambitious plan can be put into practice then in this long period is sometimes written in the stars. However, for the short-term reduction of emissions, bridge technologies with economic advantages for the commercial vehicle industry are already available.

dynaCERT with an immediate solution

In the near future, dynaCERT boss Jim Payne sees no alternative to the internal combustion engine. He already stated this in an earlier interview. Instead, the Company, which was founded back in 2004 under the name Dynamic Fuel Systems, is focusing on reducing CO2 emissions and increasing fuel efficiency for use in diesel engines with its globally patented HydraGEN electrolyzer. CAD 90 million and 18 years of research and development have gone into this technology, which Payne says is unique in the world as well as having 20 patents and multiple certifications. The advantages of HydraGEN are obvious. In addition to the aforementioned reduction in fuel consumption and CO2 emissions, NOx emissions (nitrogen oxides) as well as CO and THC emissions are also significantly reduced. In addition, engine power and torque are increased, which can lead to longer engine and oil life. In addition, the payback period for the purchase of the market-ready product is said to be around 1 year.

The chemical process involved is simple to explain. Distilled water is introduced into the electrolysis system, converted into pure hydrogen and oxygen, and pumped into the diesel engine. Since hydrogen burns about 10 times faster than diesel, it acts as a catalyst that speeds up the combustion rate, helps the engine burn the diesel more completely, and changes the air-fuel ratio. That results in more power, less carbon buildup and a reduction in pollutant emissions right at the source. With the development of the patented ECU (Electronic Control Unit) chip, which analyzes the engine in real-time and calculates the amount of hydrogen to be supplied to the engine, the unit is fully computer controlled and determines the proper flow rate of gases to optimize combustion. Thus, the required pure hydrogen is produced only when needed and not stored.

Widely applicable technology

By building a complete product line with four series that can be customized for various engine sizes and installation specifications, dynaCERT is broadly diversified and can be offered to all industries where diesel engines are used, such as mining, transportation, construction, and agriculture. In the future, it is also planned to use it for converting cars, ships and trains. The HG2R series currently has the greatest potential in terms of sales volume, the engine between 1 and 8 liters, which is used among other things in small and heavy commercial vehicles. According to company estimates, the global sales potential here is around 135 million units. 3

The Canadians are waiting in the wings with a global network.

Concerning the final entry into the mass market, dynaCERT says it is prepared in any case. In addition to building a global distribution network of 47 retail partners in 55 countries, the Canadians have a company-owned manufacturing facility in Toronto that handles a demand of 6,000 HydraGEN units per month, and whose capacity could be expanded to 12,000 units per month if demand increases.

Proof of concept completed with distinction

In addition to certifications worldwide, including from Continental EMITEC, TÜV Nord and Süd in Europe, iCAT in India or the PIT Group in Canada, the successful completion of a pilot project with Alectra Utilities Corporation, the largest municipal power utility in Canada in terms of customer base, should open the door wide for the launch into the mass market. Alectra already launched a program last year in which 13 of the utility's vehicles were equipped with HydraGEN technology and subjected to rigorous monitoring.

Thanks to dynaCERT's system, more than 8,000 kg of CO2 were saved, and diesel consumption was reduced by an average of 230 liters for every single vehicle in a whole range of commercial vehicles. The results of the pilot program showed that, based on data from its entire 2021 fleet, the utility was able to reduce its CO2 emissions and fuel costs by more than 10%. The successful test completion also earned Alectra the "Most Innovative Leader Award", presented at the annual Sustainability Symposium hosted by the Windfall Ecology Centre ClimateWise Business Network.

Test series leads to scaling up

The successful implementation of the pilot project prompted Alectra's management to equip additional vehicles with the HydraGEN technology. In total, the inventory was increased to 88 units in order to reduce carbon dioxide emissions, maintenance and fuel costs of the vehicle fleet. A look at the annual report shows that there is further sales potential at the utility alone.

Here Alectra showed a total of 605 fleet vehicles as of Dec. 31, 2021. In general, CEO Payne is extremely optimistic for the fourth quarter. Thus the company leader, as he announced on the occasion of the 4th International Investment Forum (IIF), expects several orders. Accordingly, several test series are currently underway with major customers in important vertical markets, which are likely to be translated into subsequent purchases. This should also improve the currently low financial position, so that a capital increase and dilution of shareholders at current levels is not planned. On the other hand, a forecast with revenue and profit estimates for the next fiscal year was not announced.

Unique closed ecosystem

The global roll-out of the HydraGEN technology is likely to be accelerated by another asset in the near future, as the development of a new component, carbon credits for truck owners, is expected to add to the sales process. Here, the fleet management software HydraLytica serves as the foundation, giving HydraGEN technology owners easy access to monitor and report in real time on CO2 emissions reductions, fuel savings and CO2 credits generated. In addition, the app can monitor the system and provide live communication with the fleet manager about potential deficiencies.

In addition to providing real-time data as fleet management software, HydraLytica will also serve the Company to generate carbon credits. Back in March 2019, dynaCERT launched the global carbon credit application process for its HydraGEN technology. With accurate calculations of consumption compared to a truck's historical performance, dynaCERT holds the key to unlocking a potential new recurring revenue stream by aggregating carbon credits for truck owners who would otherwise not have access to them. By managing carbon credits for its HydraGEN customers, dynaCERT's business model is based on sharing the revenue generated by the sale of carbon credits. In doing so, the Company's plan is that approximately 50% of the proceeds from carbon credits will remain with dynaCERT, with the other half being passed on to the customer.

Verified Carbon Standard program in final stages.

According to press release dated 08/25/2022, Verra's Verified Carbon Standard ("VCS") program, the most widely used greenhouse gas crediting program globally, is in the home stretch. As the fourth and final step in the approval process, Verra contracted with Earthood, an approved validator, to provide services related to method validation in accordance with the terms and conditions set forth in the Agreement and VCS regulations. Currently, Verra, Earthood, and dynaCERT are in the process of finalizing the VCS process so that dynaCERT's carbon credits meet Verra's Verified Carbon Standard. Again, when asked, CEO Payne expects a positive outcome later this year.

SWOT analysis

Strengths

- High-margin business model

- Own production facility

- Strong shareholder structure

- Patented and certified leading technology provider

Weaknesses

- Weak capitalization

- Roll-out not yet in place

- Further dilution possible through corporate actions

- Low sales level

Opportunities

- High sales potential due to regulations on emissions reduction

- Growth potential in several sectors

- Access to the market for emission certificates

Threats

- Better technology from competitors

- Rising raw material and energy costs

- Weakening of the global economy

Hopes for Roll-Out 2.0

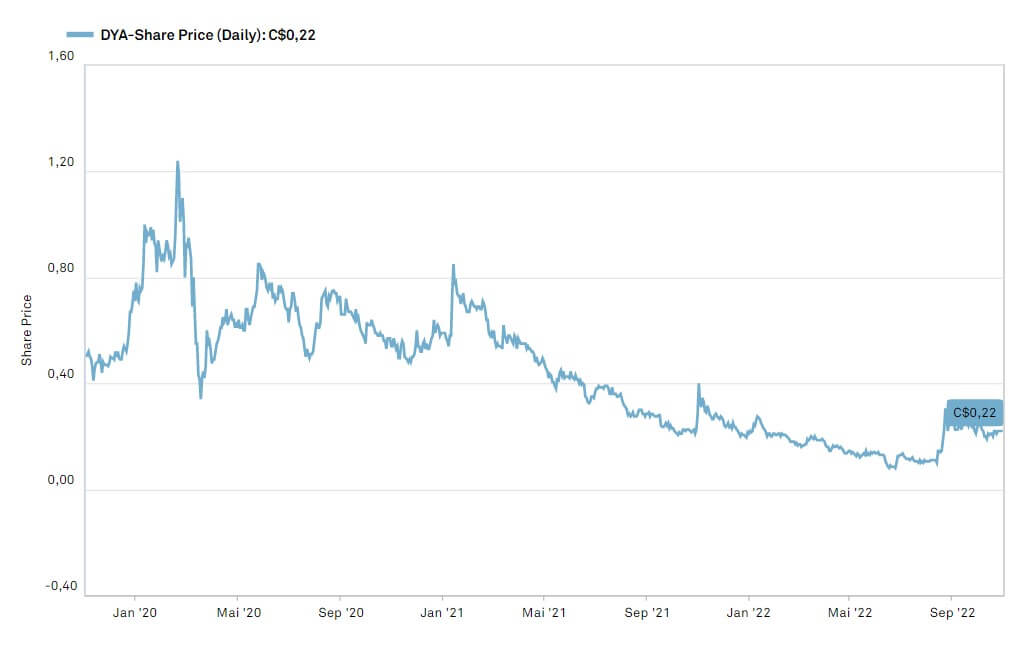

Due to the delays surrounding the Corona pandemic, which stalled the Company for about two years in terms of the roll out, dynaCERT's share price lost about 80% of its value since its peak in February 2020. The market capitalization melted down to just under CAD 88 million. However, with the announcement of several customer orders expected by management as well as a positive conclusion of Verra's Verified Carbon Standard, a turnaround could be heralded.

On a positive note, the shareholder structure is stable. In addition to the management and associated persons, who hold 31%, a further 27% is in institutional hands. Around 8% is held by the investor legend in the commodities sector, Eric Sprott, who invested because of the future of CO2 certificates. The unique combination of the HydraGEN technology, the fleet management system HydraLytica as well as the trading of emission certificates are positives to achieving the final breakthrough. Nevertheless, it should be kept in mind that an investment in dynaCERT represents a speculative bet on the use of bridging technologies. The potential, however, is huge due to stricter policy requirements. Analysts, such as those at GBC AG, assigned a price target of CAD 2.20 and see dynaCERT as a buy candidate.