China's growth engine sputters

The world's second-largest economy is in crisis, with the high growth rates it was accustomed to in past decades collapsing in the current year. According to the International Monetary Fund, the Chinese economy is expected to grow by only 3.2% in 2022, which would mean the weakest growth in around 50 years.

In addition to the global economic slowdown, a severe real estate crisis, and youth unemployment approaching 20%, there were two other home-grown disruptive factors. On the one hand, the Zero-COVID strategy imposed by the government put the brakes on growth; on the other hand, the regulation of the once booming large technology corporations caused a sell-off in Chinese stocks. With the re-election of Xi Jinping as the undisputed head of state, another sell-off took place in the tech sector. The Hang Seng Index, which includes the largest stocks in this sector, lost more than 40% of its value since the beginning of the year and plunged to a 13-year low as a consequence.

Boom in electric mobility

In contrast to the general economy, the electric car market is booming in the Middle Kingdom. Meanwhile, every second vehicle with an electric drive is sold in China worldwide. According to calculations by analysts at Global Data, China, as the world's largest car market, will account for around 60% of the world's electric vehicles by 2030. Here, the "Build Your Dream" company is the undisputed market leader as of September, with a NEV share of 28.9% or 201,259 NEV vehicles delivered, followed by Tesla with 7.9%. In order to expand its market position, the Company, which was founded back in 1995, put all its focus on the production of pure electric and plug-in hybrid vehicles from March 2022 and discontinued the production of gasoline vehicles.

Convincing figures

The record sales figures, with over 200,000 plug-in hybrid and pure electric vehicles sold for the first time in September, are reflected in the strong third-quarter figures. In the process, Net profit increased by 350% to USD 786 million. Sales grew 115.6% YOY to USD 16.1B. That represents an increase of 39.8% compared to the previous quarter. Cash flow from operations increased by approximately 186% in the January-September period. Here, a broader product portfolio and robust sales in the NEV market are the drivers of the outperformance. BYD's combined sales of pure electric and plug-in hybrid vehicles increased 250% YOY to 1.2 million units in the first nine months of this year. For the full year, the bar continues to be set at 1.5 million units sold. Although BYD management expects continued growth, a forecast for the current fiscal year has yet to be published.

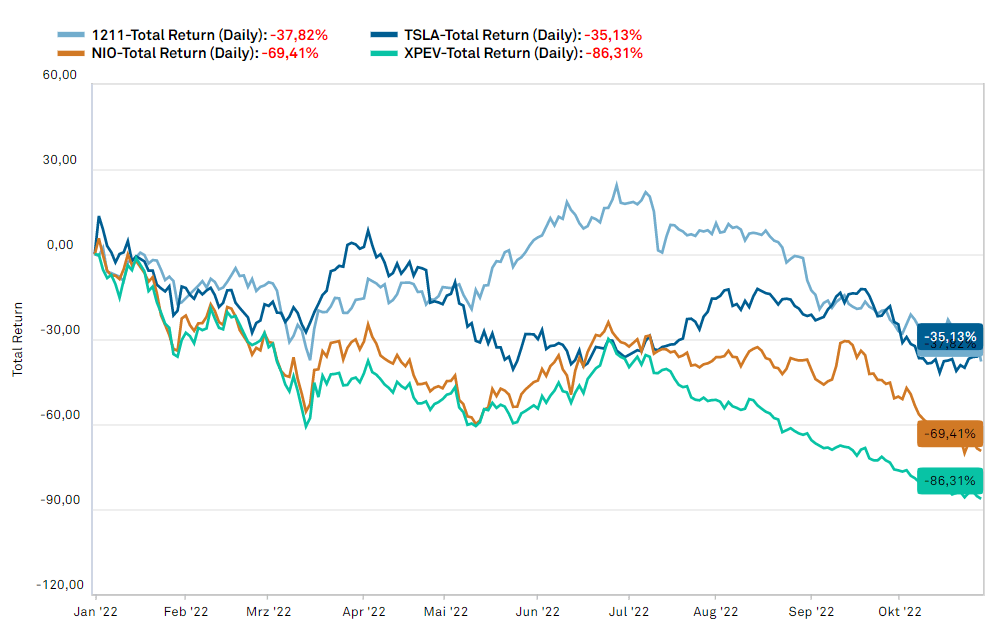

Double bottom or further sell-off?

Despite the excellent quarterly figures, BYD shares continued to be sold off by investors. Down 6.14%, the stock equaled its March low of the current trading year at USD 21.42 on the NASDAQ, then closed somewhat recovered at the USD 21.91 level towards the end of the trading session. A slide below the striking support should once again cause the triggering of further stop orders and would have a theoretical potential to the area of USD 17.41. The divergences in the MACD are negative, so there is a likelihood of retesting the Corona low of March 2020. In contrast, the Relative Strength Index is in the oversold zone, so that at least a short-term countervaluation would be possible. The chart picture should brighten sustainably when the USD 27.15 mark is exceeded.

Interim conclusion

Despite the publication of outstanding quarterly figures, the BYD share has been sold off further and is threatening to slide towards the lows of 2020. With growth prospects with expansion into Europe and a leading market position, a long-term entry into the Chinese leader for NEV vehicles should prove profitable in the long run at current levels. In addition to the production of electrified vehicles, the Company, which continues to be backed by Warren Buffett, is one of the world's largest battery manufacturers and has another strong asset in the form of its Blade technology, which experts consider to be the safest in the world. By building a seamless value chain, BYD will be less dependent on weakened supply chains than its broad competition.

The update is based on our initial Report 07/2022