Energy transition as a major challenge

Mobility is a fundamental part of daily life, yet the transport sector is one of the largest emitters of greenhouse gases. In 2019, according to the Federal Environment Agency, transport was responsible for 164.00 million tons of CO2 equivalents (CO2-eq) or 20% of greenhouse gas emissions in Germany. Thus, compared to the energy sector or industry, despite the development of more energy-efficient vehicles, CO2 emissions have actually increased since 1990. Although the years 2020 and 2021, marked by Corona with several lockdowns, brought a decrease of 146 and 148 million t CO2-eq, respectively, the targets of the Climate Protection Act were missed by far. With the measures adopted by policymakers, greenhouse gas emissions in transport can be reduced, considering the Projection Report of the Federal Government 2021 of 13 October 2021, can be reduced to around 126 million t CO2-eq. by 2030. However, the target should be 85 million t CO2-eq. Thus, the screws must be tightened even more significantly in this area in order to achieve the defined emission targets for climate-neutral transport.

1

Electromobility is the key

A total of 8 building blocks were presented in detail, but for passenger cars and light commercial vehicles (LNF) there are mainly 2 levers. Besides higher efficiency and thus lower energy consumption and CO2 emissions, electrification of powertrains is the all-encompassing solution. Around 16 million electric cars and electric LNF would have to replace corresponding combustion vehicles in Germany by the end of the decade in order to comply with the CO2 standards. The transformation from diesel or gasoline-powered cars to battery-powered vehicles is being fueled by the local automotive industry. European leader Volkswagen announced last year on the occasion of its specially organized "Power Day" that 70% of all new cars are to be electrically powered by 2030. With this, the Wolfsburg-based company plans to produce the last combustion engines for the European markets between 2033 and 2035.

2

Global redistribution

Both in Germany and globally, electromobility has already reached the mass market. Worldwide, despite the Covid-19 pandemic and problems in the supply chain, such as bottlenecks with semiconductor chips, more than 6.5 million e-cars were sold last year according to Mc Kinsey, doubling the previous year's figure. In addition to sales, the market share of battery-powered vehicles also doubled from 4.7% in 2020 to 9.5% now last year. The largest market by far was China, with sales of over 3.3 million units, representing over half of global sales. Sales in Europe rose by more than 60% to 2.3 million units. China and Europe together thus accounted for more than 85% of the global market volume in 2021, followed by a wide margin by the United States. Here, sales doubled compared to 2020, but remained at a comparatively low level of 630,000 units. According to a forecast by Statista, there are expected to be 116 million electric vehicles worldwide in the year 2030, representing an increase of 1,800% since 2020.

3

Tough battle for pole position

Especially in China, by far the largest market in the world, a fierce battle for market share has broken out. Due to the lockdowns imposed since the end of March due to the zero-Covid policy and the associated closures of production facilities, car sales in the following April slumped by around 50% compared to the same period last year. The hardest hit was the economic metropolis of Shanghai. Here, the previous market leader Tesla maintains a plant that, due to the closures of 22 working days, delivered 254,695 units in the 2nd quarter alone, about 18% less than in the first 3 months of the current fiscal year.

the increase in sales figures compared to the same period last year.

As a result, analyst forecasts, which were expecting just under 300,000 units, were undercut. Even more painful for the ambitious company leader Elon Musk, however, is probably the fact that competitor BYD passed Tesla and was even able to gain further market share. The "Build Your Dreams" company sold a total of 641,350 units and increased its delivery figures for the first half of 2022 by an enormous 314.90%. The Shenzhen-based company naturally benefited from the fact that BYD plants were significantly less affected by closures.

Shift by Corona

Last June, the electric vehicle industry rebounded strongly, posting over 140% month-on-month growth in sales despite the lingering effects of the Covid-19 pandemic and supply chain issues. According to the China Passenger Car Association (CPCA), sales reached a record total of 571,000 automobiles. With 134,036 e-cars, BYD defended its place in the sun, followed by Tesla with 78,906 and SAIC-GM-Wuling with 49,450. Listed manufacturers Geely (29,671), XPeng Motors (15,295), Li Autos and Nio, each with around 13,000 cars sold, follow at a distance.

Focus on the essentials

In order to expand its market position, the Company, which was founded in Shenzhen back in 1995, has been putting its entire focus on the production of pure electric and plug-in hybrid vehicles since March 2022 and discontinued the production of gasoline vehicles. The move follows the group's mantra, proclaimed since its inception, of building an "ecosystem for zero-emission energy solutions." With its renewable energy solutions, the Company has successfully grown internationally and now employs around 230,000 people working in subsidiaries in more than 50 countries and regions.

to 116 million e-cars by 2030.

On the whole, the conglomerate is not a pure electric car maker but is also one of the world's largest battery manufacturers, which founder Wang Chuanfu started as an origin business, producing not only rechargeable batteries for electric vehicles, but also batteries and mobile phone components. The long-standing know-how in the battery sector now comes in handy for the Company and the proprietary blade technology and could become the guarantee of success for BYD in the future.

According to industry experts, blade batteries are considered the safest in the industry. The new lithium iron phosphate (LFP)-based technology is primarily characterized by low heat generation, making it much less susceptible to fire compared to conventional lithium iron phosphate batteries. In addition, BYD says it has been able to improve the use of space within the new LFP battery by 50%, resulting in a higher energy density and thus range. BYD also plans to supply the battery to other automakers. Tesla, in particular, has recently been mentioned as a future customer. Should the innovative battery be installed in the Teslas, blade technology could establish itself as the new standard in the future and BYD could more or less determine the market.

Securing the value chain is top priority

In general, BYD is tinkering with building its own value chain in order to eliminate supply chain dependencies as much as possible. As Chinese media report, major investments are planned in developing a chip for intelligent driving. The project is being led by a team from semiconductor subsidiary BYD Semiconductor. The chip could be presented to the broad market as early as the end of the year. BYD owns a total of 72.3% in the Semiconductor division. An IPO is already planned, and talks are currently underway with the Chinese stock exchange regulator China Securities Regulatory Commission (CSRC).

The Chinese group's recent investments and acquisitions have also shown how active it is in remaining independent despite the scarcity of raw materials, such as lithium, which is elementary for battery production. In order to secure production, BYD has taken a stake in the Shenzhen Chengxin Lithium Group with an investment of EUR 425 million. In return, BYD receives secured lithium supplies. In addition, the commitment 5 of the lithium producer Shanshan Lithium Battery Material Technology was expanded. The Company is also investing with partners in Zhongrun Chemical, a producer of NMP solvents needed to make lithium batteries. With the acquisition of six African lithium mines, which according to circles contain more than 25 million tons of ore with a lithium oxide content of 2.5%, it would theoretically be possible to mine up to 1 million tons of lithium carbonate and secure demand for the scarce raw material for the next decade.

SWOT analysis

Strengths

- Proprietary battery technology

- Focus on the EV market

- Broad product portfolio

- Establishment of own value chain

Weaknesses

- High valuation

- Dependence on scarce raw materials

Opportunities

- Blade battery technology as the standard for other automakers

- Expansion and increase in market share globally

- Expansion of brand portfolio

- Fantasy through IPO of BYD Semiconductor

Threats

- Decline in sales figures Economic downturn

- Further lockdowns in China

- Disrupted supply chains

- Policy focus on alternative technologies such as hydrogen

- End of Chinese government promotion of EVs

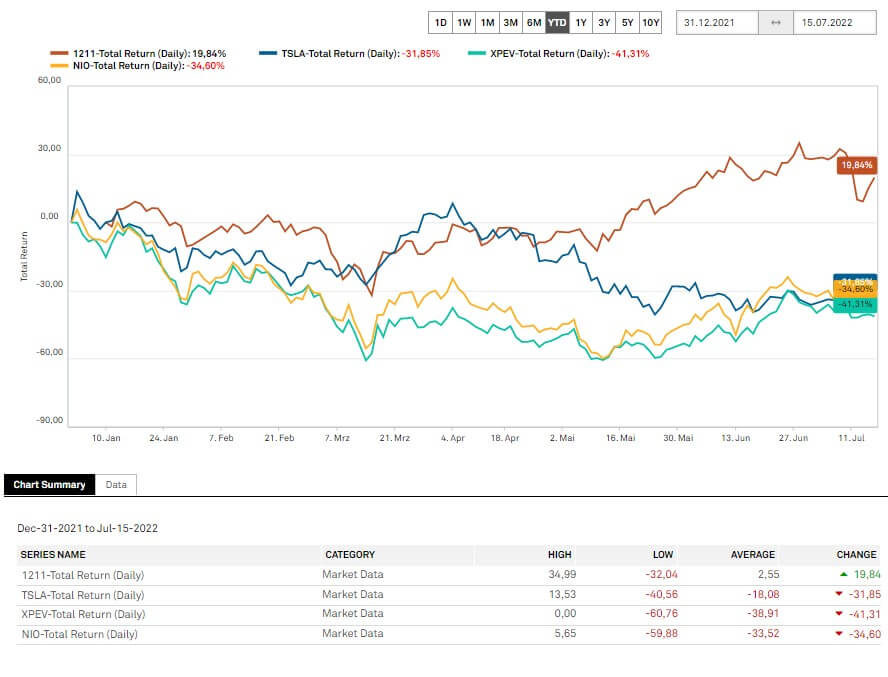

Ambitious valuation, fear for Warren Buffett

Recently, there has been an outcry in the broader stock market community about investing legend Warren Buffett, who has reportedly divested himself of the BYD position he took in 2008. Although this has neither been confirmed nor denied, the S&P Capital IQ Pro system still contains the 225,000,000 H-shares that the stock market fox acquired at HKD 8.00 and which currently correspond to a 7.73% stake in BYD. That this could tend to profit-taking, one could understand after a thirty-seven-fold increase (37!) only too well.

In addition to the strong performance, the Berkshire Hathaway boss should also be concerned about the now no longer relatively cheap valuation of the Chinese market leader. Although the Company is growing in sales and profitability, the net result alone could be increased by 140% in the first half of the year. A price-earnings ratio of 95 in the current year and 46 for the year 2024 are, however, no longer a bargain. After the announcement of the figures, various analyst firms were nevertheless impressed. For example, the Swiss bank Credit Suisse awarded the rating "outperform" and raised the price target to HKD 380, equivalent to EUR 48, after the results. The investment bank Goldman Sachs is equally bullish on the leading Chinese electric car company. The verdict is still buy, and the price target was set at HKD 404, equivalent to EUR 51.15. In addition, BYD remains on the analysts' "Conviction List".

| in EUR thousand | 2021e | e2022 | e2023 | e2024 |

|---|---|---|---|---|

| Sales | 28.350.011 | 49.672.299 | 65.355.080 | 76.366.478 |

| Ebit | 545.746 | 1.705.495 | 2.552.298 | 3.506.871 |

| Ebit-Margin in % | 1,93 | 3,43 | 3,91 | 4,59 |

| Net profit | 399.418 | 1.069.558 | 1.636.243 | 2.314.077 |

| Earnings per share in EUR | 0,14 | 0,39 | 0,60 | 0,80 |

Strong position likely to be expanded

The energy transition is one of the greatest challenges in the recent history of humanity. In view of achieving climate neutrality and the targets by 2030, the electrification of transport is considered a fundamental building block. The switch from internal combustion engines to battery-powered vehicles is growing rapidly. By the end of the decade alone, the number of e-cars worldwide is expected to increase more than tenfold. In the world's largest market, BYD was able to take over the market leadership from Tesla and is preparing to expand it in the near future. In addition to the innovative blade technology, which could also be used by other producers as a battery standard in the future, the Warren Buffett-backed company is broadly diversified on the one hand to gain independence even from weakened supply chains. On the other hand, management is focusing on EV technology, which could act as leverage going forward. Fundamentally, BYD belongs to the absolute top tier in this industry, but the group is currently no longer favorably valued.