Seamless hydrogen chain

The Canadian company, with offices in Vancouver and London, is clearly set for expansion, both strategically and geographically. The vision of the first-class management team is to cover the entire value chain in the hydrogen sector. The market for fuel cells is growing dynamically. According to Allied Market Research, between 2020 and 2027 alone, growth will be 21.4% annually. In addition, the market research company expects the market for light commercial vehicles to reach a volume of USD 786.5 billion in 2030. The rise of fuel cells as a major energy source is thus fueled by manufacturers converting their fleets from fossil fuels or electric to hydrogen technology. First Hydrogen is focusing on developing emission-free light-duty vehicles, building a hydrogen fueling system, and producing and distributing green hydrogen.

Further milestone for the "Utility Van"

With globally established partners such as Ballard Power and AVL Powertrain UK, and a "best-of strategy", First Hydrogen is working to develop and manufacture zero-emission, hydrogen-powered utility vehicles with a range of over 500 km. This will draw on existing technologies and a proven chassis. In terms of trial operation of the two developed demonstration vehicles, the first operational readiness test drives have been successfully completed.

The next stage of development has now been ignited with approval by the Vehicle Certification Agency, the British vehicle approval authority for road transport in the United Kingdom, excluding Northern Ireland. This will allow customers to test the "Utility Vans" on public roads for a period of 24 months from January 2023. There has been huge interest from fleet operators. A total of 13 UK fleet operators from a variety of sectors, including telecommunications, utilities, infrastructure, delivery services, grocery and healthcare, have already signed up to participate in the trial.

Expansion into Europe and the US

With the recently approved hydrogen strategy goals and the simplification of the regulatory framework by the European Union, the Canadians are also planning expansion into Europe. The focus of the new initiative is said to be to attract fleet operators interested in the planned test deployments of First Hydrogen's first light-duty vehicles in Europe. Testing is expected to begin in early 2024 in Germany and France. In addition, market development is planned in Eastern Europe, France, Spain, Portugal and the Benelux countries.

Management intends to proceed in a similar way in the US. Here, too, the passage of the Inflation Reduction Act, the US government's authorization of USD 369 billion in spending on energy and climate change, has opened the door wide for the expansion of renewables and the industrialization of several key technologies, including green hydrogen generation. The Company responded to the improved environment by establishing First Hydrogen Energy (USA) Inc. and First Hydrogen Automotive (USA) Inc.. In addition to offering US fleet operators the opportunity to test hydrogen-powered fuel cell vehicles, there are long-term plans to expand the other two core businesses into the United States.

Development of refueling station infrastructure

In addition to the development of the light commercial vehicles with a range of over 500 km, the development of a filling station network is the second piece of the puzzle in First Hydrogen's business philosophy. A joint venture was established with EV Consulting GmbH, based in Aachen, Germany, to develop a prototype for a customized refueling system for the hydrogen mobility market. In addition to North America, the European Union's higher targets make the development of an H2 infrastructure on the old continent an obvious option. The European Parliament's Transport and Tourism Committee recently voted in favor of significant changes to hydrogen mobility and transport, agreeing on a directive to build a hydrogen refueling station every 100 km on the Trans-European Transport Network as well as the overall network connecting all of Europe. That would mean a total of 1,500 H2 refueling stations by 2030. So far, only 200 refueling stations have been planned.

Own production to round it off

In order to complete the entire value chain, four sites in the UK have already been identified for green hydrogen production. The goal is to supply the Company's automotive customers with majority of their green hydrogen needs from production to fuel their fleets of First Hydrogen fuel cell-equipped light commercial vehicles; together, the projects are expected to produce over 7,100t of green hydrogen per year at full capacity. In total, the Company plans to have up to four sites, each with a fueling station for commercial vehicles and passenger cars. Total initial production capacity estimates range from 80 MW to 160 MW. As part of its "Hydrogen-as-a-Service" program, potential production sites will be explored in Europe and North America in addition to the United Kingdom.

Interim conclusion

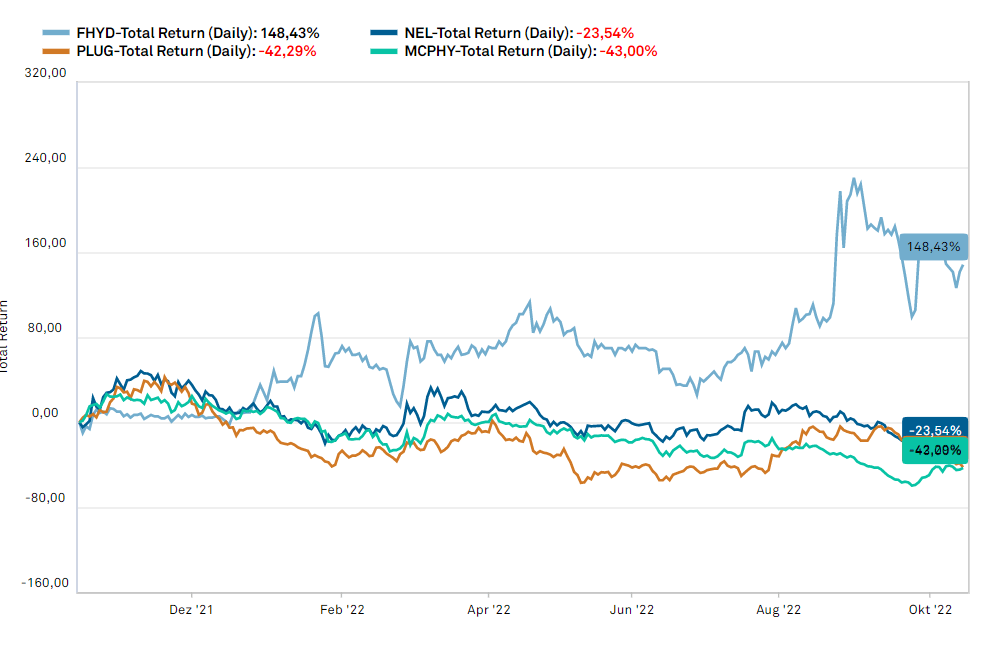

The promotion of hydrogen projects by policymakers worldwide creates tremendous future growth opportunities for First Hydrogen. With the "Hydrogen-as-a-Service" model, the Canadians cover the complete value chain and have significant economies of scale in their business model. The approval of the utility vans for road use in the UK also represents a further milestone that is likely to accelerate the rapid rise of the newcomer. Compared to companies in the hydrogen peer group, First Hydrogen's market capitalization is a moderate CAD 200.53 million. However, it should not be forgotten that the Company is still in the process of implementation, so the investment should be considered speculative.

This update is based on our initial Report 12/2021.