The SMSZ project in the Western Gold Belt of Mali

Desert Gold is currently a hot topic at the Mining INDABA 2024 commodities fair in Cape Town. The promising land area of 440 sq km is located in the Senegal-Mali Shear Zone. The producing mines of large companies such as Barrick Gold, Endeavour Mining and B2Gold are already bustling in the immediate vicinity. Not far north of Desert Gold's properties lie the blockbuster properties in the form of the reactivated Yatela and Sadiola districts. They have been majority-owned by Allied Gold since 2021 and have historically produced 6.8 million ounces of gold. IAM Gold sold 80% of the Sadiola mine to the new producer, Allied Gold. Over the next few years, it is expected to be developed into one of Mali's largest reactivated mines. According to Management, output is set to increase from around 200,000 ounces to around 400,000 ounces AU by 2028. Due to heavy investments, Allied is currently still producing at around USD 1,300 AISC per ounce, but here too costs are now falling quarter by quarter.

The search continues.

In Mali, the gold is very close to surface, which puts the average cost per ounce in the range of USD 850 on a sustainable basis and also keeps drilling costs low. Desert CEO Jared Scharf wants to significantly expand the current resource estimate of Indicated Mineral Resources of 310,300 ounces and Inferred Mineral Resources of 769,200 ounces of gold over the next few years. To this end, a drilling program totalling 30,000 meters is to be carried out in 2024.

Pre-feasibility study (PFS) is now underway

CEO Jared Scharf and his management team are currently negotiating with potential strategic partners to fund the pre-feasibility study and mine development. The study will determine the viability of mining the oxide and transitional mineral resources at the Barani East and Gourbassi West gold deposits. These deposits are located on Desert Gold's SMSZ concession in western Mali. If all goes according to plan, Heap Leach production could start in the second half of 2025. In addition, the Company is considering exploring near-surface gold commercially in a joint venture, which should significantly increase cash flow for future drill programs and resource expansions. Desert has already identified 24 gold zones in its land sections, and the drilling program now underway is expected to reveal some undiscovered mineralization.

Allied Gold, with its DIBA property, is a direct neighbor

A catalyst for Desert Gold's success could also be the exploration activities of major mining companies in the region. They are constantly looking for mine expansions and can finance further drilling from their cash flow. The ex-Yamana management under the new name Allied Gold has been particularly active so far. Over the past 10 years, they have already amassed a portfolio of gold projects with estimated mineral reserves of around 10 million ounces. The reactivated Sadiola mine is being consistently expanded, but the focus is on potential mineralization to the south. It is here where the Diba exploration zone is located. It borders directly on Desert Gold's properties, and initial soil samples showed grades ranging from 1.2 to 5.6 grams of gold per tonne. It can, therefore, be assumed that Desert Gold will find similar results in its new drilling program. **A collaboration or a complete takeover of Desert Gold should not be ruled out from this perspective.

Jared Scharf, CEO of the Company, comments: "Management believes that gold in the oxidized portion of the Barani East and Gourbassi West deposits can be profitably mined. As such, a PEA has been initiated. If the PEA confirms our initial assumptions, work will be carried out to advance the project towards production."

Follow CEO Jared Scharf's comments from his interview with the International Investment Forum at the Mining INDABA Conference in Cape Town in early February 2024. He will report in more detail at the forum of the same name on February 21, 2024, at 18:30 CET, where participants are invited to a live question and answer session. Click here to register

The Company's core objective remains the development of a Tier 1 gold project through targeted exploration. Desert is confident that both mining and exploration can be conducted concurrently from 2025 onwards. As a first step, additional drilling is now being completed to provide fresh material for metallurgical testing, including column leach testing, which is required to determine the expected gold recovery in the event of heap leaching of the ore. These drillings will also serve to gather geotechnical information on pit wall stability, ore hardness, and ore characteristics. Based on this information, throughput rates, gold recovery, gold recovery options, and the equipment required for the proposed mining project will be determined.

As part of the Company's ongoing property review, a multi-spectral satellite and synthetic aperture radar survey of the 440 sq km SMSZ project in western Mali was completed. The objective was to identify major alterations and/or structural features that could contribute to the further prioritization of a growing list of gold zones identified on the property. This type of review has had success on projects in other areas of the world. This work has identified additional exploration targets and potential extensions to known target areas, with targets yet to be validated by drilling. Further data analysis is also required to create a testable, proven exploration model. Mining veteran John Dudek (P.Geo) is responsible for the NI 43-101 technical reports.

Interim conclusion: The signs are pointing to a storm

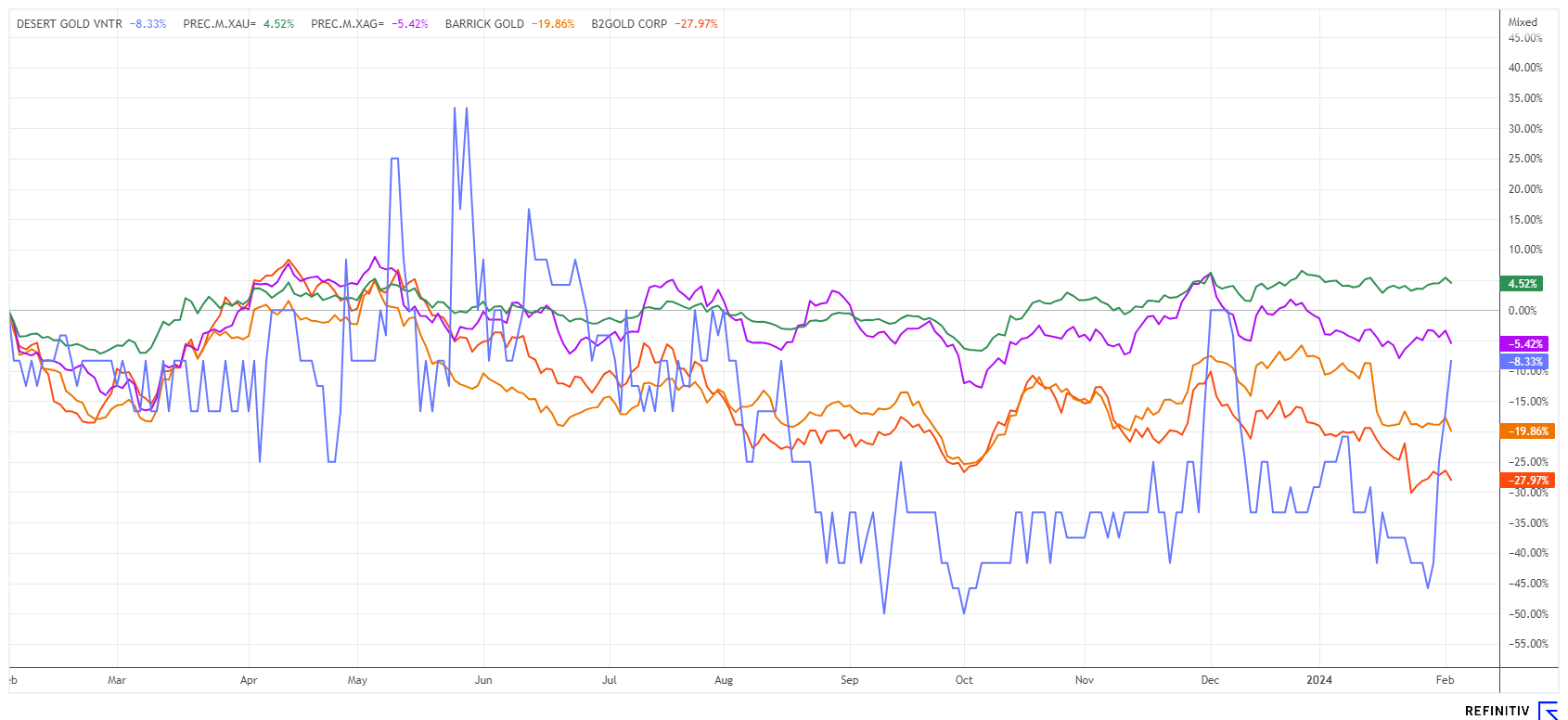

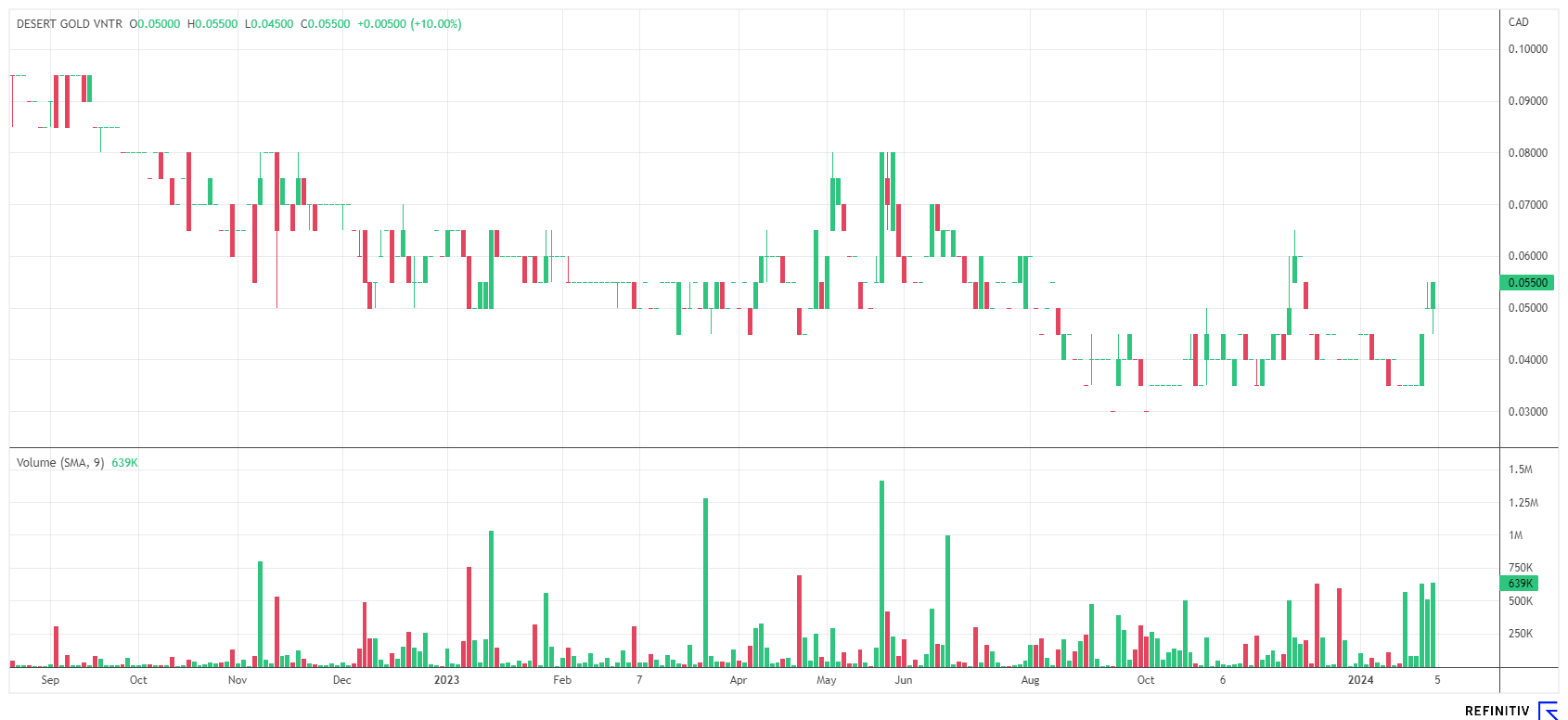

The Desert Gold share has started the new year relatively well after a long sideways trend in 2023. A private placement at CAD 0.07 is currently underway. The first anchor investors were even prepared to pay a small premium to the current price of CAD 0.06 due to the good prospects. The reward also lies in the allocation of a warrant with a basis of CAD 0.08 and a term of 3 years. A total of up to 10 million shares are to be placed. However, CEO Jared Scharf assumes that there is further interest from major investors, who could also make a strategic commitment of up to 10%. On the chart, Desert Gold is currently showing a strong recovery compared to its large peer group in Mali. Although all stocks are still in the red, the small Desert Gold has already made up a lot of ground.

If the first takeover activities in Mali become known, African junior explorers will very quickly become the focus of investors and may experience disproportionately high speculative gains. With a feasibility study soon to be available, the risk in the project is significantly reduced, as the potential takeover price increases with each additional resource expansion, should a deal be reached. After the current placement, there should be no further dilution for some time, as the first cash flow is expected from 2025. The volume in the share has recently risen significantly with higher prices. It will be really exciting when the 2023 high of around CAD 0.11 can be overcome. From today's perspective, the Desert Gold share will likely not be available for less than CAD 0.06.

The update is based on our initial report 11/21.